Your pension liability can be figured out by subtracting the total amount due to retirees from the money you plan on using to make the pension payments. When you acquire a capital lease for an asset, all the rights and ownership transfer to you. For example, say you own a construction company and you use capital leases to get the equipment you need. For each year you have the equipment, you will pay a certain amount of money to the lessor. You also will pay insurance, maintenance, taxes, and the other costs associated with the equipment. These can include wages, interest, taxes, and other expenses that build up for your small business. They include expenses that your small business plans to pay at a future date.

You’ll be able to see how your business responds to changes over time. After making adjustments, you will need to make sure that your assets equal your liabilities added to your equity. Organize your assets, liabilities, and shareholders’ equity into the classifications or subcategories. These loans are paid off in a time period that is longer than one year. These involve money that your small business has received in advance of delivering goods or services to a customer. For example, a customer may use a deposit to hold certain goods before they can be delivered. This equation can be broken down further by looking at each section in depth.

What is a bad balance sheet?

The debt ratio is simply total debt divided by total assets. A debt ratio of less than 1 tells us the company has more assets than debt, so the lower the ratio, the stronger the balance sheet. … Here again, a higher debt-to-equity ratio is a sign of a weaker balance sheet.

Often, the reporting date will be the final day of the reporting period. Similar to a balance sheet, your pro forma balance sheet lists your assets, liabilities, and shareholders’ equity. However, pro forma balance sheets often predict the “snapshot” of your small business’s finances at a certain date in the future. For example, pro forma balance sheets can provide snapshots across a five-year period, compared to only the single year’s snapshot that’s provided on a balance sheet. This allows you to look for financial trends over those five years and make key assumptions. This will be especially relevant for forecasting and budgeting for your small business. The final section of the balance sheet equation is your shareholders’ equity.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Depreciation is calculated and deducted from most of these assets, which represents the economic cost of the asset over its useful life. If you are a shareholder of a company or a potential investor, it is important to understand how the balance sheet is structured, how to analyze it and how to read it. Eric is currently a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer.

Guide To Balance Sheet Projections

In time, it becomes a basis for founders to make smart business decisions. One of the main reasons to learn to create a balance sheet is to make reliable business decisions. In fact, without consistent balance sheets, you won’t be able to make calculated decisions. It refers to the items you own in the startup business, such as accounts receivables, plants, equipment, property, vehicles, and cash reserves. On the surface, a balance sheet serves as the source to assess the financial capabilities and strengths of the startup business.

- Management’s analysis of financial statements primarily relates to parts of the company.

- For assets themselves, liquidity is an asset’s ability to be sold without causing a significant movement in the price and with minimum loss of value.

- A balance sheet gives a snapshot of your financials at a particular moment, incorporating every journal entry since your company launched.

- Also called the statement of financial position, it reveals the overall financial health of a business at the end of a reporting period, such as a year, quarter, or month.

- Calculating your net worth is a simple calculation now that you have this info.

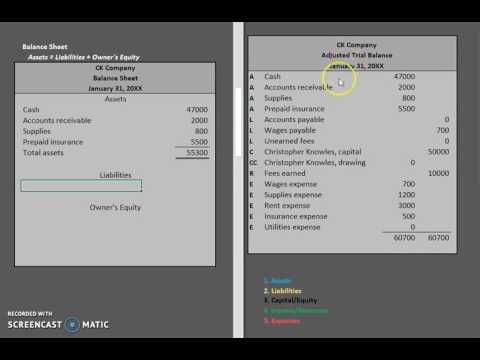

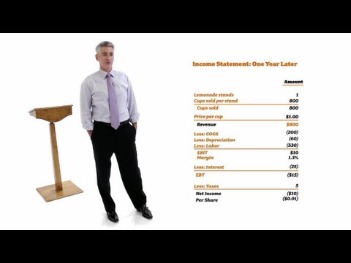

No balance sheet statement is complete without an income statement to go along with it. Next, if you’re tracking fixed assets, you’ll want to include the total of your fixed assets. Add your current and fixed asset totals to arrive at your assets total. Assets are usually divided into two categories on your balance sheet, current assets and long-term assets. Current assets are considered anything that can be converted into cash quickly. A balance sheet is not affected by adjusting journal entries or closing entries, nor does your balance sheet directly affect your net income and your cash flow statement. A balance sheet, like a profit and loss statement and cash flow statement, is designed to be distributed to people outside of a company.

We’re here to take the guesswork out of running your own business—for good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month. It is also convenient to compare the current assets with the current liabilities.

How To Prepare A Balance Sheet For A Startup Company

Current liabilities are the company’s liabilities that will come due, or must be paid, within one year. This includes both shorter-term borrowings, such as accounts payables, along with the current portion of longer-term borrowing, such as the latest interest payment on a 10-year loan. Assets are what a company uses to operate its business, while its liabilities and equity are two sources that support these assets. Along with the income statement and the statement of cash flows, the balance sheet is one of the main financial statements of a business.

The operating cash flow ratio can be calculated by dividing the operating cash flow by current liabilities. This indicates the ability to service current debt from current income, rather than through asset sales. In financial accounting, owner’s equity consists of the net assets of an entity. Net assets is the difference between the total assets of the entity and all its liabilities. Equity appears on the balance sheet, one of the four primary financial statements. In accounting and finance, equity is the residual claim or interest of the most junior class of investors in assets, after all liabilities are paid. Unless you have a very small business, it can be extremely difficult to prepare a balance sheet manually.

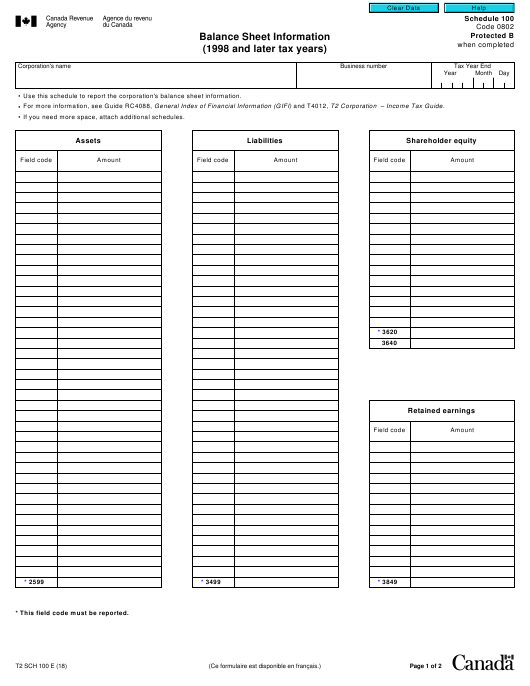

How To Prepare A Balance Sheet

Retained earnings are the amount of profit a company has earned for a particular time period. Intangible assets refer to non-monetary assets that have no physical substance and will last more than 1 year. These include patents, copyrights, trademarks, and other rights.

For you, the small business owner, your balance sheet can show you the scope, organization, and direction of your small business’s financial health. For a pro forma balance sheet, as with a regular balance sheet, you calculate the equity by subtracting your liabilities from your assets. Study the liabilities on your current balance sheet and make adjustments. You can subtract that from your current balance sheet’s number. One way to make predictions for your small business’s financial health is by creating a pro forma balance sheet.

We’ll pair you with a bookkeeper who will prepare your financial statements for you—so you’ll always know where you stand. A balance sheet gives a snapshot of your financials at a particular moment, incorporating every journal entry since your company launched. It shows what your business owns , what it owes , and what money is left over for the owners (owner’s equity). You could lose money by investing in a money market mutual fund. The money market funds offered by Brex Cash are independently managed and are not affiliated with Brex Treasury. Yield is variable, fluctuates and is inclusive of reduced expense fees, as determined solely by the fund manager. See program disclosures and the applicable fund prospectus before investing for details and other information on the fund.

A Sample Balance Sheet

The balance sheet informs company owners about the net worth of the company at a specific point in time. This is done by subtracting the total liabilities from the total assets to calculate the owner’s equity, also known as shareholder’s equity or simply the net worth.

What happens if the balance sheet doesn’t balance?

If the Balance Sheet still doesn’t balance after step 2, it can only mean one thing. It must mean there is at least one line on the Balance Sheet that is moving period to period without a corresponding Cash Flow Statement change or an offsetting Balance Sheet change.

In order for the balance sheet to balance, total assets on one side have to equal total liabilities plus shareholders’ equity on the other side. A company’s balance sheet, also known as a “statement of financial position,” reveals the firm’s assets, liabilities and owners’ equity . The balance sheet, together with the income statement and cash flow statement, make up the cornerstone of any company’s financial statements. By examining a sample balance sheet and income statement, small businesses can better understand the relationship between the two reports. Every time a company records a sale or an expense for bookkeeping purposes, both the balance sheet and the income statement are affected by the transaction. The balance sheet and the income statement are two of the three major financial statements that small businesses prepare to report on their financial performance, along with the cash flow statement. A non-current asset is a term used in accounting for assets and property which cannot easily be converted into cash.

This Business Builder will explain what data is necessary for accurate financial statements, but answering the following questions might be a good place to start. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

Financial modeling is performed in Excel to forecast a company’s financial performance. Overview of what is financial modeling, how & why to build a model. Line 6 lists accounts payable, which are the short-term credit accounts you owe your suppliers. With a greater understanding of a balance sheet and how it is constructed, we can review some techniques used to analyze the information contained within a balance sheet. The line items for each side are listed in order of liquidity, with the more liquid items (e.g., cash and inventory) listed before accounts that are more illiquid (e.g., plant, property, and equipment). If you run your own business or are just getting into accounting, creating a balance sheet could seem difficult.

Personal Balance Sheet Example

With this information in mind, let’s go over the process of creating a balance sheet step-by-step. All of HubSpot’s marketing, sales CRM, customer service, CMS, and operations software on one platform. Add the “Total Liabilities” and “Total Owner’s Equity” figures. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice.

A company’s equity represents retained earnings and funds contributed by its shareholders. In this article, we describe what balance sheets are, explain how to create one and provide both a template and a sample to help balance sheet example you create your own. Regardless of the size and nature of a company, balance sheets can reveal crucial information, such as the organization’s net worth, the amount of capital it has and where the capital is located.

Notes payable refers to any money due on a loan during the next 12 months. Accrued payroll taxes would be any compensation to employees who have worked, but have not been paid at the time the balance sheet is created. As a powerful document that lets a business work with its finances to establish a workable balance, a balance sheet affects the way a company handles its finances and forecast into the future. Also called the statement of financial position, it reveals the overall financial health of a business at the end of a reporting period, such as a year, quarter, or month.

How To Claim Losses From A Small Business On Taxes

She has consulted with many small businesses in all areas of finance. She was a university professor of finance and has written extensively in this area. Capital employed, also known as funds employed, is the total amount of capital used for the acquisition of profits. Then, you’ll subtotal and total these the same way you did with your assets.

Here, make a list of all the equity accounts like common stock, treasury stock, and the retained earnings number from Step 1. Add the current liabilities subtotal to the long-term liabilities subtotal. Label this line “Total Liabilities.” The balance for total liabilities will be shown on the second part of your balance sheet and will be added to the owner’s equity. In this way, the income statement and balance sheet are closely related.

Liquidity – The ability to produce cash from assets in a short period of time. Other assets are generally intangible assets—such as patents, royalty arrangements and copyrights. This Business Builder assumes that you are familiar with depreciation and have already selected a depreciation method and are comfortable with its application. If you are not familiar with depreciation, you can still prepare a balance sheet. It will provide you with similar benefits, but it will not be in conformance with GAAP.

Assets have value because a business can use or exchange them to produce the services or products of the business. Finally, you’ll need to calculate the amount of money you have invested in the company. Liabilities are considered obligations that your business has. For example, liabilities include accounts payable, interest payable, wages and salary payable, and customer deposits. Also known as fixed assets, long-term assets include land, machinery, equipment, as well as intangible assets such as patents and trademarks. Balance sheet totals can also be used when performing any kind of accounting calculations such as accounting ratios or creating projections for your business. You’ll also find fixed costs such as loans and notes payable on a balance sheet.