What is a book steadiness and an obtainable balance?

To initially fund a petty cash account, the accountant should write a check made out to “Petty Cash” for the specified amount of cash to keep on hand after which money the verify on the company’s bank. The journal entry on the balance sheet should list a debit to the enterprise bank account and a credit to the petty money account. When petty money is used for business expenses, the suitable expense account — such as workplace provides or employee reimbursement — must be expensed. The CFPB additionally wants customers to know that deposits can clear particularly shortly in the event that they’re produced from an account at the similar bank, from a authorities check, or via cash, money order, or certified examine. Although this may be inconvenient, these holds can defend you.

Sometimes you’ll see an available balance that’s lower than your account balance. In those cases, you possibly can solely spend your obtainable stability (or much less if you have excellent checks), and the rest of the cash is being held by your financial institution.

However, banks and authorities organizations have the authority to place restrictions on financial institution accounts. A restricted account might restrict or forestall you from withdrawing funds. It may even limit the variety of deposits you can also make and checks you possibly can write. In some instances, an account holder can place restrictions on his personal account.

During such a freeze, the investor may continue to buy securities; nevertheless, they need to pay for the trades in full on the date they’re made. When a checking account is frozen, it could be because of money owed to another individual or enterprise. Account freezes may also be the results of outstanding debt to the Internal Revenue Service (IRS).

So when you spend themoney from a foul verify, you may have to replace those funds in your checking account (plus pay charges to your bank). Also, you could find yourself bouncing checks of your personal and racking up fees consequently. A e-book balance is the account balance in a company’s accounting records. The time period is most commonly utilized to the stability in a company’s checking account on the end of an accounting interval.

You can nonetheless make deposits, however you are unable to withdraw funds. If your account has been overdrawn as a result of insufficient funds, the financial institution probably will prohibit your account. Any checks written or pending purchases against the account could also be declined. When your account is no longer within the negative, it’s restored to good standing, and the restrictions are lifted.

The data entry display for the Project Costing distribution program is displayed under. When reconciling the bank statement, the steadiness per books is the steadiness of the Cash account within the general ledger that pertains to the bank account. “How Quickly Can I Get Money After I Deposit a Check Into My Checking Account? What Is a Deposit Hold?” Accessed April 1, 2020. Now, start bank reconciliation statement with updated money guide stability. It‘s not obligatory to prepare a BRS and there’s no fixed date for preparing BRS.

How do you calculate adjusted cash balance per book?

balance per books definition. The amount appearing in the general ledger. When reconciling the bank statement, the balance per books is the balance of the Cash account in the general ledger that pertains to the bank account.

steadiness per books definition

In different words, BRS is an announcement which is prepared for reconciling the difference between balances as per cash guide’s financial institution column and passbook on a given date. Note that the Balance Sheet is not affected with the results of the above entry as the money flow is between two asset accounts. A financial institution levy is a UK tax on banks, forcing them to pay government taxes over and above any normal corporate taxes they could incur. A financial institution levy additionally refers to the legal act of freezing a bank account in an try to get well a debt. Regulators or a court might freeze accounts if the account holder fails to disburse funds which are due or other violations.

- A restricted account could limit or prevent you from withdrawing funds.

- However, banks and authorities organizations have the authority to place restrictions on financial institution accounts.

- It may even limit the variety of deposits you can make and checks you can write.

Although banks have gotten more digital and tech-savvy, it could take up to a number of days for brand new funds to turn out to be obtainable to withdraw as cash or write checks on. When you deposit a check or receive a direct deposit in your checking account, you might count on the money to be accessible instantly, however this may not always be the case. Government agencies can place restrictions on a checking account. If you fail to pay your taxes, the Internal Revenue Service has the ability to grab property, together with your checking account.

In addition to financial institution accounts, brokerage accounts may also be frozen by the Federal Reserve Board underneath the stipulations of Regulation T concerning money accounts and the acquisition of securities. A 90-day freeze is finished to stop free-using, a prohibited act the place an investor attempts to purchase and sell securities with out absolutely paying for them.

In those instances, you’ll be able to solely spend your available stability (or less when you have outstanding checks), and the rest of the money is being held by your financial institution. Current balances embody all of your cash, including all out there funds PLUS funds that are being held.

What is difference between book balance and available balance?

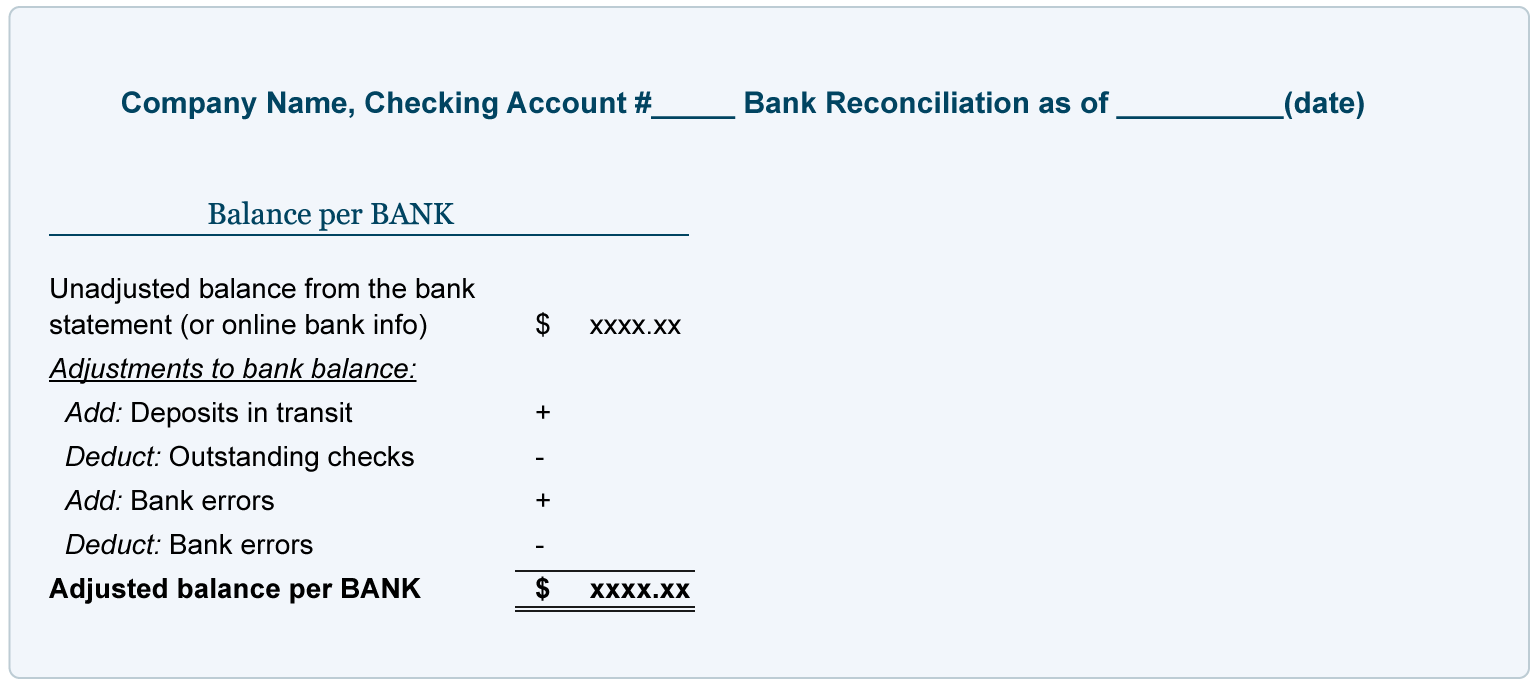

Bank Reconciliation Procedure: Using the cash balance shown on the bank statement, add back any deposits in transit. Deduct any outstanding checks. This will provide the adjusted bank cash balance. Next, use the company’s ending cash balance, add any interest earned and notes receivable amount.

Sometimes the financial institution balances as per money book and bank statement doesn’t match. In case balance available within the passbook doesn’t match the financial institution column of the cash e-book, the business should identify the explanations for the same. A contra entry is recorded when the debit and credit affect the identical mother or father account and leading to a web zero impact to the account. These are transactions which might be recorded between cash and bank accounts.

Upon acceptance of the Project Costing distribution the General Ledger Distribution window is displayed allowing customers to document distribution to the General Ledger. The knowledge entry display screen for the General Ledger distribution program is displayed below. Select OK to simply accept the adjustment entry or Cancel to change the adjustment amount area.

The firm may generally report a deposit incorrectly, or it could deposit a examine for which there aren’t adequate funds. If so, and the financial institution spots the error, the company must regulate its book stability to appropriate the error.

BRS is prepared on a periodical foundation for checking that financial institution related transactions are recorded properly in money guide’s bank column and in addition by the financial institution in their books. BRS helps to detect errors in recording transactions and determining the exact bank steadiness as on a specified date. For reconciling the balances as proven in the Cash Book and passbook a reconciliation statement is prepared known as Bank Reconciliation Statement or BRS.

Free Accounting Courses

An group uses the bank reconciliation process to check its e-book stability to the ending money stability in the financial institution assertion offered to it by the company’s bank. In previous accounting ideas, we now have looked on the totally different kinds of financial statements a enterprise prepares. Some examples of this are the balance sheet, revenue assertion, and cash flow assertion. Sometimes you’ll see an obtainable balance that’s decrease than your current stability.

Bank Reconciliation Statement

If your employer nonetheless pays you with a check, join digital payments so that the cash goes directly from your employer’s bank account to your checking account. You don’t need to wait on the verify (especially if it goes by way of the mail), and also you don’t have to go to the trouble of depositing the check. As a bonus, the cash would possibly even hit your account a day or two before the checks are printed, and a few banks supply same-day availability for those payments.

One cause banks do this is so that they can ship the vast majority of the day’s work on to the processing heart in order that everything can be handled by midnight. The petty cash account ought to be reconciled and replenished every month to ensure the account is balanced and any variances are accounted for. The accountant should write a examine made out to “Petty Cash” for the amount of bills paid for with the petty cash that month to convey the account again up to the unique quantity. The check should be cashed on the company’s bank and the cash positioned back within the petty cash safe or lock box. Petty cash is a present asset and must be listed as a debit on the corporate steadiness sheet.