Option Premium – Everything You Need to Know

Similar motion in places means investors predict the inventory to fall over the identical time period. Sometimes the numbers can lie due to a complicated institutional trade, but if you monitor them for per week or so, you must get a fairly good learn.

July 60 put is a contract to promote 100 shares of Cisco for $60 each on or earlier than the third Friday of the contract month, in this case July 21. It could be exercised profitably if the inventory is at 55 because the holder would have paid for the proper to promote the shares at 60 (the strike value), it doesn’t matter what the current market price. However, for instance that the stock rallies and on the finish of the buying and selling day, it closes at $50.

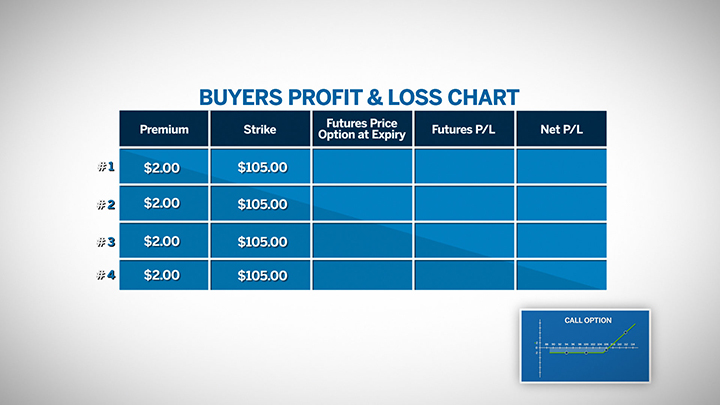

How is call premium calculated?

Call premiums may also be adjusted depending on how volatile a stock is. The premium, or cost of an option can be calculated with the following formula: Price = Intrinsic value + time value + volatility value. A call premium may decline as the expiration date of an option approaches.

Call premiums are paid to investors as compensation for the danger of getting a bond known as early or an option offered. When this occurs, buyers should perceive how premiums are calculated.

What Are the Risks of Investing in a Bond?

An out-of-the-money call has a strike worth that is greater than the current inventory price; an out-of-the-cash put has a strike price lower than the inventory price. Assume an investor buys one name choice contract on inventory ABC with a strike price of $50 in May and a July expiration. Further, let’s suppose that it’s the day that the option contract expires (or the third Friday of July).

How Call Premiums Work in Options

For example, a trader buys a name option for a premium of $1 on a inventory with a strike price of $10. Near the expiration date of the option, the underlying stock is trading at $sixteen. Instead of exercising the option and taking management of the stock at $10, the choices dealer will typically just promote the choice, closing out the commerce.

What is a call premium?

Call premium is the dollar amount over the par value of a callable debt security that is given to holders when the security is redeemed early by the issuer. In options terminology, the call premium is the amount that the purchaser of a call option must pay to the writer.

How To Evaluate Bond Performance

Put options are most commonly used within the stock market to protect in opposition to a fall within the price of a inventory under a specified value. In this manner the client of the put will obtain no less than the strike worth specified, even if the asset is at present nugatory.

What Is a Call Premium?

A bare put, also known as an uncovered put, is a put possibility whose writer (the vendor) doesn’t have a position in the underlying inventory or different instrument. This technique is greatest used by buyers who want to accumulate a place within the underlying inventory, but only if the price is low enough. If the buyer fails to train the options, then the author retains the option premium. That allows the exerciser (purchaser) to profit from the distinction between the inventory’s market worth and the choice’s strike worth. For instance, if the inventory is trading $fifty one and the strike value of a name choice is $50, the investor can train the decision, purchase the stock for $50, sell it in the market at $51, and extract $1 of intrinsic value.

Call Premium

- This strategy is finest used by investors who wish to accumulate a place in the underlying stock, but provided that the value is low enough.

- A bare put, also referred to as an uncovered put, is a put possibility whose writer (the vendor) does not have a place in the underlying inventory or other instrument.

- If the buyer fails to exercise the choices, then the author retains the option premium.

The choice contract is at the cash as a result of the stock value is the same as the strike worth and has zero intrinsic value. Therefore, the put choice also expires without being exercised as a result of exercising it doesn’t monetize any worth. On the opposite hand, assume one other trader purchased one put choice contract on inventory ABC with a strike value of $50 and a July expiration. On expiration day, if the inventory is trading at $forty nine (under the strike worth) in the morning, the choice is in the money as a result of it has $1 of intrinsic worth of one dollar ($50 – $49).

More time till the option’s expiration adds risk, and the person selling you that choice will want to be paid slightly extra for that threat. As a end result, if it is June, a July option will be cheaper than a December choice, and a June possibility will be cheaper than a July possibility. Thepremiumis paid up entrance at purchase and is not refundable – even when the choice isn’t exercised. Thus, a premium of $zero.21 represents a premium payment of $21.00 per choice contract ($0.21 x a hundred shares).

An possibility purchaser pays a worth referred to as a premium, which is the cost of the option, for their proper to buy or sell the underlying asset at the possibility’s strike worth. If a buyer chooses to make use of that proper, then they’re “exercising” the option. In other words, the choice’s strike value is synonymous with its train price.

The value of the contract that’s not intrinsic value, is known as extrinsic or time worth. So, if the 50-strike name is buying and selling $1.50 with the inventory at $51, it has $1 of intrinsic worth and 50 cents of time value.

Option Spread Strategies You Need to Know (Part

The present worth is $50 per share, and Trader A pays a premium of $5 per share. If the worth of XYZ stock falls to $40 a share right before expiration, then Trader A can exercise the put by buying 100 shares for $4,000 from the inventory market, then selling them to Trader B for $5,000. Even if you do not trade choices, watching the market can provide hints on future stock motion. Heavy volume in calls (the amount of choices contracts traded in a day known as quantity) means buyers count on the inventory to rise between that day and the expiration date (the third Friday of the contract month).

When the stock price equals the strike price, the choice contract has zero intrinsic value and is on the money. Therefore, there may be actually no cause to train the contract when it may be bought out there for a similar value. “Trader A” (Put Buyer) purchases a put contract to promote one hundred shares of XYZ Corp. to “Trader B” (Put Writer) for $50 per share.

At open, the inventory is trading at $49 and the call option is out of the cash—it doesn’t have any intrinsic value because the stock price is buying and selling below the strike worth. However, at the close of the trading day, the inventory value sits at $50.

In the derivatives market, the relationship between the value of the underlying asset and the strike value of the contract has essential implications. This relationship is a crucial determinant of the worth of the contract and, as expiration approaches, will be a deciding factor when contemplating whether or not the options contract must be exercised. The put buyer either believes that the underlying asset’s price will fall by the train date or hopes to protect a long place in it. The put buyer’s prospect (threat) of gain is proscribed to the option’s strike value much less the underlying’s spot value and the premium/fee paid for it.

Implied volatility is derived from the option’s price, which is plugged into an option’s pricing mannequin to indicate how volatile a inventory’s worth may be sooner or later. Moreover, it impacts the extrinsic value portion of option premiums. If investors are long choices, a rise in implied volatility would add to the worth.

For bonds, traders have to know the face worth of the bond, market volatility, and other components that may decide the premium. For options, traders should know the intrinsic worth, time value and volatility worth that is used to calculate the cost of promoting an possibility.