Account definition — AccountingTools

accounting

A single entry system is only designed to supply an income assertion. The complete amount of debits must equal the total amount of credits in a transaction. Otherwise, an accounting transaction is said to be unbalanced, and will not be accepted by the accounting software. The function of accounting is to build up and report on monetary details about the performance, financial position, and cash flows of a business. This data is then used to achieve selections about how to manage the enterprise, or invest in it, or lend cash to it.

The first accounting book actually was certainly one of 5 sections in Pacioli’s mathematics book, titled Summa de Arithmetica, Geometria, Proportioni et Proportionalita (Everything About Arithmetic, Geometry and Proportions). This part on accounting served as the world’s solely accounting textbook till well into the 16th century.

This data is accumulated in accounting records with accounting transactions, that are recorded both by way of such standardized business transactions as buyer invoicing or provider invoices, or through more specialized transactions, generally known as journal entries. Although Luca Pacioli did not invent double-entry bookkeeping, his 27-web page treatise on bookkeeping contained the primary recognized revealed work on that matter, and is claimed to have laid the muse for double-entry bookkeeping as it is practiced at present. Even though Pacioli’s treatise displays nearly no originality, it is generally thought-about[by whom? ] as an important work, primarily due to its broad circulation; it was written within the vernacular Italian language, and it was a printed book.

Business transactions are events that have a financial influence on the monetary statements of a company. When accounting for these transactions, we document numbers in two accounts, the place the debit column is on the left and the credit score column is on the proper. double-entry bookkeepingFra Luca Bartolomeo de Pacioli (sometimes Paccioli or Paciolo; c. 1447 – 19 June 1517) was an Italian mathematician, Franciscan friar, collaborator with Leonardo da Vinci, and an early contributor to the sector now known as accounting.

Luca Pacioli: The Father of Accounting

Under double-entry bookkeeping, your debit accounts and your credit accounts should be equal, successfully balancing your financial accounts and serving to ensure that your small business funds don’t receive extra attention from the tax authorities within the type of an audit. Whenever an accounting transaction is created, no less than two accounts are all the time impacted, with a debit entry being recorded towards one account and a credit entry being recorded against the opposite account. There is no upper limit to the number of accounts concerned in a transaction – but the minimal is at least two accounts.

What account means?

An account can be the record in a system of accounting in which a business records debits and credits as evidence of accounting transactions. Under this meaning, an account is another entity or person for whom a business acts as a supplier, and with whom there may be an outstanding accounts receivable balance.

- Clearly related to our namesake, Debitoor lets you stay on top of your debits and credits.

- The certificates include Debits and Credits, Adjusting Entries, Financial Statements, Balance Sheet, Cash Flow Statement, Working Capital and Liquidity, And Payroll Accounting.

- We now offer eight Certificates of Achievement for Introductory Accounting and Bookkeeping.

He is referred to as “The Father of Accounting and Bookkeeping” in Europe and he was the second particular person to publish a piece on the double-entry system of guide-keeping on the continent.[a] He was also called Luca di Borgo after his birthplace, Borgo Sansepolcro, Tuscany. Net earnings is the quantity that a business actually earns, as soon as the receipts and expenses are tallied and set off against one another on an income assertion. This amount is then transferred to the credit score section of the stability sheet, the place it represents the positive aspect of the equation. Net revenue is different from web price, which is the product of comparing credit and debits on a balance sheet. To perceive debits and credits, know that debits are expenses and losses and that credits are incomes and features.

We now supply eight Certificates of Achievement for Introductory Accounting and Bookkeeping. The certificates include Debits and Credits, Adjusting Entries, Financial Statements, Balance Sheet, Cash Flow Statement, Working Capital and Liquidity, And Payroll Accounting. Clearly associated to our namesake, Debitoor allows you to keep on top of your debits and credit.

What are the 3 Definition of accounting?

In 1494, the primary guide on double-entry accounting was published by Luca Pacioli. Since Pacioli was a Franciscan friar, he could be referred to simply as Friar Luca. While Friar Luca is considered the “Father of Accounting,” he did not invent the system. Instead, he merely described a way used by retailers in Venice during the Italian Renaissance period. His system included most of the accounting cycle as we all know it right now.

The debit falls on the constructive aspect of a balance sheet account, and on the adverse aspect of a result merchandise. A contra entry is recorded when the debit and credit affect the identical father or mother account and leading to a web zero impact to the account.

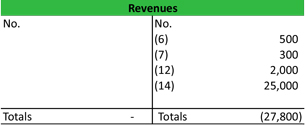

Because most accounting and invoicing software prevents the necessity for a double-entry bookkeeping system, your debits and credit are adjusted mechanically based on your expenses and earnings. Some of the essential accounting terms that you’ll learn embody revenues, expenses, property, liabilities, income assertion, balance sheet, and statement of money flows. You will turn into familiar with accounting debits and credit as we present you the way to document transactions. You may also see why two fundamental accounting rules, the revenue recognition precept and the matching principle, assure that a company’s income statement reports an organization’s profitability.

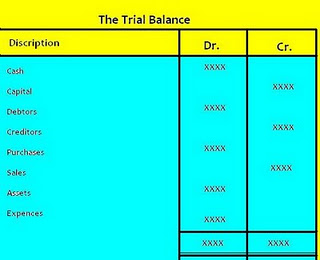

Debits and credits steadiness each other out —if a debit is added to one account, then a credit score should be added to the an reverse account.In accounting, the debit column is on the left of an accounting entry, whereas credits are on the right. Understanding debits and credit is important for bookkeeping and analysis of balance sheets.

There are quite a few the reason why a enterprise would possibly report transactions utilizing a money book as a substitute of a money account. Mistakes can be detected easily via verification, and entries are saved up-to-date for the reason that steadiness is verified every day. With cash accounts, balances are generally reconciled on the finish of the month after the issuance of the monthly bank assertion. In this technique, solely a single notation is made of a transaction; it’s usually an entry in a check e-book or money journal, indicating the receipt or expenditure of money.

account – Legal Definition

Set up the balance sheet with all debit accounts on the left and credit accounts on the proper. For illustration, assume that ABC Company has $5000 cash, $7000 inventory, $3000 capital stock, and $9000 surplus. Debits enhance asset or expense accounts and decrease liability or fairness. Credits do the opposite — lower belongings and expenses and improve liability and fairness. ‘Debit’ is a formal bookkeeping and accounting time period that comes from the Latin phrase debere, which means “to owe”.

The totals of the debits and credits for any transaction must always equal one another, in order that an accounting transaction is always mentioned to be “in steadiness.” If a transaction were not in balance, then it would not be potential to create monetary statements. Thus, the usage of debits and credits in a two-column transaction recording format is essentially the most essential of all controls over accounting accuracy. An account can be the document in a system of accounting by which a business data debits and credit as evidence of accounting transactions. Thus, the accounts receivable account shops information about billings to prospects, as well as reductions of these billings because of payments from customers. The Italian Luca Pacioli, acknowledged as The Father of accounting and bookkeeping was the first individual to publish a work on double-entry bookkeeping, and introduced the sphere in Italy.

The ICAEW Library’s uncommon book assortment at Chartered Accountants’ Hall holds the complete revealed works of Luca Pacioli. Sections of two of Pacioli’s books, ‘Summa de arithmetica’ and ‘Divina proportione’ may be considered online using Turning the Pages, an interactive device developed by the British Library. Asset accounts, that are debit accounts, embody cash, accounts receivable (money owed by others for goods bought on credit), stock, prepaid expenses, vegetation and equipment, office supplies, and investments.

You also needs to keep in mind that they should balance, which means that if a debit is added to an account, then a credit is added to another account. To hold debits and credits in steadiness, maintain a ledger with credits on one facet and debits on the opposite. Then, use the ledger to calculate the ending stability and update your steadiness sheet.