What Is the Purpose of Budgeting?

The usefulness of budgeting is determined by accuracy of accessible information. The budgeting process helps to type the pro forma financial statements. By growing these forecasted financial statements, a business can observe its revenue margins.

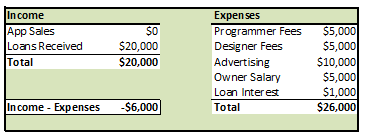

The major parts of a master price range include income and expenses, overhead and production prices, and the month-to-month, annual, average and projection totals. A grasp finances is an mixture of an organization’s particular person budgets designed to current a complete image of its monetary exercise and well being. Master budgets are sometimes used in bigger corporations to keep all individual managers aligned.

A master finances is used to challenge the earnings and expenses of an organization. From the master budget, a small-business proprietor can develop quite a lot of stories to assist set specific objectives for the enterprise.

By precisely outlining the expenditures, the budgeting process helps to manage the spending. Without a price range, a business will never have the ability to hold observe of its expenditures and may finally face considerable loss. However, a budget offers them with vivid expectations through which they will all the time predict which way the business is headed. A price range is a monetary plan for a defined period, usually one year.

Budgeting is finished so as to keep monitor of the expenditures and revenue. It serves as a monitoring and controlling method to be able to manage the funds of a enterprise. It begins by deciding upon the monetary targets according to which the finances might be made. Other important activities in the budgeting course of include things similar to forecasting, monitoring, controlling and evaluating the financial targets.

It can also embody planned sales volumes and revenues, resource portions, costs and expenses, assets, liabilities and money flows. Companies, governments, households and other organizations use it to express strategic plans of activities or occasions in measurable phrases. Therefore, finances may look like an added hassle but is an essential and core aspect of a enterprise. It is thru setting oneself a finances that the profit, income and savings may be categorically understood, saved and deliberate forward. With a thorough and goal based price range, every business becomes higher outfitted to investigate the place the cash comes from and in addition maintain the document of where it goes.

What is a budget easy definition?

budget. A budget is defined as a plan or estimate of the amount of money needed for cost of living or to be used for a specific purpose. An example of budget is how much a family spends on all expenses in a month. An example of budget is how much a person plans on spending on a new bed.

What Does Budget Mean?

An working budget is a forecast and analysis of projected revenue and bills over the course of a specified time period. Operating budgets are typically created on a weekly, monthly, or yearly foundation. A supervisor might evaluate these reviews month after month to see if a company is overspending on provides.

This will determine whether or not it’s worthwhile to run the business operations in future. If the business just isn’t producing revenue, the business may have sufficient time to adjust its income and prices beforehand.

What Is the Purpose of a Budget?

Profit technology is an important factor as a result of which a enterprise is working. Without producing revenue, a business cannot hope to survive for long in the future.

What about Budget Forecasting and Planning?

It permits a enterprise owner or manager to find out whether or not the enterprise lives as much as expectations through variations between budgeted and precise expenditure. A specific budget provides info on how a lot a enterprise can spend every month. Moreover, it lets a enterprise owner understand how much profit to make to meet all bills.

What are the three types of government budgets?

- An operating budget is a forecast and analysis of projected earnings and expenses over the course of a specified time period.

- Operating budgets are typically created on a weekly, month-to-month, or yearly basis.

Creating a budget helps cut back the danger of sudden losses as a result of statistics can assist a business by predicting upcoming developments. Above all, it essentially allows them to have the ability to provide you with newer schemes and methods to induce a larger profit for the long run. By properly and diligently following steps to understanding the set goals, people can discover ways to work efficiently along the passage of time. It also helps them gain expertise in their spending and allows them the margin to know what’s saved and what overspent. Thus, it can be concluded that a price range is a highly useful gizmo when a enterprise struggles with spending too much and receiving too little.

An example of how budgeting performs a job in determination making is when spending money on advertising. When the finances allocated for this aspect has been fully used, the decision is prone to stop spending cash on it. Budgeting additionally helps measure the forecast business performance against the precise enterprise efficiency.

It helps the enterprise to avail the alternatives essential for business growth. Any capital expenditure plans must be taken prematurely, and they should be included within the budgeting course of accordingly. In order to take care of the morale of the workers, bonuses are incessantly given to out motivated staff.

In the top-down budgeting course of, the primary enter is made by the highest-stage executives of the business. The echelon of a sure organizational hierarchy lays down all the rules according to which price range might be made. They outline the monetary objectives that a budget ought to maintain. Moreover, tips associated to gross sales price range, compensation, and so on. are all given by the highest administration. The lower degree administration is given the least quantity of participation within the budgeting course of.

Personal instruments

A enterprise owner has to foretell whether the corporate might be worthwhile. Budgeting offers a model of the potential financial performance of a enterprise, on condition that specific methods and plans are adopted. It offers a monetary framework for making important decisions. To handle a business effectively, expenditure have to be correctly managed.

What is mean by budgeting?

Definition: A budget is a formal statement of estimated income and expenses based on future plans and objectives. In other words, a budget is a document that management makes to estimate the revenues and expenses for an upcoming period based on their goals for the business.

A budget makes sure that each one the money is being spent in the best direction and monetary goals are attained. Some of the essential elements of the budgeting process are discussed as follows. Cash circulate/money finances – a prediction of future cash receipts and expenditures for a particular time interval. The money circulate price range helps the enterprise to find out when earnings shall be adequate to cowl expenses and when the corporate might want to search outdoors financing.

Without a correct price range, a business can by no means maintain monitor of how much it has earned and the way a lot it has spent. Budget serves a fantastic guide by which a enterprise can oversee its earnings stream and can determine potential dangers to it beforehand. Furthermore, budget acts as a useful device to be able to take management of how a business spends.

Budgeting all month-to-month expenditures can help change your mindset towards cash. Instead of spending impulsively, you possibly can learn to worth cash as a software to achieve goals and fulfill wants. And getting your kids concerned within the budgeting course of early on can help them study the value of cash, since they’re involved in some of the choices needed to determine the price range. Budgeting is a process whereby future earnings and expenditure are determined in order to streamline the expenditure course of.