After the 5-year period, if the company were to sell the asset, the account would need to be zeroed out because the asset is not relevant to the company anymore. Therefore, there would be a credit to the asset account, a debit to the accumulated depreciation account, and a gain or loss depending on the fair value of the asset and the amount received. Accumulated depreciation is recorded as a contra asset via the credit portion of a journal entry. Accumulated depreciation is nested under the long-term assets section of a balance sheet and reduces the net book value of a capital asset. Meanwhile, its balance sheet is a life-to-date running total that is not clear at year-end.

In our PP&E roll-forward, the depreciation expense of $10 million is recognized across the entire forecast, which is five years in our illustrative model, i.e. half of the ten-year useful life. In order to calculate the depreciation expense, which will reduce the PP&E’s carrying value each year, the useful life and salvage value assumptions are necessary. A contra asset is defined as an asset account that offsets the asset account to which it is paired, i.e. the reverse of the standard impact on the books. The purpose of depreciation is to match the timing of the purchase of a fixed asset (“cash outflow”) to the economic benefits received (“cash inflow”). Income refers to the company’s revenue or earnings generated from its operations, while expenses are the costs incurred by the company in its operations.

How Accumulated Depreciation Works

Accumulated Depreciation is a valuable information source regarding an asset’s age and condition. Accumulated depreciation on 31 December 2019 is equal to the opening balance amount of USD400,000 plus depreciation charge during the year amount of USD40,000.

Straight-line depreciation is calculated as (($110,000 – $10,000) ÷ 10), or $10,000 a year. This means the company will depreciate $10,000 for the next 10 years until the book value of the asset is $10,000. Company A buys a piece of equipment with a useful life of 10 years for $110,000. The equipment is going to provide the company with value for the next 10 years, so the company expenses the cost of the equipment over the next 10 years.

Accumulated Depreciation: Everything You Need To Know

If a company decides to purchase a fixed asset (PP&E), the total cash expenditure is incurred in once instance in the current period. The concept of depreciation describes the allocation of the purchase of a fixed asset, or capital expenditure, over its useful life. Accumulated depreciation is the total amount of depreciation expense allocated to each capital asset since the time that asset was put into use by a business.

- Therefore, it would recognize 10% or (8,000 ÷ 80,000) of the depreciable base.

- This means the company will depreciate $10,000 for the next 10 years until the book value of the asset is $10,000.

- Accumulated Depreciation does not appear directly in the statement of cash flows.

- Are you an accountant looking to calculate the accumulated depreciated value of the company’s vehicle?

Let’s assume that, in this instance, we wish to calculate the accumulated depreciation after 3 years. The estimated life of the machine is 15 years, and its salvage value is $3,000. The cost of the PP&E – i.e. the $100 million capital expenditure – is not recognized all at once in the period incurred. Starting from the gross property and equity value, the accumulated depreciation value is deducted to arrive at the net property and equipment value for the fiscal years ending 2020 and 2021. Alternatively, the accumulated expense can also be calculated by taking the sum of all historical depreciation expense incurred to date, assuming the depreciation schedule is readily available.

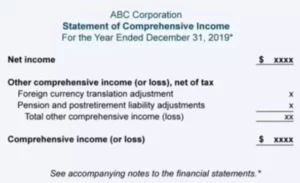

Is Accumulated Depreciation An Asset, Liability, Equity, income, or expenses

In accordance with accounting rules, companies must depreciate these assets over their useful lives. As a result, companies must recognize accumulated depreciation, the sum of depreciation expense recognized over the life of an asset. Accumulated depreciation is reported on the balance sheet as a contra asset that reduces the net book value of the capital asset section. Accumulated depreciation is calculated using several different accounting methods.

How to calculate the accumulated depreciation – the straight-line method

Under the sum-of-the-years digits method, a company strives to record more depreciation earlier in the life of an asset and less in the later years. This is done by adding up the digits of the useful years and then depreciating based on that number of years. These methods are allowable under generally accepted accounting principles (GAAP). With the above explanations in hand, accumulated depreciation is neither an asset (a resource that generates cash flow or economic value) nor a liability (something that is owed). Depreciation is an income tax deduction that allows you to use the cost of property or assets that are placed in service to offset certain types of income. So to find the accumulated depreciation AD, we need to sum the total depreciation expense from each year.

A commonly practiced strategy for depreciating an asset is to recognize a half year of depreciation in the year an asset is acquired and a half year of depreciation in the last year of an asset’s useful life. This strategy is employed to fairly allocate depreciation expense and accumulated depreciation in years when an asset may only be used for part of a year. After two years, the company realizes the remaining useful life is not three years but instead six years. Under GAAP, the company does not need to retroactively adjust financial statements for changes in estimates.

Instead, it is a contra-asset account that reflects the total depreciation expense recognized over the life of an asset. In other ways, accumulated depreciation is calculated by the sum of all of the depreciation charges to assets from the beginning up to the latest reporting period. Accumulated amortization and accumulated depletion work in the same way as accumulated depreciation; they are all contra-asset accounts. For tangible assets such as property or plant and equipment, it is referred to as depreciation. Watch this short video to quickly understand the main concepts covered in this guide, including what accumulated depreciation is and how depreciation expenses are calculated.