A cost-efficient payroll solution, Intuit showcases a payroll service that can be customized to fit the exact payroll service needs of any small business. Intuit offers several packages with different inclusions and services offered. Intuit payroll allows employers to compensate their employees efficiently without too much work or effort exerted.

Intuit payroll includes an unlimited generation of paychecks plus automated tax calculation payroll system. Moreover, Intuit payroll support comes with experts’ guidance to help users deal with technical matters concerning software use.

Another likable characteristic of Intuit online payroll is its easy-to-use serviceability and understandable interface that accounts for a faster and smoother payroll run. Intuit integrates along with its payroll service, an accounting software called QuickBooks.

Intuit Payroll offers three primary payroll packages:

- The Basic Plan – $20 per month with an additional $2 per employee per month as well. It comes with a free trial service, easily runs the payroll system, and calculates taxes automatically.

- Intuit’s Enhanced Plan – $31.20 per month, along with the benefits listed under the Basic Plan and the additional services in the form of filling in tax forms and filing and paying taxes electronically.

- The Full-Service Plan – $79.20 per month, including the additional $2 per employee covering all the services under the Enhanced Plan. More than this, the package also features a vendor that will set up, run, and file payroll for the user.

Meanwhile, the mini packages include the Full Service Payroll Online, which has the same package price with the Full Service Plan and an additional $2 per employee minus the extra services covered in the Full Service Plan. Intuit QuickBooks Payroll is also another viable option. The Assisted Payroll for QuickBooks Desktop package is also $79.20 per month plus an additional $2 per employee.

The three major packages are offered with a 20% discount for the first six months of availing the Intuit program. Each plan is paid on a month-to-month basis, making it an easy payment scheme with no accountability or long-term contract with the service provider. The ease of terminating the use of the software is also a good thing as Intuit does not charge a penalty fee for dropping the program.

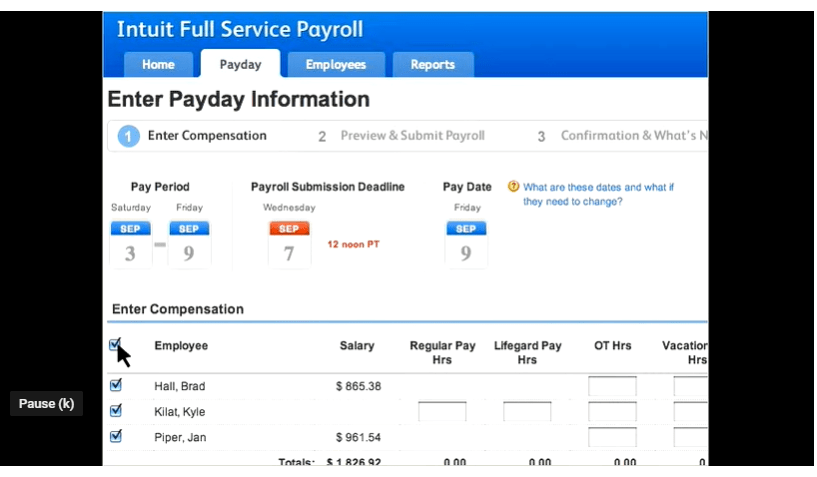

(Here’s a peek on how users do the Intuit Payroll login.)

Now that we have learned about the Intuit packages let us take a closer look at the benefits of using the accounting software as well as the salient features it possesses.

Intuit Payroll Features and Benefits

Intuit Payroll boasts of the following special features:

- Generates limitless paychecks

- Accurate tax payment, avoiding penalties

- Support from live experts

- Online chat with payroll specialists

- Compensation of employees

- Automatic calculation of taxes

- Integration of QuickBooks

- Gives hiring tips and tools

Looking at the above-listed features of the software, the Intuit online payroll for accountants makes a strong case for one of the best options in payroll solutions available. Payroll taxes using Intuit are made more manageable as Intuit systematically does the process of paying taxes. When the software has completed the filing of taxes, the user will be receiving a notification e-mail from the software regarding the completion of filing. More so, Intuit offers an error-free guarantee, which means that Intuit will take the responsibility should there be errors in taxes filed.

If we look into the advantageous opportunities in using Intuit, the following are the salient points:

Easy-to-navigate software interface: when a user goes for an Intuit payroll sign in, labels are clearly and easily seen to guide the user. The major sections of the program are also instantly featured. Link tabs are readily available for the user to open tabs for other tasks. These tabs enable the user to perform several functions, including running the payroll, printing paychecks, and checking taxes and pertinent forms.

The software is easy to maintain and can be accessed in computers with just internet connection as the lone requirement. No other software is needed to operate the Intuit software. What’s more interesting is that the software can also be downloaded from mobile phones through the Intuit mobile app. The app is both downloadable in Android and iOS devices. Using the mobile app, the user can pay taxes, run payroll, and review payroll history.

Patented customer support: when contacting Intuit, helpful customer support representatives will be of great assistance and will waste no time in accommodating any concerns raised. Their support team responds promptly to queries made via phone call, online chat, or e-mail. Moreover, the official Intuit website brings clients to several Frequently Asked Questions (FAQs) that will answer basic questions and concerns without contacting the service provider. The site also contains educational videos and an interactive user community where users help one another in solving software problems.

User Reviews on Intuit Payroll

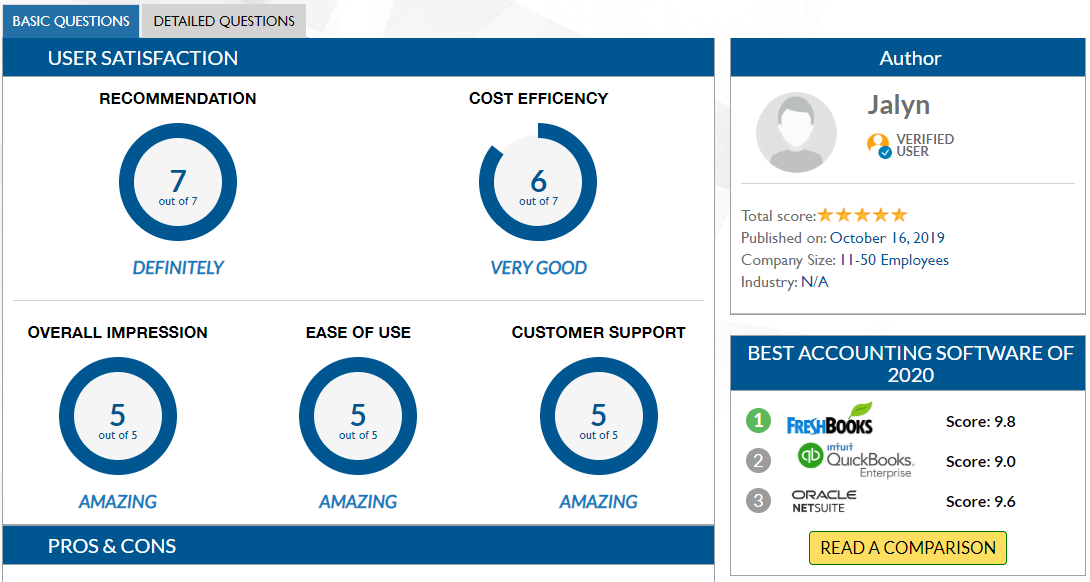

The above illustration is an actual Intuit Payroll review of a verified Intuit user. The user gave 7/7 or points for the recommendation, indicating to be highly recommendable, and 6 out of 7 for “Very Good” cost-efficiency. The other factors, including overall impression, ease of use, and customer support were graded 5 out 5 or 100% – a clear indication of the extreme satisfaction of the client with intuit as a payroll solution.

When asked more about the advantages and limitations of the product, the user noted that the best aspects of Intuit are its ability to produce fast results resulting to efficient payroll system with Intuit and the excellent Intuit Customer Support providing quick responses to queries and concerns regarding the complicated technicalities of the software.

Moreover, the user also raised no concerns when asked about the aspects of the software that could still be improved or enhanced. She went on saying that the platform handled all their business needs and that they did like pretty much everything about the product. She also affirmed Intuit by saying that she wouldn’t switch to other payroll software, indicating the client’s full trust in the Intuit Payroll Services.