Factors of Production: Land, Labor, Capital

Examples of Asset/Liability Management

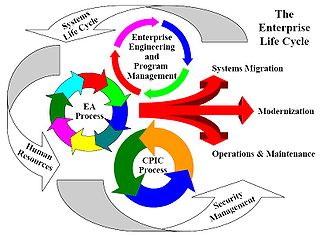

From the perspective of a single enterprise, then, the factor markets and the components themselves are of supreme importance. Accordingly, there’s a large body of economic concept dedicated to investigating the best ways of combining the factors of manufacturing. However, for monetary and business functions capital is usually seen from an operational and funding perspective.

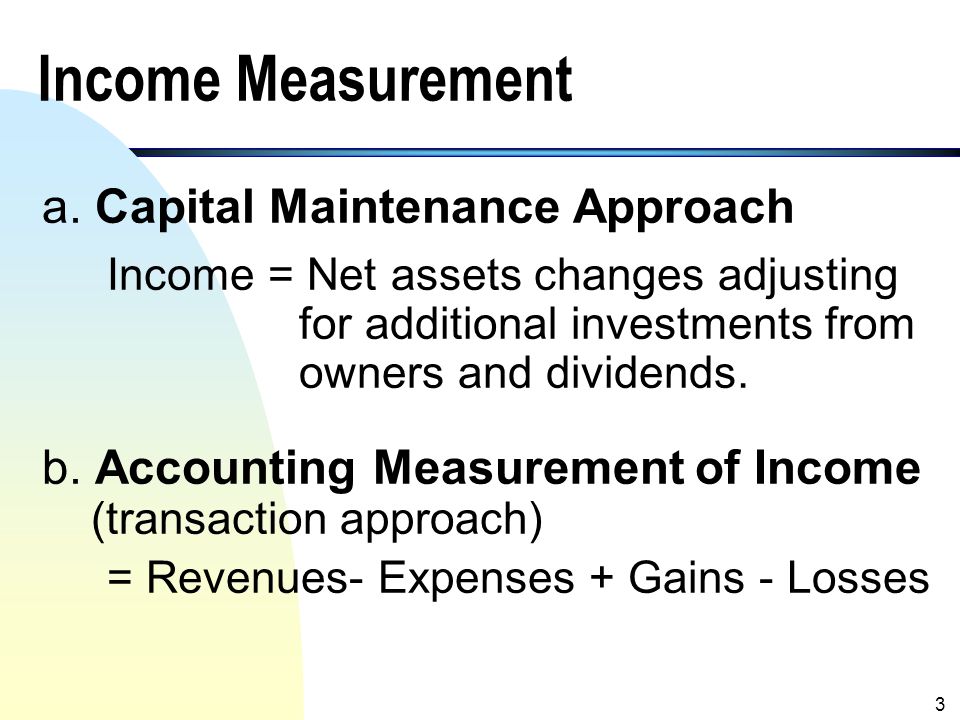

Financial capital may exist in large part as electronic entries in a computer database someplace that denote how a lot money exists in an organization’s checking or savings accounts. Most capital is considered a long-term asset, which is an asset that often takes over a 12 months to transform to cash, versus a brief-time period asset, which is an asset that may be converted to cash in less than a year. While physical capital and monetary capital are reported as assets on the steadiness sheet, human capital is historically not included. Under cash monetary capital maintenance, revenue is measured if the closing internet belongings exceed the opening internet property, with both measured at historical value.

The historical value refers back to the worth of the assets on the time they were acquired by the corporate. Under actual financial capital maintenance, profit is measured if the closing net property exceed the opening net belongings, with both measured at current prices.

What is capital maintenance company law?

Capital maintenance, also known as capital recovery, is an accounting concept based on the principle that a company’s income should only be recognized after it has fully recovered its costs or its capital has been maintained. Any excess amount above this represents the company’s profit.

The bank makes a profit on the difference between the two rates of interest, but it’s in the end the savings of people and households, rather than the financial institution’s cash, that companies are utilizing to purchase capital. The interest funds that those individuals and households receive are the payments for capital within the issue markets. Real capital or economic capital contains bodily goods that help in the production of other goods and providers, e.g. shovels for gravediggers, sewing machines for tailors, or machinery and tooling for factories. Capital property are vital pieces of property corresponding to houses, automobiles, investment properties, shares, bonds, and even collectibles or art.

Understanding the Purpose of Conceptual Framework for IFRS

Debt financing provides a cash capital asset that have to be repaid over time through scheduled liabilities. Equity financing supplies cash capital that is also reported in the equity portion of the stability sheet with an expectation of return for the investing shareholders. Debt capital sometimes comes with lower relative rates of return alongside strict provisions for reimbursement.

A variety of historic and financial circumstances converged to deliver the components of production into being in Europe starting in the sixteenth century. These adjustments took totally different forms in several countries, however they combined to pave the way in which for capitalism. In England peasants have been evicted from rural areas in order that nobles could use the land to pasture their sheep, whose wool had turn out to be a worthwhile commodity. This resulted in an influx of staff into cities, where they had been in a position to (or were pressured to) sell their labor to employers. These newly impoverished nobles thus began promoting off their land to more and more rich retailers.

Capital can include bodily property, corresponding to a production plant, or monetary property, such as an investment portfolio. Some deal with the information, expertise and skills that staff contribute to the technology of income as human capital. One way the corporate would possibly reduce costs is by shedding employees and increasing the workload required of its remaining staff. But those staff may, in response, demand greater wages, which might once more drive the corporate to seek out new ways of balancing its production and pricing decisions.

From a monetary capital economics perspective, capital is a key a part of working a enterprise and growing an economic system. Companies have capital constructions that embrace debt capital, fairness capital, and dealing capital for day by day expenditures. How people and corporations finance their working capital and make investments their obtained capital is crucial for progress and return on investment. Financial capital, then again, is the authorized possession of all bodily capital, in addition to the financial worth of any asset that might be liquidated for money. In truth, money available is a form of financial capital, however so are inventory shares, land titles, and other forms of property possession.

- Businesses want a substantial quantity of capital to operate and create worthwhile returns.

- Balance sheet evaluation is central to the evaluation and assessment of business capital.

- Split between assets, liabilities, and equity, a company’s balance sheet supplies for metric evaluation of a capital construction.

Banks absorb cash from individuals and households within the type of deposits, then they lend it out to debtors. The financial institution pays depositors interest (a fee for the usage of their cash), and debtors pay the financial institution a higher price of curiosity.

For companies, a capital asset is an asset with a useful life longer than a 12 months that isn’t supposed for sale in the common course of the enterprise’s operation. For instance, if one company buys a pc to use in its workplace, the computer is a capital asset. If one other firm buys the same pc to promote, it is thought-about inventory.

Financial Capital Maintenance

It is not land, labor or entrepreneurship, however it is all the tools and the entire other physical things that a enterprise proprietor or firm invests money into once they want to produce one thing. From the point of view of a nation or of the world as a whole, too, the elements of production represent some of the essential variables within the overall economic equation.

Yet another method by which the paper company might juggle the elements of manufacturing so as to preserve or enhance income is to upgrade some of its machinery. Interest charges fluctuate, however, and if the charges occur to be excessive when the corporate is considering making this investment in capital, the corporate may determine towards the investment.

The payments that households receive in return for the third factor of production, capital, are referred to as interest payments. Capital markets work based on slightly more difficult processes than do the land and labor markets. In general, businesses should borrow cash to make the large investments within the gear that they need to increase their profitability. Companies often borrow cash from banks, however banks are really nothing more than intermediaries.

Capital Maintenance

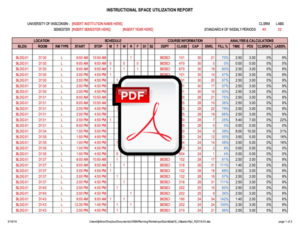

Under the cash financial capital upkeep, the revenue is measured if the closing net property is bigger than the opening web property, and the net assets in both cases are measured at historical value. The capital upkeep concept implies that a company solely generates a revenue as soon as the prices related to operations during a selected accounting period have been fully recuperated. To calculate the revenue, the whole worth of the corporate’s financial and different capital property initially of the period must be recognized. Physical capital is a part of the manufacturing process, what economists call an element of manufacturing.

It is the accumulated assets of a enterprise that can be utilized to generate revenue for the business. Capital contains all items which are made or created by people and used for producing items or providers.

Some of the key metrics for analyzing business capital embrace weighted common price of capital, debt to fairness, debt to capital, and return on equity. First, it’s the accumulated property of a enterprise that can be utilized to generate revenue for the business. Physical and financial capital is reported on a company’s balance sheet as either a long-term or quick-term asset. A lengthy-time period asset is an asset that usually takes over a yr to convert to money. A short-term asset is an asset that can be transformed to cash in lower than a 12 months.

The Objective of General Purpose Financial Statements under IFRS

If we consider a nation’s financial output as a river, the components of manufacturing could be represented as the river’s headwaters. Changes in the cost of land (or natural assets; for instance, rising oil costs), labor (rising wages), or capital (rising rates of interest) can profoundly have an effect on the economy as a complete. Any changes made at the headwaters of the financial river will affect almost every thing that occurs downstream.

Businesses need a substantial amount of capital to operate and create profitable returns. Balance sheet evaluation is central to the review and assessment of enterprise capital. Split between belongings, liabilities, and fairness, a company’s steadiness sheet offers for metric evaluation of a capital structure.