Normal Profit Definition

AccountingTools

Normal costing is a method of costing that is used in the derivation of price. The parts used for the normal costing to derive the price are precise costs of material, actual costs of labor and commonplace overhead price that are used for allocation function. Since the conventional costing makes use of normal overhead charges instead of actual overhead charges, this technique is used in figuring out the product prices where there isn’t any sudden increase in the prices. This method of normal costing can be typically accepted, and it is allowed to derive the price of product utilizing this system under GAAP and IFRS. Normal profit permits enterprise house owners to match the profitability of their work with that of different attainable business ventures.

Examples of explicit prices embrace raw supplies, labor and wages, rent, and proprietor compensation. Implicit costs, on the other hand, are costs associated with not taking an motion, referred to as the chance price, and are subsequently rather more difficult to quantify. Implicit costs come into consideration when an entity is foregoing other kinds of revenue and choosing to take a different path.

The shirts themselves cost you $2,000, and the vinyl lettering prices another $500. All of your shirts are shrink-wrapped, which provides $200 to your total prices.

Unit product cost is the total value of a given production run (referred to as a value pool), divided by the number of units produced. The manufacturing value is comprised of labor, overhead, materials and another associated expenses. Your firm goes to be printing 5,000 purple T-shirts for a neighborhood bank.

Actual Costing

In macroeconomic theory, regular revenue should occur in situations ofperfect competitionandeconomic equilibrium. Conceptually it’s because competition eliminates economic revenue. Moreover, economic profit can serve as a key metric for understanding the state of earnings comprehensively inside an industry. When an organization or firms are attaining financial profit, it might encourage other companies to enter the market as a result of there is revenue potential. New entrants contribute extra of the product to the market, which lowers themarket priceof items and has an equalizing impact on earnings.

It provides a more constant valuation of production prices which eliminates month to month fluctuations. Understanding how to calculate these prices, in addition to the benefits of each, is important in choosing the appropriate methodology for a given production process. Managers can use these formulation to calculate the entire production costs. For instance, managers first have to learn the way many hours it took the corporate to provide the product and how much the corporate is paying its workers per hour. Using the first actual costing formulation, these numbers make up the labor portion of the production costs.

After assessing her projected accounting, normal, and financial earnings she can make a more informed decision on whether to increase her enterprise. If all you will be producing are T-shirts, you possibly can decide a general cost per shirt in the same means you calculated the unit product cost for the local financial institution’s order in the above instance. You will still need to know your manufacturing unit’s overhead costs, the price of your supplies and the worth you will pay for labor. These three components are at all times needed for figuring out your value pool. Normal costing uses a predetermined annual overhead rate to assign manufacturing overhead to merchandise.

When trying to calculate financial and normal revenue, you will need to perceive the 2 elements of whole value. Explicit prices are simply quantifiable and customarily contain a transaction that’s tied to an expense.

Standards in Accounting (four Types)

The distinction is in how the overhead is allocated to each item produced. Under precise costing, the overhead allocation fee is calculated based mostly on the newest precise amount of overhead expense. Under the conventional costing methodology, it is calculated based mostly on the budgeted amount for the entire yr. The regular costing technique thus smooths out the month-to-month variation within the amounts of overhead allocation. Since overhead like utility utilization is a little troublesome to assign to a single product, managers usually make estimates.

A company may report high accounting profit but nonetheless be in a state of regular profit if the opportunity prices of maintaining enterprise operations are high. The reason you need the unit product value is also essential when determining what data to incorporate in its calculation. If, as an example, you’re calculating it so that you can find the lowest possible worth at which you can promote your product, you must miss sure overhead or labor prices. This is especially the case when you would possibly have the ability to cut these costs ultimately down the line. By doing so, you’ll then be capable of develop a value that permits for maximum profitability over the long term.

Eventually, the trade reaches a state of normal revenue as prices stabilize and earnings decline. In the meantime, firms managing for economic revenue could take action to obtain a more outstanding market place, enhance operational performance to lower direct prices, or reduce prices to decrease oblique prices. Implicit costs, also known as alternative prices, are prices that may influence financial and regular profit. When substantial implicit prices are involved, regular revenue could be considered the minimal amount of earnings wanted to justify an enterprise. Unlike accounting profit, regular profit and economic revenue take into accounts implicit or alternative costs of a particular enterprise.

- Actual costing makes use of the precise cost of materials and labor to calculate manufacturing costs.

- Two costing methodologies, actual costing and regular costing, assist businesses in evaluating manufacturing costs.

What is Actual Costing?

This variation is what makes standard costing distinguished to the traditional price. Both actual and regular costing strategies use actual amounts for direct material and labor costs.

In different words, the overhead price beneath normal costing is predicated on the anticipated overhead prices for the whole accounting yr and the expected manufacturing quantity for the complete year. Variable costs are costs which are instantly associated to the adjustments within the amount of output; due to this fact,variable costs increase when production grows, and decline when production contracts. Common examples of variable prices in a firm areraw materials, wages, utilities, sales commissions, manufacturing taxes, and direct labor, among others. The variable price does not all the time change on the same rate that labor does. The technical variation in the normal costing and the usual costing is using costs for the costing purposes.

Businesses might analyze economic and regular revenue metrics when determining whether to stay in business or when contemplating new forms of costs. When you’re working a enterprise that manufactures merchandise, it’s critical to be on high of your financials. From your supplies’ value and production bills to overhead and labor, preserving tabs on each detail of the investment involved in manufacturing is important to determine future spending, hiring and pricing. One facet of your bills that you’ll want to pay close consideration to is your unit product cost. Given the upper value of your granola, you’ll both want to seek out other ways to supply your supplies, lower labor prices, scale back overhead expenses or increase the price in your granola.

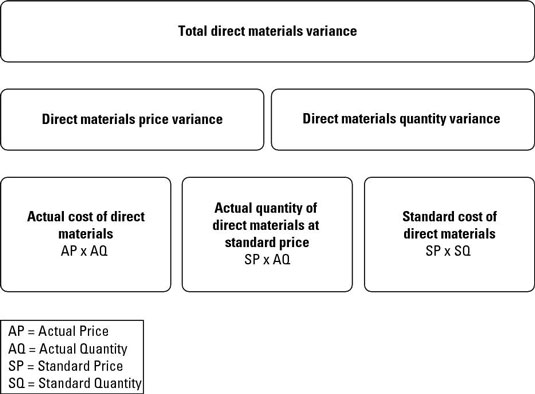

Two costing methodologies, actual costing and normal costing, help companies in evaluating production prices. Actual costing makes use of the precise cost of materials and labor to calculate production costs. This is useful when analyzing a particular portion of the production process and an exact accounting of costs is needed. Normal costing makes use of indirect materials and labor costs to estimate manufacturing costs.

Accounting Topics

They estimate how much overhead was used and how lengthy the overhead was used. Using the second precise costing method, administration can decide the oblique productions costs for producing the product. After all the calculations are accomplished, add up the totals and also you’ll get the precise value of producing your product. As demonstrated with Suzie’s Bagels, normal profit does not point out that a enterprise isn’t earning money.

How do you calculate actual cost?

Actual costing is the recording of product costs based on the following factors: Actual cost of materials. Actual cost of labor. Actual overhead costs incurred, allocated using the actual quantity of the allocation base experienced during the reporting period.

Because regular revenue consists of opportunity costs, it is theoretically potential for a enterprise to be working at zero economic profit and a traditional profit with a substantial accounting profit. The term normal revenue can also be used in macroeconomics to discuss with economic areas broader than a single business. In addition to a single enterprise, as within the example above, regular revenue could check with a complete trade or market.

However, the market might not support a price that may yield acceptable margins in your granola. It is for reasons like this that figuring out a unit product price before beginning work is so critical. With this information in hand, you’ll be able to step back and resolve what changes, if any, need to be made before you proceed with full-blown production.