Receivables Turnover Ratio – Definition

This implies that the remaining items in inventory will have a value of products offered of $3,000,000 and their average inventory price will be $900,000. As a end result, the vast majority of the items in stock could have an average turnover ratio of 3.three ($three,000,000 divided by $900,000). In different words, the majority of gadgets are turning on average every 109 days (360 days divided by the turnover ratio of three.three).

The receivables turnover ratio measures the effectivity with which an organization collects on their receivables or the credit it had prolonged to its customers. The ratio additionally measures how many instances an organization’s receivables are converted to money in a period. The receivables turnover ratio could possibly be calculated on an annual, quarterly, or monthly basis. The accounts receivable turnover ratio is an accounting measure used to quantify a company’s effectiveness in collecting its receivables or cash owed by purchasers. The ratio reveals how well an organization makes use of and manages the credit score it extends to prospects and how shortly that brief-time period debt is collected or is paid.

Lastly, a low receivables turnover won’t essentially point out that the company’s issuing of credit and collecting of debt is lacking. For instance, if the company’s distribution division is working poorly, it might be failing to deliver the proper items to clients in a well timed manner.

The accounts receivable turnover ratio measures an organization’s effectiveness in collecting its receivables or cash owed by purchasers. The ratio reveals how nicely an organization uses and manages the credit it extends to customers and the way shortly that brief-time period debt is collected or being paid. A high receivables turnover ratio can point out that a company’s assortment of accounts receivable is environment friendly and that the company has a high proportion of quality customers that pay their money owed shortly. A excessive receivables turnover ratio may additionally indicate that a company operates on a cash basis.

How do you calculate your stock turnover ratio?

It is a sign of ineffective stock management because stock often has a zero price of return and excessive storage price. Higher stock turnover ratios are thought of a constructive indicator of efficient stock administration. However, a higher inventory turnover ratio doesn’t at all times mean higher efficiency. It generally might indicate insufficient inventory degree, which may end in lower in sales.

As a end result, customers would possibly delay paying their receivable, which would lower the corporate’s receivables turnover ratio. As such, the beginning and ending values selected when calculating the typical accounts receivable must be fastidiously chosen so to precisely reflect the corporate’s efficiency. Investors might take a median of accounts receivable from every month during a 12-month period to help smooth out any seasonal gaps.

The Formula for Average Inventory Is:

The finish of the yr, for instance, might characterize unusually low stock levels, since most products are sold throughout Christmas. Using only two figures to calculate the common inventory levels for the entire 12 months could end in mistaken assumptions in regards to the agency. Utilizing data from all 4 quarterly reports considerably mitigates the problem, but isn’t always an ideal solution.

How to Calculate the Inventory Turnover Ratio

When a business funds its belongings and operations primarily by way of debt, collectors may deem the enterprise a credit score threat and traders shy away. However, one monetary ratio by itself does not provide enough details about the company. When considering debt, wanting at the firm’s money move is also necessary.

- For example, if the corporate’s distribution division is operating poorly, it might be failing to deliver the right items to prospects in a well timed manner.

- Lastly, a low receivables turnover may not necessarily point out that the company’s issuing of credit and collecting of debt is lacking.

This measures what number of occasions common inventory is “turned” or sold throughout a period. In different phrases, it measures how many instances an organization sold its whole common stock greenback quantity through the 12 months. A firm with $1,000 of average inventory and gross sales of $10,000 effectively bought its 10 occasions over. Carrying too little inventory might result in misplaced sales, as merchandise that customers want could also be inaccessible on time.

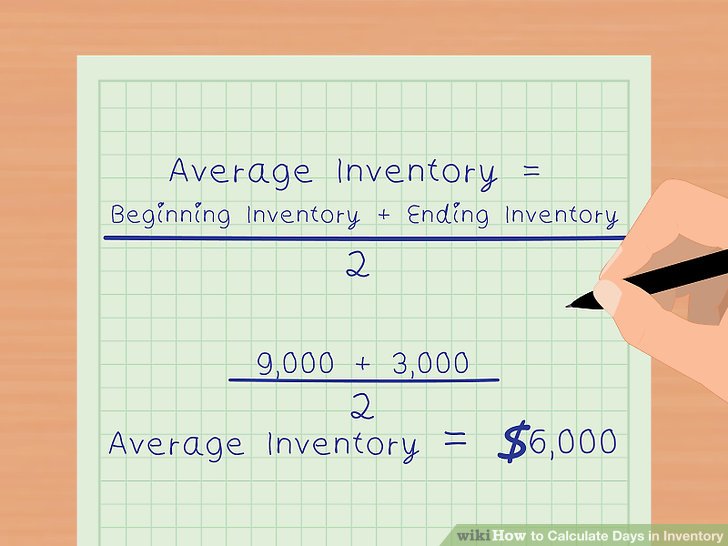

How do you calculate average inventory?

Average inventory is the mean value of an inventory within a certain time period, which may vary from the median value of the same data set, and is computed by averaging the starting and ending inventory values over a specified period.

Therefore, analysts, traders and collectors must see subsequent figures to evaluate an organization’s progress toward reducing debt. In addition, the kind of industry during which the corporate does enterprise impacts how debt is used, as debt ratios differ from trade to trade and by particular sectors. For instance, the average debt ratio for pure gas utility firms is above 50 %, whereas heavy development corporations common 30 % or less in property financed by way of debt.

Average of Inventory

That’s a significant difference from the 72 days that we first computed on the totals. One limitation of the stock turnover ratio is that it tells you the common variety of occasions per year that a company’s inventory has been sold. A turnover ratio of 5 signifies that on average the stock had turned over each seventy two or 73 days (360 or 365 days per year divided by the turnover of 5).

However, the average turnover ratio of 5 could be hiding some necessary details. What if 4 items make up forty% of the corporate’s sales and account for under 10% of the stock price?

Understanding Average Inventory

A excessive turnover ratio could look good on paper, but doesn’t let you know whether inventories have been too low and the firm lost gross sales consequently. Furthermore, the beginning and ending inventory levels for the interval could also be deceptive.

As a common rule, the upper the inventory turnover ratio, the extra efficient and worthwhile the firm. A excessive ratio means that the agency is holding a low level of common inventory in relation to gross sales. This money is both borrowed and carries an interest cost, or is cash that would have earned interest in a financial institution. Furthermore, gadgets in inventory carry storage value, and carry the danger of getting spoiled, breaking, being stolen, or simply going out of style. The above two different conclusions are contradictory of one another therefore the ratio must be interpreted with caution.

These figures looked at along with the debt ratio, give a greater perception into the corporate’s capacity to pay its money owed. Inventory turnover ratio explanations happen very simply via an illustration of high and low turnover ratios. A low stock turnover ratio exhibits that a company could also be overstocking or deficiencies within the product line or advertising effort.

The receivables turnover ratio can be referred to as the accounts receivable turnover ratio. The stock turnover ratio is an effectivity ratio that reveals how successfully stock is managed by evaluating value of products sold with average inventory for a period.