This results in an increase in inventory due to the new purchases and a reduction in cash due to the payment. Thus the following entries will be entered into respective T accounts, i.e. The difference of these accounts is then carried to the unadjusted trial balance in the next step. As you can observe from the above example, all the debit and credits entries have been posted to the appropriate side of the respective t-accounts. This will give the management a holistic view of what is happening in his accounts and if there is anything out of the ordinary occurring.

You will notice that the transaction from January 3 is listed already in this T-account. The next transaction figure of $4,000 is added directly below the $20,000 on the debit side. This is posted to the Unearned Revenue T-account on the credit side. In the last column of the Cash ledger account is the running balance. This shows where the account stands after each transaction, as well as the final balance in the account.

The T-account can also be used in determining the proper account balance or to determine the amount to be entered in order to arrive at a desired balance. I always use two T-accounts when determining how to adjust an account balance. Drawing two T-accounts reminds us that every transaction or adjustment will have to involve at least two accounts because of double-entry accounting. Gift cards have become an important topic for managers of any company. Understanding who buys gift cards, why, and when can be important in business planning. Also, knowing when and how to determine that a gift card will not likely be redeemed will affect both the company’s balance sheet and the income statement . You want the total of your revenue account to increase to reflect this additional revenue.

When Cash Is Debited And Credited

In other words, a journal is similar to a diary for a business. When you enter information into a journal, we say you are journalizing the entry. Journaling the entry is the second step in the accounting cycle. The September 6 purchase of supplies results in an increase in the company’s resources and an equal increase in the company’s sources of resources . Since the company owes $550 for the supplies, the source of resources that increases is liabilities, as shown below. T-accounts and general ledger accounts use the same account titles and account numbers found on the chart of accounts. When you create a T-account, you place the account title and account number at the top of the T.

- A summary showing the T-accounts for Printing Plus is presented inFigure 3.10.

- Placing an amount on the opposite side decreases the account.

- It is not taken from previous examples but is intended to stand alone.

- One T-account reflects the debit entry, and the other T-account contains the credit entry.

- The bottom set of T accounts in the example show that, a few days later, the company pays the rent invoice.

- Debit entries are entered in the left side of the T and credits are entered to the right of the T.

A Credit side entry comes on the right side of a T account. It increases liability, expenses, and owner’s equity accounts and decreases asset and prepaid expense accounts. In accounting , all financial transactions affect at least two of a company’s accounts. One account will get a debit entry while the other one will get a credit entry . A graphic representation of these accounts resembles T shape; hence, any individual account/ledger account is called a T account. All increases to Accounts Receivable are placed on the debit side .

Final General Ledger Including All T

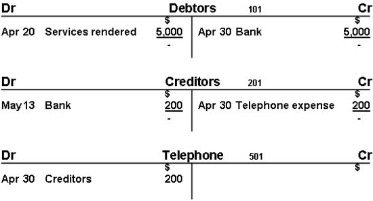

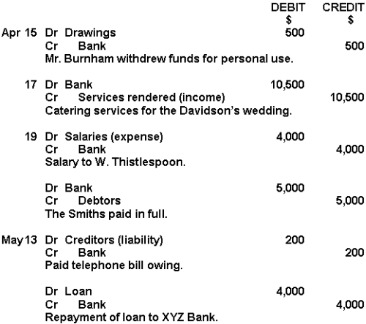

Since each business event can be viewed in two parts, the double-entry system uses T accounts to record both parts. As shown below, a T account consists of two sides, the left side of which is called the debit side and the right side is called the credit side. I was hoping to see double entry on T-accounts for the catering example. Ie credit one account, and debit another with the same amount. Draw a bank account for George’s catering business and obtain the closing balance of the bank account. Prepare the necessary journal entries after reviewing the transactions and post them to necessary T- Accounts.

Before you can begin to use a T-account, you have to understand some basic accounting terms. Product Reviews Unbiased, expert reviews on the best software and banking products for your business. News Learn how the latest news and information from around the world can impact you and your business. Best Of We’ve tested, evaluated and curated the best software solutions for your specific business needs. t account Construction Management CoConstruct CoConstruct is easy-to-use yet feature-packed software for home builders and remodelers. This review will help you understand what the software does and whether it’s right for you. Appointment Scheduling 10to8 10to8 is a cloud-based appointment scheduling software that simplifies and automates the process of scheduling, managing, and following up with appointments.

Total debits amount to $320,000 while total credits amount to $230,000. Therefore, accounts receivable has a debit balance of $90,000.

Business Plan

This liability increases Accounts Payable; thus, Accounts Payable increases on the credit side. Accounts Receivable was originally used to recognize the future customer payment; now that the customer has paid in full, Accounts Receivable will decrease. Accounts Receivable is an asset, and assets decrease on the credit side. Printing Plus provided the services, which means the company can recognize revenue as earned in the Service Revenue account. Service Revenue increases equity; therefore, Service Revenue increases on the credit side. The t-account is often used as a useful tool for accountants and students in analyzing company accounts or in solving accounting problems.

That’s because we increased our rent expense for the amount of the rent. In turn, by paying the rent, we also decreased the amount of cash available in the bank. While we only completed one transaction , two accounts were affected. T-accounts are used as an aid for managing debits and credits when using double-entry accounting.

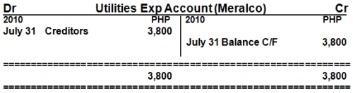

Dividends is a part of stockholder’s equity and is recorded on the debit side. This debit entry has the effect of reducing stockholder’s equity. Paying a utility bill creates an expense for the company. Utility Expense increases, and does so on the debit side of the accounting equation. Printing Plus has not yet provided the service, meaning it cannot recognize the revenue as earned.

Understanding T Accounts

The same process occurs for the rest of the entries in the ledger and their balances. The following are selected journal entries from Printing Plus that affect the Cash account. We will use the Cash ledger account to calculate account balances. Recall that the general ledger is a record of each account and its balance.

What is the difference between T account and ledger?

The key difference between T account and ledger is that T account is a graphical representation of a ledger account whereas ledger is a set financial accounts. Therefore, a ledger can also be interpreted as a collection of T accounts.

A Debit side entry comes on the left side of a T account. A debit entry increases asset and prepaid account balances while it decreases liability and equity account balances. Accounts Payable 50, ,000 80,000 50, , ,000 Liabilities normally have credit balances. Since Accounts Payable are liabilities, all increases are place on the credit side while all decreases are place on the debit side. Total debits amount to $190,000 while total credits amount to $50,000. The balance of Accounts Payable is computed by getting the difference which is equal to $170,000. A T-Account is a visual presentation of the journal entries recorded in a general ledger account.

For large scale businesses where many transactions are conducted, it may not be convenient to enter all transactions in the general ledger due to the high volume. In that case, individual transactions are recorded in subsidiary ledgers and the totals are transferred to an account in the general ledger.

How To Fix An Incorrect Trial Balance

The company was able to collect $220,000 of customers’ accounts. Use the following transaction and t-account to determine the balance of Accounts Receivable. The shape supports the ease of accounting in such a way that all additions and subtractions to the account can be tracked and represented easily. This can help prevent errors while also giving you a better understanding of the entire accounting process. T-accounts can be extremely useful for those struggling to understand accounting principles. The shaded area in an accounting journal is designed to resemble a T-account.

Accounting TransactionAccounting Transactions are business activities which have a direct monetary effect on the finances of a Company. For example, Apple representing nearly $200 billion in cash & cash equivalents in its balance sheet is an accounting transaction. Here is an example of two T-accounts posting the purchase of a car. As you can see, the cash account is credited for the purchase of the car and the vehicles account is debited. Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money. Find out what you need to look for in an applicant tracking system.

A bookkeeper can quickly spot an error if there is one and immediately fix it with the help of this visualization. The total receivables are the sum of all the individual receivable amounts. Thus, the Accounts Receivable general ledger account total is said to be the “control account” or control ledger, as it represents the total of all individual “subsidiary account” balances. A normal balance is the side of the T-account where the balance is normally found. When an amount is accounted for on its normal balance side, it increases that account.

What are the 5 types of accounts?

The chart of accounts organizes your finances into five major categories, called accounts: assets, liabilities, equity, revenue and expenses.

CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle. Occasionally, an account does not have a normal balance.

What Is A T Account And Why Is It Used In Accounting?

Since asset accounts increase through debits, the purchase of supplies will appear as a $300 debit to the supplies account. To increase liability and capital accounts, they are credited. To increase expenses and withdrawals, they are credited. Placing an amount on the opposite side decreases the account. Since so many transactions are posted at once, it can be difficult post them all. In order to keep track of transactions, I like to number each journal entry as its debit and credit is added to the T-accounts. This way you can trace each balance back to the journal entry in the general journal if you have any questions later in the accounting cycle.

Back To The Basics: Use Accounts Payable T

Subsidiary ledgers can include purchases, payables, receivables, production cost, payroll and any other account type. Increase in shareholders equity account will be recorded via a credit entry.

A t-account is one of the simplest ways to present ledger accounts. T-accounts resemble the English letter “T”, hence the name. Debits are entered into the left hand side of a t-account whereas credits into the right hand side. Changes in assets, liabilities and equity items are recorded chronologically in accounts.

General ledger contains all the debit and credit entries of transactions and is separated with classes of accounts. There are five main types of classes or accounts as follows. This section discusses fundamental concepts as they relate to recordkeeping for accounting and how transactions are recorded internally within Indiana University. Information presented below walks through specific accounting terminology, debit and credit, as well as what are considered normal balances for IU. A T-account is a visual structure shaped in the letter T that shows the transactions of an account represented in a company’s general ledger.