How many shares are in a startup company

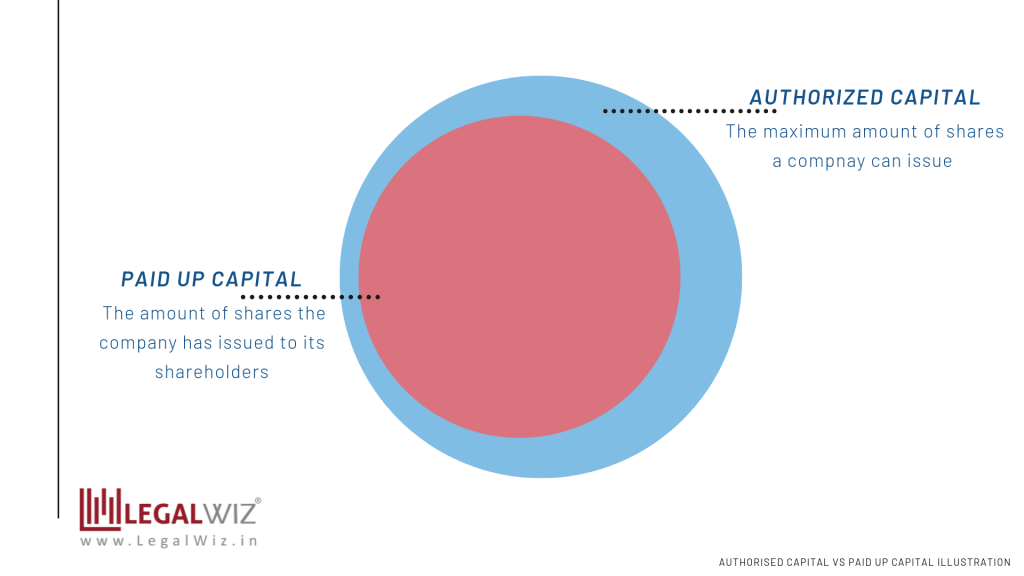

Authorized stock represents the utmost number of frequent shares that can be issued legally by the corporate. The number of authorized shares will most probably exceed the number of shares that had been issued throughout a company’s preliminary public providing.

The accounting information would observe the number of authorized shares however use the excellent share count for calculating shareholders’ equity. It can also be often listed in the capital accounts part of the stability sheet. Authorized shares should not be confused with outstanding shares, which are the variety of shares the corporation has really issued which are held by the general public. Authorized shares are the number of shares that an organization is legally allowed to problem, while outstanding shares have already been issued.

Delaware asks enterprise owners to disclose how many approved shares the corporate wants at formation to determine franchise charges. A enterprise has to pay taxes on stocks issued as gifts or inventory options. The amount of shares you wish to give away is a think about deciding a total number to authorize. Speak with a tax professional or tax lawyer for more data on your state’s charges and taxes. Typically a startup firm has 10,000,000 approved shares of Common Stock, but as the corporate grows, it might improve the total number of shares as it points shares to traders and staff.

Companies can also announce stock splits to make the shares more inexpensive for individual traders. For instance, a 2-to-1 inventory cut up would double the outstanding inventory and cut back the share value by about 50 percent.

Related Articles

The initial corporate filing paperwork, created through the startup process, licensed a certain number of shares which may be issued. Issued shares check with the variety of shares of an organization that are held by shareholders. The shares may be exchanged for any form of asset that the corporate believes will help capitalize the business.

The quantity also adjustments often, which makes it onerous to get an exact count. The if-transformed technique is used to calculate diluted EPS if an organization has potentially dilutive most popular inventory. The variety of shares of frequent stock outstanding is a metric that tells us how many shares of a company are currently owned by investors. This can typically be found in a company’s monetary statements, but is not at all times available — quite, you might even see phrases like “issued shares” and “treasury shares” as a substitute.

Companies generally repurchase stock as a means of returning money to shareholders. The repurchased shares either are retired or are recorded in a separate treasury stock account if the company intends to reissue them later. The variety of excellent shares is the same as the number of issued shares minus treasury shares.

Besides, it may be useful to grasp the place the numbers you’re looking at came from. Any authorized shares which are held by or bought to a company’s shareholders, unique of treasury stock which is held by the corporate itself, are often known as excellent shares. In different words, the number of shares outstanding represents the quantity of inventory on the open market, including shares held by institutional investors and restricted shares held by insiders and company officers. Investors might need to know what the worth of their shares would be if all convertible securities were executed since doing so reduces the incomes power of every share. The worth of earnings per share if all these convertible securities (government stock options, equity warrants, and convertible bonds) were really transformed to widespread shares is calleddiluted earnings per share (EPS).

The variety of shares really obtainable to commerce is known as float. In addition, restricted shares, which are reserved for worker compensation and incentives, are also a part of approved shares. The total number of an organization’s outstanding shares as seen in the stability sheet is the sum of float and restricted shares. If excellent shares are lower than licensed shares, the distinction (unissued inventory) is what the corporate retains in its treasury.

- Authorized inventory represents the maximum variety of frequent shares that can be issued legally by the corporate.

- The variety of authorized shares will more than likely exceed the variety of shares that have been issued during a company’s initial public providing.

Reverse inventory splits reduce the excellent stock but enhance share prices. Stock splits and reverse splits don’t have any immediate effect on the entire worth of the shares in your portfolio. When a company is formed, it decides on the maximum number of shares it want to provide. The shares that are issued to the general public to trade on the open markets comprise all or a portion of an organization’s licensed stock.

A firm’s outstanding shares can fluctuate for a number of causes. Companies typically concern shares when they elevate capital by way of an fairness financing, or upon exercising employee stock choices (ESO) or different monetary devices. Outstanding shares will decrease if the corporate buys again its shares under a share repurchase program. Shares outstanding discuss with a company’s inventory at present held by all its shareholders, together with share blocks held by institutional traders and restricted shares owned by the company’s officers and insiders. A company’s variety of outstanding shares is not static and may fluctuate wildly over time.

As an actual-world example, here is some data from Johnson & Johnson’s 2014 yr-finish balance sheet. The firm has four.32 billion licensed widespread shares, of which three,119,843,000 have been issued as of December 31, 2014. Next, 336,620,000 shares have been held within the firm’s treasury at the moment, so subtracting this from the variety of issued shares means that Johnson & Johnson had 2,783,223,000 excellent shares at the finish of 2014.

The variety of approved shares could also be kept considerably greater than the variety of outstanding shares, so that the group has the pliability to sell extra shares at any time. Authorized stock is the maximum number of shares an organization can concern. Outstanding stock is the distinction between issued inventory and repurchased inventory held for resale.

Why You Need to Know How to Calculate a Company’s Float

Issued inventory is what the company has issued, which is less than the approved inventory. Each share of widespread stock represents an possession curiosity, which is the ratio of the shares you hold to the excellent shares. The price of a inventory is principally the present value of future earnings per share as perceived by traders. If a company’s profit is $1 million they usually have 10 million shares, it is .10 per share. Even for companies traded on a serious exchange, if they do a secondary inventory concern it dilutes EPS and lowers the inventory price.

The difference between licensed and outstanding shares

Authorized stock is larger than issued and excellent inventory as a result of companies want the pliability of issuing further shares without having to return to the regulatory authorities for approval. For instance, a company may specify 10 million shares as the licensed variety of shares in its incorporation documents. However, it could problem solely 10 p.c of the approved amount when it lists on a inventory market as a result of the proceeds would be enough to fund operations.

Understanding Authorized Stock

A firm that issues all of its authorized stock will have its excellent shares equal to approved shares. Outstanding shares can never exceed the authorized number, because the licensed shares complete is the maximum variety of shares that an organization can issue. Taxes and fees play a role in deciding the quantity of shares authorized.

More Articles

Thus, the variety of outstanding shares is all the time equal to or lower than the variety of approved shares. The variety of approved shares is initially set in a company’s articles of incorporation. The shareholders can increase the number of licensed shares at any time at a shareholders meeting, as long as a majority of shareholders vote in favor of the change.

What does Authorized Stock mean?

Authorized shares are the number of shares that a corporation is legally allowed to issue, while outstanding shares have already been issued. The number of authorized shares is initially set in a company’s articles of incorporation.