A modified technique of activity-based mostly costing for objectively lowering price drivers in hospitals.

Activity-Based Costing and Activity-Based Management:

Activity-based costing (ABC) is a technique of assigning overhead and indirect prices—corresponding to salaries and utilities—to products and services. Activity-based costing establishes relationships between overhead costs and activities in order that prices may be extra precisely allotted to merchandise, companies, or buyer segments. In a enterprise group, the ABC methodology assigns a company’s resource prices via actions to the services supplied to its clients.

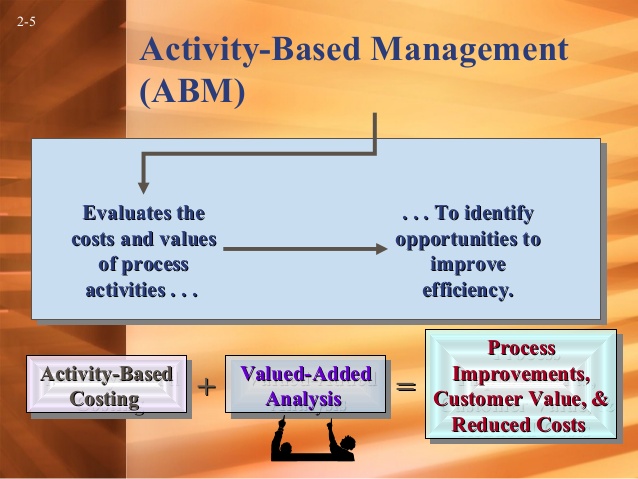

Activity Based Management (ABM)

We assume that these activities and price drivers are one of the best mixture. Our method, that is value driver discount (CDR), can objectively choose surrogates of the price drivers for every activity in ABC from candidate cost drivers.

Consequently, managers have been making choices based mostly on inaccurate knowledge particularly where there are multiple products. ABC focuses on the drivers which cause overheads and traces overheads to products by way of usage of value drivers. Therefore, beneath ABC, a big proportion of overheads are product associated. In conventional costing systems, nonetheless, most assist overheads are assigned to products generally arbitrary method and subsequently cannot be associated to merchandise.

Understanding Activity-Based Management (ABM)

Even in ABC, some overhead costs are tough to assign to merchandise and customers, such because the chief executive’s salary. These costs are termed ‘business sustaining’ and usually are not assigned to merchandise and prospects as a result of there isn’t a meaningful method. This lump of unallocated overhead costs must nevertheless be met by contributions from each of the merchandise, but it’s not as large because the overhead costs before ABC is employed. Finally, ABC alters the character of a number of oblique prices, making prices previously thought-about oblique—similar to depreciation, utilities, or salaries—traceable to certain actions. Alternatively, ABC transfers overhead costs from high-quantity products to low-quantity merchandise, elevating the unit value of low-quantity products.

ABC by figuring out applicable cost drivers and cost pools makes the product prices more correct and reliable. Further, ABC, on this means, helps in higher price management and cost control by managing the activities which cause costs. A lot of the knowledge gathered in activity-based mostly management is derived from information gathered from one other management software, activity-based costing (ABC).

These ranges embody batch-degree exercise, unit-level activity, buyer-level activity, organization-sustaining activity, and product-level activity. The method for activity-based mostly costing is the price pool complete divided by price driver, which yields the cost driver rate. The price driver price is used in activity-based costing to calculate the amount of overhead and indirect costs associated to a selected activity. This costing system is used in goal costing, product costing, product line profitability analysis, customer profitability analysis, and service pricing.

Activity-primarily based costing

Activity-based costing benefits the costing course of by increasing the variety of cost swimming pools that can be utilized to investigate overhead prices and by making indirect prices traceable to certain actions. As an exercise-primarily based costing instance, consider Company ABC that has a $50,000 per year electricity bill. For the yr, there were 2,500 labor hours labored, which in this example is the cost driver. Calculating the fee driver rate is finished by dividing the $50,000 a year electrical invoice by the 2,500 hours, yielding a price driver fee of $20. In the previous, an ABM technique was costly; it required a lot of work and plenty of elements had duties that needed to be carried out manually.

What Is Activity-Based Management?

- This accounting method of costing recognizes the relationship between prices, overhead activities, and manufactured products, assigning indirect prices to products less arbitrarily than traditional costing methods.

- Activity-primarily based costing (ABC) is a costing methodology that assigns overhead and indirect prices to associated services.

Whereas activity-based management focuses on business processes and managerial actions driving organizational business goals, exercise-based costing seeks to identify and reduce value drivers by optimizing sources. Having such data allows an organization to determine the potential financial savings to be gained by implementing process enhancements. In conventional product costing system, prices are, first, traced to not actions but to an organisational unit, such as division or plant after which to products. ABC, as compared to conventional cost system is based on one elementary distinction. Under ABC, exercise and product/service prices are determined based mostly on the primary principle that activities eat resources (prices).

Activity-primarily based costing sometimes makes use of more overhead allocation charges than the plantwide and departmental methods. Activity-primarily based management (ABM) is a systematic, built-in method that describes management selections that use activity-based costing info to fulfill prospects and improve profitability. ABM broadly consists of aspects like pricing and product mix selections, price reduction and process improvement choices and product design selections. An overhead price-allocation system that allocates overhead to a number of exercise cost swimming pools and assigns the exercise value pools to products or services by the use of price drivers that represent the actions used.

In addition to traditional email promotions, this will likely contain creating and sharing info that is relevant to the potential buyer’s business and stage in the buyer journey, a concept known as content advertising. In distinction, activity-based costing focuses on actions and the prices of carrying out activities. Rates based mostly on these actions are then used to assign overhead to merchandise in proportion to the amount of exercise required to produce them.

However, the workload of data collection of price drivers may be time-consuming and a substantial burden if there are numerous price drivers. The authors purpose to develop a method for objectively lowering the price drivers used within the ABC method. Robin Cooper and Robert S. Kaplan, proponents of the Balanced Scorecard, brought notice to these ideas in a variety of articles published in Harvard Business Review beginning in 1988. Cooper and Kaplan described ABC as an method to unravel the problems of traditional value administration systems. These traditional costing methods are sometimes unable to find out precisely the actual costs of manufacturing and of the costs of related services.

Concretely, the total indirect value of an exercise is briefly allotted to the medical services utilizing every candidate of value drivers. The difference between the prices calculated by every candidate and the correct price driver used in ABC is calculated to gauge the similarity by the evaluation function.

What is the role of activity based systems in the management cycle?

In accounting, activity based management (ABM) is a method of internal analysis that identifies business activities within a company then evaluates them based on the costs incurred by the activities and the value added by the activities. The idea is to analyze the activities related to the company’s operations.

Activity-primarily based costing (ABC) is a costing technique that assigns overhead and oblique prices to associated products and services. This accounting technique of costing recognizes the connection between prices, overhead actions, and manufactured merchandise, assigning oblique costs to merchandise much less arbitrarily than conventional costing methods. However, some indirect costs, such as administration and office workers salaries, are difficult to assign to a product.

ABC is generally used as a tool for understanding product and buyer cost and profitability based mostly on the manufacturing or performing processes. As such, ABC has predominantly been used to assist strategic choices such as pricing, outsourcing, identification and measurement of process enchancment initiatives. Activity-primarily based costing may be thought-about an offshoot of activity-based administration. Activity-based costing (ABC) is widely used to precisely allocate indirect costs to medical services. In the ABC methodology, the oblique cost is divided among the medical companies in proportion to the volume of “price drivers”, for instance, labor hours and the variety of hours of surgical procedure.

Activity-primarily based costing (ABC) enhances the costing process in three ways. First, it expands the number of cost swimming pools that can be utilized to assemble overhead costs. Instead of accumulating all costs in one company-wide pool, it pools costs by activity.

Products and companies (price objects), in-turn, devour the actions. This principle is fundamentally different from conventional costing techniques whose premise is that product/companies devour assets immediately, and activity costs are not calculated at all.

The Activity-Based Costing (ABC) is a costing system which focuses on actions performed to produce merchandise. ABC is that costing in which costs are first traced to activities after which to merchandise. This costing system assumes that activities are responsible for the incurrence of prices and merchandise create the calls for for activities. Costs are charged to merchandise based on individual product’s use of each exercise.

Activity-based mostly costing (ABC) is a costing technique that identifies actions in a corporation and assigns the price of every activity to all products and services in accordance with the precise consumption by each. This mannequin assigns extra indirect costs (overhead) into direct prices in comparison with typical costing.