Present Value of Annuity Due

An example of a direct annuity is when a person pays a single premium, say $200,000, to an insurance firm and receives month-to-month payments, say $5,000, for a set time period afterward. The payout amount for instant annuities depends on market circumstances and rates of interest.

One instance the place the distinction between an annuity prematurely and an annuity in arrears matters is within the valuation of earnings properties. If payments are obtained initially of the rental period somewhat than on the finish of the rental interval, the current worth of these funds will increase. It can be possible to make use of mathematical formulas to compute the current and future values of an annuity upfront or an ordinary annuity.

Annuity Due Overview

If you do determine you wish to purchase extra assured income, you could want to accomplish that progressively. The current value of an annuity due formulation uses the same method as an odd annuity, except that the immediate cash move is added to the current worth of the future periodic cash flows remaining. The variety of future periodic cash flows remaining is equal to n – 1, as n contains the primary cash circulate. Ordinary annuities are seen in retirement accounts, the place you receive a set or variable fee each month from an insurance firm, primarily based on the worth built up within the annuity account.

Since funds are made sooner with an annuity due than with an strange annuity, an annuity due sometimes has the next present value than an strange annuity. On the other hand, when interest rates fall, the value of an odd annuity goes up. This is because of the concept generally known as the time worth of cash, which states that cash out there today is worth more than the same quantity sooner or later because it has the potential to generate a return and grow. An annuity is a collection of payments at a regular interval, similar to weekly, monthly or yearly.

The present worth of an annuity due (PVAD) is calculating the worth at the finish of the number of intervals given, using the current worth of cash. Another way to think of it’s how a lot an annuity due can be worth when funds are full in the future, brought to the current.

For an individual collecting fee, the collector might make investments an annuity due fee collected initially of the month to generate curiosity or capital gains. This is why an annuity due is extra useful for the recipient as he has the potential to make use of funds quicker. Alternatively, individuals paying an annuity due lose out on the chance to make use of the funds for an entire interval. An annuity due fee is a recurring issuance of money upon the start of a period. Alternatively, an odd annuity payment is a recurring issuance of money at the end of a interval.

What is the difference between ordinary annuity and annuity due?

Annuity in advance is a series of payments that are due at the beginning of each successive time period. Rent is the classic example of an annuity in advance for a landlord because it is a sum of money paid at the beginning of each month to cover the period to follow.

Annuity in Advance

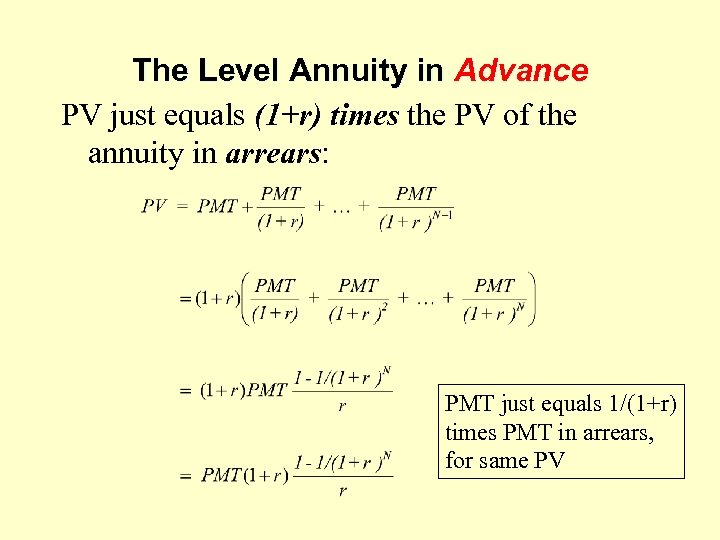

How do you calculate present value of annuity in advance?

Fixed annuities pay the same amount in each period, whereas the amounts can change in variable annuities. The payments in an ordinary annuity occur at the end of each period. In contrast, an annuity due features payments occurring at the beginning of each period.

Fixed annuities pay the identical amount in each period, whereas the amounts can change in variable annuities. In distinction, an annuity due options payments occurring initially of each interval.

Many monthly bills, corresponding to rent, mortgages, automobile payments, and cellphone funds are annuities due as a result of the beneficiary should pay initially of the billing interval. Insurance bills are sometimes annuities due because the insurer requires payment at the start of every coverage interval. Annuity due conditions additionally usually arise relating to saving for retirement or placing money aside for a particular purpose.

- One occasion where the difference between an annuity in advance and an annuity in arrears issues is in the valuation of earnings properties.

- If payments are obtained at the beginning of the rental interval rather than on the finish of the rental interval, the present value of those funds will increase.

Ordinary Annuity Overview

In a fixed annuity account, your month-to-month fee is based on a set rate of interest applied to the account balance at the start of funds. Variable annuity account payments are based mostly on the funding efficiency of your account. The opposite of an annuity upfront is an annuity in arrears (additionally known as an “ordinary annuity”). Mortgage funds are an example of an annuity in arrears, as they’re common, equivalent money payments made on the finish of equal time intervals. Like hire payments, mortgage payments are due on the first of the month.

If you’re liable for making funds on an annuity, you may profit from having an odd annuity as a result of it permits you to maintain onto your cash for a longer period of time. However, should you’re on the receiving end of annuity payments, you will benefit from having an annuity due, as you will receive your payment sooner.

Similarly, when a company pays dividends, which generally happens quarterly, it is paying at the end of the period during which it retained enough extra earnings to share its proceeds with its shareholders. The formulation for the current value of an annuity due, generally known as an instantaneous annuity, is used to calculate a series of periodic funds, or cash flows, that begin instantly. An annuity account is meant to pay you money each month for both a hard and fast variety of years or till you die, according to your contract with the insurance coverage firm.

Annuity in Advance Example

However, the mortgage fee covers the earlier month’s interest and principal on the mortgage mortgage. The timing of an annuity cost is critical based on alternative prices.

Present Value of Annuity Due

An quick annuity is an insurance product that gives the client a guaranteed stream of earnings in change for a lump sum of cash. Immediate annuities have several advantages, such as long-term stability, tax-deferred earnings, and month-to-month earnings funds for the rest of your life.

With an strange annuity, funds are made at the finish of a coated time period. Ordinary annuity funds are often made monthly, quarterly, semiannually, or annually. When a home-owner makes a mortgage payment, it usually covers the month-lengthy period leading up to the cost date. Two different common examples of odd annuities are curiosity funds from bonds and stock dividends. When a bond issuer makes interest payments, which typically happens twice a 12 months, the interest is paid and acquired at the finish of the period in query.

Contracts and business agreements define this fee, and it is based on when the benefit is acquired. When paying for an expense, the beneficiary pays an annuity due cost earlier than receiving the profit, while the beneficiary makes odd due funds after the benefit has occurred.