Supplemental Indenture

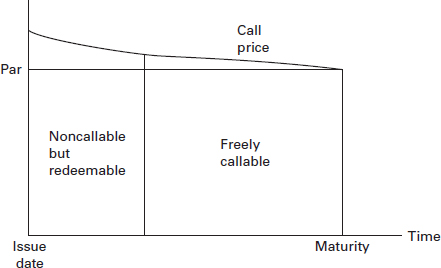

Callable or redeemable bonds are bonds that can be redeemed or paid off by the issuer prior to the bonds’ maturity date. When an issuer calls its bonds, it pays buyers the decision worth (usually the face value of the bonds) along with accrued curiosity thus far and, at that point, stops making curiosity payments. Call provisions are sometimes a characteristic of corporate and municipal bonds. In company finance, a debenture is a medium- to long-term debt instrument used by large corporations to borrow cash, at a fixed price of interest. The legal term “debenture” initially referred to a doc that both creates a debt or acknowledges it, however in some nations the time period is now used interchangeably with bond, loan stock or note.

Understanding the Trust Indenture Act

The fund had an affordable expense ratio of zero.sixty nine% and had an average ten-yr return of seven.41%. A trust indenture also includes the traits of the bond, corresponding to maturity date, face value, coupon price, fee schedule, and purpose of the bond concern. One section of the belief indenture dictates the circumstances and processes surrounding a default. The indenture establishes a collective action mechanism under which collectors or bondholders can collect in a good, orderly method if default by the issuer takes place. A bondholder should pay attention to and perceive the proper sequence of events, permitting them to take the correct course of action should such a scenario happen.

Convertible vs. Nonconvertible

Foreign investments involve greater dangers than U.S. investments, and may decline considerably in response to opposed issuer, political, regulatory, market, and economic risks. Any fixed-earnings safety bought or redeemed prior to maturity may be subject to loss. It paid a 30-day Securities and Exchange Commission (SEC) yield of three.fifty eight% as of February 2020. The debt securities in the fund’s portfolio had an average weighted maturity of 6.forty years and a period of 3.32 years. That is a lower duration, which indicates the bonds have less publicity to rate of interest danger.

What is the difference between a bond agreement and a bond indenture?

A bond indenture is the contract associated with a bond. The terms of a bond indenture include a description of the bond features, restrictions placed on the issuer, and the actions that will be triggered if the issuer fails to make timely payments. The dates when interest payments will be made to bondholders.

Bond Characteristics

The finest way for small buyers to cope with default threat is thru diversification. Fund managers have the sources to buy a big selection of excessive-yield company bonds, lowering default risk. Investors should review the details of a sinking fund provision in a bond’s indenture and determine their very own preferences earlier than investing their money into any company bond. There are also other features that reduce threat, similar to a “sinking fund”, which means that the debtor should pay a number of the value of the bond after a specified time period.

A prospectus is a formal and authorized document that presents particulars concerning the structure and targets of the issuing bond firm. The Vanguard High-Yield Corporate Fund focuses on company debt with decrease credit scores. Vanguard states that this strategy is intended to return consistent revenue whereas minimizing defaults and principal loss. The fund does have larger volatility, closer to that of the stock market.

Often there is a clause within the contract that allows this; for instance, if a bond issuer needs to rebuy a 30-yr bond at the 25th year, they have to pay a premium. If a bond is called, it signifies that much less curiosity is paid out. In common, an unsecured debt, typically an unsecured bond backed only by the integrity or creditworthiness of the issuer (and not by any type of collateral, corresponding to property or stock or another asset). Debentures are governed by agreements often known as indentures, that are topic to the Trust Indenture Act of 1939.

While it’s perfectly safe to buy Treasuries instantly, individual excessive-yield bonds carry high default risk. However, most company choices should include a trust indenture. A copy of it should be filed with the Securities and Exchange Commission (SEC) for company bonds with combination principal issues of a minimum of $5 million. Corporate points for lower than $5 million, municipal bonds, and bonds issued by the government are not required to file belief indentures with the SEC. Of course, these exempted entities might choose to create a belief indenture to reassure prospective bond buyers, if not to adhere to any federal legislation.

- The contract outlines the phrases of the bond, the promise of the issuer and your rights as an investor.

- Some of the elements lined in a bond indenture, also referred to as a bond indenture settlement, embrace the maturity date, the coupon rate (stated rate of interest) and any particular options of the particular bond.

- In simplest phrases, a bond indenture is the contract between the bond issuer and an investor.

In the United States, public debt choices in excess of $10 million require using an indenture of belief under the Trust Indenture Act of 1939. No trust relationship exists between the bondholder and the issuing company.

A debenture is thus like a certificates of mortgage or a loan bond evidencing the truth that the company is liable to pay a specified quantity with interest. Although the cash raised by the debentures becomes a part of the company’s capital construction, it does not turn into share capital.

The par or face worth of a bond is the value at which the issuer sets the bond upon issuance. The premium refers to the amount for which the bond sells above its par worth. In different phrases, if you purchase a $500 bond for $550, the premium you paid was $50. You may be able to buy low cost bonds below their face values due to falling interest rates or antagonistic market conditions, via both a bond indenture or bond settlement. Different methods are necessary for top-yield corporate bonds.

This decreases risk for the collectors, as a hedge in opposition to inflation, chapter, or other danger elements. A sinking fund makes the bond much less risky, and subsequently offers it a smaller “coupon” (or curiosity fee). There are also options for “convertibility”, which suggests a creditor may turn their bonds into fairness in the firm if it does properly. Companies additionally reserve the proper to call their bonds, which mean they can call it sooner than the maturity date.

These two are in a regular contractual, arm’s size, non-fiduciary, non-equity relationship. In basic, the bond market is risky, and fixed revenue securities carry rate of interest threat. (As interest rates rise, bond prices often fall, and vice versa. This effect is often more pronounced for longer-term securities). Fixed income securities additionally carry inflation threat, liquidity danger, name risk and credit and default dangers for both issuers and counterparties. Lower-quality fixed income securities contain larger threat of default or price modifications due to potential adjustments in the credit quality of the issuer.

Bonds are issued to lenders or buyers to lift money for an organization or governmental body. To issue a bond, the issuer hires a 3rd-celebration trustee, normally a financial institution or belief company, to symbolize traders who purchase the bond. The settlement entered into by the issuer, and the trustee is referred to as the belief indenture. Similar to most bonds, debentures might pay periodic curiosity payments called coupon payments. Like different kinds of bonds, debentures are documented in an indenture.

A trust indenture describes the bond’s characteristics and the phrases of its callability. It also delineates the quantity of further debt the issuer can assume, and the circumstances and procedures in case of issuer default.

A belief indenture is a contract entered into by a bond issuer and an impartial trustee to guard the interests of bondholders. A bond’s maturity refers to the length of time before the issuing company is required to pay bond holders the principal amount of the bond.

Bond Indenture

In easiest phrases, a bond indenture is the contract between the bond issuer and an investor. The contract outlines the terms of the bond, the promise of the issuer and your rights as an investor. Some of the aspects lined in a bond indenture, also known as a bond indenture agreement, embody the maturity date, the coupon fee (acknowledged fee of interest) and any special features of the actual bond. Bonds are required by the Securities and Exchange Commission (SEC), to have indentures, that are typically summarized in the bond prospectus.

An indenture is a legal and binding contract between bond issuers andbondholders. The contract specifies options of a debt providing, such as the maturity date, the timing of interest or coupon payments, the strategy of interest calculation, and other features. Debt issuers are expected to reveal the terms under which a safety is issued with a proper written agreement known as a belief indenture.