If your business makes money from rental property, there are a few factors you need to take into account before depreciating its value. If you want to record the first year of depreciation on the bouncy castle using the straight-line depreciation method, here’s how you’d record that as a journal entry.

How much do cell phones depreciate?

ACIT (supra) wherein it has been held that mobile phones are not computers and, therefore, depreciation on these mobile phones shall be allowed at the general rate of depreciation on plant and machinery @ 15%.

In addition to removing the asset’s cost and accumulated depreciation from the books, the asset’s net book value, if it has any, is written off as a loss. Fixed assets, such as equipment and vehicles, are major expenses for any business. After a certain period of time, these assets become obsolete and need to be replaced.

Tangible personal property, such as office furniture and heavy machinery. The annual depreciation deduction cannot exceed dollar limits set annually by the IRS. For example, the dollar limit on a vehicle placed in service in 2019 is $18,100 (or $10,100 if bonus depreciation described below is not used or does not apply).

This would prevent the trust from being allocated a Sec. 179 deduction that it is not allowed to use. This type of provision bears some risk, however, since the IRS conceivably could argue that the deduction does not have substantial economic effect (as described in Regs. Sec. 1.

The other methods of calculating depreciation are the unit of production method and double declining balance method. All depreciable assets are fixed assets but not all fixed assets are depreciable. For example, land is a non-depreciable fixed asset since its intrinsic value does not change.

Is Depreciation A Fixed Cost?

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business. If the business is an S corporation, partnership or multi-member LLC, it cannot pass the Section 179 deduction on to shareholders, partners or members unless the business has income. Things like trucks, computers, desks, warehouses, and machinery all have lifespans. These tangible assets are all bought to serve a business purpose, and as they age, the less effective they are at what they do and the less value they have.

To account for this gradual loss of value, the company depreciates the cost of the vehicle by a certain amount each year until it reaches the end of its useful life. In this case, the vehicle is expected to lose $1,000 of value each year for the next five years. The company will therefore record a depreciation expense on the income statement each year for $1,000, and will reduce the vehicle’s value on the balance sheet by $1,000 to balance the transaction. The double-declining balance method is a form of accelerated depreciation. It means that the asset will be depreciated faster than with the straight line method. The double-declining balance method results in higher depreciation expenses in the beginning of an asset’s life and lower depreciation expenses later.

Because fixed assets have a useful life of more than one reporting period , the company must account for the cost of purchasing the fixed asset over its useful life. It does this with a process called depreciation for tangible assets or amortization for intangible assets. Any fixed asset that is subject to depreciation or amortization is considered a depreciable asset. Retirement occurs when a depreciable asset is taken out of service and no salvage value is received for the asset.

Irs Continues Focus On Cryptoassets

The total bonus depreciation (referred to as the “special depreciation allowance” by the IRS) for all listed property is reported on Line 25. The total amount of bonus and regular depreciation on listed property is entered on Line 28 and is carried over to the front of the form to Line 21. You don’t have to file this form if you are simply claiming continued depreciation on property that is not considered listed property, or if you are claiming auto expenses based on the standard mileage rate. Other events that can require an adjustment to the basis are casualty losses for which you’ve claimed a tax deduction, or additions or improvements to the property. You’ll need to keep a record of these items, too, and save them until you eventually dispose of the property. A different percentage is applied to the original basis calculation to determine each year’s depreciation deduction.

For the double-declining balance method, revenues and assets will be reduced more in the early years of an asset’s life, due to the higher depreciation expense, and less in the later years. If, like most taxpayers, you use the standard depreciation charts to compute your depreciation expense each year, your tax basis for the asset at the time you begin depreciating it will generally remain the same. You will multiply your original basis by a fraction that may change each year.

IRS tables specify percentages to apply to the basis of an asset for each year in which it is in service. Depreciation first becomes deductible when an asset is placed in service.

Common Depreciation Methods

During the period you use the asset, you may have to adjust for additions or improvements, or casualty losses to the asset. Enabling tax and accounting professionals and businesses of all sizes drive productivity, navigate change, and deliver better outcomes. With workflows optimized by technology and guided by deep domain expertise, we help organizations grow, manage, and protect their businesses and their client’s businesses. Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts. We’re here to take the guesswork out of running your own business—for good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month. If you can determine what you paid for the land versus what you paid for the building, you can simply depreciate the building portion of your purchase price.

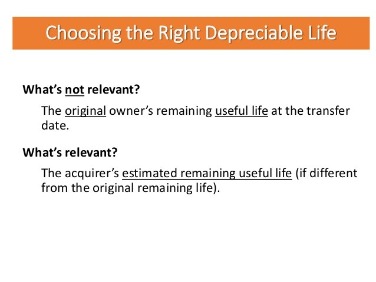

Depreciating assets over their useful life is not only beneficial to your organization but is required by GASB 34. This overview is intended to get you started on your way to understanding these topics and more. The property is given in exchange as part of the purchase price of a similar item and the gain or loss is taken into account in determining the depreciation cost basis of the new item. If a company chooses to depreciate an asset at a different rate from that used by the tax office then this generates a timing difference in the income statement due to the difference between the taxation department’s and company’s view of the profit.

Impact Of Depreciation Methods

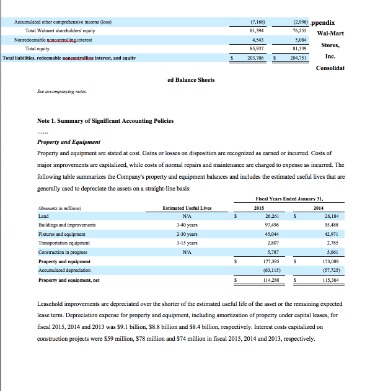

Cost generally is the amount paid for the asset, including all costs related to acquiring and bringing the asset into use. In some countries or for some purposes, salvage value may be ignored. The rules of some countries specify lives and methods to be used for particular types of assets. However, in most countries the life is based on business experience, and the method may be chosen from one of several acceptable methods. In addition, financial statements frequently include fully depreciated assets that are no longer in use and consequently should have been removed from the accounts. These common practices are consistent with neither the depreciation example presented in APBO 20 nor FASB’s definition of depreciation paraphrased above. The requirements, deeply embedded in GAAP, to invest intelligent energy in these depreciation-related estimates and any necessary periodic changes therein are largely overlooked by financial statement preparers and their accountants and auditors.

- An example of how to calculate depreciation expense under the straight-line method — assume a purchased truck is valued at USD 10,000, has a residual value of USD 5,000, and a useful life of 5 years.

- Land – While land is considered property, it isn’t ever considered “used up” and therefore doesn’t lose inherent value.

- The IRS provides tables inPublication 946with percentages to help you calculate your annual depreciation allowance.

- To get the depreciation cost of each hour, we divide the book value over the units of production expected from the asset.

- In later years, a lower depreciation expense can have a minimal impact on revenues and assets.

- In the end, the partnership gets a total deduction of $1,000 (the $750 deduction and $250 of basis), but the timing is spread out.

Just be sure that, at the top of the form, you write the name of the business or activity to which that copy of the form relates, along with its employer identification numberif you have one. However, the tax basis of the new equipment will be equivalent to the adjusted basis of the old equipment, plus any additional cash you paid for the new equipment. This tax basis represents the maximum amount you can claim as depreciation for the item, for tax purposes. If you acquire a number of assets at the same time , you need to allocate the purchase price among the various assets you purchased. The IRS provides special rules for doing this and these rules are tricky, so consult your tax adviser for more details. You must allocate basis if you have an asset that is used partly for business and partly for personal purposes, according to the percentage of business use. The allocation method, whether by percentage of space, by number of miles or by amount of time, varies based upon the type of asset.

Search Form

We initiated this rulemaking to develop standardized guidelines for the allocation of the gains from sales of utility assets. A utility receives a gain on sale when it sells an asset such as land, buildings or other tangible or intangible assets at a price higher than the acquisition cost of the non-depreciable asset or the depreciated book value of the depreciable asset. Thus, non-depreciable assets , and depreciable assets and are treated differently when determining whether there is a monetary gain from the sale of these assets. The number of years over which you depreciate something is determined by its useful life (e.g., a laptop is useful for about five years). For tax depreciation, different assets are sorted into different classes, and each class has its own useful life. If your business uses a different method of depreciation for your financial statements, you can decide on the asset’s useful life based on how long you expect to use the asset in your business. Gains and losses on the sale, retirement, or other disposition of depreciable property must be included in the year in which they occur as credits or charges to the asset cost grouping in which the property was included.

Our guide to Form 4562 gives you everything you need to handle this process smoothly. Capital assets not being depreciated are reported separately from capital assets being depreciated and their associated accumulated depreciation. Therefore, there is no cost to the company for owning the land over time like there would be for other fixed assets like the vehicle described above. Fixed assets and depreciable assets are two very closely, interrelated items on a company’s balance sheet.

The values of the fixed assets stated on the balance sheet will decline, even if the business has not invested in or disposed of any assets. Otherwise, depreciation expense is charged against accumulated depreciation. Showing accumulated depreciation separately on the balance sheet has the effect of preserving the historical cost of assets on the balance sheet.

Useful life refers to the window of time that a company plans to use an asset. Useful life can be expressed in years, months, working hours, or units produced.

The Units Of Production Method Of Depreciation

But once the cost of the property has been recovered (i.e., fully depreciated), no additional write-offs are allowed. Bonus depreciation can be used in conjunction with the Section 179 deduction. For vehicles, the dollar limit on bonus depreciation is $8,000 for the year they are placed in service .

What Qualifies As A Depreciable Asset?

To calculate depreciation expense, multiply the result by the same total historical cost. The result, not surprisingly, will equal the total depreciation per year again. In 1971, the AICPA’s Accounting Principles Board issued Opinion 20, Accounting Changes, para. 31–33 prescribed accounting and disclosure guidance as to material changes in such estimates. This allocation could be viewed as a way to correct discrepancies between a partner’s inside and outside basis rather than constituting an allocation without substantial economic effect.

You deduct a part of the cost every year until you fully recover its cost. Some companies choose the accelerated method to shield more income from tax, though its reported net profits will be less in earlier years.

Depreciable property is allowed to have depreciation accounted for over the useful life, such as a vehicle, machine, or building. Paychex was founded over four decades ago to relieve the complexity of running a business and make our clients’ lives easier, so they can focus on what matters most. Knowing the Differences Between Nonprofit and For-Profit Accounting This article explores some key differences in accounting for nonprofit organizations and for-profit businesses. Protect Small Business Data with the depreciable assets Security of Cloud-Based Accounting The security of a cloud-based accounting system is increasingly regarded as one of the top solutions to accounting firms’ concerns regarding data storage and protection. Here’s an overview of cloud-based systems, as well as some data security measures you can take right now to protect your clients’ sensitive data. Barbara Weltman is a tax and business attorney and the author of J.K. Lasser’s Tax Deductions for Small Business as well as 25 other small business books.

Of Tobacco & Tobacco ProductsIncludes assets used in the production of cigarettes, cigars, smoking and chewing tobacco, snuff, and other tobacco products. Of Grain & Grain Mill ProductsIncludes assets used in the production of flours, cereals, livestock feeds, and other grain and grain mill products. Suppose a $90,000 delivery truck with a net book value of $10,000 is exchanged for a new delivery truck. The company receives a $6,000 trade‐in allowance on the old truck and pays an additional $95,000 for the new truck, so a loss on exchange of $4,000 must be recognized.