Amortization — AccountingTools

Business begin-up costs may be amortized, too, however generally, they, as well as other intangible belongings, can only be amortized for a most of 15 years. Some intangible assets present profit to a company for an indefinite interval, but these is probably not amortized. Amortization is strictly restricted to belongings which are solely useful for a determined span of time.

What is an example of amortization?

Amortization is the process of incrementally charging the cost of an asset to expense over its expected period of use, which shifts the asset from the balance sheet to the income statement. Examples of intangible assets are patents, copyrights, taxi licenses, and trademarks.

Loans That Don’t Get Amortized

Complexity / Cost Complex and expensive course of that requires identification, valuation, and title switch of individual property. Taxes If the target liquidates, then there are two levels of tax, at the corporate level and once more at the shareholder stage when the liquidation proceeds are distributed. Tax Basis The buyer’s foundation in the acquired assets is stepped up to the purchase worth (FV).

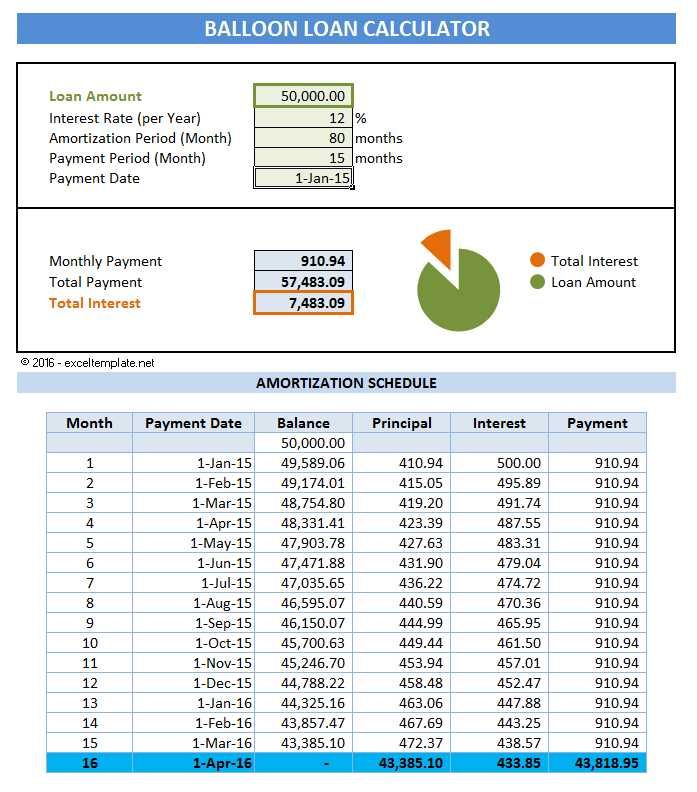

Amortization is the process of spreading out a mortgage right into a series of mounted funds over time. You’ll be paying off the mortgage’s curiosity and principal in several quantities each month, although your complete fee stays equal every period.

Sample Amortization Table

It is classed as an intangible asset on the steadiness sheet, since it could neither be seen nor touched. Under US GAAP and IFRS, goodwill is never amortized, as a result of it’s thought-about to have an indefinite useful life. Instead, administration is liable for valuing goodwill every year and to find out if an impairment is required.

Amortization expense is an income statement account affecting revenue and loss. The offsetting entry is a stability sheet account, amassed amortization, which is a contra account that nets against the amortized asset. Amortized loans are designed to fully repay the mortgage stability over a set period of time. Your last mortgage fee will repay the ultimate amount remaining on your debt.

What Is Amortization? Definition and Examples

- Goodwill in accounting is an intangible asset that arises when a purchaser acquires an present enterprise.

- Goodwill is also only acquired by way of an acquisition; it cannot be self-created.

- Goodwill additionally does not embody contractual or different legal rights regardless of whether these are transferable or separable from the entity or different rights and obligations.

However, some property can’t be transferred easily without third celebration consents. All liabilities transfer to the buyer by operation of legislation, wished or not. However, the customer can contractually allocate liabilities to the vendor by promoting them again.

Amortization and depreciation are non-money expenses on an organization’s income statement. Depreciation represents the price of capital belongings on the balance sheet getting used over time, and amortization is the similar price of using intangible property like goodwill over time. Amortization is the process of expensing using intangible assets over time as opposed to recognizing the fee solely in the 12 months it’s acquired. Many instances when a business acquires something, the quantity spent is instantly used to decrease revenue. When something is amortized, the acquisition value is divided by the asset’s “useful life,” and that quantity is used to lower a business’ income over a interval of years.

Goodwill in accounting is an intangible asset that arises when a purchaser acquires an current enterprise. Goodwill additionally doesn’t embrace contractual or different authorized rights regardless of whether these are transferable or separable from the entity or different rights and obligations. Goodwill is also solely acquired by way of an acquisition; it can’t be self-created. Examples of identifiable assets which are goodwill embrace a company’s model identify, buyer relationships, creative intangible assets, and any patents or proprietary expertise. The goodwill quantities to the excess of the “purchase consideration” (the money paid to purchase the asset or enterprise) over the online worth of the assets minus liabilities.

Find the best charges for…

If the honest market worth goes under historical cost (what goodwill was purchased for), an impairment should be recorded to bring it down to its honest market value. However, an increase within the truthful market value wouldn’t be accounted for within the financial statements. Private corporations within the United States, nevertheless, might elect to amortize goodwill over a interval of ten years or much less under an accounting different from the Private Company Council of the FASB.

AccountingTools

In firm report-preserving, earlier than amortization can happen, the purchase of the asset have to be recorded. The cost of the asset is entered in a balance sheet account, with the offsetting entry to the account representing the method of cost, such as cash or notes payable.

The purchaser’s basis within the acquired stock is stepped as much as the purchase price (FV). Goodwill Tax-deductible and amortized over 15 years for tax functions beneath IRC Section 197.

A major tax benefit to the acquirer of structuring a transaction as a taxable asset purchase is that the acquirer receives stepped-up tax basis in the target’s web assets (assets minus liabilities). This means that the acquired internet property are written up (or down) from their carrying values on the vendor’s tax steadiness sheet to truthful worth (FV) on the acquirer’s tax stability sheet.

It’s all in regards to the assets.

Intangible belongings are outlined as those with a lack of physical existence but have a long-term profit to the company. Amortization is most often utilized to purchases of logos, patents, copyrights, licensing and contracts, properties that present tangible benefit to the corporate however only for a sure length of time.

The company determines the helpful life of the asset and divides the purchase amount by the variety of accounting intervals occurring throughout that life. For instance, a company purchases a patent for $one hundred twenty,000 and determines its useful life to be 10 years. The annual amortization bills will be $12,000, or $1,000 a month if you’re recording amortization expenses monthly.

The greater ensuing tax basis within the acquired web belongings will decrease taxes on any achieve on the future sale of those property. Under U.S. tax legislation, goodwill and other intangibles acquired in a taxable asset buy are required by the IRS to be amortized over 15 years, and this amortization is tax-deductible. Recall that goodwill is never amortized for accounting functions however as a substitute tested for impairment.

For instance, after exactly 30 years (or 360 month-to-month funds) you’ll pay off a 30-yr mortgage. Asset Deal Stock Deal (no §338 Election) Assets / Liabilities Acquirer can “cherry pick” needed property/liabilities, avoiding unwanted liabilities.