The exercise is even more prone to error than the simple formulation in the sidebar. APV is both less cumbersome and more informative. Only available for returns not prepared by H&R Block.

Additional fees apply with Earned Income Credit and you file any other returns such as city or local income tax returns, or if you select other products and services such as Refund Transfer. A tax shield is a reduction in taxable income by taking allowable deductions. Stated another way, it’s the deliberate use of taxable expenses to offset taxable income. While tax shields are used for tax savings for both personal and business tax returns, this article focuses on tax shields for businesses.

Note that tax is a cash expense while depreciation is not. This then means that the businesses will be able to a great value of money. The Interest Tax Shield refers to the tax savings resulting from the tax-deductibility of the interest expense on debt borrowings. The payment of interest expense reduces the taxable income and the amount of taxes due – a demonstrated benefit of having debt and interest expense. Some amount to technicalities, which are much more interesting to academics than to managers. But two in particular are worth knowing about because they introduce consistent biases in the analysis. First, income from stocks—as opposed to bonds—may be taxed differently when the investor files a personal tax return.

Note that there is a significant impact when companies add or remove tax shield, therefore, most business owners will always consider their optimal capital structure. As you review tax shields, compare the value of tax shields from one year to the next. If your business has a higher income and a higher tax rate in one year, the amount of tax savings will be higher in that year. Tax Shield FormulaTax Shield refers to the deduction allowed on the taxable income that eventually results in the reduction of taxes owed to the government. It is calculated by adding the different tax-deductible expenses and then multiplying the result by the tax rate.

Step 2: Discount The Flows Using An Appropriate Discount Rate And Terminal Value

If she buys the new equipment, Kelsey can make an extra $5,000 per month (that’s a lot of pies). The equipment would cost $75,000, and she has the cash for it. But, Kelsey could also get a loan with a 7% interest rate, 20% down and a seven-year term.

Your designated Tax Attorney will negotiate to settle your tax debt for as low as the laws allow, establish compliance and work out terms for repayment that you can afford. Our Tax Professionals will file Power of Attorney, order your master tax file, remove your account from active collections and begin preparing your case for negotiations. The most common types of depreciation methods include straight-line, double declining balance, units of production, and sum of years digits. If an investor pays $1,000 of capital, at the end of the year, he will have ($1,000 return of capital, $100 income and –$20 tax) $1,080. He earned net income of $80, or 8% return on capital. “All the strategic functions for our business in Europe are based in Luxembourg,” Amazon’s head of public policy, Andrew Cecil, told UK parliamentarians in November. If tax departments around the continent were to recognize the arrangement, Amazon needed a meaningful corporate presence.

More Tax Debt Questions

Once you have submitted your tax returns, you will need to begin the process of handling your outstanding tax debt. Fines and penalties are assigned to individuals who do not file their taxes properly. Your tax practitioner at US tax shield can help you understand what you’re facing and find the most affordable resolution. S corporations and general partnerships are not taxed at the business level. Instead, income passes through to the owners and is taxed at their personal tax rate.

- The process for calculating the impact of a tax shield is relatively straightforward.

- Since this business is lacking in customer feedback, this is likely pulling its score down.

- The income may be lowered for a given year, or taxes may be deferred into future years.

- However, fees typically start around $1,000 and average about $4,000.

- Helping private company owners and entrepreneurs sell their businesses on the right terms, at the right time and for maximum value.

For example, if annual depreciation is $1,000 and the tax rate is 10%, then the depreciation tax shield would be $100. If an accelerated depreciation method is used, which allows for higher depreciation during the early life of an asset, then tax savings are greater during the early stages of the asset’s life. Free In-person Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2019 individual income tax return . It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Additional terms and restrictions apply; SeeFree In-person Audit Supportfor complete details. Tax evaders tend to conceal their income and/or underreport their income on their tax returns.

Cash Pile Builds

Potential customers may worry about a US Tax Shield tax relief scam, but tax relief companies like this can offer legitimate assistance. It’s important to understand the services and solutions available so you never feel as though you were mislead. Read on to learn more about what US Tax Shield does and how this company can work for you.

The agreement may include restrictions where a business needs to adhere to, to be able to obtain the debt. Such may include refraining from say, selling of business assets. Asset Is Fully DepreciatedFully depreciated assets are the assets that can no longer be depreciated for accounting or tax purposes.

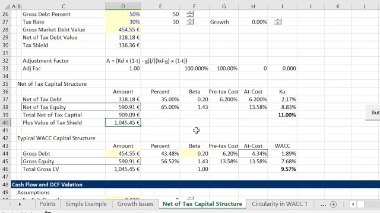

Why is debt cheaper than equity?

Since Debt is almost always cheaper than Equity, Debt is almost always the answer. Debt is cheaper than Equity because interest paid on Debt is tax-deductible, and lenders’ expected returns are lower than those of equity investors (shareholders). The risk and potential returns of Debt are both lower.

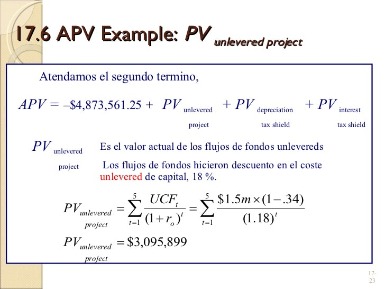

Bringing foreign profits home allowed Amazon to set them against U.S. losses, so the company did not have to pay tax on overseas profits, according to Stephen Shay, a professor of tax law at Harvard University. In effect, Amazon used inter-company payments to form a tax shield for the group, behind which it has accumulated $2 billion to help finance its expansion. We can evaluate Acme Filters without APV, using the same pro forma cash-flow projections and discounting at the weighted-average cost of capital . Unfortunately, this is not as simple a procedure as textbooks often make it appear.

Valuation Techniques

Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visithrblock.com/ezto find the nearest participating office or to make an appointment. The process for calculating the impact of a tax shield is relatively straightforward. The tax shield’s value is the amount of money it saves on taxes. An interest tax shield equals the cost of interest multiplied by the company’s tax rate.

Solvable does not include all Business Loan companies or all types of offers available in the marketplace. All credit card rates, fees, and terms are presented without guarantee and are subject to change pursuant to each Provider’s discretion. There is no guarantee you will be approved for credit or that upon approval you will qualify for the advertised rates, fees, or terms shown.

This will become a major source of cash inflow, which we saved by not giving tax on depreciation amount. But since the WACC already factors this in, the calculation of unlevered free cash flow does NOT account for these tax savings – otherwise, you’d be double-counting the benefit.

Some of the fringe benefits you offer to employees increases their total compensation but does not increase your payroll taxes. Here are seven tax shields you can realistically take advantage of in your business. This can be done with a few of the tax shields below, such as interest and hiring your kids.

Joshua Wiesenfeld is a financial investigator, certified public accountant , and certified fraud examiner with almost a decade of experience. He writes about taxes and investing and has been published in the Journal of Accountancy and Fraud Magazine. Joshua has a master’s of public administration in forensic accounting from John Jay College. Another restriction may be for a business to maintain various levels of ratios such as debt coverage ratio or debt-equity ratio.

Tax Shield On Depreciation

Be sure to ask up front about all fees, costs and terms associated with each loan product. In some cases, lenders may require that you have an account with them already and for a prescribed period of time in order to qualify for better rates on their personal loan products. The most obvious reason is simply to pay lower taxes now. The tax shield approach will decrease taxable income and decrease the tax you owe. Remember, when you use tax shields like depreciation, the taxes are deferred, not avoided, so they’ll eventually need to be paid.

Does the interest tax shield subsidized debt?

In the valuation of the interest tax shield, it capitalizes the value of the firm and it also limits the tax benefits of the debt. Interest expenses are considered to be tax-deductible, so tax shields are very important, as firms can get benefits from the structuring of such arrangements.

For instance, if the tax rate is 21.0% and the company has $1m of interest expense, the tax shield value of the interest expense is $210k (21.0% x $1m). Robert developed an interest in tax during his tenure in law school.

Why Does The Depreciation Tax Shield Matter?

Access to our industry partners allows your tax business access auto bank approvals, refund services, audit assistance, and IRS protection support. The information in this article is not intended to be “written advice concerning one or more Federal tax matters” subject to the requirements of section 10.37 of Treasury Department Circular 230. The information contained herein is of a general nature and based on authorities that are subject to change. Applicability of the information to specific situations should be determined through consultation with your tax adviser. This article represents the views of the authors only, and does not necessarily represent the views or professional advice of KPMG LLP. Most U.S.-parented groups generally should welcome the replacement of BEAT with the inbound-focused SHIELD. Foreign-parented groups also may be better off under SHIELD if the recipients of deductible payments are in high-tax countries .

Tax Shield Vs Tax Evasion

A sketch of the approach many companies take to this analysis highlights some of its pitfalls. Consent is not required as a condition of purchase. Applicants must be 18 years of age in the state in which they reside (19 in Nebraska and Alabama, 21 in Puerto Rico.) Identity verification is required.

For example, if a company’s machinery has a 5-year life and is only valued $5000 at the end of that time, the salvage value is $5000. You are required to compute and analyze cash flow and to advise as to which option is better. Tax shield lower tax bills, which is one of the major reasons why taxpayers, whether individuals or corporations, spend a considerable amount of time determining which deduction and credits they qualify for each year. Since the interest expense on debt is tax-deductible, whereas dividends to common equity holders are not, debt financing is often considered to be a “cheaper” source of capital initially. If a company decides to take on debt, the lender is compensated through interest expense, which will be reflected on the company’s income statement in the non-operating income/ section.