What Is Depreciation? Definition, Formulas and Types

Because a fixed asset does not maintain its value over time (like money does), it needs the carrying value to be steadily reduced. Depreciation expense steadily writes down the worth of a set asset so that asset values are appropriately represented on the stability sheet. Why would a business willingly choose costlier early expenses on the asset? Accumulated depreciation has a credit score balance, as a result of it aggregates the amount of depreciation expense charged towards a set asset. This account is paired with the fixed property line merchandise on the balance sheet, so that the combined total of the 2 accounts reveals the remaining book worth of the fastened belongings.

Depreciation also affects your small business taxes and is included on tax statements. On the stability sheet, a company uses cash to pay for an asset, which initially results in asset transfer.

Over time, the quantity of accrued depreciation will enhance as extra depreciation is charged in opposition to the fastened property, leading to an even lower remaining guide value. In utilizing the declining stability methodology, a company stories bigger depreciation bills through the earlier years of an asset’s useful life.

What Is the Tax Impact of Calculating Depreciation?

The preliminary accounting entries for the first cost of the asset are thus a credit score to accounts payable and a debit to the fixed asset account. Depreciation is the gradual charging to expense of an asset’s value over its anticipated helpful life.

The accrued depreciation balance will increase over time, including the amount of depreciation expense recorded within the current interval. Accumulated depreciation is the total quantity an asset has been depreciated up till a single level. Each interval, the depreciation expense recorded in that period is added to the beginning accumulated depreciation steadiness. An asset’s carrying worth on the stability sheet is the distinction between its historic value and accrued depreciation.

How Are Accumulated Depreciation and Depreciation Expense Related?

Depreciation bills, on the other hand, are the allocated portion of the price of an organization’s fixed assets that are applicable for the period. Depreciation expense is recognized on the revenue statement as a non-money expense that reduces the company’s internet income.

The final merchandise is a contra-asset account that reduces the worth of the corresponding fastened resource. The accrued depreciation lies right beneath the “property, plant and tools” account in a statement of monetary place, also referred to as a steadiness sheet or report on monetary situation. Depreciation expense flows via an earnings assertion, and this is where accrued depreciation connects to a statement of revenue and loss — the opposite name for an income assertion or P&L. The quantity of amassed depreciation for an asset or group of assets will increase over time as depreciation expenses proceed to be credited against the assets. When an asset is finally bought or put out of use, the quantity of the accumulated depreciation that is related to that asset shall be reversed, eliminating all record of the asset from the corporate’s balance sheet.

The complete quantity of depreciation expense is recognized as accumulated depreciation on an organization’s balance sheet and subtracts from the gross quantity of mounted assets reported. The quantity of accumulated depreciation will increase over time as month-to-month depreciation expenses are charged in opposition to a company’s property.

AccountingTools

This means that it must depreciate the machine at the rate of $1,000 per thirty days. For the December income statement at the finish of the second 12 months, the month-to-month depreciation is $1,000, which seems in the depreciation expense line merchandise. For the December balance sheet, $24,000 of amassed depreciation is listed, since that is the cumulative amount of depreciation that has been charged in opposition to the machine over the past 24 months.

Accumulated depreciation is the total depreciation expense a enterprise has utilized to a set asset since its purchase. At the top of an asset’s working life, its accrued depreciation equals the value the company proprietor initially paid — assuming the resource’s salvage value is zero. If not, accumulated depreciation equals the asset’s guide value minus its residual price.

- Depreciation expense is recognized on the income assertion as a non-cash expense that reduces the company’s net revenue.

- For accounting functions, the depreciation expense is debited, and the amassed depreciation is credited.

- Depreciation expenses, then again, are the allocated portion of the cost of a company’s fixed belongings which might be applicable for the interval.

For accounting functions, the depreciation expense is debited, and the amassed depreciation is credited. Depreciation is an accounting technique for allocating the price of a tangible asset over time. Companies must be careful in choosing appropriate depreciation methodologies that may precisely symbolize the asset’s worth and expense recognition. Depreciation is discovered on the revenue statement, stability sheet, and cash move assertion. It can thus have a huge impact on an organization’s financial performance total.

Is Accumulated Depreciation a Current Asset or Fixed Asset?

This expense is tax-deductible, so it reduces your small business taxable income for the year. To unfold the price of a capital asset, a corporate bookkeeper debits the depreciation expense account and credits the accrued depreciation account.

At the top of an asset’s helpful life, its carrying worth on the stability sheet will match its salvage worth. The technique of accounting used to allocate the price of a tangible asset over its useful life and is used to account for declines in value is called depreciation. Business can deduct the price of the tangible asset they buy off their taxes but how and when the company can deduct depreciation is dictated by IRS guidelines. As an example, a company acquires a machine that prices $60,000, and which has a helpful life of five years.

How do you record accumulated depreciation on equipment?

Accumulated depreciation is an asset account with a credit balance known as a long-term contra asset account that is reported on the balance sheet under the heading Property, Plant and Equipment. The amount of a long-term asset’s cost that has been allocated, since the time that the asset was acquired.

Accumulated depreciation is utilized in calculating an asset’s net book worth. Net guide worth is the cost of an asset subtracted by its accrued depreciation. For example, a company bought a bit of printing tools for $100,000 and the accrued depreciation is $35,000, then the web guide worth of the printing gear is $sixty five,000. The accumulated depreciation account is a contra asset account on a company’s steadiness sheet, that means it has a credit balance.

“Fixed asset” is what finance folks name a tangible asset, capital resource, bodily asset or depreciable useful resource. When recording depreciation within the general ledger, an organization debits depreciation expense and credit amassed depreciation. Depreciation expense flows via to the income statement in the period it’s recorded. Accumulated depreciation is presented on the stability sheet below the line for related capitalized assets.

What Is Accumulated Depreciation?

The use of a depreciation technique permits an organization to expense the price of an asset over time while additionally lowering the carrying value of the asset. Initially, most fastened belongings are purchased with credit score which also permits for fee over time.

By charting the lower within the worth of an asset or property, depreciation reduces the quantity of taxes a company or business pays by way of tax deductions. Over time, the accumulated depreciation steadiness will proceed to increase as extra depreciation is added to it, until such time because it equals the original value of the asset. At that point, stop recording any depreciation expense, since the cost of the asset has now been reduced to zero. Accumulated depreciation is the entire lower in the worth of an asset on the stability sheet of a enterprise, over time. The price for each year you own the asset turns into a enterprise expense for that year.

Depreciation is a technique used to allocate the cost of tangible assets or fastened property over the property’ useful life. In different phrases, it allocates a portion of that price to periods during which the tangible property helped generate revenues or sales.

Is accumulated depreciation equipment an asset?

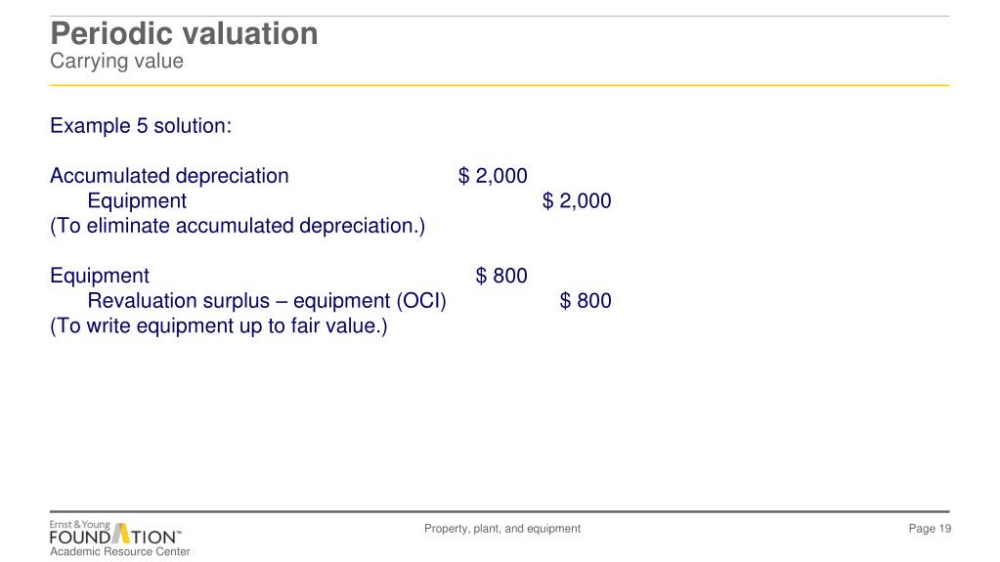

Accumulated depreciation – equipment is the aggregate amount of depreciation that has been charged against the equipment asset. The balance in this account is paired with the equipment fixed asset account to arrive at the net book value of all equipment.