What Is Coupon Rate and How Do You Calculate It?

Bond Yield Rate vs. Coupon Rate: What’s the Difference?

A coupon rate is the yield paid by a fixed-revenue safety; a fixed-income safety’s coupon price is simply just the annual coupon funds paid by the issuer relative to the bond’s face or par value. The coupon rate, or coupon payment, is the yield the bond paid on its concern date. This yield modifications as the worth of the bond modifications, thus giving the bond’s yield to maturity.

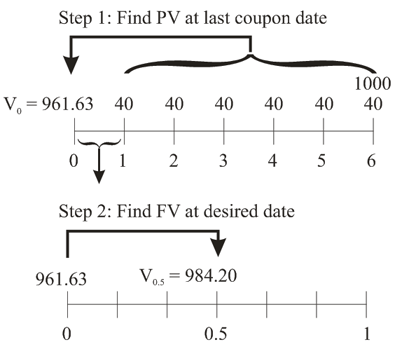

The same phenomenon can also be proven for an rate of interest of 4 p.c. In this case, the bond’s worth would have to be set at $918.89 to adequately entice an investor. The eight.1 p.c value reduction offers a yield to maturity of 4 percent to the brand new purchaser that then matches the overall greater rate of interest within the financial system. When buyers purchase a bond initially at face value after which maintain the bond to maturity, the curiosity they earn on the bond is based on the coupon rate set forth on the issuance.

How can I calculate a bond’s coupon rate in Excel?

Whoever owns the bond is entitled to the predefined cash flows of $30 per yr plus $1,000 extra in the final year. For an investor who pays $958.forty two for the bond, the yield to maturity obtained by the investor on this smaller funding is 3.5 p.c. Note that a 0.5 p.c improve in interest rates decreased the selling worth of the bond by four.2 p.c. If the investor bought the bond, the return obtained by the earlier proprietor is outlined by way of any coupon payments received much less the capital loss associated with the rate of interest rise.

If the coupon price is beneath the prevailing rate of interest, then traders will transfer to more attractive securities that pay a better interest rate. For instance, if different securities are providing 7% and the bond is offering 5%, then buyers are likely to buy the securities offering 7% or extra to ensure them a higher revenue sooner or later.

A bond’s yield to maturity rises or falls relying on its market worth and how many payments remain to be made. A bond’s coupon price could be calculated by dividing the sum of the safety’s annual coupon payments and dividing them by the bond’s par worth. For instance, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. All else held equal, bonds with larger coupon rates are extra desirable for traders than those with decrease coupon rates. The yield to maturity is the internal rate of return an investor will earn by holding a bond to maturity and receiving its money flows.

The yield to maturity for a brand new investor differs from the coupon rate whenever the bond sells for a unique price than its face worth. It is quintessential to know the idea of the speed as a result of almost all kinds of bonds pay annual interest to the bondholder, which is named the coupon fee. Unlike other monetary metrics, the coupon cost when it comes to the greenback is fastened over the life of the bond.

If rates of interest within the financial system are three.5 %, then an investor would not be keen to pay $1,000 for this bond that gives only three % coupon funds. The investor would prefer a new bond that presumably is now providing a three.5 % coupon. To entice an investor to purchase the bond on this exhibit, the bond would have to be bought for a lower price. In a aggressive and active market, bonds with the identical maturity and threat traits must offer the identical potential return for each parties to comply with a trade.

In this case, the future cash flows are discounted at three.5 percent, and the sum of those discounted money flows (and potential selling value) is $958.forty two. The prevailing interest rate instantly affects the coupon price of a bond, as well as its market price. In the United States, the prevailing interest rate refers to the Federal Funds Rate that’s fixed by the Federal Open Market Committee (FOMC). The Fed expenses this fee when making interbank in a single day loans to other banks and the rate guides all other rates of interest charged out there, including the rates of interest on bonds. The decision on whether or to not invest in a selected bond is determined by the speed of return an investor can generate from different securities out there.

Coupon rates are one of the most confusing elements of bonds for people to know. For a regular Treasury bond, if the coupon price is 3 % and face value is $1,000, then the bond pays coupons of $30 per year. Usually these are paid semiannually—two coupon funds of $15 in this case. Interest rates can change, but that can affect the yield, not the coupon rate.

- If the ask price matches the face worth, then the yield will be the identical as the coupon.

- The yield is the yield to maturity based mostly on the ask value paid by the investor—the return the investor would get for getting the bond today and holding it to maturity.

YTM and Market Value

But bonds can be offered and resold on secondary markets prior to the maturity date. If I pay $900 for a bond providing a fixed set of promised funds, then I’m going to get a higher return on my $900 funding than if I paid $1,one hundred for a similar set of promised funds.

When calculating the yield to maturity, you bear in mind the coupon rate and any improve or decrease in the value of the bond. The current yield is less complicated measure of the speed of return to a bond than the yield to maturity. Current yield is measured as the ratio of the bond’s annual coupon cost to the bond’s market value.

What Is a Coupon Rate?

A extra complete measure of a bond’s rate of return is its yield to maturity. Since it is possible to generate profit or loss by purchasing bonds beneath or above par, this yield calculation takes into account the effect of the acquisition worth on the entire rate of return.

If a bond’s buy worth is equal to its par worth, then the coupon price, present yield, and yield to maturity are the identical. Current yield compares the coupon fee to the current market value of the bond. Therefore, if a $1,000 bond with a 6% coupon price sells for $1,000, then the current yield can be 6%. However, because the market value of bonds can fluctuate, it may be attainable to purchase this bond for a value that is above or below $1,000. The yield to maturity (YTM) is the proportion rate of return for a bond assuming that the investor holds the asset until its maturity date.

For investors buying the bond on the secondary market, relying on the prices they pay, the return they earn from the bond’s curiosity payments could also be larger or decrease than the bond’s coupon fee. Most investors contemplate the yield to maturity a more essential determine than the coupon price when making funding selections. The coupon price stays mounted over the lifetime of the bond, while the yield to maturity is bound to alter.

If rates of interest rise, then the price the bond could be offered at will decrease, raising the underlying yield to maturity to match the increasing rate of interest. Though this will appear primary and easy as I clarify it, it has proved to be a major supply of confusion.

Yield to Maturity – YTM vs. Spot Rate: What’s the Difference?

For instance, if a bond with a face value of $1,000 presents a coupon rate of 5%, then the bond pays $50 to the bondholder until its maturity. The annual interest payment will proceed to remain $50 for the complete lifetime of the bond till its maturity date irrespective of the rise or fall in the market value of the bond.

The yield is the yield to maturity based mostly on the ask price paid by the investor—the return the investor would get for getting the bond today and holding it to maturity. If the ask price matches the face worth, then the yield would be the same because the coupon. If the ask worth is greater, then the yield might be less than the coupon, and if the ask worth is lower, then the yield shall be greater than the coupon. This will get again to the point I was stressing before about how the coupon fee never adjustments. It pays all the mounted coupon quantities and repays the face worth at the maturity date.