A debit to a revenue account (111.11) is decreasing the revenue account’s actual amount . Then, one day, the company accountant visited the office.

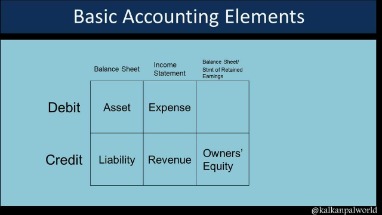

The concept of debits and credits may seem foreign, but the average person uses the concept behind the terms on a daily basis. In accounting, debits or credits are abbreviated as DR and CR respectively. Second, all the debit accounts go first before all the credit accounts. Third, indent and list the credit accounts to make it easy to read. Last, put the amounts in the appropriate debit or credit column.

A Franciscan monk by the name of Luca Pacioli developed the technique of double-entry accounting. Pacioli is now known as the “Father of Accounting” because the approach he devised became the basis for modern-day accounting. Pacioli warned that you should not end a workday until your debits equal your credits. Note that debits are always listed first and on the left side of the table, while credits are listed on the right. If a company pays the rent for the current month, Rent Expense and Cash are the two accounts involved. If a company provides a service and gives the client 30 days in which to pay, the company’s Service Revenues account and Accounts Receivable are affected. These are net asset entries (or the value of a company’s non-operational assets after liabilities have been paid).

What Are Some Examples Of Current Liabilities?

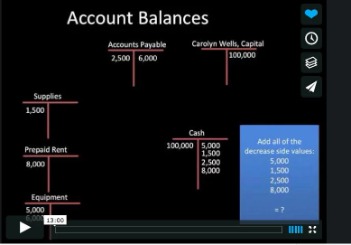

In an accounting journal, increases in assets are recorded as debits. The double entry accounting system provides a system of checks and balances. By summing up all of the debits and summing up all of the credits and comparing the two totals, one can detect and have the opportunity to correct many common types of bookkeeping errors. You will increase your accounts receivable balance by the invoice total of $107, with the revenue recognized when the transaction takes place. Cost of goods sold is an expense account, which should also be increased by the amount the leather journals cost you.

A trial balance is a standard format used by accountants to prepare financial statements , which allows the company’s financial activities to be shared in an easily understood fashion. You can see which accounts are debit accounts and credit accounts in QuickBooks. You will then see all the postings done to that account. There is logic behind which accounts maintain a negative balance. It makes sense that Liability accounts maintain negative balances because they track debt, but what about Equity and Revenue?

What Effect Does Declaring A Cash Dividend Have On Stockholders’ Equity?

I did not have a formal accounting background when I started working in investment banking. I had taken several courses in college, but that was the extent of my education prior to taking an analyst role. On account of my limited exposure, debits and credits did not come naturally to me at first. Each transaction is recorded using a format called a journal entry. Dividends are a special type of account called a contra account. Common expenses include wages expense, salary expense, rent expense, and income tax expense. So, to add or subtract from each account, you must use debits and credits.

You write a check for $300, which results in a credit of $300. Or the store may “credit” your charge card – giving money back to you.

- Debits and credits form the basis of the double-entry accounting system of a business.

- The initial challenge is understanding which account will have the debit entry and which account will have the credit entry.

- Recording transactions into journal entries is easier when you focus on the equal sign in the accounting equation.

- You will then see all the postings done to that account.

- The inventory account, which is an asset account, is reduced by $55, since five journals were sold.

Fiscal Foundations has branch offices in Minneapolis/St Paul and Denton, TX. Our long term business plan includes establishing branches in major metropolitan areas around the country. We hope to attract professional bookkeepers/accountants and QuickBooks ProAdvisors such as yourself (I checked out your website too!) to join us when the time is right. In 2012, we will be interviewing debits and credits for our Denton TX Branch, managed by an Advanced Certified QuickBooks ProAdvisor. If you’re interested in relocating to the Dallas/Ft Worth area and wish to be considered, feel free to contact us at The cardinal rule of bookkeeping is that DEBITS must equal CREDITS. Product Reviews Unbiased, expert reviews on the best software and banking products for your business.

What Are Debits And Credits?

Conversely, credits decrease expenses or assets and increase equity or liability. Let’s review the basics of Pacioli’s method of bookkeeping or double-entry accounting. On a balance sheet or in a ledger, assets equal liabilities plus shareholders’ equity. An increase in the value of assets is a debit to the account, and a decrease is a credit. On the other hand, when a utility customer pays a bill or the utility corrects an overcharge, the customer’s account is credited. If the credit is due to a bill payment, then the utility will add the money to its own cash account, which is a debit because the account is another Asset. Again, the customer views the credit as an increase in the customer’s own money and does not see the other side of the transaction.

Liability accounts record debts or future obligations a business or entity owes to others. When one institution borrows from another for a period of time, the ledger of the borrowing institution categorises the argument under liability accounts. Asset accounts are economic resources which benefit the business/entity and will continue to do so. Debit cards and credit cards are creative terms used by the banking industry to market and identify each card. From the cardholder’s point of view, a credit card account normally contains a credit balance, a debit card account normally contains a debit balance. A debit card is used to make a purchase with one’s own money. A credit card is used to make a purchase by borrowing money.

The two sides of the account show the pluses and minuses in the account. Accounting uses debits and credits instead of negative numbers.

Accounting Topics

However, you will notice that some of the accounts have a greater number of debits, while others have a greater number of credits. The accounts carrying a debit balance are Bank Account, Bank Loan, Interest Expense, and Office Supplies Expense. The Owner Equity account is the only account carrying a credit balance.

We aim to complete your annual accounts well ahead of schedule to ensure you have complete financial records. Show bioRebekiah has taught college accounting and has a master’s in both management and business. Accounting Game – Debits and Credits is designed to challenge and teach common accounting transactions in a visually entertaining and engaging way. To practice T-account transactions, download Accounting Game – Debits and Credits, the free Apple App. Smaller firms invest excess cash in marketable securities which are short-term investments. Kashoo is an online accounting software application ideally suited for start-ups, freelancers, and small businesses.

Debits and credits can mean either increasing or decreasing for different accounts, but their T Account representations look the same in terms of left and right positioning in relation to the “T”. My goal is to help you learn finance skills and Excel so you can improve your financial life. I have taught financial skills and Excel to thousands of students. This works for students learning principles of accounting or financial accounting. However, only $6,000 is in cash because the other $4,000 is still owed to Andrews. To review the revenues, expenses, and dividends accounts, see the following example. Debit means to put an entry on the left side of the account.

The Double Entry System

So if you complete a transaction that increases assets , you must also increase the equity or liability so that Assets remain equal to Equity and/or Liability. Using T Accounts, tracking multiple journal entries within a certain period of time becomes much easier.

So, now that you have the basics down, let’s talk a little about what debits and credits are. Debits and credits are both forms of notation that are used in accounting to keep the balance in accounts. A debit is an entry on the left side of the T-account that increases asset and prepaid expense balances and decreases liability and equity account balances. A credit, the opposite of a debit, is an entry on the right side of the T-account. It increases liability, expense, and owner’s equity accounts and decreases asset and prepaid expense accounts. It can seem a little confusing to understand debits and credits, so let’s look at an example.

Whats does CR mean?

In accounting, cr. is the abbreviation for credit. In accounting and in bookkeeping, credit or cr. indicates an entry on the right side of a general ledger account.

Another theory is that DR stands for “debit record” and CR stands for “credit record.” Finally, some believe the DR notation is short for “debtor” and CR is short for “creditor.” The term debit comes from the word debitum, meaning “what is due,” and credit comes from creditum, defined as “something entrusted to another or a loan.” An increase in liabilities or shareholders’ equity is a credit to the account, notated as “CR.” ScaleFactor is on a mission to remove the barriers to financial clarity that every business owner faces. To debit an account means to enter an amount on the left side of the account. To credit an account means to enter an amount on the right side of an account. You can earn our Debits and Credits Certificate of Achievement when you join PRO Plus.

Issuing Stock For Cash

Accounting books will say “Accounts that normally have a positive balance are increased with a Debit and decreased with a Credit.” Of course they are! You owe your Dad $300, so you might say your account balance is -$300. You borrow another $100, which results in a credit to the loan account. You move to the LEFT on the number line because you credit the account.

Owners’ equity, a credit account, includes capital invested by the original investors and retained earnings and surplus. The overall value of your assets must equal the value of your liabilities plus the value of your equity. Calculate the ending balance in each account and update the balance sheet. Remember, your balance sheet is appropriately named because it must always stay in balance. Whenever there is an accounting transaction, at least two accounts will always be impacted. Remember that if you debit one account, you’re going to need to credit the opposite account. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes.