With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity. In accounting and business, the breakeven point is the production level at which total revenues equal total expenses. Companies seek to maximize profit by reducing unit costs and optimizing the market offering price. A business’s break-even point is the stage at which revenues equal costs. Once you determine that number, you should take a hard look at all your costs — from rent to labor to materials — as well as your pricing structure.

Financial Institutions Integrate our services with yours to solidify your place as a trusted advisor for your commercial banking customers. Asymmetric information is, just as the term suggests, unequal, disproportionate, or lopsided information. It is typically used in reference to some type of business deal or financial arrangement where one party possesses more, or more detailed, information than the other. Mariel Loveland is a small business owner, content strategist and writer from New Jersey. Throughout her career, she’s worked with numerous startups creating content to help small business owners bridge the gap between technology and sales.

How To Calculate Cost Per Unit

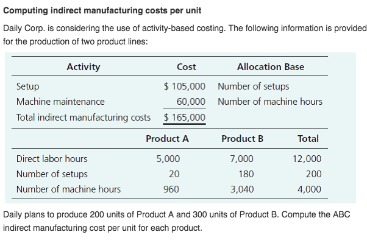

In this example, it can be seen that the total cost of production is directly proportional to the level of production. After this, it should calculate the total amount of money spent on the variable cost during the period by adding all the expenditure incurred on the variable cost for the period. The unit cost, also known as thebreakeven point, is the minimum price at which a company must sell the product to avoid losses.

What is the formula for cost price and selling price?

Following is the step-by-step procedure to calculate the selling price per unit: Identify the total cost of all units being bought. Divide the total cost by the number of units bought to obtain the cost price. Use the selling price formula to find out the final price i.e.: SP = CP + Profit Margin.

Enter the total cost per unit and the total weight per unit in ounces into the calculator to determine the cost per ounce. For more information on this, you can visit the price per unit calculator linked below. Your total fixed cost is simply the result when you add up each individual fixed cost. Once you know the total fixed cost of your business, you can use that information in various ways.

Sales

Your total variable cost is equal to the variable cost per unit, multiplied by the number of units produced. Your average variable cost is equal to your total variable cost, divided by the number of units produced. Make sure to be clear about which costs are fixed and which ones are variable. Take your total cost of production and subtract your variable costs multiplied by the number of units you produced. A unit cost is the total expenditure spent to produce an individual unit of goods or services. This is determined by adding fixed costs with variable costs for production or service delivery. It is usually simpler to calculate the cost of total production per run or period of time and then divide the amount by the number of units produced.

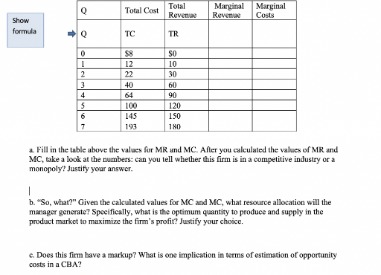

How do you calculate marginal cost from cost function?

Marginal cost is the derivative of the cost function, so take the derivative and evaluate it at x = 100. Thus, the marginal cost at x = 100 is $15 — this is the approximate cost of producing the 101st widget.

Businesses have a lot of expenses to factor into the cost of a unit including things like employee salaries, equipment upgrades, insurance and rent. This example has also excluded fixed costs since production and design were both outsourced . You’re also theoretically not paying rent on a spare bedroom you already own. The cost per unit is how much money a company spends producing a single unit of a particular product or service. You might also hear this called the cost of goods sold and the cost of sales.

Average Cost

In the previous page, we discussed the physical flow of units and how to calculate equivalent units of production under the weighted average method. We will continue the discussion under the weighted average method and calculate a cost per equivalent unit. These costs are likely attributed to your food truck monthly payment, auto insurance, legal permits, and vehicle fuel.

When you hit enter, you will see the fixed cost equaling $26,000, the same amount you calculated with the first formula. how to calculate cost per unit Tangible assets such as factory machinery or company vehicles lose their value over time in a predictable manner.

Join Pro Or Pro Plus And Get Lifetime Access To Our Premium Materials

Her work has been featured in publications like Business Insider and Vice. Utilities ExpensesUtilities Expenses are the prices incurred by a Company for the usage of utilities like sewage, electricity, waste disposal, water, broadband, heating, & telephone. These are included as operating expenses in the Company’s income sheet. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

When you hit enter, Excel will automatically add up the costs to “$26,000”. Browse through our resume examples to identify the best way to word your resume. Then choose from 10+ resume templates to create your resume. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com. TABLE 2.3 Unit costs for options of using small equipment and large equipment. This means Sam needs to sell just over 1800 cans of the new soda in a month, to reach the break-even point.

- Variable costs, in contrast, are directly affected by your output.

- As a journalist, he has extensively covered business and tech news in the U.S. and Asia.

- Say that in this example, in the highest month you had a water bill of $9,000 and 60,000 machine-hours of production.

- She specializes in business development, operations, and finance.

- Companies that manufacture goods will have a more clearly defined calculation of unit costs while unit costs for service companies can be somewhat vague.

- Now let’s consider what this information would mean for your business.

Your average variable cost is ($600 + $450) ÷ 25, or $42 per unit. We will calculate a cost per equivalent unit for each cost element (direct materials and conversion costs . It’s in your best interest to spread out your fixed costs by producing more units or serving more customers. You should also be aware of how many units you need to sell if you want to break even and become profitable.

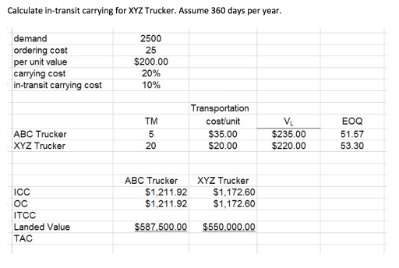

Then, find data on the average variable cost for that company’s industry. This can give you a standard of comparison by which to judge the first company. Higher per-unit variable costs may suggest that a company is less efficient than others, whereas a lower per-unit variable cost might represent a competitive advantage. Marginal cost is the cost of producing one additional unit of output. It shows the increase in total cost coming from the production of one more product unit.

For example, a company produces 1,000 units that cost $4 per unit and sells the product for $5 per unit. If a unit were priced at $3 per unit, there would be a loss because $3 minus $4 is a loss of $1 per unit.

What Is Unit Cost?

These costs are best broken up into separate fixed and variable elements. In this case, only the employee’s commission would be treated as a variable cost.

Therefore, the formula for total cost can be represented as shown below. Variable overhead is the indirect cost of operating a business, which fluctuates with manufacturing activity. Cost-volume-profit analysis looks at the impact that varying levels of sales and product costs have on operating profit. It is often the case, whether one is a manufacturer or a buyer, that marginal costs decrease with volume.

If the average variable cost of one unit is found using your total variable cost, don’t you already know how much one unit of your product costs to develop? Can’t you work backward, and simply divide your total variable cost by the number of units you have? Total Cost per Unit is used in accounting to determine profit and selling price of product or service, calculate Cost of Goods Sold , Revenue , Gross Profit Margin, Operating Margin. Total Cost per Unit depends on the number of units produced because overhead costs are usually fixed.

Talus Pay Advantage Our cash discount program passes the cost of acceptance, in most cases 3.99%, back to customers who choose to pay with a credit or debit card. Partners Merchant accounts without all the smoke and mirrors. Earn your share while providing your clients with a solid service.

Variable costs are directly associated with the product or service and can only be incurred in case of production. The higher your total cost ratio, the lower your potential profit. If this number becomes negative, you’ve passed the break-even point and will start losing money on every sale. These costs aren’t static — meaning, your rent may increase year over year. Instead, they remain fixed only in reference to product production.