Accounts Receivable Common Term and Definition

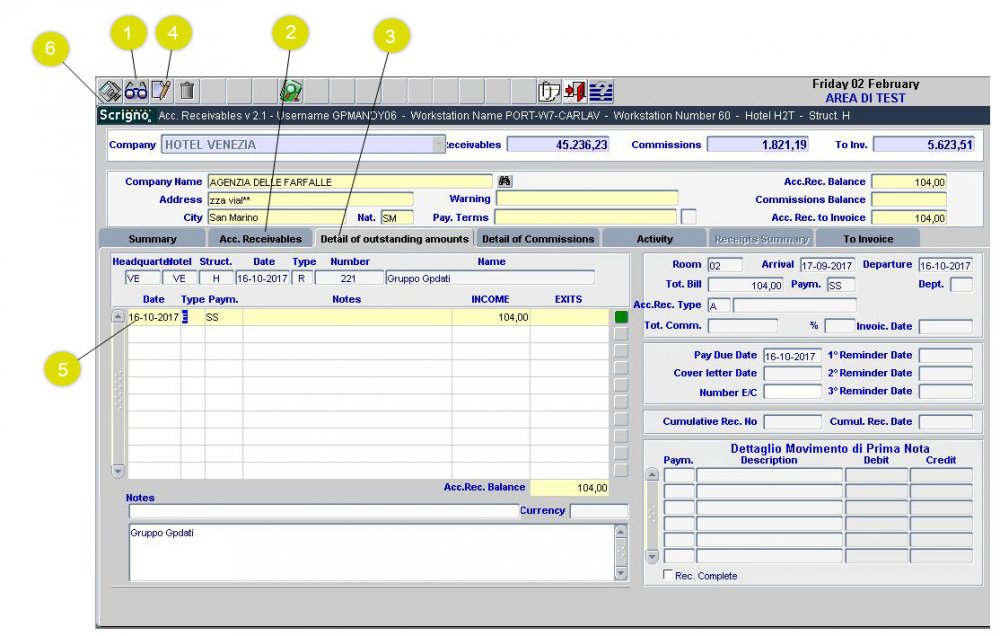

Example of Accounts Receivable

In simplistic terms, this means that Assets are accounts seen as having a future value to the company (i.e. money, accounts receivable, gear, computers). Liabilities, conversely, would include items that are obligations of the company (i.e. loans, accounts payable, mortgages, money owed).

Debits and credit are historically distinguished by writing the transfer quantities in separate columns of an account book. Alternately, they are often listed in a single column, indicating debits with the suffix “Dr” or writing them plain, and indicating credit with the suffix “Cr” or a minus signal. Despite the usage of a minus sign, debits and credit do not correspond on to constructive and adverse numbers. When the whole of debits in an account exceeds the total of credits, the account is said to have a net debit balance equal to the difference; when the alternative is true, it has a net credit score stability.

If you got it as a mortgage then the -$a hundred could be recorded next to the Loan Account. If you obtained the $100 since you sold one thing then the $-100 could be recorded next to the Retained Earnings Account. If every little thing is viewed when it comes to the balance sheet, at a very high degree, then picking the accounts to make your balance sheet add to zero is the picture. The complete accounting equation primarily based on fashionable strategy is very simple to remember if you focus on Assets, Expenses, Costs, Dividends (highlighted in chart). All those account varieties enhance with debits or left side entries.

Whenever an accounting transaction is created, no less than two accounts are at all times impacted, with a debit entry being recorded towards one account and a credit score entry being recorded towards the opposite account. There is no higher limit to the number of accounts involved in a transaction – but the minimum is a minimum of two accounts. Thus, the use of debits and credit in a two-column transaction recording format is the most essential of all controls over accounting accuracy. Before the advent of computerised accounting, manual accounting procedure used a guide (known as a ledger) for every T-account. The assortment of all these books was known as the final ledger.

The chart of accounts is the table of contents of the overall ledger. Totaling of all debits and credit in the common ledger on the finish of a financial interval is known as trial balance. This use of the terms can be counter-intuitive to individuals unfamiliar with bookkeeping ideas, who may at all times consider a credit as a rise and a debit as a lower.

If you receive $100 money, put $one hundred (debit/Positive) subsequent to the Cash account. If you spend $100 money, put -$a hundred (credit/Negative) next to the cash account. The subsequent step would be to stability that transaction with the opposite signal so that your steadiness sheet adds to zero.

Accounts with a net Debit stability are typically proven as Assets, while accounts with a internet Credit steadiness are typically proven as Liabilities. The fairness section and retained earnings account, basically reference your profit or loss. Therefore, that account can be constructive or adverse (depending on if you made money). When you add Assets, Liabilities and Equity collectively (using constructive numbers to characterize Debits and adverse numbers to symbolize Credits) the sum must be Zero. The simplest best way to perceive Debits and Credits is by really recording them as optimistic and negative numbers directly on the balance sheet.

Accounts Receivable

Conversely, a lower to any of those accounts is a credit or proper facet entry. On the opposite hand, increases in income, legal responsibility or equity accounts are credit or right side entries, and decreases are left facet entries or debits. Debits improve asset or expense accounts and reduce legal responsibility or fairness.

- At the tip of any monetary interval (say on the end of the quarter or the 12 months), the web debit or credit score quantity is known as the accounts steadiness.

- If the sum of the debit aspect is greater than the sum of the credit score aspect, then the account has a “debit steadiness”.

- If the sum of the credit facet is greater, then the account has a “credit balance”.

Credits do the other — lower belongings and expenses and increase legal responsibility and fairness. On the opposite hand, when a utility buyer pays a invoice or the utility corrects an overcharge, the customer’s account is credited. This is as a result of the customer’s account is one of the utility’s accounts receivable, which are Assets to the utility because they characterize cash the utility can expect to receive from the shopper in the future. Credits truly lower Assets (the utility is now owed much less money).

What is an example of an accounts receivable?

Accounts receivable is a term used to describe the quantity of cash, goods, or services owed to a business by its clients and customers. Moreover, when a business has trouble collecting what it is owed, it also often has trouble paying off the bills (accounts payable) it owes to others.

For a specific account, one of these would be the regular balance kind and will be reported as a positive quantity, whereas a adverse balance will indicate an irregular state of affairs, as when a checking account is overdrawn. Debit balances are regular for asset and expense accounts, and credit score balances are normal for legal responsibility, fairness and income accounts. The accounts receivable turnover ratio is an accounting measure used to quantify an organization’s effectiveness in amassing its receivables or money owed by purchasers. The ratio shows how nicely a company uses and manages the credit it extends to prospects and the way quickly that short-time period debt is collected or is paid.

If the credit score is because of a bill cost, then the utility will add the money to its own cash account, which is a debit as a result of the account is one other Asset. Again, the client views the credit score as a rise within the customer’s own money and doesn’t see the other side of the transaction.

At the top of any financial interval (say at the finish of the quarter or the yr), the web debit or credit score quantity is known as the accounts balance. If the sum of the debit aspect is greater than the sum of the credit side, then the account has a “debit balance”. If the sum of the credit score facet is bigger, then the account has a “credit stability”. If debits and credits equal each, then we’ve a “zero steadiness”.

All accounts must first be categorised as one of the five types of accounts (accounting components) ( asset, liability, equity, income and expense). To decide tips on how to classify an account into one of many five elements, the definitions of the five account types should be absolutely understood. The definition of an asset in accordance with IFRS is as follows, “An asset is a resource managed by the entity on account of previous occasions from which future financial benefits are anticipated to move to the entity”.

Understanding Accounts Receivable (AR)

The way of doing these placements are merely a matter of understanding where the money got here from and the place it goes within the particular account varieties (like Liability and internet assets account). So if $one hundred Cash got here in and you Debited/Positive next to the Cash Account, then the next step is to find out where the -$one hundred is assessed.

Is Accounts Receivable an Asset or Liability?

A depositor’s bank account is actually a Liability to the bank, as a result of the financial institution legally owes the cash to the depositor. Thus, when the customer makes a deposit, the financial institution credits the account (will increase the financial institution’s liability). At the identical time, the bank provides the money to its personal cash holdings account. But the shopper usually doesn’t see this aspect of the transaction.

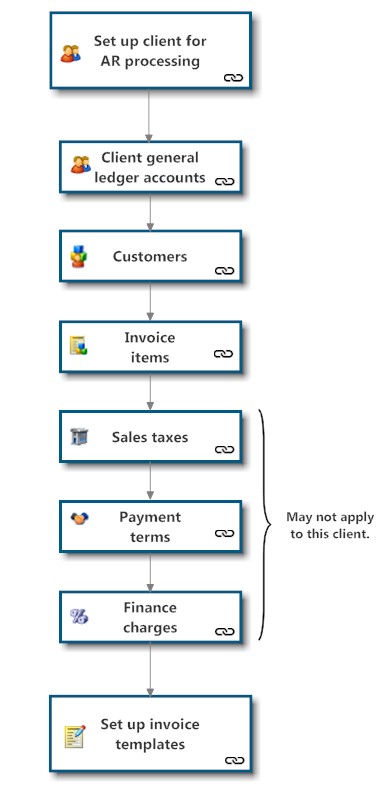

The receivables turnover ratio can be known as the accounts receivable turnover ratio. Further analysis would come with days sales outstanding analysis, which measures the common collection period for a firm’s receivables balance over a specified period. Companies record accounts receivable as assets on their steadiness sheets since there is a authorized obligation for the customer to pay the debt. Furthermore, accounts receivable are current assets, meaning the account steadiness is due from the debtor in a single year or less.