Retained earnings represent the cumulative amount of a company’s net income that has been held by the company as equity capital and recorded as stockholders’ equity. Some net income may have been distributed outside the corporation via payment of dividends. Essentially, retained earnings represent the amount of company profits, net of dividends, that have been reinvested back into the company. Stockholders’ equity is the value of assets a company has remaining after eliminating all its liabilities. Companies with positive trending shareholder equity tend to be in good fiscal health.

You can calculate this by subtracting the total assets from the total liabilities. In our modeling exercise, we’ll forecast the shareholders’ equity balance of a hypothetical company for fiscal years 2021 and 2022. Since repurchased shares can no longer trade in the markets, treasury stock must be deducted from shareholders’ equity. But an important distinction is that the decline in equity value occurs due to the “book value of equity”, rather than the market value. For mature companies consistently profitable, the retained earnings line item can contribute the highest percentage of shareholders’ equity. In these types of scenarios, the management team’s decision to add more to its cash reserves causes its cash balance to accumulate.

Share Capital

Every company has an equity position based on the difference between the value of its assets and its liabilities. A company’s share price is often considered to be a representation of a firm’s equity position. In most cases, retained earnings are the largest component of stockholders’ equity. This is especially true when dealing with companies that have been in business for many years.

Note that the treasury stock line item is negative as a “contra-equity” account, meaning it carries a debit balance and reduces the net amount of equity held. After the repurchase of the shares, ownership of the company’s equity returns to the issuer, which reduces the total outstanding share count (and net dilution). Return on stockholders’ equity, also referred to as Return on Equity (ROE), is a key metric of company profitability in relation to stockholders’ equity. Investors look to a company’s ROE to determine how profitably it is employing its equity. ROE is calculated by dividing a company’s net income by its shareholders’ equity.

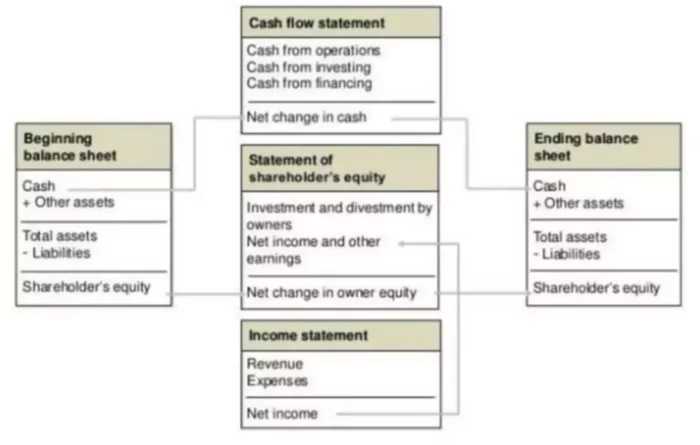

Statement of Stockholders’ Equity

If used in conjunction with other tools and metrics, the investor can accurately analyze the health of an organization. Often referred to as paid-in capital, the “Common Stock” line item on the balance sheet consists of all contributions made by the company’s equity shareholders. While there are exceptions – e.g. dividend recapitalization – if a company’s shareholders’ equity remains negative and continues to trend downward, it is a sign that the company could soon face insolvency. Treasury shares continue to count as issued shares, but they are not considered to be outstanding and are thus not included in dividends or the calculation of earnings per share (EPS). Treasury shares can always be reissued back to stockholders for purchase when companies need to raise more capital.

- Shareholders Equity is the difference between a company’s assets and liabilities, and represents the remaining value if all assets were liquidated and outstanding debt obligations were settled.

- Stockholders’ equity is the remaining assets available to shareholders after all liabilities are paid.

- If the same assumptions are applied for the next year, the end-of-period shareholders equity balance in 2022 comes out to $700,000.

If the same assumptions are applied for the next year, the end-of-period shareholders equity balance in 2022 comes out to $700,000. When companies issue shares of equity, the value recorded on the books is the par value (i.e. the face value) of the total outstanding shares (i.e. that have not been repurchased). Otherwise, an alternative approach to calculating shareholders’ equity is to add up the following line items, which we’ll explain in more detail soon.

Now that we’ve gone over the most frequent line items in the shareholders’ equity section on a balance sheet, we’ll create an example forecast model. Stockholders’ equity is equal to a firm’s total assets minus its total liabilities. An alternative calculation of company equity is the value of share capital and retained earnings less the value of treasury shares. For this reason, many investors view companies with negative shareholder equity as risky or unsafe investments. Shareholder equity alone is not a definitive indicator of a company’s financial health.

Low Stockholders’ Equity

The original source of stockholders’ equity is paid-in capital raised through common or preferred stock offerings. The second source is retained earnings, which are the accumulated profits a company has held onto for reinvestment. The stockholders’ equity, also known as shareholders’ equity, represents the residual amount that the business owners would receive after all the assets are liquidated and all the debts are paid. Shareholder equity is also known as the book value of the company and is derived from two main sources, the money invested in the business and the retained earnings.

Stockholders’ Equity: Formula & How It Works

Under a hypothetical liquidation scenario in which all liabilities are cleared off its books, the residual value that remains reflects the concept of shareholders equity. Shareholders’ equity is the residual claims on the company’s assets belonging to the company’s owners once all liabilities have been paid down. Once all liabilities are taken care of in the hypothetical liquidation, the residual value, or “book value of equity,” represents the remaining proceeds that could be distributed among shareholders. However, shareholders’ equity alone may not provide a complete assessment of a company’s financial health. Long-term assets are the value of the capital assets and property such as patents, buildings, equipment and notes receivable.

Stockholders’ equity is the value of a company directly attributable to shareholders based on in-paid capital from stock purchases or the company’s retained earnings on that equity. While it’s an important financial metric on its own, incorporating the stockholders’ equity into financial ratios, such as return on equity, provides a more detailed picture of how a company is managing its equity. A debt issue doesn’t affect the paid-in capital or shareholders’ equity accounts.

If a company doesn’t wish to hang on to the shares for future financing, it can choose to retire the shares. Current liabilities are debts typically due for repayment within one year, including accounts payable and taxes payable. Long-term liabilities are obligations that are due for repayment in periods longer than one year, such as bonds payable, leases, and pension obligations.

When a company generates net income, or profits, and holds on to it rather than pay it out as dividends to shareholders, it’s recorded as retained earnings, which increase stockholders’ equity. For example, if a company reports $10,000,000 in net profits for the quarter and pays $2,000,000 in dividends, it increases stockholders’ equity by $8,000,000 through the retained earnings account. If a company reports a loss of net income for the quarter, it will reduce stockholders’ equity.

Stockholders’ Equity and Paid-in Capital

In recent years, more companies have been increasingly inclined to participate in share buyback programs, rather than issuing dividends. The excess value paid by the purchaser of the shares above the par value can be found in the “Additional Paid-In Capital (APIC)” line item. Assessing whether an ROE measure is good or bad is relative, and depends somewhat on what is typical for companies operating within a particular sector or industry. Generally, the higher the ROE, the better the company is at generating returns on the capital it has available. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.