After preparing the financial statement, all the temporary accounts must be closed at the end of accounting period. The accounts which collected information about revenue and expenses for the accounting period are temporary.

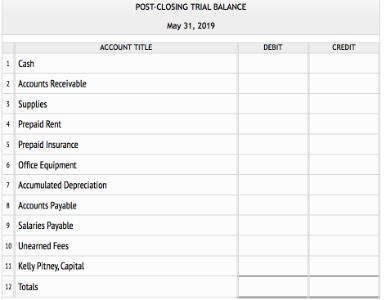

Closing entries to the general ledger reduce the balance of each expense to zero; the accounts are not included in the post-closing trial balance. A trial balance sheet showcases the balances of various ledger accounts.

Having a zero balance in these accounts is important so a company can compare performance across periods, particularly with income. It also helps the company keep thorough records of account balances affecting retained earnings. Revenue, expense, and dividend accounts affect retained earnings and are closed so they can accumulate new balances in the next period, which is an application of the time period assumption.

What will not appear on a post closing trial balance?

The revenue, expense, income summary and owner’s drawing accounts will not appear on a post-closing trial balance since these accounts will not carry a balance after the accounting period has ended.

While all of the adjusting entries for ABC Business are reflected in the adjusted trial balance, we still need to do some closing entries before running the post-closing trial balance. If you’re not using accounting software, consider using a trial balance worksheet, which can be used to calculate account totals.

Likewise, your sales return account would show a short debit of $10,000 if you understate your sales returns by $10,000. Thus, the impact of such entries would be nil on your books of accounts. This post closing trial balance is because an increase in one account is offset by a decrease in the other. A tallied trial balance indicates that the posting of the journal entries to the general ledger is arithmetically correct.

The Closing Process In The Accounting Cycle

For instance, you may commit an error of principle if you incorrectly classify an expenditure or a receipt between capital and revenue accounts. Committing such an error would certainly impact your financial statements. That is, such an error would lead you to understate or overstate income, assets, liabilities, etc. As stated earlier, there exist accounting errors if the debit column of your trial balance does not equate to its credit column. In other words, accounting errors occur when your trial balance sheet does not tally. Remember, accounting errors occur at any one of the stages of the accounting process.

A post-closing trial balance is a trial balance which is prepared after all of the temporary accounts in the general ledger have been closed. Permanent accounts are accounts that once opened will always be a part of a company’s chart of accounts. Revenue, expenses and dividends do not show up on the post-closing trial balance because they are considered temporary accounts. Temporary accounts are accounts whose balances are zeroed out at the end of each accounting period. When a new accounting period opens, these accounts are used again and will accrue balances until the accounting period comes to an end. At that time, the accounts will be closed to permanent accounts and once again have a zero balance. We see from the adjusted trial balance that our revenue accounts have a credit balance.

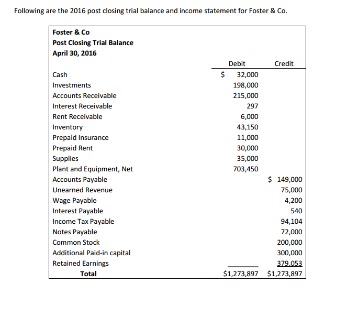

Further, your trial reveals the unadjusted and adjusted balances of various ledger accounts. You need to make adjustment entries in case of any accounting errors, as stated above. Remember, your general ledger accounts are recorded in the following order in your trial balance sheet.

Start Your Business

If not, you’ll have to do some research to locate and correct any errors. Accounting software requires that all journal entries balance before it allows them to be posted to the general ledger, so it is essentially impossible to have an unbalanced trial balance. Thus, the post-closing trial balance is only useful if the accountant is manually preparing accounting information. For this reason, most procedures for closing the books do not include a step for printing and reviewing the post-closing trial balance. This is one of the last steps in the period-end closing process. Say for instance Watson Electronics paid $25,000 to Bob & Co who is the supplier of goods. However, you debit Bob & Co’s account with $2,500 only while posting this transaction to the general ledger.

Temporary accounts are reduced during the closing process when closing entries are posted, leaving only permanent accounts displayed on the balance sheet. The post-closing trial balance sheet accounts should show that the total of all the debit accounts balances equals the total of all credit accounts balances, which would then net to zero. The post-closing trial balance is the last step or final step in the accounting cycle, and then the cycle starts all over again for the next accounting period. It is the final trial balance before the new accounting period begins.

Before that, it had a credit balance of 9,850 as seen in the adjusted trial balance above. It’s important that your trial balance and all debit balances and all credit balances in your general ledger are the same. If they’re not, you’ll have to do some research to locate the errors.

A trial balance helps in understanding and verifying arithmetical accuracy. As soon as the numbers of records are transferred across accounts, checking the figures becomes extremely important. Printing Plus has a $4,665 credit balance in its Income Summary account before closing, so it will debit Income Summary and credit Retained Earnings. Companies are required to close their books at the end of each fiscal year so that they can prepare their annual financial statements and tax returns. The business has been operating for several years but does not have the resources for accounting software. This means you are preparing all steps in the accounting cycle by hand.

The Accounting Cycle Example

The purpose of preparing a post-closing trial balance is to assure that accounts are in balance and ready for recording transactions in the next accounting period. The adjusted trial balance includes income from the current period. Closing entries reduce the income account to zero and transfer the balance to the income summary account.

As mentioned earlier, you prepare a Trial Balance Sheet to check the arithmetical accuracy of your ledger accounts. To ascertain the accuracy of various ledger accounts, you need to locate errors and in return rectify such errors. The accounting cycle ends with the preparation of a post-closing trial balance. This trial balance lists the accounts and their adjusted balances after closing. It is important to note that the post-closing trial balance contains only balance items accounts.

The Entries For Closing A Revenue Account In A Perpetual Inventory System

When the accountant reviews the ledger and unadjusted trial balance, some adjustments may require. All of the adjustments should be made to the ledgers and trial balance. Once the adjustments are completed, we then get the adjusted trial balance. Prepare the closing entries for Frasker Corp. using the adjusted trial balance provided. The remaining balance in Retained Earnings is $4,565 (Figure 5.6). This is the same figure found on the statement of retained earnings.

This is because you take the final balances from the trial balance itself. That is, you do not have to go through the hassle of checking each and every ledger account. The post-closing trial balance will reflect the final balances for the company accounts at the end of the financial reporting period.

Thus, it provides you a summary of the financial transactions of your business. You prepare such a summary by transferring the balances of various income, expense, asset, liability, and capital accounts. The very objective of preparing a trial balance is to determine whether all your debit or credit entries are recorded properly in the ledger.

Temporary And Permanent Accounts

The closing entry will credit Dividends and debit Retained Earnings. Once the closing process is completed, the company’s accounting records are ready to account for the company’s January activity. Since all revenue, expense, and dividends accounts have $0 balances after December’s closing, any dollar amounts appearing in these accounts in January will be the result of January’s activity. In this way, the accounting process separates the accounting for December’s activity from January’s.

- For instance, Nominal accounts are the ones that have entries from the income statement and real accounts consist of entries from the balance sheet.

- A repository for all of your accounts, every transaction recorded either in your accounting software or in your manual ledgers directly impacts the general ledger.

- Our discussion here begins with journalizing and posting the closing entries (Figure 5.2).

- Instead, declaring and paying dividends is a method utilized by corporations to return part of the profits generated by the company to the owners of the company—in this case, its shareholders.

- Typically, you prepare the trial balance sheet at the end of the financial year.

A company needs to prepare Profit & Loss, Balance Sheet, and Cash Flow statement at the end of each accounting period. Since the balances of all the ledger accounts are there in the trial balance. The second entry requires expense accounts close to the Income Summary account. To get a zero balance in an expense account, the entry will show a credit to expenses and a debit to Income Summary. Printing Plus has $100 of supplies expense, $75 of depreciation expense–equipment, $5,100 of salaries expense, and $300 of utility expense, each with a debit balance on the adjusted trial balance.

Preparing the post-closing trial balance will follow the same process that took to create the unadjusted or adjusted trial balance. Each individual account balance is transferred from their ledger accounts to the post-closing trial balance.

To make them zero we want to decrease the balance or do the opposite. We will debit the revenue accounts and credit the Income Summary account.

Its purpose is to test the equality between debits and credits after the recording phase. A trial balance is a report that lists the ending account balances in your general ledger. A repository for all of your accounts, every transaction recorded either in your accounting software or in your manual ledgers directly impacts the general ledger. You achieve this by tallying the debit column with the credit column of your company’s trial balance.

Business Checking Accounts

The eighth step in the accounting cycle is preparing closing entries, which includes journalizing and posting the entries to the ledger. Understanding the accounting cycle and preparing trial balances is a practice valued internationally. The Philippines Center for Entrepreneurship and the government of the Philippines hold regular seminars going over this cycle with small business owners. They are also transparent with their internal trial balances in several key government offices. Check out this article talking about the seminars on the accounting cycle and this public pre-closing trial balance presented by the Philippines Department of Health. The next day, January 1, 2019, you get ready for work, but before you go to the office, you decide to review your financials for 2019. What are your total expenses for rent, electricity, cable and internet, gas, and food for the current year?