One method is called partial year depreciation, where depreciation is calculated exactly at when assets start service. Simply select “Yes” as an input in order to use partial year depreciation when using the calculator. You will find the depreciation expense used for each period until the value of the asset declines to its salvage value. Even if you’re still struggling with understanding some accounting terms, fortunately, straight line depreciation is pretty straightforward.

In our example, the title transfers, which means at the end of the lease term the lessee will own the asset and continue depreciating it. However, the useful life of the equipment in this example equals the lease term so at the end of the lease, the asset will be depreciated to $0. Now, let’s consider a full example of a finance lease to illustrate straight-line depreciation expense. Below we will describe each method and provide the formula used to calculate the periodic depreciation expense. Depreciation is an accounting method of allocating the cost of a tangible asset over its useful life and is used to account for declines in value over time. To calculate depreciation using a straight line basis, simply divide net price by the number of useful years of life the asset has. Straight line basis is calculated by dividing the difference between an asset’s cost and its expected salvage value by the number of years it is expected to be used.

What is an example of straight line depreciation?

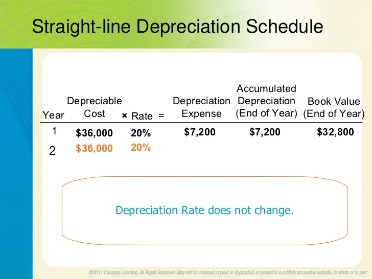

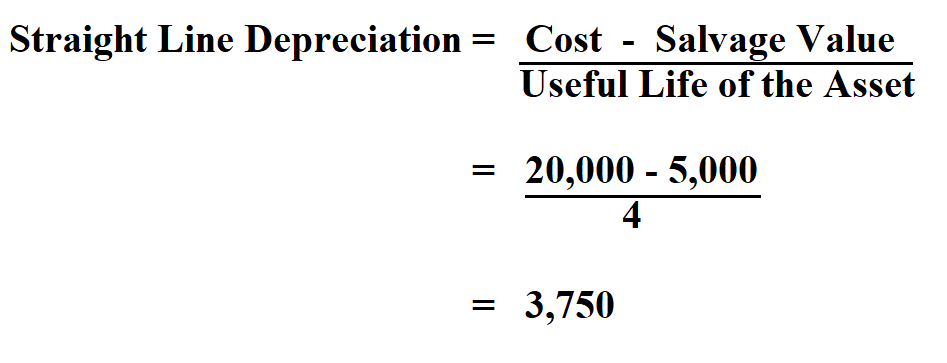

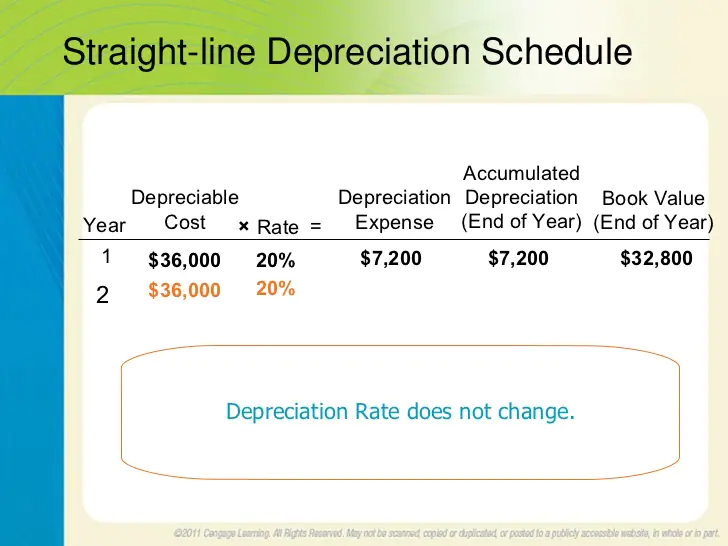

Example of Straight Line Depreciation Purchase cost of $60,000 – estimated salvage value of $10,000 = Depreciable asset cost of $50,000. 1 / 5-year useful life = 20% depreciation rate per year. 20% depreciation rate x $50,000 depreciable asset cost = $10,000 annual depreciation.

Assume that our company has an asset with an initial cost of $50,000, a salvage value of $10,000, and a useful life of five years and 3,000 units, as shown in the screenshot below. Our job is to create a depreciation schedule for the asset using all four types of depreciation.

Straight Line Depreciation Method Examples

Double declining balance is the most widely used declining balance depreciation method, which has a depreciation rate that is twice the value of straight line depreciation for the first year. Use a depreciation factor of two when doing calculations for double declining balance depreciation. Regarding this method, salvage values are not included in the calculation for annual depreciation. For accounting, in particular, depreciation concerns allocating the cost of an asset over a period of time, usually its useful life. When a company purchases an asset, such as a piece of equipment, such large purchases can skewer the income statement confusingly. Instead of appearing as a sharp jump in the accounting books, this can be smoothed by expensing the asset over its useful life.

These accounts have credit balance (when an asset has a credit balance, it’s like it has a ‘negative’ balance) meaning that they decrease the value of your assets as they increase. Straight-line depreciation is a simple method for calculating how much a particular fixed asset depreciates over time. Understanding asset depreciation is an important part of running any business. When you’re able to accurately determine the condition of your assets as well as its current depreciation rate, you’ll improve your overall efficiency.

Straight Line Depreciation For Your Business

Or you can also come up with an estimation of how many units the asset can produce during its useful life. Straight-line depreciation has advantages and disadvantages, and is only one of many other methods used to calculate depreciation.

How many straight lines does the figure have?

The Slanting lines are AB, AC, BF and DC i.e. 4 in number. Thus, there are 2 + 3 + 4 = 9 straight lines in the figure.

However, the straight line method does not accurately reflect the difference in usage of an asset and may not be the most appropriate value calculation method for some depreciable assets. This method is regarded as the most accurate representation of devaluation, as it more closely reflects the actual wear and tear that assets go through. When using the units of production method, more resources are needed to collect enough data over long periods of time. Because of additional efforts required for this method, it is typically used for higher-value equipment. Besides capital expenditures, businesses also incur operating expenditures.

Each of those $1,600 charges would be balanced against a contra account under property, plant, and equipment on the balance sheet. This is known as accumulated depreciation, which effectively reduces the carrying value of the asset. For example, the balance sheet would show a $5,000 computer offset by a $1,600 accumulated depreciation contra account after the first year, so the net carrying value would be $3,400. Straight-line depreciation is a method used to calculate the decline in value of fixed assets, such as vehicles or office equipment. If your company uses a piece of equipment, you should see more depreciation when you use the machinery to produce more units of a commodity. If production declines, this method lowers the depreciation expenses from one year to the next. The straight-line method of depreciation isn’t the only way businesses can calculate the value of their depreciable assets.

The annual depreciation expense is a measure of the loss of value of the item. In the article, we have seen how the straight line depreciation method can be used to depreciate the value of the asset over the useful life of the asset. It is the easiest and simplest method of depreciation where the cost of the asset is depreciated uniformly over its useful life. The depreciation rate is the rate an asset is depreciated each period.

But keep in mind this opens up the risk of overestimating the asset’s value. Reed, Inc. also evaluates the incremental borrowing rate for the lease to be 4%. For this example we will assume no other lease incentives, accruals, or initial direct costs are applicable for this lease. A depreciation schedule that treats all property acquired during the year as being acquired exactly in the middle of the year. But the IRS uses the accelerated/MACRS or Section 179 for certain assets, including intangible assets like copyrights, patents and trademarks.

Other Methods Of Depreciation:

Further, the full value of the asset resides in the accumulated depreciation account as a credit. Combining the total asset and accumulated depreciation amounts equals a net book value of $0. Using the facts and circumstances presented, we can use LeaseQuery’s present value calculator to calculate the present value of the lease payments.

- This method is regarded as the most accurate representation of devaluation, as it more closely reflects the actual wear and tear that assets go through.

- Under such a convention, all property of a particular type is considered to have been acquired at the midpoint of the acquisition period.

- Depreciation expense generally begins when the asset is placed in service.

- The percentage is then applied to the cost less salvage value, or depreciable base, to calculate depreciation expense for the period.

- One look at the straight line depreciation formula and you might feel intimidated by it.

- For example, computers and printers are not similar, but both are part of the office equipment.

- To calculate straight line depreciation for an asset, you need the asset’s purchase price, salvage value, and useful life.

In addition, this gain above the depreciated value would be recognized as ordinary income by the tax office. If the sales price is ever less than the book value, the resulting capital loss is tax-deductible. If the sale price were ever more than the original book value, then the gain above the original book value is recognized as a capital gain. Also, this method isn’t cost-effective if the information you get as a result isn’t used by the people who go through the financial statements of the company. This means that the cost that’s associated with the production of depreciation information that’s more accurate might not prove valuable, especially if it doesn’t result in specific actions. To help you calculate the loss of value of a business asset, we’ve created this guide to help you understand and calculate straight-line depreciation. Read through to learn more about the straight-line method of depreciation, or use the links below to jump to a section of your choice.

The declining balance method calculates more depreciation expense initially, and uses a percentage of the asset’s current book value, as opposed to its initial cost. So, the amount of depreciation declines over time, and continues until the salvage value is reached. The most common types of depreciation methods include straight-line, double declining balance, units of production, and sum of years digits. Straight-line depreciation is the most common method of allocating the cost of a plant asset to expense in the accounting periods during which the asset is used. With the straight-line method of depreciation, each full accounting year will report the same amount of depreciation. The total amount of depreciation over the years of the asset’s useful life will be the asset’s cost minus any expected or assumed salvage value. Four types of depreciation systems are commonly available within accounting.

As such, the income statement is expensed evenly, so is the value of the asset on the balance sheet. The carrying amount of the asset on the balance sheet reduces by the same amount. There are many methods of distributing depreciation amount over its useful life. The total amount of depreciation for any asset will be identical in the end no matter which method of depreciation is chosen; only the timing of depreciation will be altered. There are a lot of reasons businesses choose to use the straight line depreciation method. The straight-line depreciation method is one of the most popular depreciation methods used to charge depreciation expenses from fixed assets equally period assets’ useful life.

The total cost of the furniture and fixtures, including tax and delivery, was $9,000. Sally estimates the furniture will be worth around $1,500 at the end of its useful life, which, according to the chart above, is seven years. The final cost of the tractor, including tax and delivery, is $25,000, and the expected salvage value is $6,000. According to the table above, Jim can depreciate the tractor over a three-year period. In the last line of the chart, notice that 25% of $3,797 is $949, not the $797 that’s listed. However, the total depreciation allowed is equal to the initial cost minus the salvage value, which is $9,000.

Most tax systems provide different rules for real property (buildings, etc.) and personal property (equipment, etc.). The carrying value would be $200 on the balance sheet at the end of three years. The depreciation expense would be completed under the straight line depreciation method, and management would retire the asset. Any gain or loss above or below the estimated salvage value would be recorded, and there would no longer be any carrying value under the fixed asset line of the balance sheet.

Straight Line Depreciation: Which Method Of Depreciation Should You Be Using?

The straight-line method of depreciation assumes a constant rate of depreciation. It calculates how much a specific asset depreciates in one year, and then depreciates the asset by that amount every year after that. As buildings, tools and equipment wear out over time, they depreciate in value. Being able to calculate depreciation is crucial for writing off the cost of expensive purchases, and for doing your taxes properly.

While it can be useful to use double declining or other depreciation methods, those methods also present more complex formulas, which can result in errors, particularly for those new to depreciation. Straight line depreciation straight line depreciation is the easiest depreciation method to use, making it ideal for small businesses that need to depreciate fixed assets. Let’s go through an example using the four methods of depreciation described so far.

How To Calculate Straight Line Depreciation Formula

We discuss these briefly in the last section of our Beginners Guide to Depreciation. After an asset has been fully depreciated, it can remain in use as long as it is needed and is in good working order. To learn how to handle the retiring of assets, please see last section of our tutorial Beginner’s Guide to Depreciation. They have estimated the useful life of the machine to be 8 years with a salvage value of $ 2,000. Here, we are simply taking an average of the useful value of the asset over its useful life.

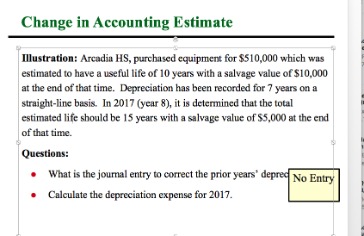

However, in most countries the life is based on business experience, and the method may be chosen from one of several acceptable methods. The straight line depreciation calculation should make it clear how much leeway management has in managing reported earnings in any given period. It might seem that management has a lot of discretion in determining how high or low reported earnings are in any given period, and that’s correct.

We’ll do one month of your bookkeeping and prepare a set of financial statements for you to keep. You can’t get a good grasp of the total value of your assets unless you figure out how much they’ve depreciated. This is especially important for businesses that own a lot of expensive, long-term assets that have long useful lives. Compared to the other three methods, straight line depreciation is by far the simplest. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes. Note how the book value of the machine at the end of year 5 is the same as the salvage value.

Step 1: Calculate The Cost Of The Asset

Contra AccountContra Account is an opposite entry passed to offset its related original account balances in the ledger. It helps a business retrieve the actual capital amount & amount of decrease in the value, hence representing the account’s net balances. As can be seen from the above table – At the end of 8 years, i.e., after its useful life is over, the machine has depreciated to its salvage value. Cost Of SalesThe costs directly attributable to the production of the goods that are sold in the firm or organization are referred to as the cost of sales.

A company may also choose to go with this method if it offers them tax or cash flow advantages. Four standard types of calculationsare used to determine depreciation expenses. The most common methods are straight-line depreciation, double declining balance depreciation, units of production depreciation, and sum of years digits depreciation. With the double-declining balance method, higher depreciation is posted at the beginning of the useful life of the asset, with lower depreciation expenses coming later. This method is an accelerated depreciation method because more expenses are posted in an asset’s early years, with fewer expenses being posted in later years. This approach works by calculating depreciation as a percentage and then depreciating the asset at twice the percentage rate. Accumulated depreciation is the associated balance sheet line item for depreciation expense.

To calculate composite depreciation rate, divide depreciation per year by total historical cost. To calculate depreciation expense, multiply the result by the same total historical cost. The result, not surprisingly, will equal the total depreciation per year again.