What dose the accrued surplus /deficit quantity imply?

While the presentation of those statements varies barely from industry to trade, large discrepancies between the annual treatment of either doc are sometimes thought of a red flag. The P&L statement exhibits internet income, or whether or not a company is within the pink or black. The steadiness sheet shows how a lot a company is actually worthor its complete value. Though both of those are a little oversimplified, this is typically how the P&L statement and the balance sheet are typically interpreted by investors andlenders. Balance sheets are built extra broadly, revealing what the corporate owns and owes, in addition to any long-term investments.

What Is Accumulated Deficit on a Balance Sheet?

The matching concept requires expenses of a period be matched with revenues of the same period. This means an organization has increased its belongings and that revenues have exceeded the assets used to generate the revenues.

This results in the stockholders’ fairness, which is accounted for as retained earnings on the stability sheet. In monetary accounting, the corporate has a deficit if the retained earnings figure is adverse. This indicates the firm’s fairness is less than the quantity traders originally paid for the inventory. Deficits usually occur when the company incurs sustained losses because it units prices too low, has surprising expenses or doesn’t sell sufficient to turn a profit. Sometimes a startup firm will show a deficit because sales and earnings haven’t yet caught up with the expense of getting the corporate up and operating.

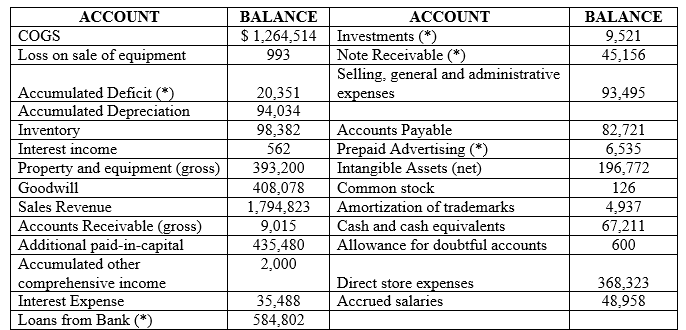

It is listed on the balance sheet as retained earnings under stockholders’ fairness, which makes the puzzle more full. It then lists the expenses, which may embody cost of sales, promoting and administrative, and revenue taxes.

The steadiness sheet consists of outstanding expenses, accrued income, and the value of the closing stock, whereas the trial stability doesn’t. The monetary statement summarizes the impact of events on a enterprise. Its elements are the revenue statement, retained earnings assertion, stability sheet and assertion of money flows. The retained earnings statement summarizes the retained earnings, that are the online earnings retained by an organization. The statement of cash flows summarizes money receipts and money funds.

What is accumulated deficit mean?

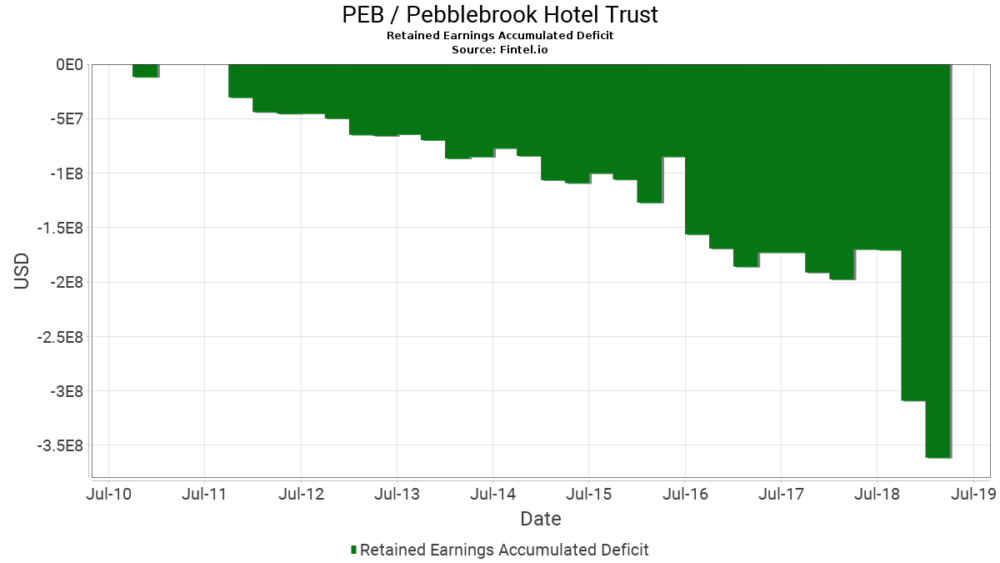

An accumulated deficit is a negative retained earnings balance. This deficit arises when the cumulative amount of losses experienced and dividends paid by a business exceeds the cumulative amount of its profits.

What Does Retained Earnings Deficit Mean?

Unlike an revenue statement, the full value of long-time period investments or debts seems on the balance sheet. The title balance sheet is derived from the way that the three major accounts finally steadiness out and equal each other. All assets are listed in one section, and their sum should equal the sum of all liabilities and the shareholders’ fairness. The stability sheet reveals a company’s assets or belongings, and likewise reveals how these assets are financed—whether or not that’s via debt beneath liabilities, or by way of issuing fairness as proven in shareholder’s fairness. The balance sheet supplies both traders and collectors with a snapshot as to how successfully an organization’s management makes use of its resources.

This is recorded as a unfavorable $three,000 on the money circulate statement as a result of it is an outflow of cash to make an investment. The land is recorded on the steadiness sheet as negative cash however as a positive asset. The company, which offers accounting companies, earns $10,000 in fees. The $10,000 from operations is recorded on the money circulate statement. It is recorded on the integrated financial statement as a positive money influx.

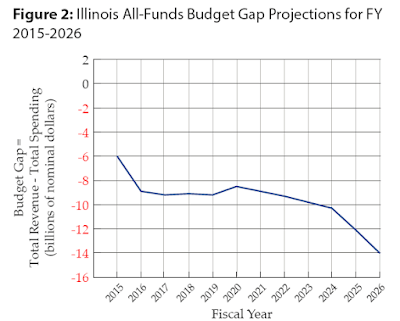

In other words, unfavorable shareholders’ equity should inform an investor to dig deeper and discover the reasons for the unfavorable balance. A good place to start out is for investors to learn to read a company’s income assertion and steadiness sheet. Accumulated losses over several durations or years might lead to a negative shareholders’ fairness. The P&L assertion reveals the company’s realized earnings or losses for the required time frame by comparing total revenues to the company’s complete costs and expenses. Over time, it could possibly present a company’s capacity to extend its profit, both by decreasing costs and bills, or by rising gross sales.

- In this example, the company has $10,000 in cash and $5,000 in capital inventory on hand.

- The cash can be listed underneath belongings and the capital stock underneath stockholders’ equity.

- An integrated financial assertion further shows how the revenue assertion impacts the stability sheet.

Shareholders’ fairness represents an organization’s web price (additionally known as guide worth) and measures the corporate’s financial health. If total liabilities are larger than complete property, the corporate may have a negative shareholders’ fairness. A unfavorable stability in shareholders’ fairness is a pink flag that buyers ought to examine the company additional before buying its stock. After the dividends are paid, the dividend payable is reversed and is now not current on the liability facet of the steadiness sheet. When the dividends are paid, the effect on the steadiness sheet is a lower within the firm’s retained earningsand its money balance.

What Is a Deficit in Financial Accounting?

The stability sheet lists a enterprise’s assets, liabilities and equity. Retained earnings are the total web revenue that a company has accrued from the date of its inception to the present monetary reporting date minus any dividends that the company has distributed over time. Companies report retained earnings within the shareholders’ equity part of the stability sheet. As earnings develop over time, the amount of retained earnings might exceed the total contributed capital by company shareholders and become the first supply of capital used to soak up any asset losses.

AccountingTools

When used collectively along with different monetary documents, the balance sheet and P&L statement could be utilized to assess the operational effectivity, year-to-yr consistency, and organizational course of an organization. For this reason, the numbers reported in each document are scrutinized by traders and by the company’s executives.

Companies publish income statements annually, on the finish of the corporate’s fiscal 12 months, and can also publish them on a quarterly foundation. Accountants, analysts, and buyers study a P&L assertion carefully, scrutinizing money flow and debt financing capabilities. In contrast, the balance sheet aggregates a number of accounts, summing up the variety of assets, liabilities, and shareholders’ equity in the accounting records at a specific time.

Retained earnings are listed in the shareholders’ fairness section of the stability sheet. If you have retained earnings, you enter them in the “house owners’ fairness” part of the steadiness sheet. Retained earnings characterize all the enterprise income you didn’t distribute to shareholders. Each year – or quarter, or month – you add your profits for the interval to the retained earnings account, or subtract your losses. In this article, we’ll evaluate how shareholders’ fairness measures a company’s web value and some causes behind negative shareholders’ equity.

START YOUR BUSINESS

A company has a web loss and a decrease in belongings when bills have exceeded revenues. Net income is shown on the assertion of cash flows as cash from working activities. It also is placed at the top of the retained earnings assertion and matched towards any dividends that had been distributed.

An built-in monetary statement additional reveals how the earnings statement affects the balance sheet. In this example, the corporate has $10,000 in money and $5,000 in capital inventory readily available. The cash would be listed underneath belongings and the capital inventory under stockholders’ fairness.