Opening entry in accounting refers to the primary entries of business at the beginning of each fiscal year or the beginning of its establishment. It involves the business’ assets, liabilities, and equity that are stated in a balance sheet. Its function is to assess where the business is at present with regards to financial or accounting status.

How to: Opening Entry with Examples

Here, two cases of opening entry will be discussed: (1) a newly-established business and (2) a business’ opening entry in a new fiscal year.

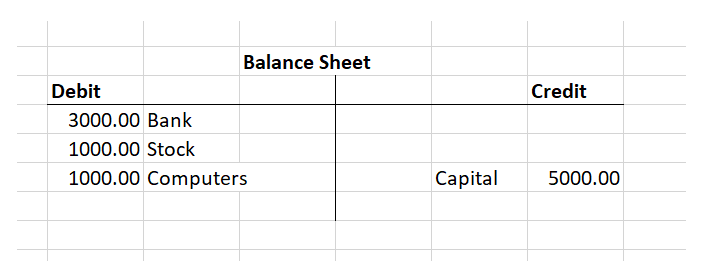

For new business opening entry for the first time

Opening entry for a new business basically involves debit and credit. It is composed of the funding to start the business (directors’ contributions or borrowed from a bank), assets (if the business has acquired assets, to begin with), and capital or stocks. Normally, at the beginning of a business, the capital that you traded for assets now fall under debit.

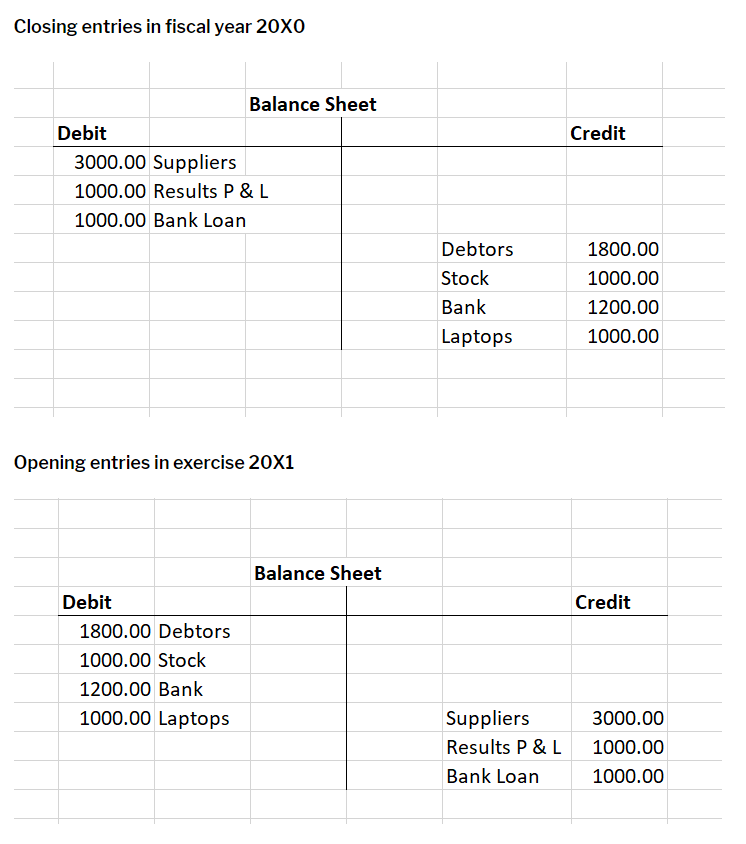

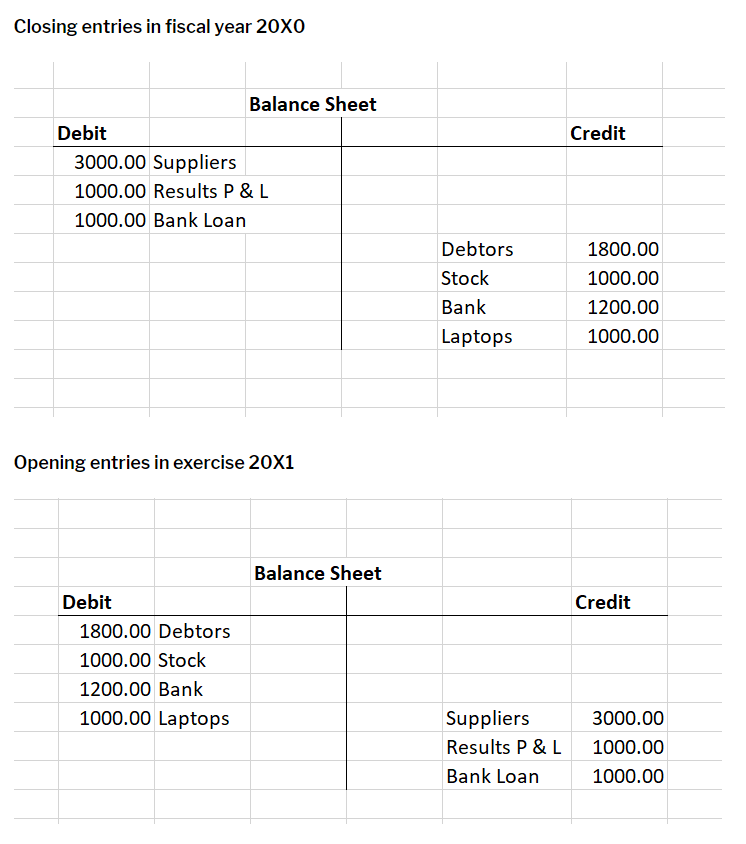

For business opening entry in the new fiscal year

Opening entry for the new fiscal year is basically the closing entry of the last fiscal year. Technically, a business begins the new fiscal year by looking back at the preceding year’s closing entry in order to determine its financial status.

The only difference in the opening entry of a new fiscal year is that the debit now falls under credit, and vice versa. See the reference below:

The Accounting Equation

The accounting equation is used to solve and determine a business’s financial or accounting status. This basic equation states that a business’ total assets are equal to its liabilities plus equity.

Assets = Liabilities + Equity

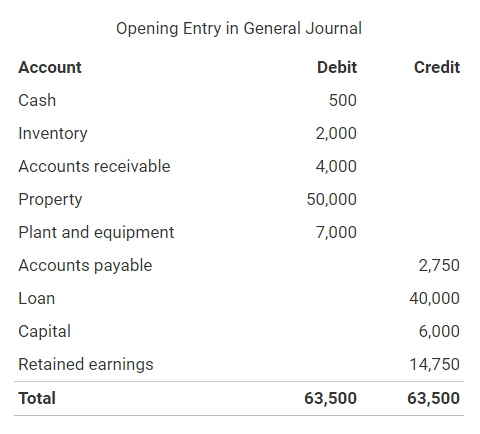

How to: Open Balance Journal Entry

Once done, the opening entry will be recorded on the general ledger journal. This tracks the business’ equity, assets, and liabilities as opening balances. The following transactions under the same fiscal year will be recorded in the journal in the same manner. Below is an example of an opening balance in the journal that takes note of a business’s debit and credit.

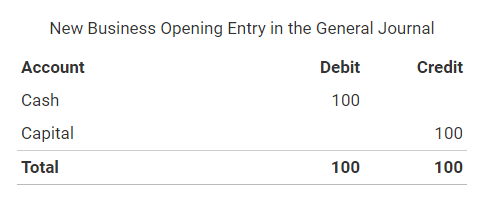

How to: Opening Entry Journal for New Business

Starting a business may require raising capital, which falls under credit on normal balance. In a theoretical scenario, the founder of the business trades cash for the capital in order to gain ownership of the company. Now, the company’s financial status lists capital under credit acquired cash under debit. In double-entry bookkeeping, it is like trading assets. Indicating both of these in double-entry accounting allows full disclosure of the company funds’ coming and going.

Other Double Entry Bookkeeping

Aside from the opening entry journal, there is much double entry bookkeeping that is used in accounting. Some of these are: (1) Payroll Advance to an Employee Journal Entry, (2) Fixed Deposit Journal Entry, (3) Certificate of Deposit in Accounting, (4) Accounts Payable Payment and (5) Property Purchase Deposit Journal Entry.