How Amortization Works: Examples and Explanation

Goodwill is carried as an asset and evaluated for impairment a minimum of annually. For instance, the payment on the above state of affairs will stay $733.76 no matter whether the excellent (unpaid) principal steadiness is $one hundred,000 or $50,000.

The goodwill quantities to the excess of the “purchase consideration” (the cash paid to purchase the asset or business) over the net value of the property minus liabilities. It is classified as an intangible asset on the steadiness sheet, since it could possibly neither be seen nor touched. Under US GAAP and IFRS, goodwill isn’t amortized, as a result of it’s considered to have an indefinite useful life. Instead, management is answerable for valuing goodwill every year and to determine if an impairment is required. If the truthful market value goes beneath historical price (what goodwill was purchased for), an impairment must be recorded to bring it right down to its fair market worth.

How Amortization Works

What are two types of amortization?

Amortization = (Bond Issue Price – Face Value) / Bond Term Simply divide the $3,000 discount by the number of reporting periods. For an annual reporting of a five-year bond, this would be five. If you calculate it monthly, divide the discount by 60 months. The amortized cost would be $600 per year, or $50 per month.

Each repayment for an amortized loan will contain both an curiosity fee and fee in direction of the principal stability, which varies for every pay interval. An amortization schedule helps indicate the precise amount that will be paid towards each, along with the interest and principal paid to date, and the remaining principal balance after each pay period. In 2001, the Financial Accounting Standards Board (FASB) declared in Statement 142, Accounting for Goodwill and Intangible Assets, that goodwill was no longer permitted to be amortized.

Additional Amortization Information

Usually you must make a trade-off between the month-to-month payment and the whole amount of curiosity. The amortization schedule is extremely useful for accounting for each payment in a time period mortgage, since it separates the interest and principal parts of each fee. The schedule can also be helpful for modeling how the remaining mortgage liability will range should you speed up or delay payments, or alter their measurement. An amortization schedule can also embody balloon funds and even unfavorable amortization situations the place the principal balance will increase over time. Credit playing cards, however, are typically not amortized.

They are an example of revolving debt, the place the outstanding balance may be carried month-to-month, and the quantity repaid each month can be varied. Please use our Credit Card Calculator for more info or to do calculations involving bank cards, or our Credit Cards Payoff Calculator to schedule a financially feasible method to repay a number of credit cards.

Amortization is the method of spreading out a mortgage right into a sequence of fixed payments over time. You’ll be paying off the loan’s interest and principal in numerous amounts each month, although your complete cost remains equal each interval. This mostly occurs with monthly mortgage funds, however amortization is an accounting time period that can apply to other types of balances, corresponding to allocating certain prices over the lifetime of an intangible asset. Goodwill in accounting is an intangible asset that arises when a purchaser acquires an existing business. Goodwill represents property that are not individually identifiable.

You record every payment as an expense, not the complete cost of the loan directly. In accounting, the amortization of intangible assets refers to distributing the price of an intangible asset over time.

However, a rise within the truthful market worth wouldn’t be accounted for within the financial statements. Private firms within the United States, nevertheless, might elect to amortize goodwill over a interval of ten years or less under an accounting different from the Private Company Council of the FASB. Amortization is an accounting term that refers to the strategy of allocating the price of an intangible asset over a time frame.

- Amortization is the method of spreading out a loan right into a sequence of mounted payments over time.

- This mostly occurs with month-to-month mortgage funds, however amortization is an accounting term that may apply to different forms of balances, such as allocating certain prices over the lifetime of an intangible asset.

- You’ll be paying off the mortgage’s interest and principal in numerous amounts each month, though your total cost stays equal every interval.

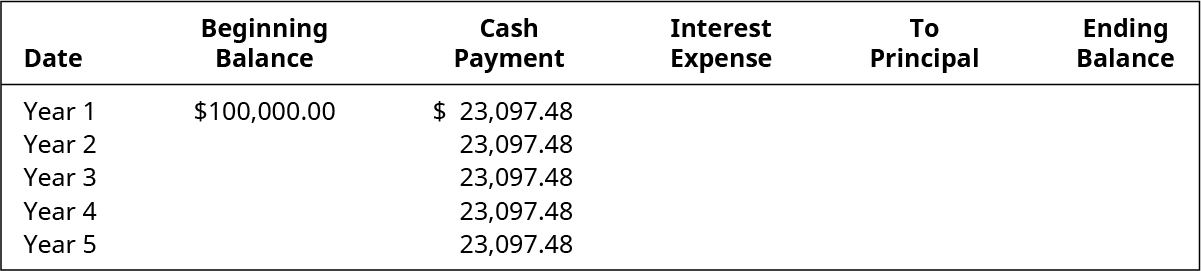

An amortization schedule (sometimes called amortization desk) is a table detailing every periodic fee on an amortizing loan. Each calculation accomplished by the calculator may even include an annual and month-to-month amortization schedule above.

How to Amortize Loans: Calculations

Examples of different loans that are not amortized embrace interest-solely loans and balloon loans. The former contains an curiosity-solely interval of cost and the latter has a big principal payment at loan maturity. Other kinds of loans—specificallyvariable rate loansandlines of credit—are tougher to calculate with an amortization desk. Amortization also refers back to the reimbursement of a loan principal over the mortgage period. In this case, amortization means dividing the mortgage quantity into funds until it’s paid off.

The amortization idea can also be utilized in lending, the place an amortization schedule itemizes the start balance of a mortgage, much less the interest and principal due for payment in every period, and the ending loan balance. This schedule is sort of useful for correctly recording the interest and principal parts of a mortgage fee. An amortization schedule usually will present you how much curiosity and principal you are paying each interval, and often an amortization calculator may also calculate the entire curiosity paid over the lifetime of the loan. Besides contemplating the monthly payment, you must think about the term of the loan (the number of years required to pay it off if you make common payments). The longer you stretch out the loan, the extra curiosity you may end up paying in the long run.

What Is an Amortization Table?

An amortization schedule is a desk detailing every periodic cost on an amortizing loan (usually a mortgage), as generated by an amortization calculator. Amortization refers back to the means of paying off a debt (usually from a mortgage or mortgage) over time by way of regular funds. A portion of every payment is for curiosity while the remaining amount is utilized in the direction of the principal balance. The share of curiosity versus principal in every payment is decided in an amortization schedule. The schedule differentiates the portion of fee that belongs to curiosity expense from the portion used to close the gap of a discount or premium from the principal after each payment.

Monthly Pay: $1,687.seventy one

In accounting, goodwill is accrued when an entity pays more for an asset than its truthful worth, based on the company’s model, shopper base, or different factors. Corporations use the acquisition method of accounting, which does not enable for computerized amortization of goodwill.

How do you calculate an amortization table?

Most types of installment loans are amortizing loans. For example, auto loans, home equity loans, personal loans, and traditional fixed-rate mortgages are all amortizing loans. Interest-only loans, loans with a balloon payment, and loans that permit negative amortization are not amortizing loans.

The formulas used for amortization calculation could be type of confusing. So, let’s first begin by describing amortization, in simple terms, as the method of reducing the value of an asset or the steadiness of a mortgage by a periodic quantity . Each time you make a fee on a loan you pay some interest along with a part of the principal. The principal is the original loan amount, or the balance that you should repay. By making regular periodic payments, the principal gradually decreases, and when it reaches zero, you’ve got fully paid off your debt.

Goodwill also does not include contractual or different authorized rights no matter whether or not these are transferable or separable from the entity or other rights and obligations. Goodwill is also solely acquired through an acquisition; it cannot be self-created. Examples of identifiable property that are goodwill include a company’s brand name, customer relationships, inventive intangible belongings, and any patents or proprietary expertise.