As the name implies, a single-step income statement uses a single calculation to determine a company’s net income. The income statement is one of three key financial statements used by all companies, from small businesses to large corporations. A basic income statement along with your cash flow statement and balance sheet gives you a complete insight into your company’s financial position. Used by businesses that sell tangible goods or have more than one line of business, the multistep income statement, as its name implies, uses multiple steps instead of one. With this type of income statement, the operating revenue and operating expenses are separated from the nonoperating revenue and nonoperating costs, losses and gains. In addition to good faith differences in interpretations and reporting of financial data in income statements, these financial statements can be limited by intentional misrepresentation. One of the limitations of the income statement is that income is reported based on accounting rules and often does not reflect cash changing hands.

In this article, you’ll learn all about multi-step income statements and how to make a comprehensive one for your financial reporting. On the other hand, if small businesses are taking loans and attracting new investments, it is recommended to opt for a multi-step income statement. A third type of income statement is called a “comprehensive income statement” reports on certain gains and losses that are not included in the business’s net income. The type of income statement you choose depends on the level of financial detail you are looking for, and the type of business you operate. Multiple-Step statements provide an in-depth look at a company’s financial health, offering details about the company’s wellbeing. Thanks to cloud-based software, the days of jotting down your revenue and expenses in a physical ledger are over. These days, there areaffordable, cloud-based accounting servicesfor every size business.

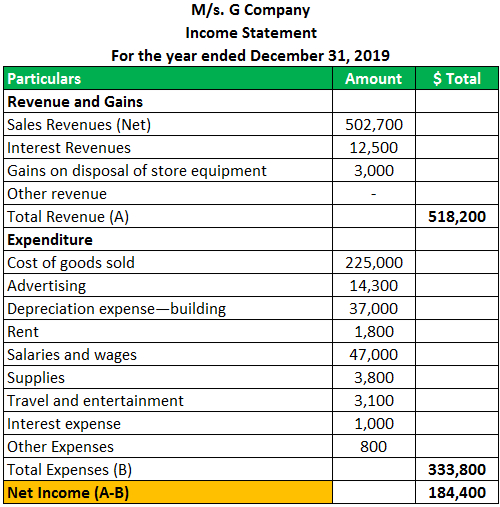

Merchandising companies prepare financial statements at the end of a period that include the income statement, balance sheet, statement of cash flows, and statement of retained earnings. The presentation format for many of these statements is left up to the business. For the income statement, this means a company could prepare the statement using a multi-step format or a simple format (also known as a single-step format). Calculation Of Operating IncomeThe operating income formula is a profitability formula that helps in calculating a company’s profits generated from core operations. The formula is a decision tool that allows investors to assess how much gross income will result in profit for a firm. The operating income can be calculated by deducting the cost of goods sold and operating expenses from total revenue. The purpose of an income statement is to provide users with information about a business’s profitability over a specific reporting period.

How To Report Product Sales Revenue & Service Revenue On An Income Statement

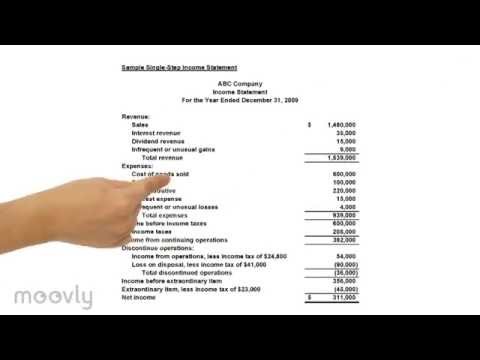

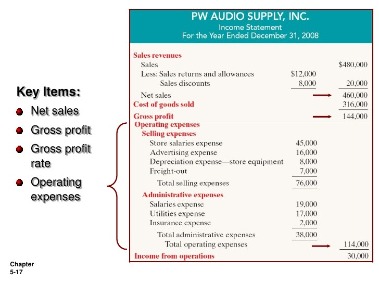

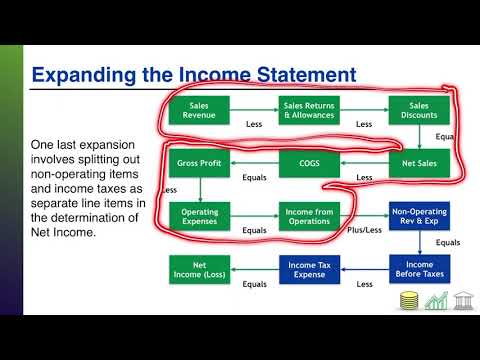

Deducting the operating expenses from gross margin produces income from operations. The income statement consists of revenues and expenses along with the resulting net income or loss over a period of time due to earning activities. The income statement shows investors and management if the firm made money during the period reported. The Single Step income statement takes a simpler approach, totaling revenues and subtracting expenses to find the bottom line. The more complex Multi-Step income statement takes several steps to find the bottom line, starting with the gross profit. It then calculates operating expenses and, when deducted from the gross profit, yields income from operations. Adding to income from operations is the difference of other revenues and other expenses.

Why is multistep income statement better?

The biggest advantage of using a multi-step income statement is that it shows operating and non-operating income as separate entities. This reduces the financial clutter and highlights the most important of company financials—the operational portion.

One of the reasons this may be happening is that according to the tax code, companies are supposed to use the accelerated depreciation method to determine their taxable profit. Seeing that they are small businesses, the release of their financial statements is not regulated by the law, but it is still advised to prepare and release financial statements quarterly. The time it takes to prepare the statement is considered one of its major disadvantages. Sometimes, it may also be considered the more confusing of the two statements. However, the benefits of completing a multi-step income statement usually outweigh the few drawbacks. In order to prepare a multi-step income statement, you will need to decide if you are tracking your expenses for a monthly, quarterly, or yearly period. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes.

Forecast Future Profitability

To do so, add together your operating income and your non-operating items. This type of income statement is simple to understand and easy to prepare, which is why it’s commonly used by small businesses and sole proprietors that don’t have several different sales lines. Companies that sell goods and services may opt to use the multistep income statement. There are several types of income statements you can employ to stay on top of profit and losses, with varying degrees of complexity. For small business owners, the single-step income statement and the multistep income statement are the most popular. “If it shows you’re not making enough margin to cover the rest of your expenses, you may have to increase prices or try to find a way to decrease cost of sales,” Freedman said.

On the other hand, some investors may find single-step income statements to be too thin on information. The absence of gross margin and operating margin data can make it difficult to determine the source of most expenses and can make it harder to project whether a company will sustain profitability. Without this data, investors may be less likely to invest in a company, causing businesses to miss out on opportunities to acquire operating capital. The income statement is designed to inform creditors, investors, lenders. “The income statement reflects the income earned and expenses paid net of either profit or loss for a period,” Mitchell Freedman, a certified public accountant atMFAC Financial Advisors, told business.com.

Compared to the balance sheet and the cash flow statement, the income statement is primarily focused on the actual operational efficiency of the organization. The balance sheet discusses leverage, assets, funding, and other aspects of the organization’s existing infrastructure. The income statement, however, is ultimately about how a given revenue input can be converted to profitability through assessing what is required to attain that revenue. The income statement is a financial statement that is used to help determine the past financial performance of the enterprise, predict future performance, and assess the capability of generating future cash flows. It is also known as the profit and loss statement (P&L), statement of operations, or statement of earnings.

Financial Ratios

Investors, creditors, and other stakeholders of interest monitor the gross margin to analyze how efficient a company’s operations are. For an expense or income to be called a non-operating activity, it should be an extraordinary item that is not part of the company’s operations. Examples of a non-operating income include gain from the sale of an asset, gain incurred in foreign exchange dealings, dividend income and profit from investments.

GAAP reporting also suggests that income statements should present financial figures that are objective, material, consistent, and conservative. Although most of the information on a company’s income tax return comes from the income statement, there often is a difference between pretax income and taxable income. These differences are due to the recording requirements of GAAP for financial accounting and the requirements of the IRS’s tax regulations for tax accounting . Noncash items, such as depreciation and amortization, will affect differences between the income statement and cash flow statement. Revenue consists of cash inflows or other enhancements of the assets of an entity.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Any mistake could cause investors to make errant assumptions about the company, which could negatively impact the business.

What Format Of Sci Is Appropriate To Use In Presenting The Income?

For instance, management might shift expenses out of cost of goods sold and into operations to artificially improve their margins. It’s always important to view comparative financial statements over time, so you can see trends and possibly catch misleading placement of expenses. The second calculation subtracts the company’s operating expenses, such as office supplies and advertising costs, to arrive at the operating income.

- For example, if a restaurant’s primary income stream comes from selling food to guests, the owner can see if food sales are being sold resource efficiently without showing non-operational data.

- The multi-step income statement breaks down operating revenues and operating expenses versus non-operating revenues and non-operating expenses.

- Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes.

- Both selling and administrative expense are added together for computing total operating expenses.

- He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer.

Using software allows you to automatically track and organize your business’s accounting data so you can easily access and review income statements. Ultimately, income statements keep track of everything going in and out and can act as a guide for business decisions—big or small. While single-step income statements are the simplest and most commonly used for small businesses, multi-step income statements are great for small businesses with several income streams. When deciding how you’d like to report your net income, it’s important to consider the pros and cons of both the single-step and multi-step income statements. A single-step income statement treats the cost of goods sold as expenses.

Both the Single step income statement and Multi step income statement are two viable methods used by most companies in preparing their income statement. Hence, to know the difference between the two, we have to first define the Multi-step income statement. An income statement can be defined as a financial document which a company prepares that describes single step vs multi step income statement its business and financial activities over a certain period. Given its higher level of information content, the multi-step format is usually preferred over the single step format (which does not incorporate sub-totals and so can be more difficult to read). Reporting in periods like monthly, quarterly or annual is common practice for businesses.

Why Are Income Statements Important For Small Businesses?

The third section is the non-operating head, which lists all business incomes and expenses that are not related to the principal activities of the business. An example of a non-operating expense is a lawsuit claim paid by the company as compensation to an aggrieved party after losing in a court case. Also, a non-operating income can be an insurance compensation paid by an insurance firm to the company’s account as settlement proceeds for damage or loss of a company’s asset. It may not give enough information to the investors, such as the gross profit, operating income, and more.

Are multiple-step income statements required by the FASB?

Multiple-step income statements: Are required by the FASB and IASB. Correct Contain more detail than a simple listing of revenues and expenses. … List cost of goods sold as an operating expense.

An income statement, also known as a profit and loss statement is required of every business when running their accounts. Most will opt for a single-step income statement, but you may also want to consider a multi-step income statement for greater clarity. Operating head covers revenues and expenses that directly relate to the primary activities of the business. It lists items in different categories to make it convenient for users of the income statement to better understand the core operations of the business. Finally, by adding or subtracting the total of the company’s non-operating items, we can arrive at the net income, which represents the actual amount of money a company made during the time period. Also, if a company plans to go for a debt or get new investors, then a multi-step income statement is the right option. This is because it would give stakeholders a true idea of the financial health of the business.

Single Step Income Statement Format

The single-step income statement is the format used to prepare an income statement where revenues, expenses, and net income are presented into a single subtotal. For example, in the revenue section, it records all types of revenues no mater those revenues are from the operation or non-operation. Income statements are among the most important financial statements small business owners should maintain. But if you make a lot of mistakes, it could paint an inaccurate picture of how your business is performing – which is why it’s important to follow these three best practices when creating your income statement. The income statement is one of three financial statements that are important to businesses of all sizes. The other two, thebalance sheetand shareholder equity, go hand in hand with the income statement. In each period, long-term noncash assets accrue a depreciation expense that appears on the income statement.

In essence, if an activity is not a part of making or selling the products or services, but still affects the income of the business, it is a non-operating revenue or expense. Analyzing the income statement can provide insights into the profitability of a company, as well as the potential for future growth. Often smaller companies will choose to use a single-step income statement due to its ease and simplicity. However, for larger public organizations a multi-step format is the most desirable due to it being more comprehensive and the fact that they are under greater scrutiny from regulator and auditors to do so as well. Hence, using multi-step income statements becomes the better alternative.