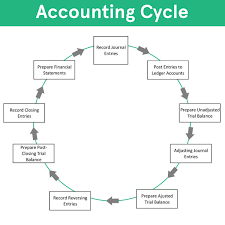

The accounting cycle refers to a cyclical and systematic workflow followed by bookkeepers. The processes involved in the cycle are essential to comprehensively record, identify, and synthesize a business’ financial transactions. This came to be every bookkeeper’s guide religiously practiced and observed throughout the year to prevent record errors. In line, its purpose is invaluable as it formally keeps financial statements and other details accurate.

8 Steps of the Accounting Cycle

The accounting cycle depends on what system bookkeepers opt to utilize. Note that a single entry accounting system is cash-based; therefore, its objective is to track incoming and outgoing cash flow. This requires bookkeepers to only to execute steps 1,2, 8 of the accounting cycle.

However, if the business is using a double-entry system, then bookkeepers should follow all eight steps as this methodology focuses on accrual accounting, a far-more complex system compared to those mentioned above. Though this is a taxing structure and requires advanced accounting knowledge, it guarantees wider accuracy of balance sheets and financial statements.

- STEP 1. IDENTIFYING BUSINESS TRANSACTIONS – This process requires bookkeepers to identify transactions that are directly related or linked to the businesses’ financial undertaking. Any ramifications of variables (expenses, purchases, revenue, and debt) to the company may be accounted for as a transaction. It is necessary to use documents such as receipts and invoices in evaluating the business transaction.

- STEP 2. RECORDING TRANSACTIONS IN THE JOURNAL – After evaluating the necessary transactions, it must be recorded in a journal or more commonly known as the book of original entry. All records presented in the journal must be chronologically arranged, recording transactions one after the other for date and time.

- STEP 3. POSTING TRANSACTIONS TO THE GENERAL LEDGER – After recording the transaction to the book of general entry, this must be copied to the book of final entry. This functions as a condensed copy of business accounts in which changes may be applied, and transactions are linked to the account it has a connection with.

- STEP 4. CALCULATING THE TRIAL BALANCE – As the name suggests, this process challenges and validates whether all posted entries are equal. To execute such, bookkeepers must segregate all debits from credits. From that point, the summation of both must be balanced. If rendered total IS unequal, there may be mistakes in the record that demand adjustments.

- STEP 5. ADJUSTING ENTRIES – This involves checking of accruals and deferrals. The former refers to revenues and expenses that were incurred but were forgotten to be documented. The latter are advanced receipts of payments or could be advanced expenses.

- STEP 6. ADJUSTING TRIAL BALANCE – Following close consideration of deferrals and accruals, bookkeepers may now tweak journal entries and identify errors that will then reflect on a worksheet.

- STEP 7. DEVELOPING FINANCIAL STATEMENTS – After errors are corrected, and trial balance is adjusted, up-to-date accounts may now be utilized to serve as a reference for financial statements. A financial statement is a descriptive rundown that discusses gains and losses throughout the whole accounting process. This creates a summary of businesses’ financial status and serves as a guide in achieving the company’s objectives.

- STEP 8. CLOSING THE BOOKS- This wraps up the overall financial activity of the company. It archives all transactions which transpired throughout the whole accounting process to serve as a basis for the next cycle.

Accounting cycle vs. budget cycle

It is very often that the accounting cycle and budget cyclewear mistaken to be of the same process. However, the accounting cycle takes an interest in financial transactions that already transpired and presented them in an orderly manner. The budget cycle, on the other hand, is executed to prepare and plan for the financial objectives of a particular business.

Why is the accounting cycle important?

The accounting cycle is essential for businesses since efficiency is guaranteed. It secures a systematic workflow to prevent grave accounting errors. Since it is an organized workflow, outputs such as financial statements are the product of intensive work, and companies are ensured that their indications have lasting and positive effects on their business.

This systematic process is unrestricted and allows time management since it plans out a calendar that bookkeepers and accountants follow. This, too, is a form of compliance as governments demand formal financial archiving reflective of taxes and general profits. Errors in financial records may put the company under unwanted charges.