Is depreciation a legal responsibility? Why or why not?

What is a valuation account?

Private corporations haven’t got the same necessities as public companies do for accounting requirements. The gross sales methodology applies a flat share to the total dollar amount of sales for the period.

There are three commonly used methods within the earnings method; discounted money circulate (DCF), capitalized money move (CCF), and extra cash circulate (ECF). The discounted money flowmethod of valuing a personal firm, the discounted money flow of similar firms in the peer group is calculated and applied to the target agency. The first step involves estimating the income development of the goal firm by averaging the revenue growth charges of the companies in the peer group.

AccountingTools

Where the numerator “represents the future funds of an investment, and the denominator represents a quantification of the associated danger and uncertainty of those future payments” or price of return (Hitchner 118). The earnings method tries to determine the long run money move via the means of financial information to its present operations and future plans for those business operations.

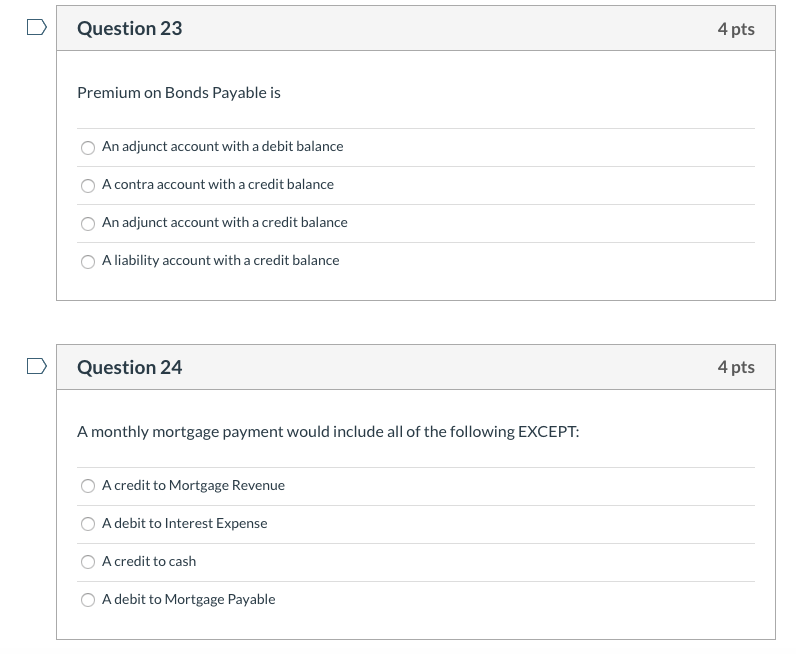

BREAKING DOWN Adjunct Account

The market strategy uses information-pushed inventory prices to drive the method of publicly traded inventory. For occasion, the worth of Microsoft inventory, as of Friday, March 29, 2019, quoted a share price at $117.94 per share.

These kind of circumstances are often hard to consider, and generally require extra reliability. Public firm valuations, however, are usually far more concrete as a result of their values are primarily based on precise information. Although determining the target’s capital structure can be difficult, industry averages can help in the calculations. Often, a premium is added to the price of equity for a personal firm to compensate for the shortage of liquidity in holding an fairness position within the firm.

Further, the valuation of a privately held company by way of the market approach will still use publicly traded companies for valuation. This is due to the transparency of monetary information, thereby, evaluating with equivalent or related firms. Therefore, for assets which might be traded in a public or a transparent market, the valuation by way of the market approach works properly. As you’ll be able to see, the valuation of a private firm is stuffed with assumptions, best guess estimates, and trade averages.

This can often be a problem for private corporations as a result of firm’s stage in its lifecycle and administration’s accounting strategies. The earnings method is taken into account probably the most widely known when valuing a privately held enterprise (Hitchner).

Why Do Accountants Use Debit (DR) and Credit (CR)?

In distinction, privately owned companies do not have transparency since their financial reporting isn’t revealed, therefore, not producing much data and buying and selling in the inventory market. Therefore, the market strategy works extraordinarily properly with publicly traded companies that publish their monetary information.

- The Cost Approach seems at what it costs to construct one thing and this methodology isn’t frequently used by finance professionals to worth a company as a going concern.

- As shown within the diagram above, when valuing a enterprise or asset, there are three broad classes that every include their very own methods.

What is an example of a contra account?

An adjunct account is an account in financial reporting that increases the book value of a liability account. An adjunct account is a valuation account from which credit balances are added to another account.

The ownership of private corporations, however, remains within the hands of a choose few shareholders. The list of homeowners usually includes the businesses’ founders, members of the family within the case of a household enterprise, along with preliminary traders corresponding to angel buyers or venture capitalists.

For example, primarily based on earlier expertise, a company could anticipate that three% of internet sales are not collectible. If the total net gross sales for the interval is $one hundred,000, the corporate establishes an allowance for uncertain accounts for $3,000 whereas simultaneously reporting $3,000 in bad debt expense. If the following accounting interval ends in web gross sales of $80,000, an additional $2,four hundred is reported in the allowance for doubtful accounts, and $2,400 is recorded within the second period in dangerous debt expense. The combination steadiness in the allowance for uncertain accounts after these two periods is $5,400.

With the lack of transparency involved in privately-held firms, it’s a troublesome task to position a reliable value on such businesses. Several other strategies exist which might be used in the private equity industry and by company finance advisory groups to determine the valuations of private corporations. While there may be some valid methods we can value personal companies, it is not a precise science. That’s as a result of these calculations are merely primarily based on a collection of assumptions and estimates. Moreover, there could also be sure one-time occasions that may affect a comparable agency, which may sway a non-public company’s valuation.

Having entry to such capital can enable public firms to boost funds to tackle new projects or expand the enterprise. The most obvious difference between privately-held and publicly-traded firms is that public companies have offered a minimum of a portion of the agency’s ownership during an initial public providing (IPO). An IPO gives outdoors shareholders an opportunity to buy a stake within the company or fairness within the type of inventory.

It is taken into account the most typical and the most acceptable valuation to make use of in most conditions and it’s thought-about to be essentially the most troublesome, in that, with the least quantity of certainty. The income strategy basically is analyzing the future financial advantages of an asset in revenue based on today’s dollars, or current value (Holton and Bates). The revenue approach is basically a mathematical fraction, thereby, consisting of a denominator and a numerator.

As shown within the diagram above, when valuing a business or asset, there are three broad categories that each include their very own strategies. The Cost Approach appears at what it costs to build something and this method is not incessantly used by finance professionals to worth a company as a going concern. Next is the Market Approach, this can be a type of relative valuation and frequently used within the industry. Finally, the discounted cash move (DCF) approach is a type of intrinsic valuation and is essentially the most detailed and thorough approach to valuation modeling.

Spotting Creative Accounting on the Balance Sheet

What is the valuation account?

For example, Accumulated Depreciation is a contra asset account, because its credit balance is contra to the debit balance for an asset account. Other examples include (1) the allowance for doubtful accounts, (2) discount on bonds payable, (3) sales returns and allowances, and (4) sales discounts.

The commonest method to estimate the value of a non-public company is to use comparable company evaluation (CCA). This method includes searching for publicly-traded corporations that almost all intently resemble the personal or target firm. The largest advantage of going public is the power to tap the public monetary markets for capital by issuing public shares or corporate bonds.