What is taken into account a great working capital ratio?

Liabilities are considered current liabilities if the money owed or obligations are due within one yr. A company’s assets are any items of economic value that a company owns or controls. Examples of property are cash, accounts receivable, stock, supplies, land, buildings and tools. Assets are thought-about present assets when they’re anticipated to be liquidated into cash or be used inside one 12 months. Working capital is calculated because the difference between an organization’s present belongings and current liabilities.

Does working capital embrace inventory?

Working capital is a measure of an organization’s liquidity, operational efficiency and its short-term monetary health. If an organization has substantial positive working capital, then it should have the potential to take a position and grow. If a company’s current belongings don’t exceed its present liabilities, then it may have bother rising or paying again creditors, and even go bankrupt. A buyer usually considers negative working capital in a target as detrimental as a result of it signifies additional capital that might be required to run the enterprise after closing. A purchaser truly prefers to see a working capital ratio of 1 to 1.5 times, which means there may be at least one dollar of present property for each greenback of present liabilities.

Inventory to Working Capital Formula

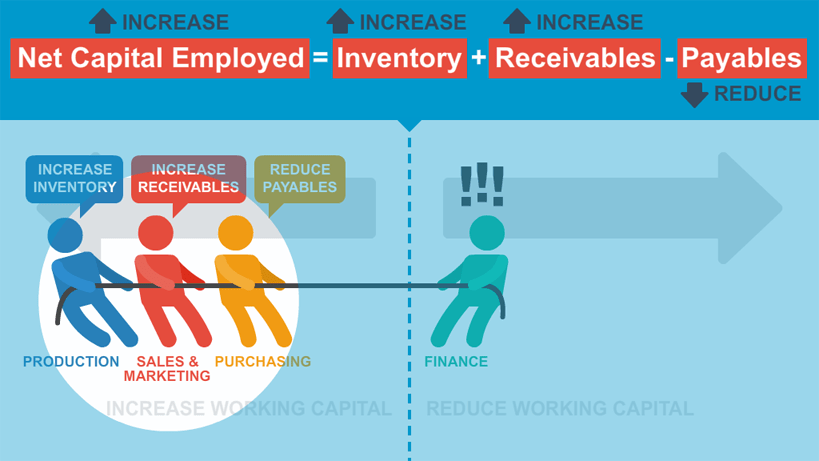

Net working capital measures a company’s capacity to satisfy its current monetary obligations. When a company has a constructive net working capital, it signifies that it has sufficient brief-term property to finance to pay its quick-term debts and even spend money on its growth. Companies can increase their net working capital by rising their present assets and lowering their quick-term liabilities. These embody the selling of lengthy-term assets for cash, increasing inventory turnover, and refinancing brief-term money owed with lengthy-time period debts. The internet working capital (NWC) ratio measures the proportion of an organization’s present assets to its quick-term liabilities.

Ideally, you’d wish to have positive web working capital and a working capital ratio between 1.2 and a couple of.0. This probably represents a healthy business that has enough quick-time period or current property to totally safe its instant debt. To better clarify stock to working capital,it is a vital indicator of an organization’s operation efficiency.

Understanding Inventory

Net operating working capital is a measure of an organization’s liquidity and refers to the difference between operating current property and working present liabilities. In many circumstances these calculations are the identical and are derived from company money plus accounts receivable plus inventories, much less accounts payable and less accrued bills.

The optimal ratio is to have between 1.2 – 2 occasions the quantity of current property to current liabilities. Anything greater might point out that an organization isn’t making good use of its current belongings.

Similar to net working capital, the NWC ratio can be utilized to find out whether or not you’ve enough present assets to cover your present liabilities. Current liabilities are brief-time period monetary obligations due in 1 yr or much less. Current liabilities usually include quick-term loans, lines of credit, accounts payable, accrued liabilities, and other money owed corresponding to credit cards, trade debts, and vendor notes. Current parts of lengthy-time period debt like industrial real estate loans and small enterprise loans are additionally considered current liabilities.

Even with a big amount of optimistic working capital, nevertheless, an organization can expertise a money shortage if its present belongings are unable to be liquidated rapidly. The amount of time it takes to turn current belongings and current liabilities into cash is known as the working capital cycle.

To calculate the working capital, compare an organization’s present property to its present liabilities. Current property listed on a company’s stability sheet embrace cash, accounts receivable, stock and different property that are expected to be liquidated or became money in less than one 12 months. Current liabilities embrace accounts payable, wages, taxes payable, and the present portion of long-time period debt. A company with positive working capital (extra assets than liabilities) is seen as being in good short-term financial health.

- Working capital is the distinction between a enterprise’ present property and current liabilities or money owed.

- Working capital serves as a metric for a way efficiently an organization is operating and how financially steady it is within the quick-time period.

- The working capital ratio, which divides present belongings by present liabilities, indicates whether or not a company has sufficient money flow to cover brief-time period money owed and bills.

Is working capital an inventory?

Inventory is generally categorized as raw materials, work-in-progress, and finished goods. Retailers typically refer to this inventory as “merchandise.” Common examples of merchandise include electronics, clothes, and cars held by retailers.

Inventory is classed as part of the present property, or short-time period belongings, since there is an expectation that this asset is going to be consumed and produce financial advantages within a year. Working capital is calculated by deducting the company’s present liabilities from its current property. A optimistic working capital implies that the corporate can repay its quick-term liabilities comfortably, while a negative determine obviously implies that the corporate’s liabilities are high.

What is an example of inventory?

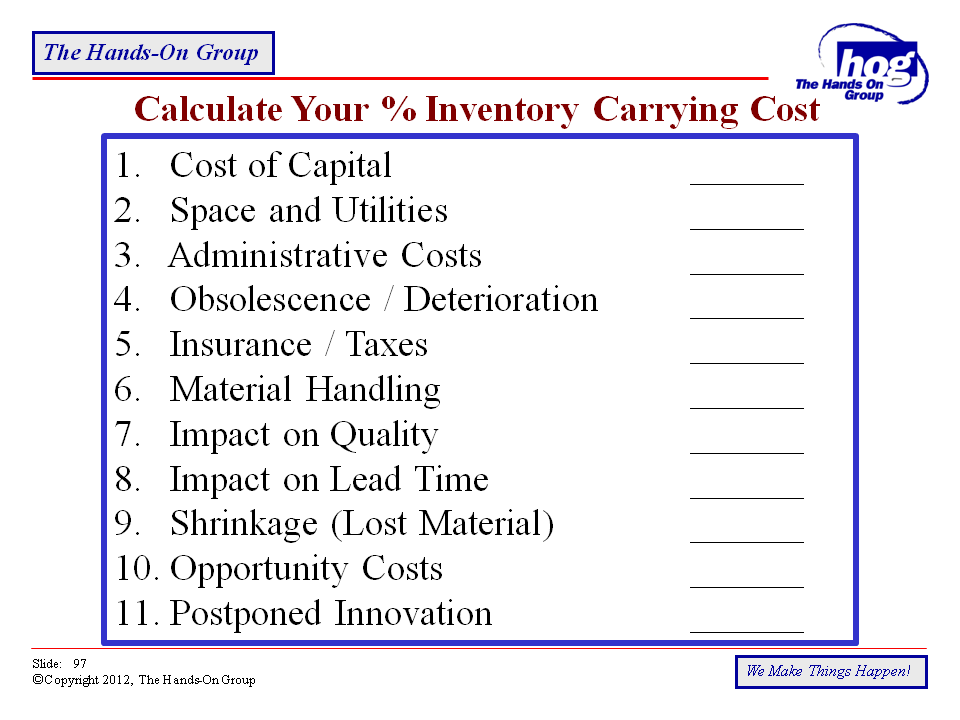

Inventory to working capital ratio is defined as a method to show what portion of a company’s inventories is financed from its available cash. This is essential to businesses which hold inventory and survive on cash supplies. In general, the lower the ratio, the higher the liquidity of a company is.

Working capital is the difference between a enterprise’ present property and current liabilities or debts. Working capital serves as a metric for how efficiently an organization is operating and the way financially secure it is within the brief-term. The working capital ratio, which divides current belongings by current liabilities, signifies whether a company has sufficient cash circulate to cowl short-time period debts and bills.

Special Considerations: Inventory to Working Capital Ratio

Liquidity measures similar to the short ratio and the working capital ratio may help a company with its short-term asset management. A managerial accounting strategy specializing in sustaining environment friendly levels of each elements of working capital, present belongings, and present liabilities, in respect to each other. Working capital management ensures an organization has enough money move to be able to meet its quick-time period debt obligations and working bills.

Trade working capital is the distinction between present property and current liabilities instantly associated with everyday business operations. A firm’s liabilities are any financial debt or obligations that an organization is responsible for because of its enterprise operations. Liabilities often embody “payable” of their account title on the steadiness sheet. Examples of liabilities are notes payable, accounts payable, salaries payable, wages payable and earnings taxes payable.

Inventory to Working Capital Analysis

The management of working capital involves managing inventories, accounts receivable and payable, and cash. Working capital (abbreviated WC) is a monetary metric which represents operating liquidity out there to a business, organization, or other entity, including governmental entities. Along with mounted property similar to plant and tools, working capital is taken into account a part of operating capital. If present assets are lower than current liabilities, an entity has a working capital deficiency, additionally referred to as a working capital deficit. The working capital ratio remains an necessary fundamental measure of the current relationship between assets and liabilities.

This assures the customer that the company can generate adequate cash over the quick term to cover provider and payroll obligations. A company could be endowed with property and profitability but may fall in need of liquidity if its property cannot be readily converted into money. Positive working capital is required to make sure that a firm is able to continue its operations and that it has sufficient funds to satisfy both maturing brief-time period debt and upcoming operational bills.

Note that a low value of 1 or less of inventory to working capital implies that a company has high liquidity of present asset. While it may also imply insufficient inventories, high value stock to working capital ratio means that an organization is carrying an excessive amount of stock in stock. Because excessive inventories can place a heavy burden on the money resources of an organization, it is not favorable for administration. A key issue for a corporation to improve its operation effectivity is to establish the optimum stock levels and thus minimize the fee tied up in inventories.