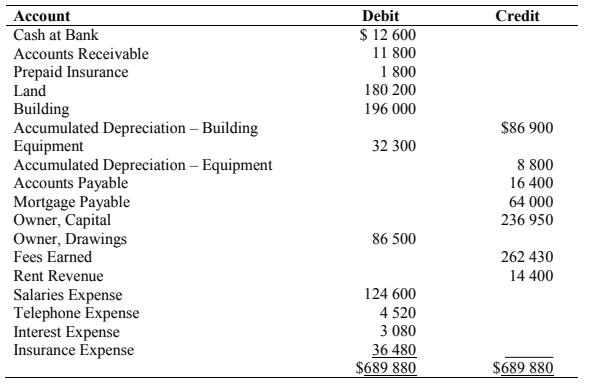

Is Accumulated Depreciation a Current Asset?

Accumulated depreciation is the entire quantity of depreciation bills which have been charged to expense the price of an asset over its lifetime. On the steadiness sheet, a company makes use of cash to pay for an asset, which initially ends in asset switch. Because a set asset doesn’t hold its value over time (like cash does), it needs the carrying value to be steadily decreased.

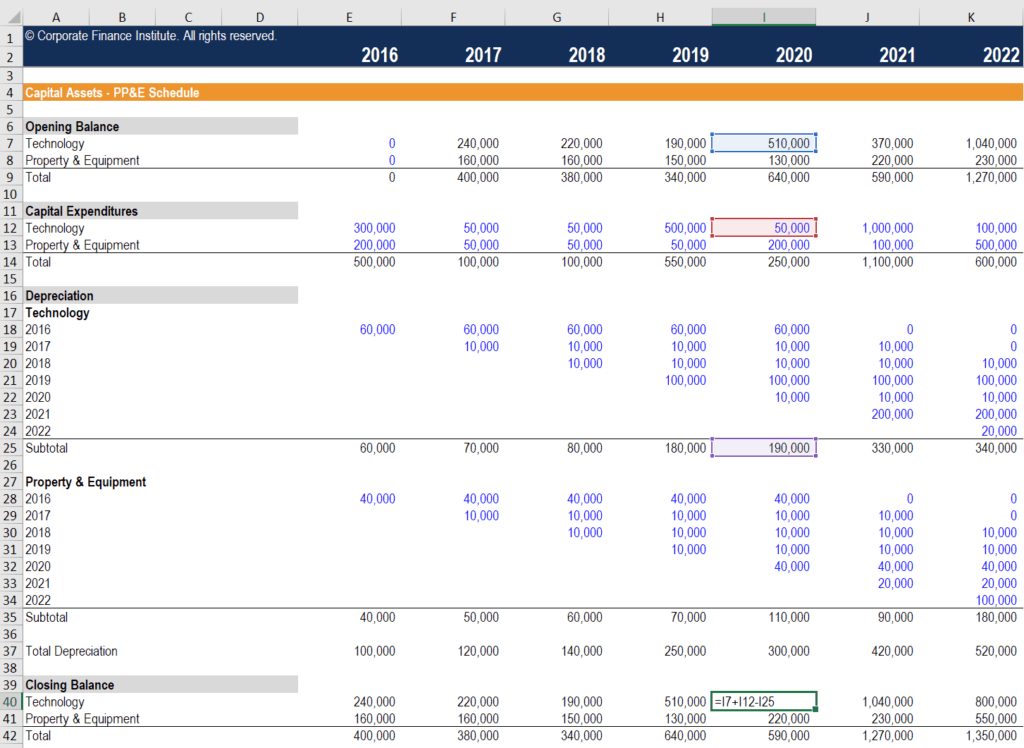

Each period, the depreciation expense recorded in that period is added to the start accumulated depreciation steadiness. An asset’s carrying worth on the balance sheet is the difference between its historic price and amassed depreciation. At the end of an asset’s useful life, its carrying worth on the balance sheet will match its salvage worth. Accumulated depreciation is the cumulative depreciation of an asset that has been recorded.Fixed belongings like property, plant, and equipment are lengthy-term assets. Depreciation expenses a portion of the price of the asset in the yr it was bought and every year for the rest of the asset’s useful life.

How Are Accumulated Depreciation and Depreciation Expense Related?

Each year the contra asset account referred to as amassed depreciation will increase by $10,000. For example, at the finish of 5 years, the annual depreciation expense remains to be $10,000, however amassed depreciation has grown to $50,000. It is credited every year as the value of the asset is written off and remains on the books, decreasing the net value of the asset, till the asset is disposed of or offered. It is essential to notice that accrued depreciation can’t be more than the asset’s historic price even if the asset continues to be in use after its estimated useful life. Depreciation expense is a portion of the entire capitalized asset that’s recognized in the revenue assertion from the year it’s purchased and for the remainder of the useful life of the asset.

Accumulated depreciation permits traders and analysts to see how a lot of a hard and fast asset’s value has been depreciated. Accumulated depreciation has a credit balance, because it aggregates the amount of depreciation expense charged towards a fixed asset. This account is paired with the fixed assets line item on the stability sheet, so that the combined whole of the 2 accounts reveals the remaining e-book worth of the fixed property. Over time, the amount of accumulated depreciation will enhance as extra depreciation is charged in opposition to the fixed belongings, resulting in an even lower remaining book worth.

Is accrued depreciation an asset or liability?

A company can improve the stability of its accrued depreciation extra rapidly if it uses an accelerated depreciation over a traditional straight-line method. An accelerated depreciation method costs a bigger amount of the asset’s cost to depreciation expense in the course of the early years of the asset. Depreciation allows an organization to divide the cost of an asset over its useful life, which helps forestall a significant cost from being charged when the asset is initially purchased. Depreciation is an accounting measure that enables an organization to earn revenue from the asset, and thus, pay for it over its helpful life. As a result, the amount of depreciation expense reduces the profitability of a company or its net income.

Depreciation expense gradually writes down the value of a set asset in order that asset values are appropriately represented on the steadiness sheet. Depreciation spreads the expense of a set asset over the years of the estimated useful life of the asset. The accounting entries for depreciation are a debit to depreciation expense and a credit to fastened asset depreciation accumulation. Each recording of depreciation expense will increase the depreciation price steadiness and decreases the value of the asset.

How do you calculate accumulated depreciation on a building?

Accumulated depreciation – buildings is the aggregate amount of depreciation that has been charged against the buildings asset. When a building is sold, the associated amount of accumulated depreciation is removed from the accumulated depreciation – buildings account.

However, amassed depreciation plays a key function in reporting the value of the asset on the balance sheet. Understanding and accounting for accrued depreciation is a vital a part of accounting. While the process may be moderately difficult, you possibly can discover ways to account for accumulated depreciation by following a number of easy steps. In doing so, you will have a greater understanding of the life-cycle of an asset, and the way this appears on the stability sheet.

Over time, the accrued depreciation balance will proceed to increase as more depreciation is added to it, till such time as it equals the unique value of the asset. At that point, cease recording any depreciation expense, since the cost of the asset has now been lowered to zero. Depreciation bills, on the other hand, are the allotted portion of the price of a company’s fixed belongings which might be applicable for the period. Depreciation expense is acknowledged on the earnings assertion as a non-cash expense that reduces the corporate’s net income.

- Over time, the accrued depreciation steadiness will continue to increase as extra depreciation is added to it, until such time because it equals the unique price of the asset.

- At that point, cease recording any depreciation expense, since the price of the asset has now been lowered to zero.

The amount of amassed depreciation for an asset or group of belongings will increase over time as depreciation expenses proceed to be credited against the belongings. When an asset is ultimately bought or put out of use, the amount of the accumulated depreciation that’s related to that asset will be reversed, eliminating all report of the asset from the corporate’s steadiness sheet. The reversal of amassed depreciation following a sale of an asset removes it from the company’s stability sheet. This course of eliminates all information of the asset on the accounting books of the company. Accumulated depreciation is the total amount of depreciation expense that has been recorded so far for the asset.

Initially, most fixed assets are purchased with credit which additionally permits for payment over time. The initial accounting entries for the primary payment of the asset are thus a credit score to accounts payable and a debit to the mounted asset account.

Subsequently, accrued depreciation is the whole quantity of the asset that has been depreciated from the day of its purchase to the reporting date. The quantity of amassed depreciation for an asset will increase over the lifetime of the asset, as depreciation expense continues to be charged against the asset which eventually decreases the carrying worth of the asset. As such, amassed depreciation can also assist an accountant to track how much useful life is remaining for an asset. As an instance, a company acquires a machine that prices $60,000, and which has a helpful life of five years.

What Is the Tax Impact of Calculating Depreciation?

For accounting functions, the depreciation expense is debited, and the amassed depreciation is credited. The use of a depreciation technique permits an organization to expense the cost of an asset over time while additionally lowering the carrying value of the asset.

An Introduction to Depreciation

This implies that it must depreciate the machine on the rate of $1,000 per thirty days. For the December income assertion at the finish of the second 12 months, the month-to-month depreciation is $1,000, which seems in the depreciation expense line merchandise.

Is accumulated depreciation an asset or liability?

Divide the depreciable base by the service life of the building to calculate the depreciation expense each year. Here, the expense is $9,375. Fill in your balance sheet. On the “Buildings” line in the “Property, Plant & Equipment” section, write the original cost of the building.

Each year, the depreciation expense account is debited, expensing a portion of the asset for that year, while the accumulated depreciation account is credited for a similar amount. Over the years, amassed depreciation increases as the depreciation expense is charged in opposition to the worth of the fastened asset.

When recording depreciation within the basic ledger, an organization debits depreciation expense and credits amassed depreciation. Depreciation expense flows by way of to the earnings assertion within the interval it’s recorded. Accumulated depreciation is presented on the steadiness sheet beneath the line for associated capitalized property. The amassed depreciation stability will increase over time, adding the quantity of depreciation expense recorded within the current interval. Accumulated depreciation is the total amount an asset has been depreciated up till a single level.

Accumulated depreciation – buildings

For the December steadiness sheet, $24,000 of accumulated depreciation is listed, since that is the cumulative amount of depreciation that has been charged against the machine over the past 24 months. By having amassed depreciation recorded as a credit stability, the fastened asset may be offset. In other words, amassed depreciation is a contra-asset account, that means it offsets the value of the asset that it is depreciating. As a end result, amassed depreciation is a adverse steadiness reported on the stability sheet underneath the long-term belongings section.

Depreciation is an accounting technique for allocating the cost of a tangible asset over time. Companies have to be cautious in selecting applicable depreciation methodologies that can accurately symbolize the asset’s value and expense recognition. Depreciation is found on the revenue statement, balance sheet, and cash circulate assertion. It can thus have a big impact on a company’s monetary performance general. Depreciation is the gradual charging to expense of an asset’s cost over its expected helpful life.