Ultimately, land gets its value based upon how it can be used—i.e., what an owner can build on the site. However, developers are often forced to make offers on property without knowing for sure what they will be able to entitle. One of the primary challenges developers face is placing a value on a piece of undeveloped land. In its natural, unimproved state, undeveloped land has little inherent value. For example, millions of square miles of rural land has virtually no economic value because they are of no economic use. In accounting, owner’s equity is the residual net assets after the deduction of liabilities.

In accounting, residual value is sometimes used interchangeably with salvage value. The salvage value of an asset is used in the calculation for its residual value. Residual value is one of the most important aspects of calculating the terms of a lease. It refers to the future value of a good (typically the future date is when the lease ends).

Example of Residual Value in Depreciation Calculation

In many cases, the depreciation of an asset affects its actual starting value. A savvy investor will know whether it’s worth purchasing an asset if it is set to depreciate relatively quickly. You wouldn’t drop several hundred thousand dollars on a property set to depreciate by orders of magnitude in just a couple of years, right? Residual value helps to calculate eventual or likely depreciation and, therefore, avoid making investment mistakes.

- A car lease’s residual value is used to calculate your monthly car lease payment.

- ABC also incurred $1,200 in shipping costs and spent $1,800 on installation.

- Calculating residual value requires two figures namely, estimated salvage value and cost of asset disposal.

- Since 1995, Alliance Consolidated Group has acquired and invested in medical properties with net leases between $3 and $25 million across the United States.

- For other assets, companies aim to have a residual value as high as possible.

Be mindful that for assets with a low salvage value and high cost to dispose of, it is entirely possible to have a negative residual value. This means it will result in a liability for a company to be rid of the asset at the end of its useful life. A strong example is assets that must adhere to regulatory disposal requirements to remove waste without environmental contamination. In investments, for instance, residual value represents the difference between the cost of capital and profits.

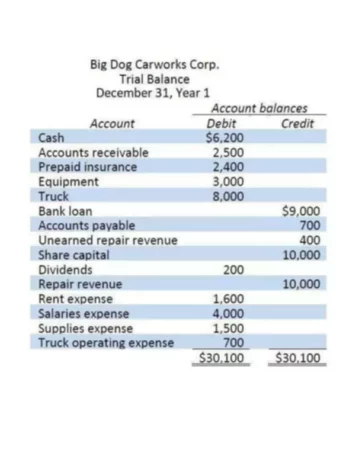

How to Calculate Residual Value

The resale value, meanwhile, is simply the market price for an asset upon resale. Residual values are calculated based on the amount that the asset’s owner would earn by selling the asset, minus any costs incurred during that asset’s disposal. When a company purchases an asset, it records the asset on its balance sheet at its original acquisition cost. An asset’s salvage value is the book value that remains on the company balance sheet at the end of its useful life. Its useful life is the length of time in which the asset can be expected to generate revenue for the company, and it is also the length of time over which the asset is depreciated. When it is fully depreciated on the company’s balance sheet, it may still hold some value for the company that can be realized at the eventual sale of the used asset.

Residual value and resale value are two terms that are often used when discussing car-purchasing and leasing terms. Using the example of leasing a car, the residual value would be a car’s estimated worth at the end of its lease term. Residual value is used to determine the monthly payment amount for a lease and the price the person holding the lease would have to pay to purchase the car at the end of the lease. The difficulty in calculating residual value lies in the fact that both the salvage value and the cost to dispose of the asset may not truly be known until disposition. Management must make an estimate on both, and companies often rely heavily on comparable assets or transactions that have happened in the past to better understand the financial implications of their own item(s).

The residual value, also known as salvage value, is the estimated value of a fixed asset at the end of its lease term or useful life. In lease situations, the lessor uses the residual value as one of its primary methods for determining how much the lessee pays in periodic lease payments. As a general rule, the longer the useful life or lease period of an asset, the lower its residual value. If a residual value is to be calculated at all, the most defensible approach is to use the residual values of comparable assets, especially those traded in a well-organized market. For example, there is a large market in used vehicles that can be the basis for a residual value calculation for similar types of vehicles.

What is Residual Value & How to Calculate It

It is worth remembering that companies owning several costly fixed assets such as vehicles, medical equipment and other heavy machinery may consider buying residual value insurance. This insurance helps to minimise asset-value risk by assuring the post-useful-life value of assets enjoying proper maintenance. Various fields and industries differ in the way they calculate an asset’s residual value. However, the residual value of an asset is usually calculated from the estimated salvage value of that asset. The salvage value can be estimated using the comparable approach, i.e. based on the value of comparable assets in the market. You can’t know the total worth of your investment assets if you don’t know how to calculate and project their depreciation over time.

Open-Ended Car Lease

At the end of the ten-year lease term, the racking system has been fully depreciated. Properties can have both appreciating and depreciating residual values, depending on the perceived value of the equipment and fixtures left behind. It pertains most to investors of single-tenant properties that have been fit out with specific fixtures and equipment needed to run that business.

How Is Residual Value Used in a Car Lease?

The landlord decides to remove the racking system from the warehouse at a cost of $2,000. The residual value of the racking system is therefore $6,000 – the value of the racking system, less expenses, after the asset has been fully depreciated. Determining what a property is “worth” is no easy task, whether it is a piece of undeveloped land or a building that has recently been vacated by a long-term tenant. In this article, we explore the concepts of residual value, resale value, and residual land value – three terms that are often confused but have decidedly different meanings and purposes. Some scenarios will justify the use of one vs. the other, so it is important for investors to understand the distinctions between each. An asset’s disposal costs include expenses directly related to the disposal of the asset.

Additionally, consider the example of a business owner whose desk has a useful life of seven years. How much the desk is worth at the end of seven years (its fair market value as determined by agreement or appraisal) is its residual value, also known as salvage value. This information is helpful to management to know how much cash flow it may receive if it were to sell the desk at the end of its useful life.

Meanwhile, another housing developer might be willing to pay $1 million per acre for that same undeveloped land if they assume they can build 20-units of housing per acre. Until they bring the site through a rezoning and permitting process, there will remain uncertainty as to what they can actually build – which again, influences the value of the undeveloped land. In its first quarter 2023 earnings call, UPS notes that it incurred a one-time, non-cash charge in late 2022 that resulted from the reduction in the estimated residual value of its MD-11 fleet of cargo planes. In other words, the estimated resale value of these planes is now lower than initially expected.

Similarly, anything that raises the costs of development would lower the land residual, and therefore lower the residual value. The resale value is based on many factors, such as the condition of the car, consumer preferences, and consumer demand. A car with low miles in pristine condition may sell for more than its residual value, all else considered equal. If you decide to buy your leased car, the price is the residual value plus any fees.