Buying Bearer Bonds

Finding Bearer Bonds

It differs from the more widespread kinds of debt securities in that it’s unregistered – no records are kept of the owner (i.e. Joe Takagi), or the transactions involving ownership. In Die Hard, Hans Gruber’s reasoning for taking over Nakatomi in the first place was to steal $640 million in bearer bonds from the vault.

Recovery of the worth of a bearer bond within the occasion of its loss, theft, or destruction is often inconceivable. Some aid is possible within the case of United States public debt. Federal laws within the United States modified tax therapy of bearer and registered bonds in the Tax Equity and Fiscal Responsibility Act of 1982. This regulation eliminated the option of tax-exempt bonds being issued in bearer kind to the public unless the bond matured in one yr or much less. In addition, beneath the regulation the issuer cannot claim curiosity paid as a tax deduction, reducing the attractiveness of this kind of debt obligation to public firms.

Department of the Treasury while others had been issued by banks and financial institutions. Congress prohibited the issuance of latest bearer bonds in 1982.

Unlike other forms of bonds, where ownership is registered, bearer bonds as originally issued could possibly be redeemed by anyone possessing them. Electronic banking changed how bonds had been issued and accounted for, according to the New York Times.

A Short History of Bearer Bonds

While a bearer bond doesn’t expire per se, it could be hard to cash relying on who issued it. An issuer of a bearer kind safety keeps no record of who owns the security at any given point in time. That is, whoever produces the bearer certificates is assumed to be the proprietor of the securities and can collect both dividends and interest funds tied to the security.

Do bearer bonds still exist?

While bearer bonds aren’t issued in the U.S. any more, a few are still in circulation. If you can find them you can still collect the value, and in some cases interest. Besides buying or inheriting bearer bonds, you can get them in the foreign countries that still allow them to be issued.

How Are Municipal Bonds Taxed?

The rate for brand new bonds is introduced by the Treasury each year on May 1 and November 1. EE bonds purchased before May 2005 have variable rates of interest. This type of bond is out there in an electronic kind and can be purchased in penny increments beginning at $25 and as much as a most of $10,000 per calendar yr. Because there isn’t any owner of report, a bearer bond is a useful method to evade taxes. For this cause, Congress banned the issuance of bearer bonds within the United States in 1982.

With a normal bond, a document of the proprietor is recorded and the person receives common payments. However, bearer bonds operate like money in that they can be owned anonymously.

- Unlike different types of bonds, the place ownership is registered, bearer bonds as originally issued could possibly be redeemed by anyone possessing them.

- Department of the Treasury while others have been issued by banks and monetary establishments.

- Congress prohibited the issuance of recent bearer bonds in 1982.

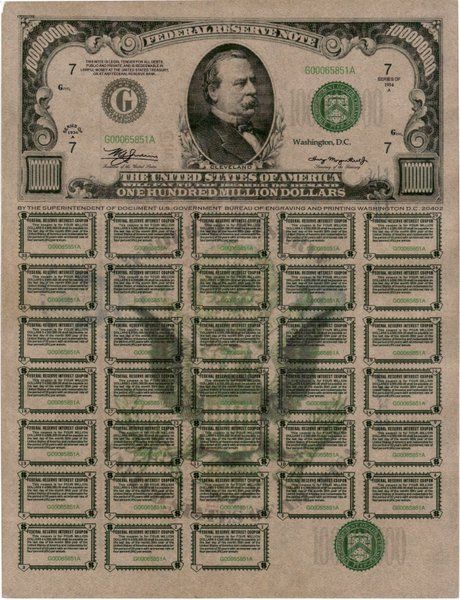

In distinction, registered bonds retained the tax-exempt treatment. Treasury bearer bond with twelve coupons affixed which was issued in February of 1977 and called on February 15, 2002.

Bearer Bonds

Savings bonds earn interest for 30 years, but rates are relatively low. Department of Treasury declared a zero.10% fee for EE savings bonds and a composite, or combined, 1.90% interest rate for Series I bonds by way of Oct. 31, 2019. These charges are comparable to the curiosity you’ll be able to earn on some financial savings accounts but decrease than that of some certificates of deposit and money market accounts. Series EE financial savings bonds earn a fixed price of interest each month for as much as 30 years.

Ownership is transferred by transferring the certificate, and there is no requirement for reporting the switch of bearer securities. Securities in bearer form can be used in sure jurisdictions to avoid switch taxes, though taxes may be charged when bearer instruments are issued. Two kinds of bearer form certificates are bearer bond and bearer stock certificates.

A bearer bond is a bond or debt security issued by a enterprise entity such as a corporation, or a government. As a bearer instrument, it differs from the more widespread forms of funding securities in that it is unregistered—no data are saved of the owner, or the transactions involving possession. Whoever physically holds the paper on which the bond is issued is the presumptive owner of the instrument.

Because of their anonymity, bearer bonds were often used for tax evasion purposes. In the United States, the Tax Equity and Fiscal Responsibility Act of 1982 considerably curtailed the issue of debt in bearer kind.

The Future of Bearer Bonds

Issued at its face value of $1,000,000, it’s nonetheless redeemable for this amount and will be until 2047. Bearer bonds have not been issued by the Treasury since 1986, and all bonds issued at present are in book entry kind, registered to particular people or institutions. If you’re in search of an item that can afford you the final word in “bragging rights,” that is definitely an merchandise you should deliver house this evening. A bearer bond is totally different than a traditional monetary bond in that no records are stored of who truly owns it.

Since some bearer bonds issued previous to the ban had maturities of 30 years or more, a couple of are nonetheless around. As with registered bonds, once bearer bonds have matured or been referred to as for early redemption, they not pay curiosity. However, unpaid interest coupons dated on or earlier than a maturity or name date could also be redeemed together with the bond itself. American Bearer Bonds are a debt security issued by a business entity, corresponding to an organization, or by a government.

Bearer bonds work equally to cash in that the current holder can submit a coupon to the issuer to receive earnings when due. The owner can promote or trade the bond to another investor, who can in flip submit a coupon when the subsequent interest funds are due and receive the earnings.