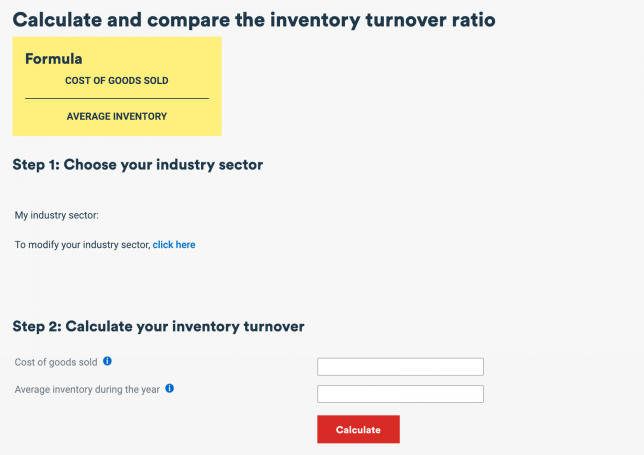

Inventory Turnover Ratio Formula

The identical average price can be utilized to the variety of objects sold in the previous accounting period to find out the price of goods offered. One limitation of the stock turnover ratio is that it tells you the average number of times per year that an organization’s stock has been bought.

Matching Year-to-Date Sales

In other words, nearly all of objects are turning on average each 109 days (360 days divided by the turnover ratio of 3.three). That’s a big distinction from the 72 days that we first computed on the totals. Now, you’ll be able to calculate the inventory turnover ratio by dividing the cost of goods sold by average stock. To calculate your stock turnover ratio, you should know your price of products bought (COGS), and your common inventory (AI).

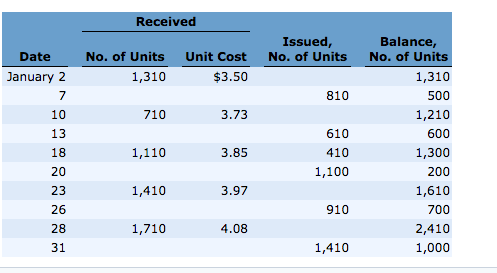

What is the average cost method for inventory?

Under the ‘Average Cost Method’, it is assumed that the cost of inventory is based on the average cost of the goods available for sale during the period. The average cost is computed by dividing the total cost of goods available for sale by the total units available for sale.

This determine is kind of essential in relation to monetary analysis since it is used in the calculation of a number of financial metrics, together with inventory turnover. The starting stock is especially necessary when it comes to calculating the price of items bought. To calculate the cost of goods offered, you begin out with the beginning inventory, add any purchases made through the period, and subtract the ending stock. People throughout the company can overcome the shortcomings described above, since they’ve entry to all the sales and stock element.

A turnover ratio of 5 indicates that on average the stock had turned over every 72 or 73 days (360 or three hundred and sixty five days per yr divided by the turnover of 5). According to your annual financial statements and accounting data, your cost of goods offered is $60,000 and the ending stock is $20,000. After dividing $20,000 into $60,000, your inventory turnover ratio is three. This means your inventory has been sold, or turned over, 3 times in the course of the 12 months.

Businesses need to trace all of the prices which are directly concerned in producing their products on the market, along with other operational costs. These direct prices are referred to as the cost of goods sold (COGS), and this determine appears within the firm’s revenue and loss assertion (P&L). It’s also an essential part of the knowledge the company should report on its tax return.

![]()

How Does Inventory Accounting Differ Between GAAP and IFRS?

Many service companies wouldn’t have any price of products offered in any respect. COGS just isn’t addressed in any detail ingenerally accepted accounting ideas(GAAP), but COGS is defined as only the price of inventory objects bought throughout a given period. Not solely do service firms don’t have any items to promote, however purely service corporations additionally wouldn’t have inventories. If COGS just isn’t listed on the income statement, no deduction may be utilized for those prices. Multiplying the typical cost per merchandise by the final stock count provides the company a figure for the price of goods out there for sale at that point.

Benefits of the Average Cost Method

In different phrases, it measures what number of instances a company bought its whole average inventory dollar quantity through the yr. A firm with $1,000 of common stock and sales of $10,000 successfully offered its 10 occasions over. An alternative methodology includes using the cost of items bought (COGS) as an alternative of gross sales. Analysts divide COGS by average stock as an alternative of gross sales for larger accuracy in the inventory turnover calculation because gross sales embody a markup over value.

- Businesses that sell merchandise to clients need to take care of inventory, which is both purchased from a separate producer or produced by the company itself.

- Items previously in stock which might be offered off are recorded on a company’s earnings assertion as price of products sold (COGS).

Average cost methodology

To learn how many days’ worth of inventory you retain readily available, divide three into one year. In this case, you could have 122 days’ value of inventory stock available on any given day. The earnings statement info is included in thebusiness tax returnand used to calculate adjusted gross earnings as well as web income for tax purposes.

What if four items make up forty% of the corporate’s sales and account for under 10% of the inventory value? This means that the remaining gadgets in inventory will have a price of products offered of $3,000,000 and their average inventory price will be $900,000. As a result, the majority of the items in stock will have a mean turnover ratio of three.3 ($3,000,000 divided by $900,000).

Your value of goods bought can change throughout the accounting interval. Your COGS depends on altering prices and the stock costing strategies you use.

Businesses that promote merchandise to prospects should take care of stock, which is both bought from a separate manufacturer or produced by the company itself. Items previously in stock which might be sold off are recorded on an organization’s revenue statement as price of goods sold (COGS).

The COGS is a crucial determine for businesses, buyers, and analysts as it’s subtracted from sales income to find out gross margin on the revenue statement. The stock turnover ratio is calculated by dividing the price of items bought for a period by the average stock for that interval.

Understanding the Average Cost Method

The inventory turnover ratio is an effectivity ratio that shows how successfully stock is managed by comparing cost of goods bought with average inventory for a interval. This measures how many instances average stock is “turned” or offered during a interval.

You also can use the prices of products sold (COGS) in its place method of calculating your inventory turnover. This helps forestall stock turnover inflation as a result of it takes into consideration the prices of the supplies used to provide the item. The common cost method uses the weighted-average of all stock purchased in a interval to assign worth to value of products bought (COGS) as well as the cost of items still available on the market. Another use of the start inventory is whenever you want to calculate your average stock in a given accounting interval. How a lot inventory are you prone to have in your warehouse at any given point in the yr?

Inventory Valuation — LIFO vs. FIFO

In each conditions, common inventory is used to assist remove seasonality results. Inventory turnover measures an organization’s efficiency in managing its inventory of goods. The ratio divides the cost of items offered by the common inventory. However, the common turnover ratio of 5 might be hiding some necessary details.