Where To Sell Used Books: 6 Of The Best Places Online

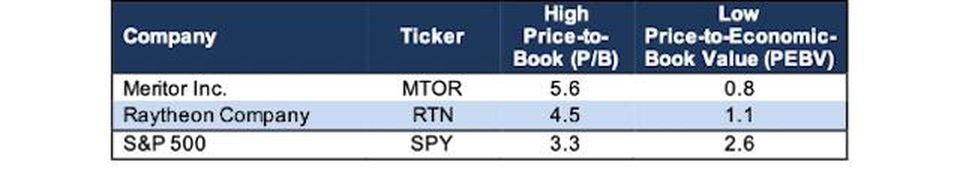

Increased debt will make a optimistic contribution to a firm’s ROE only if the matching return on property (ROA) of that debt exceeds the rate of interest on the debt. Investors may discover the P/B ratio to be a useful metric as a result of it could possibly provide a good way to check a company’s market capitalization to its guide worth. But determining a standard and acceptable worth-to-guide ratio is not always easy. In some instances, a decrease P/B ratio could imply the inventory isundervalued, but it might additionally level to elementary problems with the corporate. Like any monetary metric, the real utility comes from recognizing the benefits and limitations of guide value and market worth.

ROE is also a think about inventory valuation, in association with other financial ratios. While greater ROE ought intuitively to indicate higher inventory prices, in actuality, predicting the inventory worth of an organization based mostly on its ROE depends on too many different components to be of use by itself. Return on equity (ROE) is a measure of monetary performance calculated by dividing web revenue by shareholders’ fairness. Because shareholders’ fairness is equal to an organization’s belongings minus its debt, ROE is taken into account the return on net assets.

For instance, assume a company, TechCo, has maintained a gentle ROE of 18% over the previous few years compared to the typical of its friends, which was 15%. An investor could conclude that TechCo’s management is above average at using the company’s property to create earnings. Relatively excessive or low ROE ratios will vary considerably from one trade group or sector to another. When used to evaluate one company to a different comparable firm, the comparability shall be extra meaningful.

The P/B ratio compares an organization’s market capitalization, or market value, to its book worth. Specifically, it compares the company’s inventory worth to its e-book worth per share (BVPS). The market capitalization (company’s worth) is its share value multiplied by the variety of outstanding shares. The guide worth is the whole property – total liabilities and can be present in an organization’s balance sheet. In other phrases, if an organization liquidated all of its belongings and paid off all its debt, the value remaining can be the corporate’s e-book worth.

Book Value Vs. Market Value: What’s the Difference?

Since every industry has different ranges of investors and income, ROE can’t be used to match corporations outdoors of their industries very effectively. Return on fairness measures how effectively a firm can use the cash from shareholders to generate profits and develop the corporate. Unlike other return on funding ratios, ROE is a profitability ratio from the investor’s perspective—not the corporate. In other words, this ratio calculates how much money is made primarily based on the investors’ funding within the company, not the corporate’s funding in assets or something else. The return on equity ratio or ROE is a profitability ratio that measures the ability of a agency to generate income from its shareholders investments within the firm.

Finally, rising monetary leverage signifies that the firm uses extra debt financing relative to equity financing. Interest funds to collectors are tax-deductible, however dividend funds to shareholders usually are not. Thus, the next proportion of debt in the agency’s capital structure leads to greater ROE. Financial leverage advantages diminish as the chance of defaulting on curiosity funds increases. If the agency takes on too much debt, the price of debt rises as collectors demand the next risk premium, and ROE decreases.

Book Value Greater Than Market Value

How do you calculate book value of a company?

Book value refers to the total amount a company would be worth if it liquidated its assets and paid back all its liabilities. Book value can also represent the value of a particular asset on the company’s balance sheet after taking accumulated depreciation into account.

This can inflate earnings per share (EPS), nevertheless it doesn’t have an effect on actual efficiency or growth charges. A good rule of thumb is to target an ROE that is equal to or just above the common for the peer group.

Limitations of Book Value

- Specifically, it compares the corporate’s inventory value to its book value per share (BVPS).

- The P/B ratio compares a company’s market capitalization, or market value, to its book worth.

- The market capitalization (company’s worth) is its share value multiplied by the variety of outstanding shares.

An investor must determine when the book value or market value ought to be used and when it ought to be discounted or disregarded in favor of different significant parameters whenanalyzing a company. Value investorsoften like to seek out companies on this category in hopes that the market perception turns out to be incorrect sooner or later. In this state of affairs, the market is giving traders a possibility to buy a company for lower than its said web value, that means the inventory value is decrease than the company’s book value. If an organization has been borrowing aggressively, it can improve ROE as a result of fairness is the same as belongings minus debt. A common state of affairs is when a company borrows massive amounts of debt to purchase back its personal inventory.

Essentially, ROE will equal the web revenue margin multiplied by asset turnover multiplied by monetary leverage. Splitting return on equity into three elements makes it easier to know adjustments in ROE over time. For example, if the net margin will increase, every sale brings in more money, leading to a better general ROE. Similarly, if the asset turnover will increase, the agency generates extra sales for each unit of assets owned, once more leading to a better overall ROE.

Equity investors typically examine BVPS to the market price of the stock in the form of the market value/BVPS ratio to attribute a measure of relative worth to the shares. Keep in mind that e-book value and BVPS don’t consider the future prospects of the agency – they are solely snapshots of the frequent fairness declare at any given point in time. ROE is especially used for comparing the efficiency of companies in the identical industry. As with return on capital, a ROE is a measure of management’s ability to generate income from the fairness available to it.

In other phrases, the return on equity ratio exhibits how much profit each dollar of common stockholders’ equity generates. The market value of an asset is assigned by the buyers on that specific date i.e. based on the current price of that asset traded in the monetary markets. It is calculated by multiplying the market value per share of the company with the variety of excellent shares. When the market worth is greater than the guide value,the inventory market is assigning the next worth to the corporate because of the earnings energy of the company’s belongings. The market worth is the worth of an organization based on the financial markets.

Determining the market value of a publicly-traded company can be carried out by multiplying its stock worth by its outstanding shares. But the process for personal firms isn’t as simple or clear. Private companiesdon’t report their financials publicly, and since there isn’t any stock listed on an exchange, it’s usually difficult to find out the worth for the corporate. Continue reading to find out extra about non-public companies and a number of the ways in which they’re valued. The DuPont formulation, also known as the strategic revenue model, is a typical way to decompose ROE into three essential parts.

Book Value

A frequent shortcut for investors is to contemplate a return on equity close to the long-time period average of the S&P 500 (14%) as an appropriate ratio and anything lower than 10% as poor. That being mentioned, buyers want to see a high return on fairness ratio as a result of this indicates that the company is using its traders’ funds successfully. Higher ratios are nearly all the time higher than lower ratios, however need to be in comparison with different corporations’ ratios within the industry.

Market Value Example

An IPO gives outdoors shareholders a chance to purchase a stake within the firm or fairness in the form of inventory. Once the corporate goes by way of its IPO, shares are then offered on the secondary market to the final pool of traders.

ROE is taken into account a measure of how successfully administration is utilizing an organization’s belongings to create earnings. Because shareholders’ equity is the same as a company’s property minus its debt, ROE could be considered the return on internet property. Book worth and market worth are two fundamentally different calculations that inform a story about a company’s general monetary strength. However, with any monetary metric, it’s essential to acknowledge the limitations of book worth and market worth and use a combination of financial metrics whenanalyzing a company. The most blatant difference between privately-held and publicly-traded firms is that public companies have sold a minimum of a portion of the firm’s possession throughout an initial public providing (IPO).