Is being an enrolled agent worth it?

Individuals who are considering a new career path may find that becoming an enrolled agent is the right choice. Offering excellent job security and the opportunity to have jurisdiction throughout the United States, the position of enrolled agent can provide a good salary along with a rewarding career.There are three salary levels for enrolled agents. They are entry level, mid-level, and senior level. An enrolled agent is responsible for representing individuals to the Internal Revenue Service. Since an enrolled agent has a number of responsibilities, the salary tends to be fairly lucrative. We believe everybody should be able to make online purchases with confidence. After many years, the roles changed to monetary relief claims, especially for citizens who had unfair taxes charged on their income tax. The evolution continued because of income tax, gift tax, estate tax, progressive tax and other tax collections.In fact, enrolled agent status is the highest credential awarded by the IRS. On the other hand, certified public accountants are licensed by their applicable state boards of accountancy. Once your business is formed, Gaddis says an enrolled agent can help explain to you what business expenses are deductible from your taxes. They can also prepare and file your business and payroll tax returns. An enrolled agent is especially helpful if you’re filing returns in more than one state, as enrolled agents can operate across state lines. Note that a CPA can also prepare your business tax returns, but only in the state in which they are licensed.

Certification By The Irs

You may also wish to search the internet for commercially available materials and preparation courses in preparing to take the SEE. The IRS has a list of approved CE Providers, some of whom provide SEE test preparation courses. The IRS does not make recommendations as to any specific provider.

Additionally, enrolled agents must possess a thorough understanding of IRS documentation, as the documentation must be filed with the IRS. For this reason, an enrolled agent must also be well organized and capable of meeting reporting and filing deadlines.

Scoring The Enrolled Agent Exam

If you do not currently meet this requirement, simply create an account on the IRS website and fill out an online application. Students can take all parts together or sit for each section separately. They can make four attempts during each exam window. Once they pass a section, they can take up to two years to complete the remainder of the exam. There is a $182.00 fee per part paid at the time of appointment scheduling.He has written hundreds of articles covering topics including filing taxes, solving tax issues, tax credits and deductions, tax planning, and taxable income. He previously worked for the IRS and holds an enrolled agent certification. Enrolled agents must demonstrate to the IRS their expertise in all areas of taxation in order to be awarded the credential. If they do, they are granted unlimited representation rights to represent taxpayers before the IRS.Most personal state programs available in January; release dates vary by state. A tax professional can also qualify as an EA if they’ve worked for the IRS for at least five years in a position that requires extensive knowledge of the tax code and its applications. Once you’ve passed all three parts of the Enrolled Agent Exam, you can apply for enrollment to practice before the IRS by filling out Form 23. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty.

Can IRS visit your home?

IRS revenue officers will sometimes make unannounced visits to a taxpayer’s home or place of business to discuss taxes owed or tax returns due. … IRS criminal investigators may visit a taxpayer’s home or place of business unannounced while conducting an investigation.NATP membership includes access to the EA Exam Review – Part 1. Personalize the pace and direction of your EA exam preparation with Gleim’s review materials. This course includes digital books, test bank of questions and a realistic practice environment. The IRS, along with a board of enrolled agents, determined that 105 constitutes a passing score. Remember, Prometric scales the score according to IRS guidelines. Enrolled Agents may not provide an opinion on a financial statement like a CPA, so if your practice is both assurance and tax, you will need your CPA license for any state where you do assurance work. If an individual wants to become an enrolled agent, there are several requirements that must be met in order to gain that title.If H&R Block makes an error on your return, we’ll pay resulting penalties and interest. One state program can be downloaded at no additional cost from within the program. Emerald Cash RewardsTMare credited on a monthly basis.Tax returns may be e-filed without applying for this loan. Fees for other optional products or product features may apply.

Steps To Become An Enrolled Agent

An enrolled agent is a federally authorized tax specialist that operates to provide advisory services to American taxpayers about matters concerning the Internal Revenue Service . Achieving “EA” status is considered the highest credential awarded by the IRS and is legally recognized throughout all 50 U.S states. You can figure out whether someone is a certified enrolled agent, or find enrolled agents in your zip code, using this handy IRS directory of certified tax return preparers. However, your tax return may be fairly straightforward and you might just want some reassurance that you’re calculating everything correctly. In that case, you may be better off looking into an online filing service instead.The CTP® curriculum includes most topics on the EA exam and CTP® graduates are well prepared to pass the EA Exam after completing a Surgent EA Exam Review, also available through The Income Tax School. Attorneys, CPAs, and EAs will continue to have unlimited representation rights and can represent clients before any office of the IRS. If any of the following circumstances apply to you, an enrolled agent is one type of tax professional that can provide needed relief. Tax laws and the regulations issued by the IRS can be overwhelming. An enrolled agent can assist the taxpayer with understanding the inner workings of the law and know the best strategy to deal with the unique circumstances for their tax-related issues.The cost to test out of the Comprehensive Tax Course is $100. The Enrolled Agent credential is nationally recognized, as they are federally authorized by the IRS to practice in any state. Interestingly, CPAs have to be licensed separately in each state they wish to practice in. Income tax is a tax that is imposed by governments on individuals and businesses with respect to income or profits earned by them. We’ll do one month of your bookkeeping and prepare a set of financial statements for you to keep. We’re an online bookkeeping service powered by real humans. Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts.

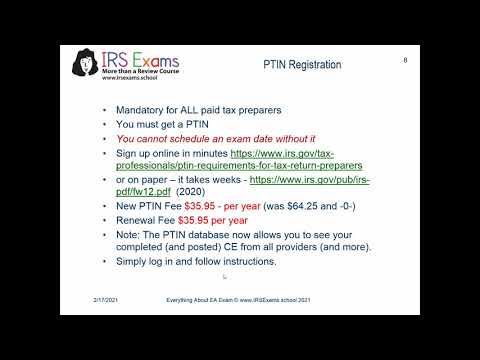

This guide also explains how to become an enrolled agent and prepare for the enrolled agent exam. If you think earning an EA certification would suit you, read on to learn everything you need to know about the process. This is a great benefit for accountants approaching retirement and want the flexibility of travel. As a PTIN holder, you will continue to have limited representation rights before limited offices of the IRS with respect to clients whose returns you prepare and sign until December 31, 2015. Individuals with EA designations are required to earn 72 CPE hours every three years, use an IRS-approved continuing education provider, and review the enrolled agent CPE credit chart.

Ea Vs Cpa: Whats The Difference?

Enrolled agents hold federal licensure, which gives them a much broader jurisdiction. This means that enrolled agents are able to represent what is an enrolled agent taxpayers in any state in the country. Furthermore, enrolled agents are able to represent citizens abroad in tax matters.In order to become an enrolled agent, you must either take the Special Enrollment Exam , also known as the enrolled agent exam, or have previous work experience at the IRS. While passing the exam is much easier once you’ve acquired several years of tax experience, there is no prerequisite for taking the EA exam. Therefore, you could sit for it during college if you wanted. You just need a Personal Tax Identification Number to schedule the exam. Enrolled agents are specifically authorized to represent taxpayers before the IRS at all administrative levels, up to but not including Tax Court.

Candidates who have a sufficient amount of work experience, according to IRS guidelines, may not even be required to take the exam. The Internal Revenue Service, in an effort to satisfy legal requirements, confers the status of enrolled agent to qualified candidates. An individual who has been certified as an enrolled agent is then allowed to serve as an intermediary for private businesses and citizens in relation to tax questions and disputes. Enrolled agents are typically employed by businesses specializing in handling income tax resolutions or preparing tax returns. There have been additional duties to the new role of an enrolled agent. Some of them include preparation of multiple returns and filling of forms.

Benefits Of Being An Enrolled Agent

An enrolled agent is a federally licensed tax practitioner who has unlimited rights to represent taxpayers before the IRS for any issues relating to collections, audits, or tax appeals. An enrolled agent is commonly known as “EA”; they possess unlimited rights to practice and have the highest IRS awards. That should be the simplest enrolled agent definition since they are also personal and business tax experts. An enrolled agent could have the same roles as the certified public accountants and tax attorneys. When you need to find an enrolled agent, bear in mind that they can represent you before any Internal Revenue Services and not at Tax Court. Typically the enrolled agent acts as a legal representative for the taxpayer in issues that relate to IRS tax matters. The enrolled agent must pass the three parts of the Special Enrollment Exam which certifies that the agent has proven competence in the areas of tax law.

- They are entry level, mid-level, and senior level.

- This course includes digital books, test bank of questions and a realistic practice environment.

- This article has been reviewed by tax expert Erica Gellerman, CPA.

- EAs could help you work through an IRS audit or a collection problem, and they can also perform bookkeeping services that could be useful for businesses when preparing tax returns.

- This privilege allows confidentiality between the taxpayer and the enrolled agent under certain conditions.

- Candidates who have trouble passing REG can shift their focus to passing the EA exam and earning the EA designation.

Most taxpayers do not have the time or the research tools to read the volumes of material that are added to or deleted from the tax code each year. Still, when we compare REG’s taxation section to the EA exam’s taxation section, we uncover quite a lot of overlap. In fact, the amount of shared content can help candidates earn both certifications at the same time. Candidates who have trouble passing REG can shift their focus to passing the EA exam and earning the EA designation.And because tax attorney fees can often climb well into the four figures, both CPAs and EAs are also an affordable alternative for those who need helpfiguring out tax obligations. Be sure that if you choose to consult with either type of professional that you have a solid handle on your finances and measure your expectations.

What Is A Certified Public Accountant Cpa?

CSEA would like to help make tax season be as painless as possible. Here are some tools and resources to help you during tax time. When you make the choice to become an EA, you’re demonstrating a commitment to excellence, as well as special tax competence that supports and services all your clients’ needs.Enrolled Agents represent taxpayers before the Internal Revenue Service for tax issues that include audits, collections and appeals. Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials.