How to Create a Pro Forma Balance Sheet

Dividends could be decided from the schedule of cash payments which reveals $one hundred twenty,000 paid this yr. Ending Retained Earnings is $1,a hundred thirty five,000 ($four hundred,000 + 855,000 – 120,000). A non-present asset is a term utilized in accounting for property and property which can’t easily be transformed into cash.

Accounting Test three

Current belongings are property that may turn into cash within one yr of the stability sheet date. They are listed in order of relative liquidity, in different words how easily they might be transformed into cash. Common current asset accounts embrace cash, marketable securities (similar to stocks, bonds, etc.), accounts receivable, supplies, inventory, and pay as you go bills (similar to prepaid insurance, prepaid lease, and so forth.). Along with the earnings statement and the statement of money flows, the balance sheet is likely one of the major monetary statements of a business. Pro forma stability sheets may give you some essential info on the well being of your small business.

What is a Budgeted Balance Sheet?

Liquidity refers to how shortly an asset may be turned into cash without affecting its value. A common size stability sheet is a balance sheet that displays each the numeric worth and relative share for complete belongings, complete liabilities, and equity accounts. Common size balance sheets are utilized by inner and external analysts and aren’t a reporting requirement of usually accepted accounting ideas (GAAP). Investors, creditors, and regulatory businesses generally focus their evaluation of financial statements on the company as a complete.

As you research in regards to the belongings, liabilities, and stockholders’ fairness contained in a steadiness sheet, you will perceive why this financial statement supplies details about the solvency of the business. A company has $eight million in complete belongings, $5 million in total liabilities, and $3 million in complete equity. The company has $1 million in money, which is a part of its total assets. The frequent measurement steadiness sheet stories the total property first so as of liquidity.

Preparing a Budgeted Balance Sheet

Even if you don’t make the most of the services of an authorized public accountant, you or your bookkeeper can adopt sure generally accepted accounting principles ( GAAP ) to develop monetary statements. The energy of GAAP is the reliability of company information from one accounting interval to a different and the power to match the monetary statements of various corporations. The balance sheet, typically known as the statement of monetary position, lists the company’s assets, liabilities,and stockholders ‘ fairness (including greenback quantities) as of a particular moment in time. That particular moment is the shut of business on the date of the balance sheet. A balance sheet is sort of a photograph; it captures the financial position of an organization at a selected point in time.

Common inventory added to retained earnings must equal total house owners’ fairness. So, by subtracting widespread inventory from total owners’ fairness, retained earnings could be determined. Pro stability sheets present how the business might be managing its assets sooner or later.It may also be used to challenge the general monetary soundness of the corporate. For instance, a pro forma steadiness sheet can help rapidly pinpoint a high debt-to-fairness ratio, a quantity that a banker may look to make use of to measure the creditworthiness of a enterprise.

Chapter 7: Budgeting

In monetary accounting, owner’s fairness consists of the online assets of an entity. Net property is the difference between the entire assets of the entity and all its liabilities. Equity appears on the steadiness sheet, one of many 4 main financial statements. The balance sheet is a proper doc that follows a normal accounting format exhibiting the same categories of belongings and liabilities regardless of the measurement or nature of the business. Accounting is taken into account the language of enterprise as a result of its ideas are time-examined and standardized.

How do you find cash on a budgeted balance sheet?

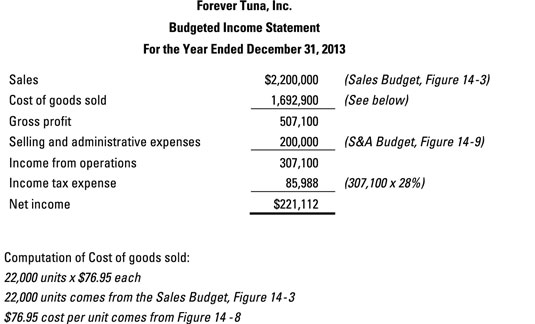

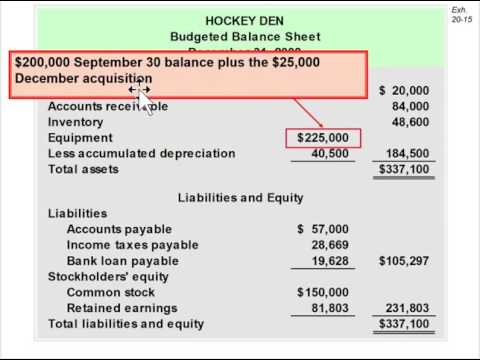

Definition: A budgeted balance sheet is a report that management uses to predict the levels of assets, liabilities, and equity based on the budget for the current accounting period.

- To make a balance sheet for accounting, begin by making a header with the title of the organization and the efficient date.

- Then, record all current assets so as of how easily they can be converted to money, and calculate the entire.

In general, authorized intangibles which are developed internally usually are not recognized, and authorized intangibles which might be purchased from third events are acknowledged. Therefore, there is a disconnect–goodwill from acquisitions may be booked, since it’s derived from a market or buy valuation. However, related inner spending cannot be booked, although it is going to be recognized by investors who examine a company’s market worth with its guide value.

A firm’s belongings must equal their liabilities plus shareholders’ equity. The balance sheet might help you report and evaluate the company’s monetary standing on the end of any given accounting period (corresponding to a fiscal 12 months). The stability sheet provides you a simple snapshot of how the corporate is doing financially, together with its belongings versus its liabilities.

Some of the current belongings are valued on estimated basis, so the steadiness sheet isn’t ready to mirror the true monetary place of the enterprise. Intangible property like goodwill are proven within the balance sheet at imaginary figures, which can bear no relationship to the market worth. The International Accounting Standards Board (IASB) presents some steering (IAS 38) as to how intangible property must be accounted for in monetary statements.

Cash fee of dividend results in money outflow and is recorded in the books and accounts as web reductions. As the corporate loses ownership of its liquid belongings within the form of money dividends, it reduces the corporate’s asset value in the balance sheet thereby impacting RE. Total liabilities and stockholders’ equity2,321,000The preparation of Leed’s monetary budgeted balance sheet completes the master budget. Management now has data to help appraise the insurance policies it has adopted earlier than implementing them.

You can discover your business’s previous retained earnings on your corporation steadiness sheet or assertion of retained earnings. Your firm’s web earnings could be discovered on your earnings assertion or revenue and loss assertion. If you’ve shareholders, dividends paid is the amount that you pay them.

If the master budget shows the outcomes of those insurance policies to be unsatisfactory, the company can change its policies before serious issues arise. Beginning retained earnings comes from the steadiness of last yr’s steadiness sheet of $400,000. Net Income comes from the budgeted revenue statement for the yr of $855,000.

To make a stability sheet for accounting, start by creating a header with the name of the group and the efficient date. Then, listing all present belongings in order of how easily they can be transformed to cash, and calculate the whole. Next, listing all your short-term and long-term liabilities and total them as nicely. Finally, calculate the proprietor’s fairness by including the contributed capital to retained earnings. Assets, liabilities and possession fairness are listed as of a particular date, corresponding to the tip of its monetary 12 months.

The retained earnings figure lies in the stockholders’ fairness part of the steadiness sheet. The retained earnings determine together with other figures of shares, inventory premium and reserves, presents the online book worth of the group.

Since they can’t request particular-objective stories, exterior users should depend on the final objective financial statements that companies publish. These statements embody the steadiness sheet, an earnings assertion, a press release of stockholders ‘ fairness, an announcement of money flows, and the explanatory notes that accompany the financial statements. Retained earnings are the amount of profit an organization has earned for a specific time period. Financial professionals will use the stability sheet to gauge the monetary well being of the corporate.

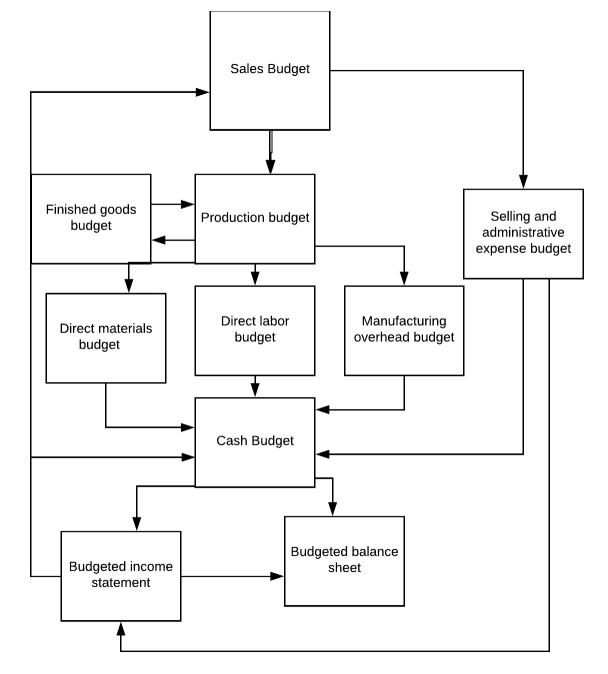

Operating Budget

A steadiness sheet is often described as a “snapshot of a company’s financial situation. ” Of the 4 fundamental monetary statements, the steadiness sheet is the only statement which applies to a single point in time of a business’ calendar 12 months. There are three primary limitations to steadiness sheets, together with the fact that they’re recorded at historical cost, using estimates, and the omission of useful things, similar to intelligence.

Distinction Between Cash Budget And Cash Flow Statement

This can be in contrast with present property corresponding to cash or financial institution accounts, that are described as liquid property. A current asset on the steadiness sheet is an asset which may both be converted to money or used to pay current liabilities within 12 months. Typical present assets embrace money and cash equivalents, brief-time period investments, accounts receivable, inventories and the portion of pay as you go liabilities which might be paid inside a year. Cash, receivables, and liabilities are re-measured into U.S. dollars using the current change rate.