Should I invest $200,000 in an annuity?

Since funds are made sooner with an annuity due than with an strange annuity, an annuity due typically has a higher present worth than an strange annuity. On the opposite hand, when rates of interest fall, the worth of an strange annuity goes up. This is because of the idea often known as the time value of cash, which states that money available right now is price more than the same quantity sooner or later as a result of it has the potential to generate a return and develop. An strange annuity is a collection of equal funds made on the finish of consecutive periods over a fixed size of time.

What is the difference between an annuity and an annuity due?

An annuity due is a repeating payment that is made at the beginning of each period, such as a rent payment. It has the following characteristics: All payments are in the same amount (such as a series of payments of $500). All payments are made at the same intervals of time (such as once a month or year).

Annuity in Advance Example

You’ll pay a sure amount of cash, either up front or as part of a fee plan. You can receive annuity payments both indefinitely or for a predetermined size of time.

Two other frequent examples of strange annuities are curiosity funds from bonds and inventory dividends. When a bond issuer makes curiosity payments, which generally occurs twice a yr, the interest is paid and received at the finish of the interval in query. Similarly, when a company pays dividends, which usually occurs quarterly, it is paying on the end of the period during which it retained sufficient excess earnings to share its proceeds with its shareholders. An ordinary annuity is a collection of equal payments made at the finish of each period over a hard and fast period of time. Examples of odd annuities are interest payments from bonds, which are usually made semi-annually, and quarterly dividends from a stock that has maintained secure payout levels for years.

Still, as a approach to guarantee a stream of income for so long as you reside, an instantaneous annuity may be extremely useful. If you are liable for making funds on an annuity, you will profit from having an ordinary annuity because it permits you to hold onto your cash for a longer amount of time. However, when you’re on the receiving end of annuity funds, you will benefit from having an annuity due, as you may obtain your cost sooner. Ordinary annuity payments are normally made monthly, quarterly, semiannually, or yearly. When a home-owner makes a mortgage cost, it usually covers the month-lengthy period main up to the cost date.

While the funds in an strange annuity may be made as regularly as every week, in practice, they are typically made monthly, quarterly, semi-yearly, or annually. The reverse of an strange annuity is an annuity due, in which funds are made initially of every interval.

An annuity is a monetary product that pays out a hard and fast stream of funds to a person, and these monetary merchandise are primarily used as an revenue stream for retirees. Annuities are created and sold by monetary establishments, which accept and invest funds from individuals.

An example of an immediate annuity is when a person pays a single premium, say $200,000, to an insurance coverage company and receives month-to-month funds, say $5,000, for a hard and fast time interval afterward. The payout quantity for quick annuities depends on market circumstances and interest rates. Variable annuities allow the proprietor to receive greater future cash flows if investments of the annuity fund do properly and smaller funds if its investments do poorly. This offers for less steady cash circulate than a set annuity but permits the annuitant to reap the advantages of strong returns from their fund’s investments.

thanks for visiting cnnmoney.

The info offered isn’t meant to be a recommendation to purchase an annuity, including a Personal Pension, which is a subscription-based deferred income annuity. Blueprint Income, Inc. is a registered mounted annuity producer in New York, NY. Blueprint Income, Inc.’s licensed fixed annuity producers are licensed in all 50 states and The District of Columbia.

- An instance of an instantaneous annuity is when a person pays a single premium, say $200,000, to an insurance coverage firm and receives month-to-month funds, say $5,000, for a fixed time interval afterward.

- Variable annuities allow the proprietor to receive larger future money flows if investments of the annuity fund do well and smaller funds if its investments do poorly.

- The payout quantity for instant annuities is dependent upon market circumstances and interest rates.

The current value of an strange annuity is basically dependent on the prevailing interest rate. For those with an employer-sponsored retirement plan, qualified annuities are an possibility. With one particular sort – a qualified longevity annuity – you can delay payments until late into retirement. Also, you don’t have to incorporate annuity funds as part of your required minimum distribution, which may reduce your taxes. Taxes are a tax profit for deferred annuities since you don’t need to report the growing incoming until you really obtain distributions.

Annuity due

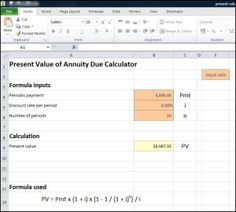

When you buy an annuity, you make a lump-sum payment or series of payments. In return, the insurer (the insurance company) agrees to make periodic funds to you (the insured) starting instantly or at some date in the future. Valuation of an annuity entails calculation of the current worth of the long run annuity funds.

Upon annuitization, the holding institution will problem a stream of payments at a later time limit. Many people use deferred revenue annuities to protect against longevity danger, with payouts kicking in at age eighty or 85 that can present supplemental earnings if you most need it.

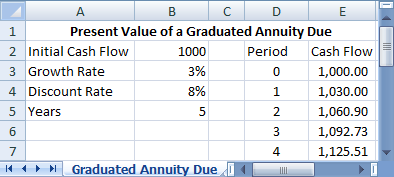

You can structure a direct annuity to pay for the remainder of your life, for a set time frame, or for as long as you and another person you choose as a beneficiary are nonetheless living. If you do determine you need to buy more assured income, you may wish to achieve this steadily. One instance the place the difference between an annuity in advance and an annuity in arrears matters is within the valuation of earnings properties. If funds are obtained initially of the rental interval quite than on the end of the rental interval, the current worth of these payments increases. It can also be possible to make use of mathematical formulation to compute the current and future values of an annuity prematurely or an strange annuity.

The valuation of an annuity entails ideas similar to time worth of cash, rate of interest, and future value. You may end up questioning, though, in regards to the present value of the annuity you’ve purchased. The present worth of an annuity is the whole cash value of all of your future annuity payments, given a decided price of return or low cost price. Knowing the present worth of an annuity can help you figure out precisely how much worth you could have left in the annuity you bought. This makes it easier so that you can plan on your future and make sensible monetary choices.

Insurance companies additionally change their merchandise and data often and with out discover. Annuities usually are not FDIC or NCUA insured, not bank guaranteed, may lose worth and aren’t a deposit. An odd annuity makes payments on the finish of each time interval, while an annuity due makes them firstly. An annuity is a contract between you and an insurance firm that’s designed to fulfill retirement and other long-range goals.

The trade-off is that it is extra common for individuals to end up getting nothing from a deferred income annuity, as a result of many won’t reach the future age at which advantages kick in. Payouts on most instant annuities are rate of interest sensitive, and so when rates are low, the quantity of future revenue you will get from an instantaneous annuity may be comparatively small.

What Is Annuity in Advance?

A fastened annuity is an annuity whose value increases based mostly on acknowledged returns throughout the annuity contract. An immediate annuity is the simplest type of annuity for most individuals to understand, because in its most common kind, it has very basic provisions. A typical fixed immediate annuity entails your making a lump-sum cost to an insurance firm upfront, in trade for the right to obtain funds from the insurer frequently starting instantly.

Blueprint Income, Inc. doesn’t advise clients on the acquisition of non-mounted annuity merchandise. The data revealed on this website online just isn’t intended to be a advice to buy a hard and fast fee annuity, immediate annuity, deferred income annuity or qualified longevity annuity contract. The contract options described on this web site is probably not current and will not apply within the state by which you reside.