The bank reconciliation course of — AccountingTools

Required Information to Create Bank Reconciliation Statement

A financial institution reconciliation is the method of matching the balances in an entity’s accounting information for a cash account to the corresponding data on a financial institution statement. The goal of this course of is to ascertain the variations between the 2, and to book adjustments to the accounting information as applicable. The info on the bank statement is the bank’s report of all transactions impacting the entity’s bank account during the previous month. Bank Reconciliation Statement is a valuable tool to identify variations between the steadiness as per Cash Book and bank assertion. Bank reconciliation also helps in detecting some frauds and manipulations.

How to do financial institution reconciliation

These are transactions during which cost is en route but the cash has not but been accepted by the recipient. When preparing the Oct. 31 bank reconciliation assertion, the examine mailed yesterday is unlikely to have been cashed, so the accountant deducts the amount from the bank steadiness.

What is a bank reconciliation and why is it important?

When you reconcile your business bank account, you compare your internal financial records against the records provided to you by your bank. A monthly reconciliation helps you identify any unusual transactions that might be caused by fraud or accounting errors, and the practice can also help you spot inefficiencies.

If you are reconciling a enterprise money account, your accounting is posted to general ledger. A business should examine the money account’s basic ledger to the bank statement activity.

What do you mean by bank reconciliation?

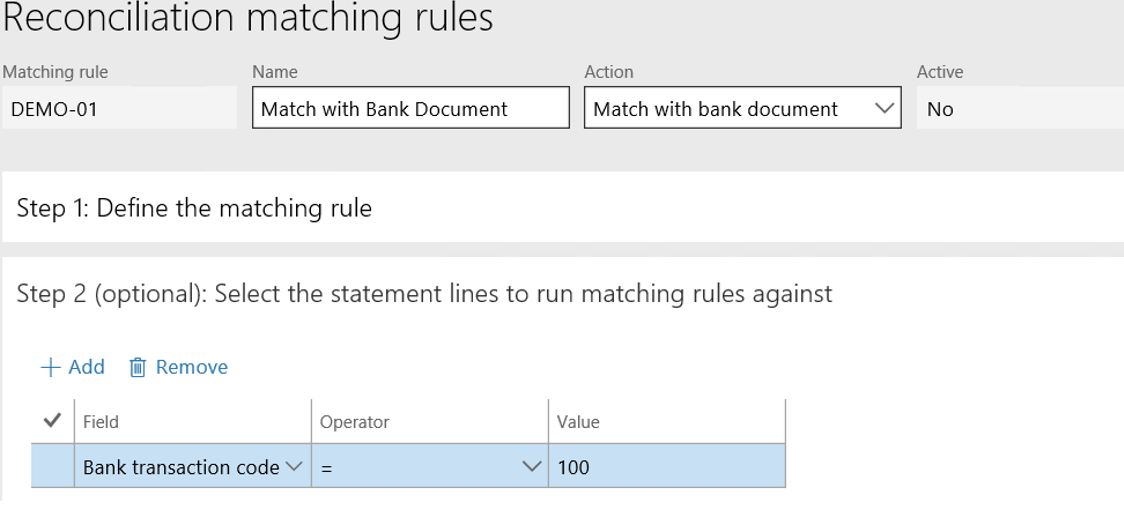

A bank reconciliation is the process of matching the balances in an entity’s accounting records for a cash account to the corresponding information on a bank statement. The goal of this process is to ascertain the differences between the two, and to book changes to the accounting records as appropriate.

Make all the required adjustments for the financial institution errors. Do vice-versa in case its start with the credit score stability. Now, evaluate credit score aspect of the financial institution assertion with debit facet of the financial institution column of cash guide and debit facet of the financial institution assertion with the credit score side of the financial institution column of the money e-book. Place a tick in opposition to all the items showing in both the records. Check for any errors made by the bank’s processing department.

Banking a hundred and one

This course of helps you monitor all of the money inflows and outflows in your bank account. The reconciliation process additionally helps you establish fraud and other unauthorized cash transactions. As a result, it’s crucial so that you can reconcile your checking account inside a couple of days of receiving your bank assertion. There are quite a few reasons why a enterprise might record transactions using a cash e-book as an alternative of a money account.

The outcome might be an overdrawn checking account, bounced checks, and overdraft fees. In some circumstances, the bank could even elect to close down your checking account. There is a difference in the steadiness as on 31st March 2019 between the bank assertion and Cash Book.

There can also be collected funds that haven’t yet been processed by the financial institution, which requires a positive adjustment. To put together a bank reconciliation, collect your bank statement and a listing of all of your current transactions. Compare your debits, or withdrawals from your checking account, and credit, or deposits you made into your account, to ensure that the transactions seem in both your information and in your financial institution statement.

- The aim of this course of is to establish the differences between the two, and to book modifications to the accounting information as appropriate.

- A bank reconciliation is the method of matching the balances in an entity’s accounting information for a cash account to the corresponding information on a bank statement.

With cash accounts, balances are commonly reconciled on the finish of the month after the issuance of the month-to-month financial institution statement. It is even higher to conduct a financial institution reconciliation every day, based on the bank’s month-to-date data, which must be accessible on the bank’s website. By finishing a financial institution reconciliation daily, you possibly can spot and proper issues immediately. The accountant adjusts the ending steadiness of the financial institution assertion to reflect excellent checks or withdrawals.

Bank Reconciliation Example

There is no higher limit to the variety of accounts concerned in a transaction – however the minimal is at least two accounts. Thus, the usage of debits and credit in a two-column transaction recording format is essentially the most essential of all controls over accounting accuracy.

If you find an error on the financial institution’s half, contact them as quickly as possible to allow them to know concerning the discrepancy. A financial institution reconciliation is used to match your records to those of your financial institution, to see if there are any differences between these two sets of data on your money transactions. The ending steadiness of your model of the money records is called the book balance, whereas the financial institution’s model known as the bank stability. It is extraordinarily widespread for there to be differences between the 2 balances, which you should monitor down and modify in your personal information. If you were to ignore these differences, there would ultimately be substantial variances between the amount of cash that you assume you’ve and the quantity the financial institution says you even have in an account.

Not only is the method used to search out out the differences, but in addition to bring about adjustments in relevant accounting data to keep the information updated. Bank reconciliations examples are carried out at regular intervals. A bank reconciliation is a critical device for managing your cash steadiness. Reconciling is the process of evaluating the cash exercise in your accounting information to the transactions in your financial institution statement.

Bank reconciliation

Daily cash balances are simple to entry and decide. Mistakes can be detected simply through verification, and entries are saved up-to-date because the stability is verified day by day.

You are required to organize a Bank Reconciliation Statement as on 31st March 2019. Below is the extract for Cash Book and Bank assertion for the month of March 2019. It is feasible to have sure transactions which have been recorded as paid within the internal cash register however that don’t appear as paid within the bank assertion.

The transactions must be deducted from the bank statement balance. An example of such a transaction is checks issued however which have but to be cleared by the bank. Each pay period, your payroll needs to balance with the payroll expense account in your ledger. The payroll reconciliation process helps you keep correct accounting information, which are necessary for tax submitting and measuring financial health. You verify that the transactions in your books equal the payroll register.

What Is a Bank Reconciliation Statement?

You might come across a transaction that you cannot absolutely explain. If you’re unclear a couple of enterprise or personal financial institution transaction, contact your bank. These definitions are totally different from how the accounting career uses these terms. Whenever an accounting transaction is created, at least two accounts are always impacted, with a debit entry being recorded in opposition to one account and a credit score entry being recorded towards the other account.

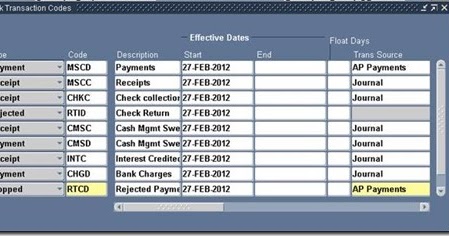

It is an effective practice to hold out this exercise at common intervals, which helps in maintaining controls in the organization. This additionally keeps the Cash Book updated as those transactions which are rightly recorded within the financial institution statement can be recorded in the Cash Book. Bank Reconciliation is a process that offers the explanations for differences between the financial institution assertion and Cash Book maintained by a business.