What is the period of a zero coupon bond?

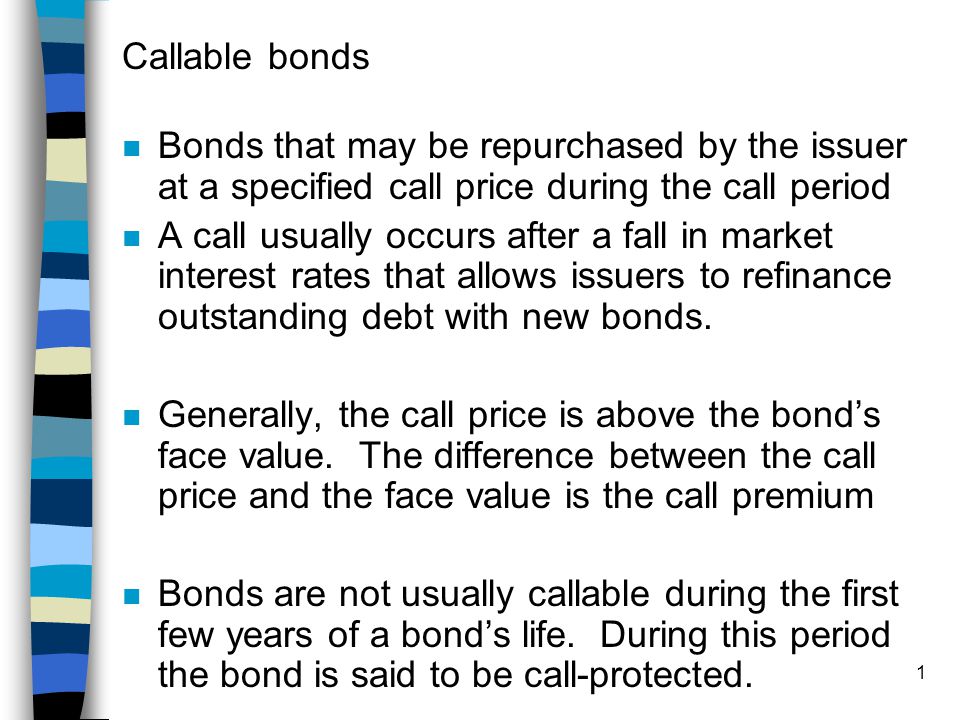

Callable Bonds vs. Interest Rates

Despite the higher price to issuers and increased risk to traders, these bonds may be very engaging to both celebration. Investors like them because they provide a better-than-regular price of return, no less than until the bonds are referred to as away. Conversely, callable bonds are engaging to issuers as a result of they permit them to cut back interest prices at a future date ought to rates lower. Moreover, they serve an necessary objective to monetary markets by creating alternatives for corporations and individuals to act upon their curiosity-rate expectations.

In addition to reinvestment-rate risk, traders should additionally perceive that market costs for callable bonds behave differently than regular bonds. Typically as rates decrease, you will see bond costs increase, but this isn’t the case for callable bonds. This phenomenon known as worth compression and is an integral aspect of how callable bonds behave.

Bonds vs. Banks

Overall, callable bonds additionally come with one massive advantage for buyers. They are much less in demand as a result of lack of a assure of receiving interest payments for the total term, so issuers should pay larger rates of interest to steer people to spend money on them. Normally, when an investor wants a bond at a higher interest rate, they must pay a bond premium, meaning that they pay greater than the face value for the bond. With a callable bond, however, the investor can obtain higher curiosity payments with no bond premium. Callable bonds do not at all times get known as; lots of them pay curiosity for the complete term, and the investor reaps the benefits of higher curiosity for the whole period.

The bond’s providing will specify the phrases of when the company could recall the notice. Although the prospects of a higher coupon ratemay make callable bonds extra attractive, call provisions can come as a shock. Even though the issuer would possibly pay you a bonus when the bond is known as, you could nonetheless end up losing cash. Plus, you may not be able to reinvest the money at an identical rate of return, which may disrupt your portfolio. Callable bonds are generally riskier for investors than non-callable bonds for these causes.

Call provisions are sometimes a feature of corporate and municipal bonds. There is not any free lunch, and the upper curiosity payments obtained for a callable bond include the price of reinvestment-fee risk and diminished price-appreciation potential. However, these dangers are related to decreases in interest rates and make callable bonds considered one of many tools for buyers to specific their tactical views on financial markets. (For further reading on investment diversification practices, try Achieving Optimal Asset Allocation).

What Is a Callable Bond?

The investor may select to reinvest at a lower interest rate and lose potential earnings. Also, if the investor desires to purchase one other bond, the brand new bond’s worth might be larger than the value of the original callable.

In other words, the investor may pay a higher worth for a decrease yield. As a outcome, a callable bond is probably not appropriate for traders looking for steady earnings and predictable returns. A callable bond is a debt instrument during which the issuer reserves the best to return the investor’s principal and cease curiosity payments earlier than the bond’smaturity date. Corporations may problem bonds to fund expansion or to repay other loans. If they anticipate market rates of interest to fall, they may concern the bond as callable, allowing them to make an early redemption and safe other financings at a lowered rate.

To compensate for such dangers, callable bonds sometimes pay a better yield than non-callable bonds of the same maturity and credit quality. However, since a callable bond can be called away, these future curiosity payments are unsure.

Typically, the interest rate is fixed for the whole term. A call feature permits the bond issuer to repay the debt previous to the end of the time period. When the call feature is activated, bondholders obtain a return of premium as well as any curiosity that has accrued. Investors often demand greater-than-average yields on callable bonds; the extra curiosity offsets some of the danger associated with misplaced income if the bond is known as in.

A callable bond, also called a redeemable bond, is a bond that the issuer could redeem earlier than it reaches the acknowledged maturity date. A callable bond permits the issuing firm to pay off their debt early. A business could choose to call their bond if market interest rates transfer in a favorable direction and can enable them to borrow at a extra helpful rate. Callable bonds also profit traders as they usually provide a gorgeous interest rate or coupon fee due to their callable nature. An issuer could select to name a bond when current rates of interest drop beneath the rate of interest on the bond.

- Cities and firms problem bonds with phrases starting from six months to 30 years.

- The bond issuer pays interest to the bondholders for the duration of the bond’s time period.

- Bonds are loan agreements involving creditors and borrowers.

When Convertible Bonds Become Stock

Callable or redeemable bonds are bonds that can be redeemed or paid off by the issuer prior to the bonds’ maturity date. When an issuer calls its bonds, it pays buyers the decision value (normally the face value of the bonds) along with accrued interest so far and, at that time, stops making interest funds.

Credit ranking businesses often review the finances of bond issuers, together with firms and municipalities. Over the course of time, an entity can enhance its credit standing by balancing its books and making debt payments on time. The higher an entity’s credit rating, the extra cheaply and simply it can borrow money. Therefore, many start-up corporations concern callable bonds so that these money owed could be refinanced with decrease-price bonds once the firm has improved its credit standing.

Issuers entice investors to purchase callable bonds by paying greater rates of interest on callable bonds than on noncallable bonds. But the value of a callable bond will not rise much above its call worth, regardless of how low interest rates go, because dropping rates of interest improve the chance that it is going to be called. Zero coupon bonds have a period equal to the bond’s time to maturity, which makes them sensitive to any modifications within the rates of interest. Investment banks or dealers might separate coupons from the principal of coupon bonds, which is known as the residue, so that different buyers might obtain the principal and each of the coupon payments.

Start-up companies have a excessive failure fee compared with larger, nicely-established companies. Consequently, small companies usually have to pay higher rates on loans and bonds than extra established corporations.

How To Invest In Corporate Bonds

That way the issuer can save money by paying off the bond and issuing one other bond at a lower interest rate. This is just like refinancing the mortgage on your house so you may make decrease month-to-month funds. Callable bonds are extra dangerous for buyers than non-callable bonds because an investor whose bond has been referred to as is often confronted with reinvesting the cash at a lower, less engaging fee. As a outcome, callable bonds typically have a better annual return to compensate for the danger that the bonds could be referred to as early. Investors in callable bonds want to trace two yields—in contrast to a standard bond with just one yield.

Callable bonds have a yield to name and ayield to maturity. The yield to name is the quantity the bond will yield earlier than it has the potential of being known as. Yield to maturity considers the time worth of cash, whereas a simple yield calculation doesn’t.

How does a callable bond work?

A callable bond is a debt instrument in which the issuer reserves the right to return the investor’s principal and stop interest payments before the bond’s maturity date. Corporations may issue bonds to fund expansion or to pay off other loans.

Here’s What Happens When a Bond Is Called

Bonds are mortgage agreements involving creditors and borrowers. Cities and firms problem bonds with phrases starting from six months to 30 years. The bond issuer pays curiosity to the bondholders during the bond’s time period.

Callable bonds sometimes pay the next coupon or rate of interest to investors than non-callable bonds. Should the market rate of interest fall decrease than the rate being paid to the bondholders, the business might name the note. They might then, refinance the debt at a decrease rate of interest. This flexibility is often extra favorable for the business than using financial institution-based mostly lending. In this situation, not only does the bondholder lose the remaining interest payments but it might be unlikely they may be capable of match the unique 6% coupon.