Capitalization Rate – Business Valuation Glossary – ValuAdder

There was “little support for the SEC to offer an option permitting U.S. firms to arrange their financial statements beneath IFRS.” However, there was support for a single set of worldwide accepted accounting requirements. The FASB and IASB deliberate conferences in 2015 to debate “business combos, the disclosure framework, insurance contracts and the conceptual framework.” As of 2017, there have been no energetic bilateral FASB/IASB projects underway.

Accounting Interpretations

Accounting Principles Board Opinions, Interpretations and Recommendations were revealed by the Accounting Principles Board from 1962 to 1973. The board was created by American Institute of Certified Public Accountants (AICPA) in 1959 and was changed by Financial Accounting Standards Board (FASB) in 1973.

Many have been superseded by FASB pronouncements; 19 opinions still stand as part of GAAP. After the Accounting Principles Board was changed by the Financial Accounting Standards Board (FASB), the APB opinions had been additionally outmoded by GAAP. The APB was disbanded within the hopes that the smaller, absolutely independent FASB could extra successfully create accounting standards.

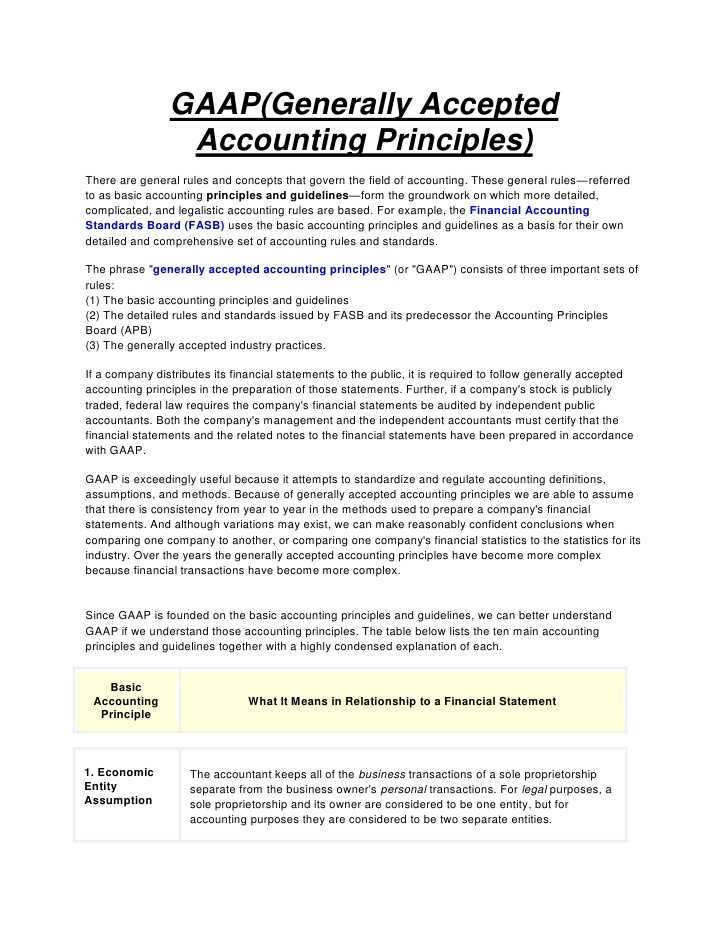

GAAP (generally accepted accounting ideas)

This board has the accountability of explicitly stating the appropriate practices of monetary reporting as well as the key objectives of economic reporting. Basically, accounting theories serve as a foundation for the understanding of financial reporting and how corporations channel their monetary statements utilizing the suitable strategies. An in depth research of accounting theory entails a look into existing accounting practices, how they advanced and the modifications or additions accomplished to them extra time. These accounting ideas serve as framework for correct financial reporting and statements. On the recommendation of the American Institute of CPAs (AICPA), the FASB was shaped as an unbiased board in 1973 to take over GAAP determinations and updates.

Between 1959 and 1973, the Accounting Principles Board (APB) was charged with creating accounting requirements and issuing pronouncements related to accounting principle and follow. Membership ranged from 18 to 21 representatives from major accounting companies, business, and academia. The APB served an necessary position, because it was the primary organized body to put the foundation for GAAP that is so integral to the integrity of economic statements right now. The APB itself was a successor group to the Committee on Accounting Procedure, which was considered ineffective. However, because of its lack of sources, the APB additionally couldn’t maintain pace with the modifications and progress of the forms of transactional exercise in company America that required financial reporting.

Who Enforces GAAP?

Instead, the FASB participates in the Accounting Standards Advisory Forum, a world grouping of standard-setters, and displays particular person projects to seek comparability. An APB opinion is an authoritative pronouncement issued by the Accounting Principles Board. The official opinions got on various accounting points that required clarification or interpretation. The APB listed 31 separate opinions throughout its existence from 1962 to 1973.

AccountingTools

In the United States, the Securities and Exchange Commission (SEC) mandates that financial stories adhere to GAAP necessities. The Financial Accounting Standards Board (FASB) stipulates GAAP total and the Governmental Accounting Standards Board (GASB) stipulates GAAP for state and local authorities. All accounting theories relaxation on the Tenets or framework of accounting provided by the Financial Accounting Standards Board.

The board was created by the American Institute of Certified Public Accountants (AICPA), and was changed by Financial Accounting Standards Board (FASB) in 1973. Its mission was to develop an total conceptual framework of U.S. typically accepted accounting principles (U.S. GAAP).

- Generally accepted accounting rules (GAAP) check with a standard set of accounting principles, standards, and procedures issued by the Financial Accounting Standards Board (FASB).

- GAAP is a mix of authoritative requirements (set by policy boards) and the generally accepted methods of recording and reporting accounting info.

- Public firms within the United States must observe GAAP when their accountants compile their financial statements.

Generally accepted accounting principles (GAAP) check with a common set of accounting rules, requirements, and procedures issued by the Financial Accounting Standards Board (FASB). Public corporations within the United States must comply with GAAP when their accountants compile their monetary statements. GAAP is a combination of authoritative standards (set by policy boards) and the commonly accepted methods of recording and reporting accounting information. GAAP goals to improve the readability, consistency, and comparability of the communication of financial data. GAAP ideas, which are updated frequently to mirror the most recent accounting methodologies, are the definitive source of accounting guidelines that companies rely on when preparing their financial statements.

What Is the Accounting Principles Board?

The APB and the associated Securities Exchange Commission (SEC) were unable to function fully independently of the U.S. authorities. The Statement of Financial Accounting Concepts is issued by the Financial Accounting Standards Board (FASB) and covers financial reporting ideas. Due to the adjustments in accounting practices, numerous modifications and additions had been additionally carried out to accounting theory. The Financial Accounting Standards Board helps to manage and revise accounting theories.

GAAP just isn’t the worldwide accounting commonplace; this can be a growing problem as companies turn into more globalized. The International Financial Reporting Standards(IFRS) is the most typical set of ideas outdoors the United States and is utilized in places such as the European Union, Australia, Canada, Japan, India, and Singapore. To reduce pressure between these two main systems, the FASB and International Accounting Standards Board are working to converge requirements. According to Stephen Zeff in The CPA Journal, GAAP terminology was first used in 1936 by the American Institute of Accountants (AIA). Federal endorsement of GAAP started with laws just like the Securities Act of 1933and the Securities Exchange Act of 1934, legal guidelines enforced by the U.S.

The requirements are established and administered by the American Institute of Certified Public Accountants (AICPA) and the Financial Accounting Standards Board (FASB). The Accounting Principles Board (APB) was the former authoritative body of the American Institute of Certified Public Accountants (AICPA) fashioned in 1959. It was changed in 1973 by the Financial Accounting Standards Board (FASB). The objective of the APB was to issue pointers and guidelines on accounting rules. Some of the opinions launched by the APB nonetheless stand as a part of the Generally Accepted Accounting Principles (GAAP), but most have been both amended or completely outdated by FASB statements.

FInancial Reporting I, Chapter 1

The American Institute of Certified Public Accountants issued Accounting Interpretations between 1968 and November 1973, when the Financial Accounting Standards Board took over the issuing of interpretations in June 1974. The Interpretations weren’t thought of pronouncements from the Accounting Principles Board, but Richard C. Lytle, the executive director of the Accounting Principles Board, was responsible for their preparation. For Interpretations see section 9551 of the final edition of the APB Accounting Principles, Volume 2, Original Pronouncements as of June 30, 1973. The interpretation numbers come from the Financial Accounting Board’s Original Pronouncements as amended 2008/2009 Edition, volume three.

What pronouncements are issued by the Accounting Principles Board?

The Accounting Principles Board (APB) was a group that issued authoritative pronouncements about accounting theory and the practical application of accounting. The APB was organized and overseen by the American Institute of Public Accountants, and operated from 1959 to 1973.

Certified Professional Accountants (CPAs) also help company businesses regulate to these modifications and new standards. The Financial Accounting Standards Board is an autonomous group that oversees the preparation of financial statements by each personal and public enterprises. Accounting laws rolled out by this board change overtime to go well with the evolving nature accounting practices. There is not any universal GAAP standard and the specifics vary from one geographic location or business to a different.

The FASB and the IASB issued guidance on recognizing income in contracts with clients in 2014, establishing ideas to report helpful information to users of economic statements concerning the nature, timing, and uncertainty of revenue from these transactions. In May 2015 the SEC acknowledged that “investors, auditors, regulators and standard-setters” within the United States didn’t assist mandating International Financial Reporting Standards Foundation (IFRS) for all U.S. public companies.

The Financial Accounting Standards Board (FASB) is a personal, non-profit organization standard-setting body whose major purpose is to determine and enhance Generally Accepted Accounting Principles (GAAP) within the United States within the public’s interest. The Securities and Exchange Commission (SEC) designated the FASB as the organization responsible for setting accounting requirements for public companies in the US. The FASB changed the American Institute of Certified Public Accountants’ (AICPA) Accounting Principles Board (APB) on July 1, 1973.

Today, the Financial Accounting Standards Board (FASB), an independent authority, regularly displays and updates GAAP. Generally accepted accounting ideas, or GAAP, are a set of rules that embody the main points, complexities, and legalities of enterprise and corporate accounting. The Financial Accounting Standards Board (FASB) makes use of GAAP as the muse for its comprehensive set of permitted accounting methods and practices. Of the APB’s 31 opinions and 4 statements a number of have been instrumental in enhancing the theory and apply of great areas of accounting.

Its mission was to develop an total conceptual framework of US generally accepted accounting principles (US GAAP). APB was the primary organization setting the US GAAP and its opinions are still an essential a part of it. All of the Opinions have been superseded in 2009 by FASB’s Accounting Standards Codification.