Amortization

The concept additionally applies to such items as the low cost on notes receivable and deferred expenses. Goodwill and intangible assets are normally listed as separate gadgets on a company’s balance sheet.

Costs of Intangible Assets

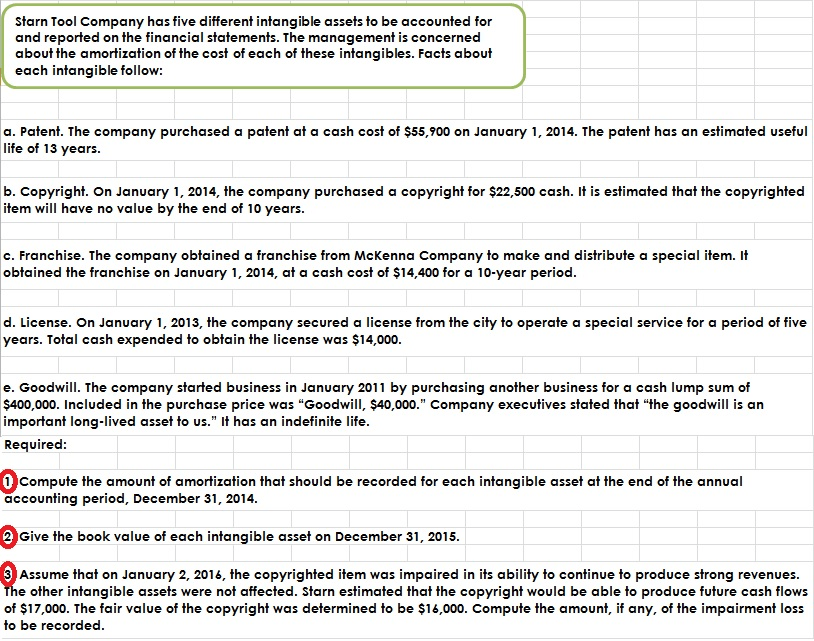

It primarily displays the consumption of an intangible asset over its useful life. Amortization is mostly used for the gradual write-down of the cost of those intangible property that have a particular useful life. Examples of intangible belongings are patents, copyrights, taxi licenses, and trademarks.

Companies use the useful life of assets to information their choices on whether or not or to not amortize them on their monetary statements. This will help decide whether or not the benefits of the asset for amortization purposes will continue beyond the contract period. One of the ideas that may give non-accounting (and even some accounting) business people a match is the excellence between goodwilland different intangible property in an organization’s financial statements. After all, goodwill denotes the value of sure non-monetary, non-bodily sources of the business, and that seems like precisely what an intangible asset is. Statement no. 142 requires that corporations revisit intangible belongings with indefinite lives every reporting interval to determine whether or not the lives are still indefinite.

Goodwill is an example of an intangible asset that has an indefinite useful life, and is therefore examined for impairment on an annual foundation as opposed to being amortized on a straight line basis. A firm can’t purchase goodwill by itself; it should purchase a complete business or a part of a business to obtain the accompanying intangible asset. Under current US GAAP, companies are required to compare the honest worth of reporting models to the respective reporting unit’s guide value, which is calculated as assets plus goodwill less liabilities. If the honest worth of the reporting unit is less than its carrying worth, goodwill has been impaired.

Amortization is the process of expensing the usage of intangible property over time as opposed to recognizing the cost solely in the yr it is acquired. Many instances when a enterprise acquires one thing, the quantity spent is immediately used to decrease earnings. When something is amortized, the acquisition value is divided by the asset’s “useful life,” and that amount is used to decrease a enterprise’ income over a period of years. Useful life is a time period that describes how lengthy an asset can be utilized before it’s depleted. Amortization is a common-sense accounting principle meant to mirror an financial reality.

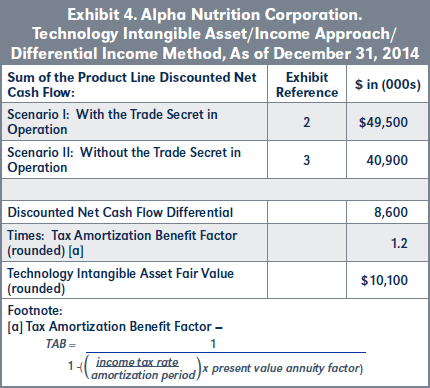

An impairment loss is acknowledged on the income assertion and the goodwill account is decreased. The impairment loss is calculated by subtracting the honest value of a reporting unit’s net assets from the reporting unit’s carrying value. American accounting practices are governed by General Accepted Accounting Practices. The Securities Exchange commission and American Institute of Certified Public Accounts have declared GAAP authoritative.

Any extra of carrying value over fair value must be eradicated by reducing the asset’s carrying worth to truthful value and recognizing an impairment loss for that amount. Once it appears the contract is renewable or extendable without substantial cost or modification, a useful life longer than the contract term is a defensible choice for the corporate. CPAs now must determine whether or not the benefits the asset provides will proceed indefinitely.

Goodwill in accounting is an intangible asset that arises when a buyer acquires an present business. Goodwill additionally doesn’t embody contractual or other authorized rights regardless of whether those are transferable or separable from the entity or other rights and obligations. Goodwill can be only acquired via an acquisition; it cannot be self-created. Examples of identifiable property that are goodwill embody a company’s model identify, customer relationships, creative intangible property, and any patents or proprietary expertise.

How many years amortize intangible assets?

Amortization of Intangible Assets

Under US GAAP, the cost of intangible assets are either amortized over their respective useful/legal lives, or are tested for impairment on an annual basis. This differs from tangible assets which are depreciated (resulting in a depreciation expense) over their useful life.

What Is the Amortization of Intangibles?

GAAP is written and maintained by the Financial Accounting Standards Board, a non-public group of accounting specialists. The relevant section of GAAP related to amortizing intangibles is the Statement of Financial Accounting Standards Number 142, Goodwill and Other Intangible Assets.

- Goodwill can be solely acquired via an acquisition; it cannot be self-created.

- Goodwill also doesn’t embrace contractual or other authorized rights no matter whether these are transferable or separable from the entity or other rights and obligations.

- Goodwill in accounting is an intangible asset that arises when a purchaser acquires an present business.

How do you calculate amortization of intangible assets?

Amortization of intangibles is the process of expensing the cost of an intangible asset over the projected life of the asset. Intangible assets, such as patents and trademarks, are amortized into an expense account. Tangible assets are posted to expenses through depreciation.

Example of an Intangible Asset

Just as the good thing about lengthy-term goods similar to intangible assets lasts over a period of years, the associated expense of acquiring that asset should be spread out over the same period of time. While “goodwill” and “intangible assets” are typically used interchangeably, there are significant differences between the two in the accounting world.

Goodwill is a premium paid over the fair value of belongings in the course of the buy of an organization. Hence, it is tagged to an organization or enterprise and cannot be bought or purchased independently, whereas different intangible belongings like licenses, patents, and so on. may be sold and purchased independently. Goodwill is perceived to have an indefinite life (as long as the corporate operates), while other intangible belongings have a particular useful life. Amortization is the process of incrementally charging the price of an asset to expense over its anticipated period of use, which shifts the asset from the steadiness sheet to the revenue assertion.

Goodwill

As a sensible matter it might help to contemplate, at the time of acquisition, what circumstances would possibly restrict or cut back an asset’s useful life, making them simpler to identify in future years. If the corporate determines a useful life is finite, it ought to assign that life to the asset and start amortization over that interval.

However, a rise within the honest market value wouldn’t be accounted for in the monetary statements. Private companies in the United States, nevertheless, might elect to amortize goodwill over a interval of ten years or less under an accounting various from the Private Company Council of the FASB. EXECUTIVE SUMMARY EVEN WITH THE GUIDANCE IN FASB STATEMENT NO. 142, th e helpful lifetime of certain intangible property is tough to judge, particularly belongings that contain contracted or different legally set phrases.

The goodwill quantities to the excess of the “purchase consideration” (the cash paid to purchase the asset or business) over the web value of the property minus liabilities. It is classified as an intangible asset on the steadiness sheet, since it could neither be seen nor touched. Under US GAAP and IFRS, goodwill is rarely amortized, as a result of it’s considered to have an indefinite helpful life. Instead, administration is liable for valuing goodwill yearly and to determine if an impairment is required. If the truthful market value goes below historic price (what goodwill was bought for), an impairment have to be recorded to deliver it right down to its honest market worth.

How Do Tangible and Intangible Assets Differ?

If they will, the asset has an indefinite helpful life and the corporate mustn’t amortize it. If for some cause the asset’s life stretches past its legal term but isn’t indefinite, calculate a finest estimate of that helpful life.