The Three Parts of a Cash Flow Statement

Since the net income was computed using the accrual technique of accounting, it needs to be adjusted in order to replicate the money acquired and paid. We now provide eight Certificates of Achievement for Introductory Accounting and Bookkeeping.

The certificates embrace Debits and Credits, Adjusting Entries, Financial Statements, Balance Sheet, Cash Flow Statement, Working Capital and Liquidity, And Payroll Accounting. The cash flow statement reports the cash generated and used through the time interval laid out in its heading. Generally, the time frame is similar because the earnings assertion. For example, the heading might state “For the Three Months Ended December 31, 2019” or “The Fiscal Year Ended September 30, 2019”. The indirect money move statement technique doesn’t embody as a lot information as the direct method.

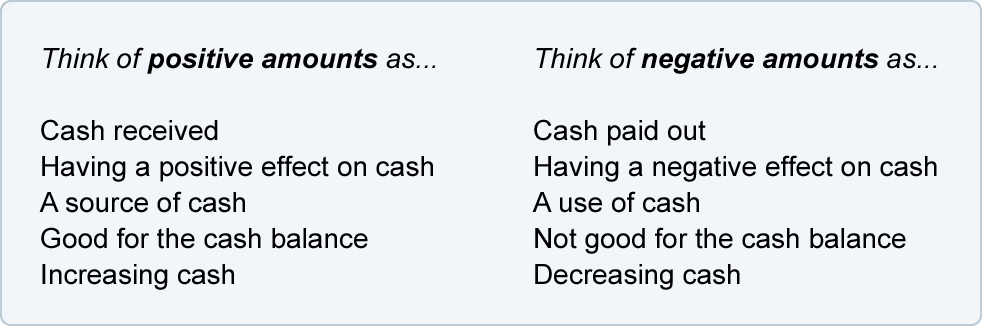

The cash move statement is essential because the revenue assertion and balance sheet are normally prepared utilizing the accrual method of accounting. Hence the revenues reported on the revenue statement have been earned however the firm might not have acquired the money from its clients. In order to grasp how cash has modified, and because many consider that “cash is king” the money flow statement ought to be distributed and browse at the same time as the income assertion and steadiness sheet. The money circulate assertion is needed because the income assertion stories the revenues earned and the bills incurred using the accrual technique of accounting. These quantities are different from the amount of money obtained and paid.

The revenue assertion and the steadiness sheet report on totally different accounting metrics associated to a business’s financial position. By attending to know the purpose of each of the reports you can higher understand how they differ from one another.

Our Understanding Financial Statements Video Seminar consists of 14 movies of approximately 10 minutes each. You’ll be taught concerning the balance sheet, revenue assertion, and money flow assertion elements.

By inspecting a sample balance sheet and income assertion, small companies can better perceive the relationship between the two stories. Every time an organization records a sale or an expense for bookkeeping functions, both the steadiness sheet and the income assertion are affected by the transaction. The balance sheet and the income assertion are two of the three major financial statements that small businesses put together to report on their financial efficiency, together with the money circulate assertion.

The money flow assertion is likely one of the main monetary statements of a business or a nonprofit entity. (It is also known as the assertion of money flows.) The cash move assertion reports a company’s main sources and uses of cash during the identical time period as the company’s income assertion. In other phrases, it lists the most important causes for the change in an organization’s cash and money equivalents reported on the stability sheets firstly and the tip of the accounting period. One of the main financial statements (together with the earnings statement and stability sheet). The assertion of cash flows is also known as the money move assertion.

How Do Interest Expenses Affect Cash Flow Statements?

Companies put together the oblique assertion by starting with net income as reported in another month-to-month financial assertion — the revenue statement. Accountants then make adjustments to this determine for all noncash gadgets. Essentially, the oblique preparation method takes an accrual-based revenue assertion and converts it to a money-based mostly revenue assertion.

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

Also, the corporate’s annual earnings statements would possibly report 3% of a new constructing’s cost as depreciation expense, but the firm might have paid money for 100% of the constructing’s cost in the 12 months it was constructed. Since money is crucial for an organization’s operations and decision making, it’s essential to have the money move assertion. The working activities section of your organization’s money move statement determines whether or not the web profit or loss reported in your revenue statement has increased or decreased the amount of your organization’s cash move. While the balance sheet and the earnings statement are essentially the most regularly referenced monetary statements, the assertion of money flows or cash move statement is an important financial statement.

To make things even more handy we’ve included printable notes. When the oblique method is used, the first section of the money flow assertion, Cash Flows from Operating Activities, begins with the corporate’s web revenue (which is the bottom line of the income statement).

- Every time a company information a sale or an expense for bookkeeping functions, each the steadiness sheet and the revenue assertion are affected by the transaction.

- By analyzing a pattern stability sheet and income assertion, small companies can higher perceive the relationship between the 2 stories.

This section particulars the adjustments in the ledger account balances in your current property and current liabilities. These accounts are accounts payable, accounts receivable, pay as you go insurance and unearned revenues. When you promote services or products, that exercise is reported here. The cash circulate assertion is one of the primary financial statements used in enterprise operations, including small businesses.

What Can The Statement of Cash Flows Tell Us?

Creating a money move assertion illustrates the amount of money the business generated in the course of the reporting interval. The money move assertion also particulars the money used in the course of the interval, serving to management see where the cash is going and differs. The money circulate statement consists of three major sections plus an elective supplemental part. It exhibits how much cash is available for your business to finance continued operations and progress. Since our Explanation of Cash Flow Statement illustrates how the amounts are determined, you’re going to get a better understanding of this very important financial statement.

No longer will you look at only the income statement and balance sheet. The income assertion presents info on the monetary outcomes of a company’s enterprise activities over a time frame.

Cash Flow Statement

Hence, we have to combine the use of Income Statement, Balance Sheet WITH the Cash Flow Statement to have a transparent and better understanding of the enterprise. The first section of the money move assertion illustrates the cash your small business received and used throughout normal operating activities.

As a result, savvy business people and investors acknowledge the SCF as an necessary monetary statement. What may not be apparent from a review of those documents is how they relate to each other. For instance, the interest expense reported on your company’s income statement reduces the amount of money recorded on the related cash move statement.

The cash move statement is also called the assertion of money flows. Because the earnings assertion is prepared underneath the accrual foundation of accounting, the revenues reported might not have been collected or became cash. Similarly, the bills reported on the revenue assertion might not have been paid. A individual might review the stability sheet changes to determine the facts, however the cash circulate statement already has built-in all that information.

The cash move statement makes use of info out of your company’s income assertion and balance sheet to indicate whether or not or not your business succeeded in producing cash during the interval defined in the report’s heading. Put simply, your organization’s cash move statement demonstrates how your small business generated and used its money. Your money flow statement will current your organization’s money inflows and outflows as they relate to working, investing and financing. The last line of the statement of money flows will reveal whether your business experienced a rise or lower in money in an outlined length of time.