Assets on a balance sheet are classified into current assets and non-current assets. The Balance Sheet is used for financial reporting and analysis as part of the suite of financial statements.

The balance sheet details what a business owns , what it owes , and its worth (shareholder or owner’s equity) at a specific point in time, such as the start date or end date of a fiscal year. In the simplest terms, the balance sheet subtracts what you owe from what you own to calculate your business’s net worth. If you’re using cloud accounting software, you’ll have the benefit of up-to-date financial information and, potentially, access to real-time data in your financial statements. Your asset performance measures how well you can take your operational resources and use them to generate revenue and profit as a trading company. The stronger your current year earnings are, the better the company’s assets is performing. They include things such as taxes, loans, wages, accounts payable, etc. The balance sheet is also known as the statement of financial position.

- Assets include physical property, such as plants, trucks, equipment and inventory.

- Anything a company owes to a third party is called a “liability.” Just like assets, liabilities are usually displayed on a balance sheet according to their due date.

- If you can read a nutrition label or a baseball box score, you can learn to read basic financial statements.

- A balance sheet provides the information for making these comparisons.

- Cash, receivables, and liabilities on the Balance Sheet are re-measured into U.S. dollars using the current exchange rate.

- The notes contain specific information about the assets and costs of these programs, and indicate whether and by how much the plans are over- or under-funded.

The balance sheet is a very important financial statement for many reasons. It can be looked at on its own and in conjunction with other statements like the income statement and cash flow statement to get a full picture of a company’s health. A balance sheet is a financial statement that reports a company’s assets, liabilities, and shareholder equity.

Formulating A Balance Sheet: Assets, Liabilities, And Equity

Whether you’re doing your own accounting with accounting software, or you hired an accountant to prepare your financial statements, you’ve likely seen the balance sheet. The balance sheet, along with the income statement and statement of cash flows, provides an overview of a business’ financial standing. Working with both the balance sheet and income statement can reveal how efficiently a company is using its current assets. The asset turnover ratio is one way to gauge efficiency by dividing a company’s revenue by its fixed assets to find out how the company is converting its assets into income. The line items towards the top of the assets section are the most liquid, meaning those assets can be converted to cash the fastest. Although the balance sheet is an invaluable piece of information for investors and analysts, there are some drawbacks.

Is money an asset?

In short, yes—cash is a current asset and is the first line-item on a company’s balance sheet. Cash is the most liquid type of asset and can be used to easily purchase other assets.

This number tells you the amount of money the company spent to produce the goods or services it sold during the accounting period. An income statement is a report that shows how much revenue a company earned over a specific time period . An income statement also shows the costs and expenses associated with earning that revenue. The literal “bottom line” of the statement usually shows the company’s net earnings or losses. This tells you how much the company earned or lost over the period.

It also includes an Excel spreadsheet that will calculate key ratios when you input financial data. If you need debt collection assistance, we are specialists in large business-to-business claims, and we can refer you to other agencies if your needs do not fit with our expertise.

Whats Included In An Income Statement?

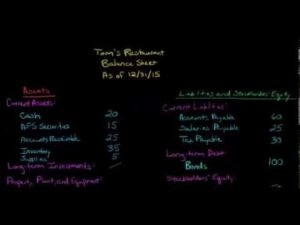

Unlike the income statement, the balance sheet does not report activities over a period of time. The balance sheet is essentially a picture a company’s recourses, debts, and ownership on a given day. This is why the balance sheet is sometimes considered less reliable or less telling of a company’s current financial performance than a profit and loss statement. Annual income statements look at performance over the course of 12 months, where as, the statement of financial position only focuses on the financial position of one day. The current liabilities of most small businesses include accounts payable, notes payable to banks, and accrued payroll taxes.

When reviewing a balance sheet, the two columns will reflect the balance sheet equation with line-item accounts showing how the two sides add up. Lenders and creditors consider balance sheet data when making decisions on whether a company qualifies for bank loans or a corporate credit card. Potential investors analyze a company’s performance by examining what a business owns versus what it owes. These scenarios are three of the most typical, but there are many other uses for a balance sheet. By comparing your income statement to your balance sheet, you can measure how efficiently your business uses its assets.

Establish The Reporting Date And Period

We’re not talking about non interest-bearing liabilities, which are also debts, such as accounts payable. And equity, as you recall, is the amount of money that shareholders have invested in the company plus net income that has been earned and retained over the years. When evaluating company strength using debt to equity ratios, the smaller the ratio, the better, as a company is financially stronger the less debt it has compared to equity. However, in many industries, it is normal for debt to be several times the amount of equity, although as that ratio gets higher and higher it begins to be known as ‘junk debt’ rather than at investment grade.

Just as a CPR class teaches you how to perform the basics of cardiac pulmonary resuscitation, this brochure will explain how to read the basic parts of a financial statement. It will not train you to be an accountant , but it should give you the confidence to be able to look at a set of financial statements and make sense of them. If you can read a nutrition label or a baseball box score, you can learn to read basic financial statements.

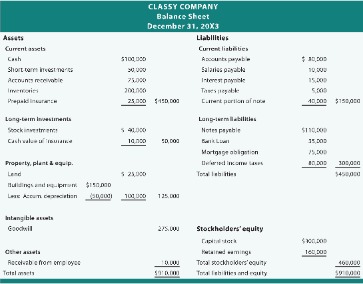

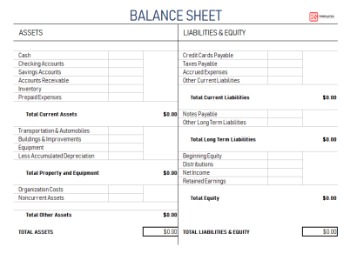

The three items needed for the balance sheet equation are the assets, liabilities, and equity. Here’s a closer look at how to make a balance sheet using the three parts. List your assets in order of liquidity, or how easily they can be turned into cash, sold or consumed. Anything you expect to convert into cash within a year are called current assets.

Although the income statement and balance sheet have many differences, there are a couple of key things they have in common. Along with the cash flow statement, they make up three major financial statements.

The Basic Equation

Here is an example of how to prepare the balance sheet from ourunadjusted trial balanceandfinancial statementsused in the accounting cycle examples for Paul’s Guitar Shop. Pension plans and other retirement programs – The footnotes discuss the company’s pension plans and other retirement or post-employment benefit programs. The notes contain specific information about the assets and costs of these programs, and indicate whether and by how much the plans are over- or under-funded. Income taxes – The footnotes provide detailed information about the company’s current and deferred income taxes. The information is broken down by level – federal, state, local and/or foreign, and the main items that affect the company’s effective tax rate are described.

A clean balance sheet refers to a company whose capital structure is largely free of debt. Deferred tax liability is the amount of taxes that accrued but will not be paid for another year. Besides timing, this figure reconciles differences between requirements for financial reporting and the way tax is assessed, such as depreciation calculations. Accounts receivable refer to money that customers owe the company. This may include an allowance for doubtful accounts as some customers may not pay what they owe. Sage 50cloud is a feature-rich accounting platform with tools for sales tracking, reporting, invoicing and payment processing and vendor, customer and employee management.

If you run your own business or are just getting into accounting, creating a balance sheet could seem difficult. In this post, we’ll demystify the balance sheet and look at some templates you can use to create your own. Depending upon the legal structure of your practice, owners’ equity may be your own , collective ownership rights or stockholder ownership plus the earnings retained by the practice to grow the business . Although Brex Treasury does not charge transaction or account fees, money market funds bear expenses and fees. Sending wire transfers is free for Brex Cash customers, but the recipient’s financial institution may charge a wire receipt fee. Knowing how to create and read a company’s balance sheet is essential to understanding the state of a business. You can generate a balance sheet for any specified period—many companies will create a multi-year balance sheet that compares how a firm has progressed over its recent history.

This is expenses incurred by the business, for which no supplier invoice has yet been received. This includes all raw materials, work in process, and finished goods items, less an obsolescence reserve. This includes any prepayment that is expected to be used within one year.

Working Capital

The final efficiency ratio going to look at is the accounts payable days outstanding. For companies thinking about doing business with this company, this is a very important ratio as you want to know how fast you will get paid. To calculate it we simply take the accounts payable balance and divide it by the cost of goods sold and then multiply that by 365 days. The reason we use cost of goods sold instead of sales in this calculation is that payables are associated with costs, not revenues. For companies where costs of goods sold is a small portion of total operating expenses, it may be better to use costs of goods sold plus operating expenses as the denominator in the equation. Companies who are thinking about providing credit to this business should feel very comfortable with this number. Investors, creditors, and regulatory agencies generally focus their analysis of financial statements on the company as a whole.

What is balance sheet and example?

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. It can also be referred to as a statement of net worth or a statement of financial position. The balance sheet is based on the fundamental equation: Assets = Liabilities + Equity.

They offer a snapshot of what your business owns and what it owes as well as the amount invested by its owners, reported on a single day. A balance sheet tells you a business’s worth at a given time, so you can better understand its financial position. A balance sheet is meant to depict the total assets, liabilities, and shareholders’ equity of a company on a specific date, typically referred to as the reporting date. Often, the reporting date will be the final day of the reporting period. Below is an example of Amazon’s 2017 balance sheet taken from CFI’s Amazon Case Study Course. As you will see, it starts with current assets, then non-current assets, and total assets.

Liquidity also refers both to a business’s ability to meet its payment obligations, in terms of possessing sufficient liquid assets, and to such assets themselves. For assets themselves, liquidity is an asset’s ability to be sold without causing a significant movement in the price and with minimum loss of value. Liquidity refers to a business’s ability to meet its balance sheet example payment obligations, in terms of possessing sufficient liquid assets, and to such assets themselves. For assets, liquidity is an asset’s ability to be sold without causing a significant movement in the price and with minimum loss of value. Equity is the residual claim or interest of the most junior class of investors in assets, after all liabilities are paid.

At the top of the income statement is the total amount of money brought in from sales of products or services. It’s called “gross” because expenses have not been deducted from it yet. A company’s assets have to equal, or “balance,” the sum of its liabilities and shareholders’ equity.

If a company’s functional currency is the U.S. dollars, then any balances denominated in the local or foreign currency, must be re-measured. Days cash on hand measures liquidity and estimates how many days of organizational expenses could be covered with current cash balances. The balance sheet – also called the Statement of Financial Position – serves as a snapshot, providing the most comprehensive picture of an organization’s financial situation.

In general, legal intangibles that are developed internally are not recognized, and legal intangibles that are purchased from third parties are recognized. Therefore, there is a disconnect–goodwill from acquisitions can be booked, since it is derived from a market or purchase valuation. However, similar internal spending cannot be booked, although it will be recognized by investors who compare a company’s market value with its book value. A company can be endowed with assets and profitability but short of liquidity if its assets cannot readily be converted into cash.

For this company they have very little interest expense and quite a bit of operating profit, so their interest coverage ratio is extremely healthy. The last component of the balance sheet is owner’s equity, sometimes referred to as net worth.