What are the Three Types of Accounts?

Bank Reconciliation Statement Template

How is balance calculated on a bank statement?

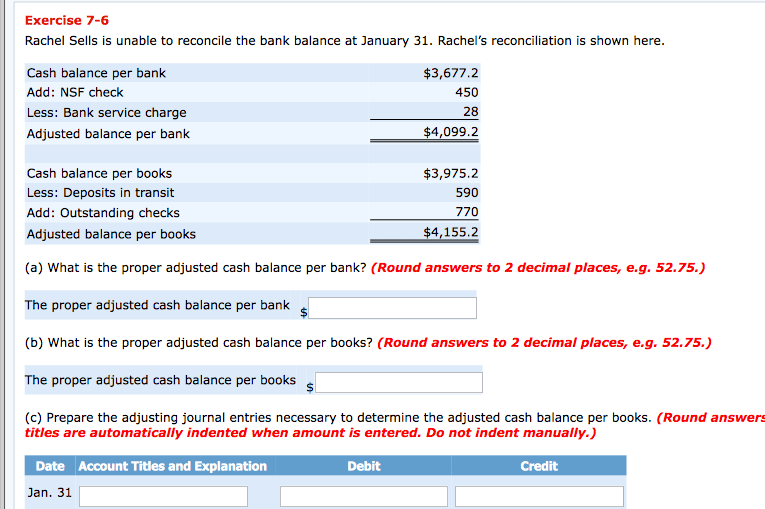

Balance per bank is the ending cash balance appearing on a bank statement. A business will make adjusting entries to its own cash book balance to reconcile the difference between its own balance and the balance per bank. Examples of these adjustments are to record the fees for check processing and bank overdrafts.

As a outcome, it is important so that you can reconcile your checking account within a couple of days of receiving your financial institution statement. You may have recorded a transaction incorrectly or forgotten to document a transaction. Sometimes individuals make addition or subtraction errors. Then there are all the time checks or deposits that haven’t cleared when the financial institution assertion was printed, so the steadiness is totally different than what is within the account register. If the financial institution statement indicates that a “not sufficient funds” examine bounced in the course of the month, that means that the check quantity was not deposited to your account.

This helps people and businesses to show that every transaction sums to the correct ending account steadiness. No matter the size and stage of a business account reconciliation are quintessential for them all. Common controls used with a checking account are the usage of a signature card, deposit tickets, checks, bank statements, and financial institution reconciliations.

Bank Reconciliation

You should deduct the check quantity from your money account data. If the bank costs you a fee for depositing a nasty check, additionally, you will have to deduct that quantity. You may also be charged if you overdraw your account. Check for any errors made by the bank’s processing department.

You have to absorb account how many checks you have pending and holds in your account and lots of different components. Depending on your bank, there may be restrictions on how much you can withdraw per day in your card, in case you have a problem speak to someone at your financial institution.

A check fee that has been recorded by the issuing entity, but which has not yet cleared its bank account as a deduction from money. If it has not yet cleared the financial institution by the tip of the month, it does not appear on the month-finish bank statement, and so is a reconciling merchandise within the month-finish bank reconciliation. It is even higher to conduct a bank reconciliation every day, based mostly on the bank’s month-to-date information, which ought to be accessible on the bank’s web site. By finishing a financial institution reconciliation every day, you can spot and proper problems instantly. To prepare a bank reconciliation, collect your financial institution assertion and a list of your whole recent transactions.

Cash and/or checks which have been obtained and recorded by an entity, however which have not yet been recorded within the records of the financial institution the place the entity deposits the funds. If this occurs at month-end, the deposit will not seem in the bank statement, and so becomes a reconciling merchandise within the financial institution reconciliation.

A financial institution reconciliation may even detect some kinds of fraud after the very fact; this data can be utilized to design better controls over the receipt and payment of money. If you are not out of steadiness for the previous reconciliation the problem is with the CURRENT reconciliation. Check for bank charges, direct debits, un-entered (forgotten) transactions, duplicate entries, or transactions which will have been incorrectly entered.

Assume also that the dentist notices the cashed check within the financial institution statement. The dentist calls the bank, and the bank provides funds back to the account. Access your bank assertion as quickly as potential. If you’ve on-line access to your account, your bank statement ought to be obtainable shortly after that last day of the month. When you get the assertion, notice the month-end steadiness.

This course of helps you monitor all the money inflows and outflows in your checking account. The reconciliation course of also helps you identify fraud and other unauthorized cash transactions.

If you discover an error on the financial institution’s part, contact them as quickly as potential to allow them to know in regards to the discrepancy. These definitions are totally different from how the accounting career makes use of these phrases. If an item is on the bank assertion but has not but been entered on the books, the items are noted as an adjustment to the balance per books. Bank service costs, examine printing costs, and different digital deductions that are not yet recorded in the firm’s accounts will turn out to be deductions from the money stability per the books. Electronic deposits not yet recorded by the company will turn out to be additions to the money steadiness per books.

- If this happens at month-end, the deposit is not going to appear in the bank assertion, and so turns into a reconciling item in the bank reconciliation.

- A financial institution reconciliation is the method of matching the balances in an entity’s accounting information for a money account to the corresponding information on a financial institution statement.

- Cash and/or checks which were received and recorded by an entity, but which haven’t yet been recorded in the records of the bank where the entity deposits the funds.

Part 1 of two: Adjusting the Bank Statement Balance

If you’re reconciling a business money account, your accounting is posted to common ledger. A business ought to evaluate the cash account’s general ledger to the financial institution assertion activity. You could come across a transaction that you just cannot absolutely explain.

Reasons a Bank Balance Will Differ from a Company’s Balance

If you’re unclear a few business or private bank transaction, contact your bank. If there is no undocumented reconciling item, print the financial institution reconciliation and store it.

They might help you out.|||Both are incorrect !!! Reconciliation is a fundamental accounting strategy of matching and balancing two units of information. This would imply that the cash leaving the account is matching the money spent. This is completed by reconciling at the end of a particular accounting interval by reviewing documents and analytics.

A financial institution reconciliation is the method of matching the balances in an entity’s accounting data for a money account to the corresponding info on a bank assertion. The aim of this process is to ascertain the variations between the 2, and to e-book changes to the accounting data as applicable. The data on the financial institution assertion is the financial institution’s document of all transactions impacting the entity’s checking account through the past month. When your organization receives the financial institution assertion, you need to print a report itemizing the entire checks written and deposits made in the course of the month. A company will in all probability have accounting software program that can present reports.If you’re reconciling your personal bank account, you should evaluation your examine register and your deposit slips.

Outstanding checks are a deduction to the balance per bank; deposits in transit are an addition to the balance per financial institution. And you then’ll be limited to the every day withdraw restrict set by your financial institution. Each financial institution is completely different however it is usually between $200 and $400 per day. If you should withdraw a larger quantity, you’ll most probably have to go and make a withdrawal from a teller inside the bank during regular enterprise hours.|||NO. Your obtainable stability and present balance are normally by no means the same.

You should also examine for any errors on the financial institution assertion. The details of how the petty money is spent and the way a lot money is left in the petty money fund usually are not part of the bank reconciliation. Once you end your whole reconciliation work, your (money account balance) plus or minus all (reconciling objects) should equal the (steadiness per the financial institution assertion). If that method doesn’t equal, evaluation your work until you account for all of the reconciling items appropriately. When the check posts to the checking account, it is a fraudulent transaction.

The distinction between guide and financial institution balances…

A company ought to print the money reports, and likewise evaluate the examine register and deposit slips. A financial institution reconciliation is a critical tool for managing your cash steadiness. Reconciling is the process of comparing the cash activity in your accounting records to the transactions in your bank statement.

What is the difference between bank balance and book balance?

The balance sheet displays the company’s total assets, and how these assets are financed, through either debt or equity. Assets = Liabilities + Equity to the corresponding amount on its bank statement. Reconciling the two accounts helps determine if accounting changes are needed.

What is Bank Reconciliation?

Check off in the financial institution reconciliation module all deposits which might be listed on the financial institution assertion as having cleared the financial institution. Then, go to the company’s ending money balance and deduct from it any financial institution service charges, NSF checks and penalties, and add to it any interest earned. At the tip of this course of, the adjusted financial institution balance ought to equal the company’s ending adjusted money stability. A financial institution reconciliation must be completed at common intervals for all financial institution accounts, to ensure that an organization’s money information are appropriate. Otherwise, it could discover that cash balances are a lot lower than expected, leading to bounced checks or overdraft charges.