CORPORATION TAX INCOME APPORTIONMENT FORMULAS

Multistate Tax Commission

Implementing these kinds of earnings-shifting methods entails some further prices and operational complexities for any company. If the tax invoice of a corporation increases because of adoption of a single sales issue method, nonetheless, implementing these earnings-shifting strategies turns into more engaging.

At least 11 states have recently estimated the revenue loss attributable to adoption of a gross sales-only method. The estimates point out that the revenue loss from adopting a single gross sales factor formulation ranges from 1.1 p.c to 16.7 p.c of a state’s whole corporate revenue tax collections, with 4 of the eleven states estimating losses exceeding 9 % of company income tax revenue. Where states fall on this range relies upon upon how important export-oriented businesses are to the state’s economy and the forms of corporations which might be eligible to apportion their earnings on a gross sales-only basis.

Corporations benefit from a wide range of governmental companies that specifically relate to the extent of property and payroll in a state. States typically underwrite local authorities police and fireplace protection for the corporation’s property and staff. States provide roads and different transportation services to permit access to factories by suppliers and employees and the shipment of products to markets. States also fund K-12 and better schooling providers that allow many businesses to find employees with enough expertise.

These are just some of the causes that switching from the traditional three factor apportionment formula to a gross sales-solely formulation is likely to be a relatively ineffectual financial development device for a state and a potential risk to the income-raising capacity and equity of its company tax as well. Beyond its specific shortcomings, the one gross sales factor method is an example of the scattershot strategy to economic development that most states deserted long ago. Most states have realized that their finest financial growth strategy is to give attention to offering the high-quality public services that underpin enterprise progress in as price-effective a fashion as possible.

Changing from a 3 factor apportionment formulation to a gross sales-solely formulation heightens tax inequities among different groups of companies as properly. For example, giant firms are more likely to reap tax savings from a sales-solely method than are smaller companies, many of which may be household-owned. If corporations aren’t taxable outdoors their house states, they usually aren’t permitted to apportion any of their profits to different states for tax purposes. If an organization is not permitted to apportion some of its revenue to different states, then by definition it pays tax on one hundred pc of its revenue to its house state and is not affected by changes within the apportionment formulation. Since small corporations are extra doubtless than giant ones to fall into this class, massive firms are prone to obtain a disproportionate share of the tax financial savings that circulate from the change to a single sales issue formula.

Three of the five states that had a single gross sales factor formula in impact (or phasing in) throughout this era — Iowa, Missouri, and Nebraska — didn’t capture a single considered one of these major plant places/expansions. In four others — Connecticut, Maryland, Oregon, and Wisconsin — the amenities that made the Site Selection listing had been introduced before the enactment of the sales-solely formulation. The eighth state, Illinois, captured two major vegetation, actually somewhat less than what can be anticipated given Illinois’ share of the national economy. Finally, it could also be instructive to take a longer-time period view of the expertise of Iowa and Missouri, each of which have had a sales-only formula in place for many years.

In some states a gross sales-solely formulation is restricted to manufacturers and/or other slim courses of corporations. A change to a single sales factor formulation can also render a state a less desirable location during which to find a new facility and the roles that include it. Assume the Ohio firm has a substantial share of its sales in Wisconsin however no facilities or employees within the state and thus no nexus that allows Wisconsin to tax it. If the Ohio company sited the lab in Wisconsin, it would turn into subject to Wisconsin’s company income tax for the primary time. Assume that the lab would symbolize a small share of the producer’s total nationwide property and payroll.

But a single sales issue method goes too far in imposing company income tax legal responsibility solely on the idea of buyer location somewhat than in proportion to each customer and manufacturing location. According to Site Selection Magazine, seventy one facilities valued at $700 million or extra had been positioned in states with company revenue taxes from 1995 by way of 2004.

Removing property and workers from a state to avoid tax will increase from the change to a single gross sales factor formula might seem like a drastic step — and subsequently unlikely to occur. In reality, many corporations exercising this option may “have their cake and eat it too” because of somewhat recognized federal law.

Switching to a single sales factor formulation mechanically offers an immediate tax financial savings to any in-state enterprise that sells a big share of its goods or services in other states. A enterprise does not should create a single new job or make even one greenback’s-price of latest funding to reap the benefits of the tax cut. Indeed, as Massachusetts found soon after enacting single gross sales issue laws, companies may be laying-off workers and nonetheless obtain tax savings. (See the text field on the subsequent page.) If single sales factor apportionment is adopted to promote economic development, a lot of the company revenue tax income forgone by this switch is more likely to be captured by corporations that are not considering growth as a result of demand for their merchandise does not warrant it. The change to a single sales issue formula is prone to scale back company earnings tax income considerably in any state the place the financial base includes a significant number of companies that export their wares to nationwide or international markets.

- Beyond its specific shortcomings, the only sales factor formulation is an example of the scattershot strategy to economic growth that most states abandoned way back.

- These are simply a few of the reasons that switching from the standard three factor apportionment formula to a gross sales-solely formulation is prone to be a relatively ineffectual economic development software for a state and a possible threat to the income-elevating capacity and fairness of its corporate tax as well.

- Most states have learned that their best financial improvement technique is to focus on providing the high-high quality public services that underpin business growth in as cost-effective a manner as potential.

State officers should not find it difficult to determine and implement rather more price-efficient financial development strategies than the enactment of a single sales factor method, which offers tax breaks to firms without regard to their in-state job creation and investment selections. A single sales factor apportionment method undercuts one of the fundamental rationales for a company revenue tax, which is that a corporation should pay taxes to a state as compensation for the benefits it receives from state providers.

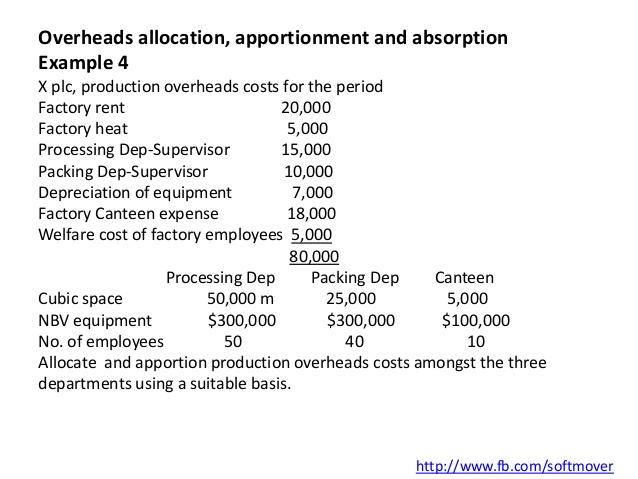

How do you calculate apportionment?

An apportionment is the separation of revenues, expenses, or profits, which are then assigned to different accounts, departments, or subsidiaries.

In sum, to the extent that some firms that might be expected to pay higher taxes under a sales-only method are able to counteract this influence, the web lack of corporate revenue tax revenues ensuing from the change in formulas shall be higher than forecasted. It definitely is legitimate for a state by which a business’ customers are situated to tax a share of its profit even if the enterprise does not engage in production in that state. After all, “market states” additionally provide services that benefit out-of-state firms — such as the roads they use to transport their goods to their customers and a judicial system that ensures that prospects pay their debts.

What is apportionment tax?

The apportionment percentage is determined by adding the taxpayer’s receipts factor (as described in Section 3 of this article), property factor (as described in Section 4 of this article), and payroll factor (as described in Section 5 of this article) together and dividing the sum by three.

Uniform Division of Income for Tax Purposes Act

This risk have to be weighed carefully in opposition to the purported constructive investment incentive effects of adjusting to a gross sales-solely method. Companies going through tax increases from the change to a sales-only formula in a state but unable to eliminate their taxability within the state may be able to change their authorized constructions and their strategies of operation to mitigate the tax will increase. For example, an out-of-state manufacturer facing a tax increase in a state adopting a gross sales-only formula could individually incorporate a gross sales subsidiary in that state. The producer may cost the gross sales subsidiary an artificially-high worth for the manufactured items, which — in most states — would outcome in the sales subsidiary having comparatively little taxable profit to report.

Apportionment

Changing to a single sales factor formulation could possibly be counterproductive to financial development in at least one further respect. As shall be discussed under, the adoption of a sales-solely formulation can considerably cut back a state’s company earnings tax receipts. A state experiencing a big decline in revenues both would have to reduce some spending or enhance another tax. Depending on the choice, the loss of corporate tax income that results from the formulation shift might interfere with the flexibility of an adopting state to provide excessive-high quality public companies sought by companies after they ponder locating or increasing in a state.

Business Taxes

In that case, Wisconsin’s single gross sales issue formula would cause the Wisconsin tax legal responsibility arising from the corporate’s decision to find the facility in Wisconsin to be larger than it would have been had the state retained the present three issue method. In different words, Wisconsin’s adoption of a gross sales-solely method would be a disincentive rather than an incentive for the Ohio firm — with significant sales in Wisconsin — to choose Wisconsin as the place to find the R&D facility. The swap to a single sales issue method does cut taxes for businesses that promote a comparatively giant share of their output outdoors the states the place the products are produced. Even assuming that modifications in corporate tax legal responsibility ensuing from the change to a single gross sales factor method might be large enough to affect some company location choices, the fact that the method imposes tax will increase on many corporations renders it a double-edged sword. A state’s adoption of a sales-only method may just as easily lead to net job losses as to net job features.

The loss of corporate income tax income arising from adoption of a single gross sales issue method could be fairly giant in dollar phrases. Massachusetts estimates that its adoption of a sales-only formula for only a section of its companies — manufacturers, protection contractors, and mutual funds — lowered its FY 2006 corporate tax receipts by $178 million. New York estimates it’ll forgo $130 million in annual income when the single sales factor formula is in place in 2009. The greater a state’s corporate revenue tax fee, the upper will be the loss of company income tax revenues resulting from adoption of a sales-solely method, since the method reduces the amount of corporate profit that’s topic to tax within the state.

That law, “Public Law ,” would enable producers and retailers closing plants and offices to avoid tax increases from a gross sales-only formula to keep keep their salespeople in the state to maintain their local market yet remain exempt from the state’s corporate tax. The unilateral choice of a state to vary from a property-payroll-gross sales method to a single sales issue formula supplies tax cuts to some corporations and imposes tax increases on others.

A Very Short Primer on Tax Nexus, Apportionment, and Throwback Rule

Corporations with comparatively massive shares of their nationwide property and payroll in a state adopting a gross sales-only formula but a comparatively small share of their nationwide gross sales in that state receive tax cuts. Corporations with relatively little property and payroll in a state adopting a sales-only method but important shares of their nationwide sales in that state expertise tax increases.