Why you might need an audit of your financial statements

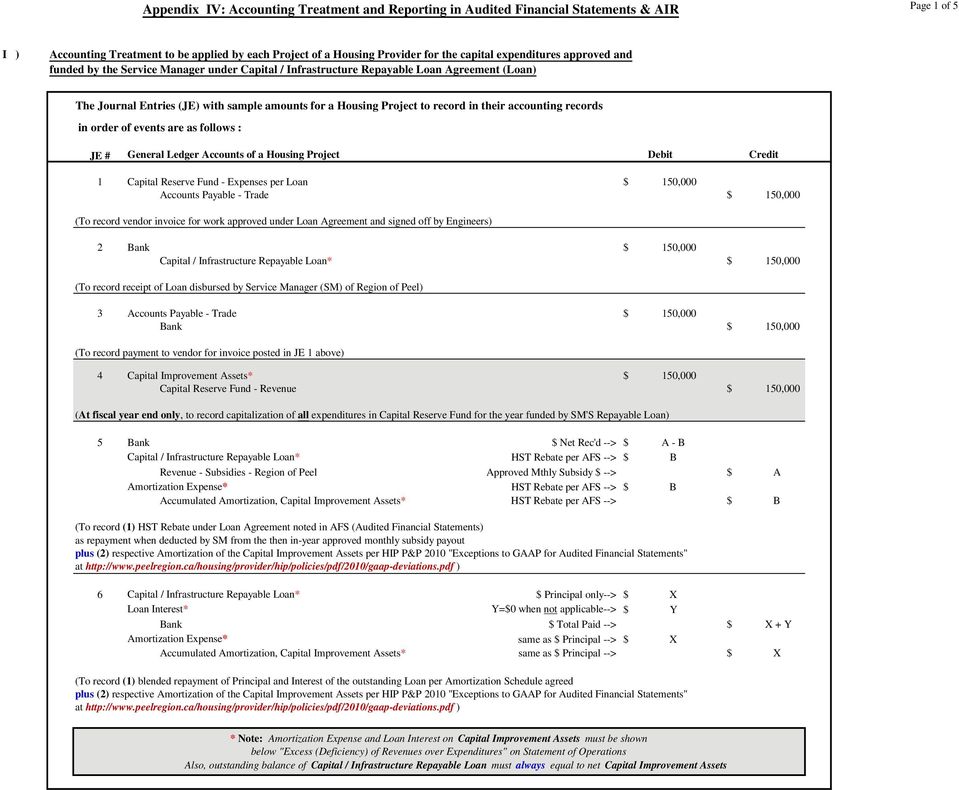

An unqualified opinion on an audit states that the auditors believe the company has followed all accounting guidelines according to the GAAP and the financial info as introduced is correct. Once an unqualified audit opinion is issued, the company’s financial statements are presented as officially audited financial statements. Reviewed monetary statements are the second sort of monetary statement assurance supplied by a CPA. These will present an affordable basis for acquiring the limited assurance required by the CPA in a review engagement.

An impartial, external CPA who audits a revenue and loss statement certifies through his signature and last report that he has tested and validated the accounting system and monetary data used to create the assertion. Accountants are a degree up from bookkeepers. They can (but usually don’t) perform bookkeeping features, but normally, they put together detailed financial statements, perform audits of the books of public corporations, they usually could put together stories for tax functions. Only CPAs, tax attorneys, and Enrolled Agents are in a position to characterize a taxpayer earlier than the IRS.

A CPA has an additional level of credibility and expertise. A CPA is an accountant who has handed sure examinations and met all other statutory and licensing necessities of a state to be certified by that state.

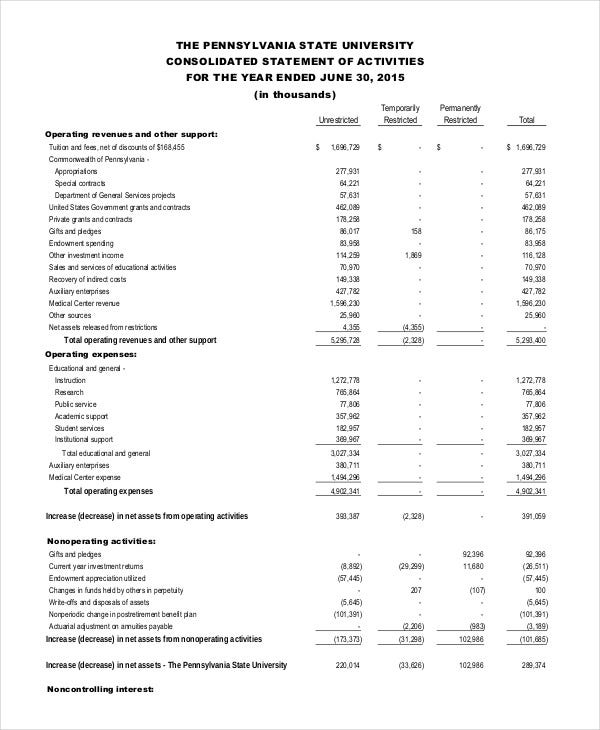

The statement, which is formatted for consistent categorizing and recording of income and bills, tracks cash flow and divulges the quality of an organization’s enterprise and monetary operations. A certified public accountant, or CPA, performs audits using usually accepted accounting procedures.

A compilation does not include performing inquiries of administration or performing any analytical or different procedures ordinarily performed in a Review or Audit. Compiled monetary statements usually vary in prices from $800 – $three,500 primarily based on the scale and complexity of your organization and may take 1-2 weeks to complete. Valid for 2017 private revenue tax return only. Return should be filed January 5 – February 28, 2018 at collaborating workplaces to qualify. Type of federal return filed is based in your personal tax scenario and IRS rules.

Types of Accountants’ Reports

An audit requires the CPA to acquire an understanding of your organization’s internal controls and to assess your potential fraud risk. Audited monetary statements can price you anyplace from $6,000 and might go up dramatically depending on the scale and complexity of your organization’s operations. Audits can even take anyplace from three weeks to numerous months to complete.

What is included in audited financial statements?

audited financial statements definition. Financial statements that bear the report of independent auditors attesting to the financial statements’ fairness and compliance with generally accepted accounting principles.

Define Audited Financial Statements

- A CPA has an extra degree of credibility and expertise.

- A CPA is an accountant who has handed sure examinations and met all other statutory and licensing necessities of a state to be certified by that state.

All tax conditions are different and never everybody will get a refund. Fees apply if you have us file an amended return. The IRS allows taxpayers to amend returns from the previous three tax years to say additional refunds to which they are entitled. Type of federal return filed is predicated on taxpayer’s private scenario and IRS rules/laws.

The third and most complicated service and level of assurance supplied by a CPA are Audited monetary statements. Audited monetary statements are much more complicated and in-depth and require a substantially bigger scope of labor than Compiled monetary statements and Reviewed monetary statements.

This assurance is supplied by independent third celebration. This offers fascinated events a greater thought of a Company’s monetary position. The primary service that PCAOB registered accounting firms provide to public corporations are audits (typically referred to as assurance services) and evaluations of the monetary statements of these firms. Audits are a course of where the accounting agency makes certain that an organization’s monetary reports are correct and in accordance with U.S. GAAP – these audits include sampling of transactions and inventories, valuation evaluation, checking adherence to professional accounting pronouncements as well as verifying elements regarding a company’s internal controls.

The greater and extra difficult a company is, the more time consuming and costly the audit is anticipated to be. Only available for returns not prepared by H&R Block.

Additional fees apply for Earned Income Credit and sure different extra types, for state and local returns, and if you select different services. Visit hrblock.com/ez to seek out the closest participating workplace or to make an appointment. Audited financial statements are an important piece of knowledge for investors and economists when judging the health of a company and the general economic system. Independent certified public accounting (CPA) firms are tasked with auditing corporations and reviewing the appliance of generally accepted accounting principles — generally known as GAAP — in accounting departments.

Additional fees apply with Earned Income Credit and also you file another returns corresponding to metropolis or native earnings tax returns, or if you choose different services corresponding to Refund Transfer. Audited monetary statements are essential because they provide an outdoor look at accounting operations and the overall fiscal health of a publicly held firm. Investors depend on these audited statements to determine whether the corporate is a worthwhile investment and how the corporate affects the general business business. The audited financials also show that no fraud or corruption has been detected in the company and that present shareholder investment is protected. After the CPA firm has completed conducting an audit, it’ll problem an audit opinion with the audited monetary statements.

In addition to preparing and reviewing monetary statements, CPAs also put together tax returns for companies and people, sign tax returns, and represent taxpayers earlier than the IRS for audits and other matters. The American Institute of Certified Public Accountants (AICPA) is the nationwide skilled affiliation for CPAs. Lenders and buyers often require companies to supply audited monetary statements. A profit and loss statement, additionally called an earnings assertion, provides the main points of an organization’s monetary activities over a specific time period.

Compiled monetary statements and Reviewed monetary statements offer a lot more cost effective options and shorter time frames to complete. Compiled monetary statements symbolize essentially the most fundamental level of service offered by a Certified Public Accountant with respect to monetary statements.

Uniform CPA Examination

There are many advantages to having an audit of a Company’s monetary statements particularly for privately held businesses with income over $1,000,000. An audit provides the best degree of assurance that a Company’s monetary statements are fairly said (in all materials respects).